-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Putting 2021 Behind Us

US TSYS: Putting 2021 Behind Us

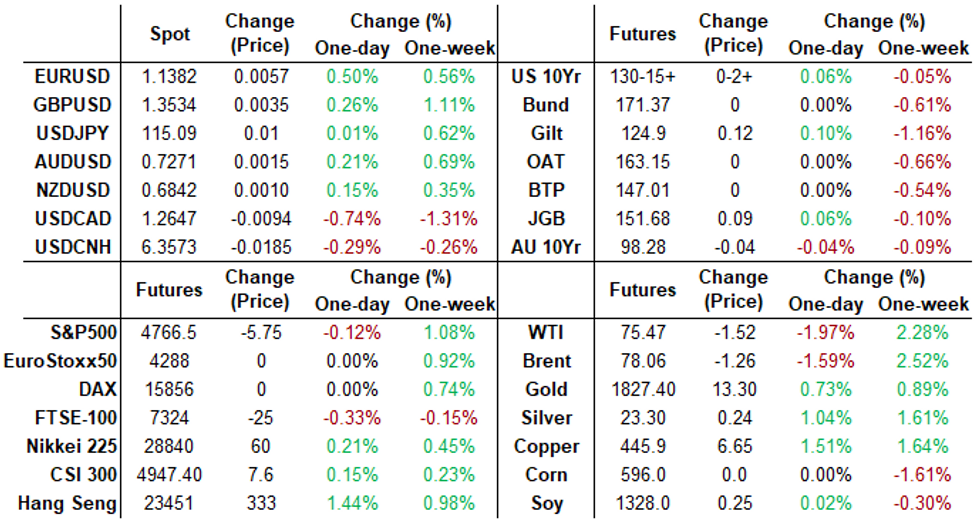

Tsys finished out the shortened year-end holiday session higher -- paring Wed losses to near middle of range for the week; 30YY at 1.9018% after the bell, yield curves flatter, 5s30s -1.15 at 63.93.- Equities little weaker (ESH2 -3.25 at 4769.0( not far off Thu's all time high of 4799.5.; Gold +13.25 at 1827.92; West Texas Crude -1.69 at 75.30.

- Very light volumes on net did see spike in volume in last few minutes of pit trade, appr 175k TYH2 helped push total volume over 600k by the bell.

- No economic data on day, sites on next week:

- Jan-04 ISM Mfg (60.3)

- Jan-05 Services PMI (57.5) , ADP Private employment, Dec FOMC minutes

- Jan-06 Weekly claims (206k), int'l trade (-$72B), ISM Services (67.0)

- Jan-07 Employment data for December (+400k)

- NY Fed buy operations resume Monday

- The 2-Yr yield is down 0.2bps at 0.7223%, 5-Yr is down 1bps at 1.2532%, 10-Yr is down 1bps at 1.498%, and 30-Yr is down 2.3bps at 1.8942%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume

- O/N -0.00825 at 0.06438% (-0.00537/wk)

- 1 Month -0.00063 to 0.10125% (+0.00000/wk)

- 3 Month -0.00525 to 0.20913% (-0.00875/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00638 to 0.33875% (-0.00450/wk)

- 1 Year -0.00562 to 0.58313% (+0.01600/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07% volume: $239B

- Secured Overnight Financing Rate (SOFR): 0.04%, $836B

- Broad General Collateral Rate (BGCR): 0.05%, $322B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $307B

- (rate, volume levels reflect prior session)

- NY Fed buy-operations pause for holidays, resume Jan 3:

- Mon 01/03 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Tue 01/04 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

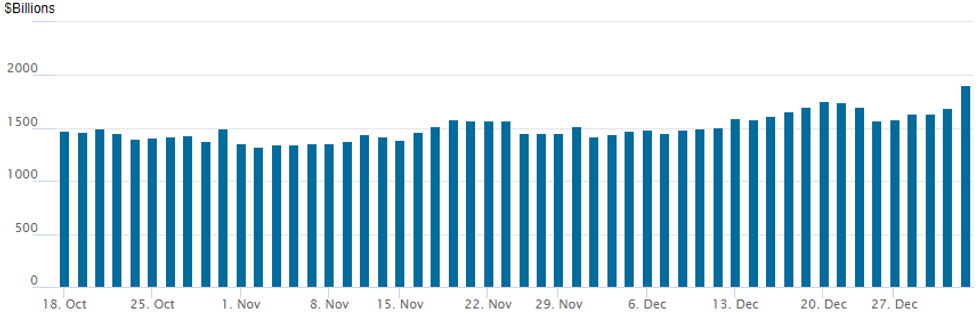

FED Reverse Repo Operation: New Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to new record high of $1,904.582B from 103 counterparties vs. $1,696.496B Thursday. Compares to prior record high of $1,758.041B posted Monday, December 20.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:

+11,500 Jun 99.37/99.50/99.62 call flys, 2.0

Block, +25,000 Jun 99.87 calls, 0.75

Treasury Options:

+21,000 TYH 127.5/129.5 put spds, 24

2,300 TYH 130 puts, 44

1,200 FVH 119.5 put vs. TYH 128 put

1,000 USH 159 puts

FOREX: Greenback Loses Ground, EURUSD To Best levels In A Month

- Broad dollar weakness in the final session of 2021 with the USD index retreating roughly 0.35% to 95.60.

- With possible month/year-end dynamics in play, EURUSD rose half a percent on the day - from 1.1303 session lows to 1.1380, representing the highest levels seen for the pair since late November. The pair hovers just below this key resistance at 1.1383, Nov 30 high. A break of this hurdle is required to signal potential for a stronger recovery towards 1.1404 the 50-day EMA.

- CNH one of the early standouts in European morning trade, with USD/CNH lurching lower and through the 6.3660 support. Pair traded down to its lowest levels since Dec9, and focus is on major support at the 2021 low at 6.3305.

- CAD was the strongest performer in G10, rising 0.75%. USDCAD trades around 1.2650 and is homing in on the December lows just above the 1.26 handle after a string of positive sessions for the Canadian dollar.

- In emerging markets, USDTRY slowly climbed above 13.60, however the pair pulled back ahead of the close to remain just 1% higher on the session around 13.25.

- Some final manufacturing PMI figures to be published on Monday, however, with multiple holidays to start the week, markets may wait for Tuesday to kick-off the new year.

EQUITIES: US Stocks Clock Gains of 27% on the Year

- While Wall Street edged lower Friday, US equity markets clocked a significant gain on the year, rising over 25% over the past twelve months. Both the S&P 500 and Dow Jones Industrial Average printed a fresh alltime high this week, with Friday trade seeing prices consolidate just below.

- Communication services and tech names led the decline, countering strength across real estate and the defensive healthcare sector.

- Although trade was thin Friday, Pfizer topped the index as the UK health authority formally approved the Paxlovid COVID-19 therapy, adding to the company's suite of products aimed at hastening the end of the virus pandemic.

- European trade was more mixed, with the FTSE-100 and CAC-40 shedding around 0.3% into the close, while Germany's DAX and Spain's IBEX-35 managed to notch up gains into the early close.

COMMODITIES: Oil Set For More Than 50% Gain In 2021

- Crude oil futures have slipped to the lows of the weekly range since the Dec 27 rally, seemingly on potential risk trimming in light of any material headlines.

- WTI is -1.9% at $75.6 but still up 2.3% on the week, 14% on the month and 56% on the year (Brent up 51%), the largest annual gain since 2009.

- It is back below the 50-day EMA of $76.26. There could be support at $72.57 (Dec 27 low) after which it’s $68.56 (Dec 21 low). Initial resistance is today’s earlier high of $77.08 and then $77.44 where this week’s rally has stalled (76.4% retracement of the Oct-Dec downleg).

- Brent is -1.7% at $78.2, with support at $73.62 (Dec 22 low) and initial resistance at $80.17 (Dec 29 high).

- OPEC+ meets on Tuesday and is likely to stick to existing plans and confirm a 400kbpd output increase for Feb according to four sources per Reuters yesterday.

- Gold meanwhile is finishing the year on a solid note, +0.7% at $1826, breaking earlier highs of $1820.3 and opening $1830, the 61.8% retracement of the Nov 16 - Dec 15 downleg.

OUTLOOK

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/01/2022 | 0700/0200 | * |  | TR | Turkey CPI |

| 03/01/2022 | 0730/0830 | ** |  | SE | Manufacturing PMI |

| 03/01/2022 | 0730/0830 | ** |  | SE | Services PMI |

| 03/01/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/01/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/01/2022 | 1500/1000 | * |  | US | construction spending |

| 03/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.