-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Bullard, Liftoff As Soon As March

US TSYS: Yields Inch Higher Ahead Key Employment Data Friday

Yields inched higher, curves bear flattening (5s30s -5.00 at 61.21) for second consecutive session in the lead-up to headline December employment data Friday.- Median estimate for December job gains climbed +42k to +442k after the release of more hawkish than anticipated minutes from Dec FOMC yesterday; not to mention Wed's ADP private jobs overshoot of +807k vs. +410k est).

- Best volumes in weeks (TYH2 >1.6M) amid two-way positioning ahead Fri's jobs data, curves flatter/short end weighed with StL Fed Bullard saying liftoff could occur as early as March and potentially allow for some balance sheet runoff later in response to an inflation surge late last year.

- Incidentally, little react to modest gain in weekly claims (207k vs. 195k est).

- Decent option hedging rate hikes via put structures in March, June and Sep reported. Flipside: longer expirys looking for policy overshoot/potential rate cut in 2023) +25,000 Red Mar'23 99.75 calls, 2.5 (open interest over 313k).

- No coupon sales Friday, but NY Fed buy-op scheduled: Tsy 0Y-2.25Y, appr $9.325B.

- The 2-Yr yield is up 5.4bps at 0.8796%, 5-Yr is up 4.6bps at 1.4753%, 10-Yr is up 2.3bps at 1.7281%, and 30-Yr is down 0.7bps at 2.0874%.

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00400 at 0.07414% (+0.00976/wk)

- 1 Month +0.00214 to 0.10414% (+0.00075/wk)

- 3 Month +0.00572 to 0.23129% (+0.02216/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02657 to 0.36657% (+0.02782/wk)

- 1 Year +0.05142 to 0.64771% (+0.06458/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $263B

- Secured Overnight Financing Rate (SOFR): 0.05%, $946B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $325B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $901M accepted vs. $1.721B submission

- Next scheduled purchases:

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

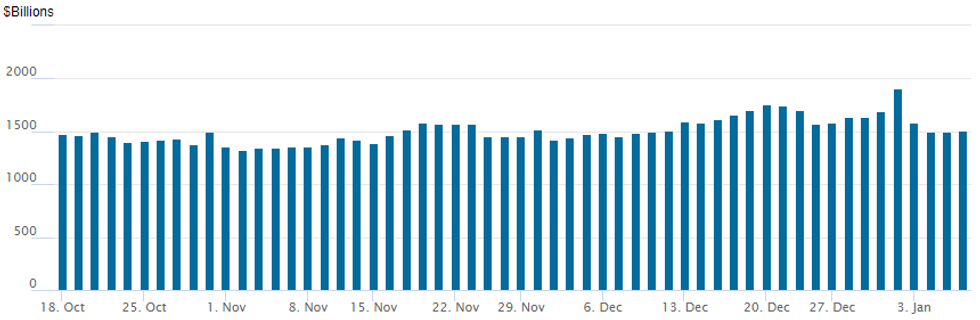

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $1,510.553B (74 counterparties) vs. $1,492.787B on Wednesday.

All-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +20,000 Apr/Jun 98.93/99.06 put spd strip, paying 1.75 to buy both spds

- Block, 12,000 Sep 98.93/99.06 put spds vs. 99.045/0.05%

- over +37,000 Jun 99.25/99.31/99.43 put trees, 0.5-1.0

- 15,000 Red Mar'23 99.75 calls, 2.5

- Overnight trade

- Block, 12,000 Mar 99.50 puts, 1.0 15k more on screen

- 9,000 short Jan 98.62/98.75 call spds

- 17,000 Green Jun 97.75/98.00 put spds

- 10,000 Jun 99.25/99.31/99.43 put trees

- 9,500 Dec 100.00 calls, 0.5

- 3,000 Sep 98.81 puts vs. 99.06/99.31 call spds

- 6,000 Mar 99.50/99.56/99.62 put trees

- 2,000 FVH 119.25/119.75 put spds

- 2,000 FVH 117.5/118.5/119/119.5 put condors

- over +25,000 FVH 120.75 calls, 14

- +7,000 USH 151/155 put spds, 107

- 5,000 TYH 108.87 puts, 14 ref: 108-26.12

- Overnight trade

- 12,800 TYG 132 calls, 1

- 2,500 TYG 127.5/128.25 put spds, 13

- 4,000 TYG 128.5 puts, 32

- 5,000 FVH 119.25 puts

- Block, 5,000 TYG 128.5 puts, 22

EGBs-GILTS CASH CLOSE: Hawks Take Flight (Then Take Profit)

The UK curve underperformed Germany's Thursday, with bear steepening and multi-year highs set in long-end yields.

- The sell-off came mostly in the early morning/open following the hawkish reaction to Wednesday's Federal Reserve minutes which helped boost global rate hike expectations.

- Indeed, we saw some apparent profit-taking by bond shorts in the afternoon.

- 10Y and 30Y Gilt yields underperformed and hit fresh post-Oct 2021 highs. But short-end /belly UK instruments took centre stage, with 2Y and 5Y yields hitting highest since Mar 2019 (0.827% / 0.981% intraday highs respectively).

- Attention turns to the U.S. again Friday, for the Dec nonfarm payrolls report.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.1bps at -0.599%, 5-Yr is up 3.1bps at -0.4%, 10-Yr is up 2.3bps at -0.061%, and 30-Yr is up 0.4bps at 0.266%.

- UK: The 2-Yr yield is up 5.1bps at 0.813%, 5-Yr is up 5.6bps at 0.973%, 10-Yr is up 6.9bps at 1.156%, and 30-Yr is up 7.3bps at 1.275%.

- Italian BTP spread up 1.5bps at 133.4bps / Spanish up 0.2bps at 68.4bps

EGB Options: Notable Short Covering

Thursday's Europe rates / bonds options flow included:

- RXG2 174c, bought for 4 in 10k (short cover)

- RXG2 168.5p, bought for 15/17 in 6k

- RXG2 169/171^^ vs 2x 172.5 call, bought for 59.5 in 2k

- RXH2 167.5/166ps 1x1.5, bought for 25 in 12k

- RXH2 172/170/169p fly, sold at 77.5 in 2.4k

- OEG2 132.5/133cs, bought for 33.5 down to 32 in 4k. (short cover)

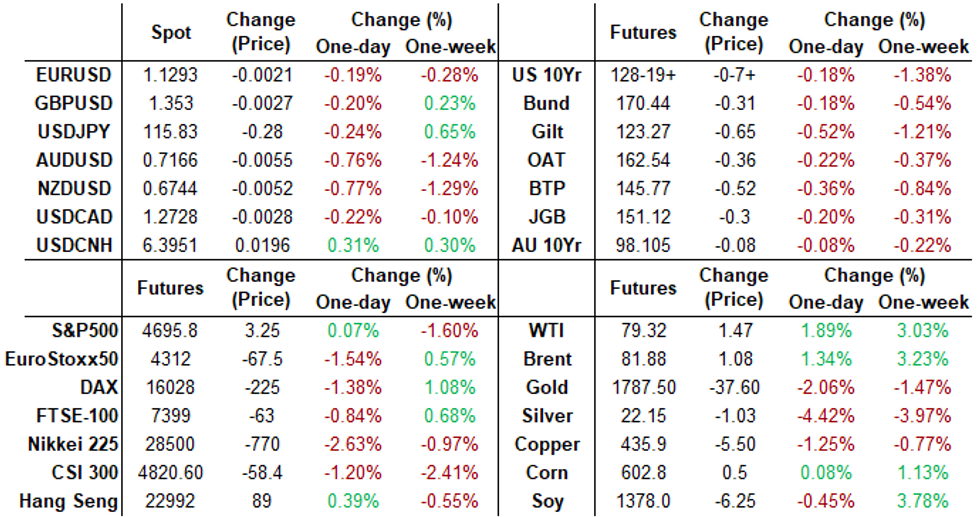

FOREX: Greenback Treads Water Ahead Of Dec. Non-Farm Payrolls

- The dollar index is marginally in the green having given back some of the early gains on Thursday. However, the index has traded in a fairly narrow range ahead of the December payrolls report, scheduled for tomorrow.

- There were mixed performances in G10 FX against the US dollar as equity indices consolidated yesterday’s retreat following the FOMC minutes.

- Antipodean FX were clear underperformers with both AUD and NZD dropping around 0.75%. AUD/USD's downtick Thursday puts the pair short of a firm break above the 50-dma - and the rejection could mark the beginning of a bearish reversal that initially targets 0.7082 ahead of 0.6993.

- Both the Swiss Franc and the Chinese Yuan also struggled on Thursday, losing 0.5% and 0.32% respectively.

- CAD bucked this trend and rose a quarter point buoyed by rising crude prices and WTI futures briefly testing above $80/bl. The pair remains above last week’s low of 1.2621 on Dec 31 - a key short-term support.

- EURUSD and USDJPY remained in familiar territory around 1.13 and 116 respectively, with markets lacking direction ahead of tomorrow’s jobs data.

- On Friday the Eurozone will publish their HICP flash estimate, before we see employment figures for both the US and Canada to round off the week.

FX: Expiries for Jan07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250(E982mln), $1.1290-00(E1.5bln), $1.1350-53(E905mln)

- USD/JPY: Y116.00($2.5bln)

- AUD/USD: $0.7160(A$2.1bln), $0.7200(A$1.3bln), $0.7250-55(A$728mln)

- USD/CAD: C$1.2650($665mln), C$1.2675-90($1.3bln), C$1.2700($581mln), C$1.2800($639mln)

EQUITIES: Stocks Stabilize Close to Lows

- The e-mini S&P slipped further following the cash open, touching pullback lows of 4662.00 before recovering and stabilizing ahead of the lows. This put prices back above the 4700 mark just after the London close.

- The energy sector led the rebound on Thursday, with oil and gas explorers rallying alongside crude prices. Both the WTI and Brent futures curves rallied sharply as Saudi Arabia cut their OSPs for crude grades headed to Asia by a far smaller margin than expected, prompting markets to rush to price in tighter supply in the near-term. This boosted the likes of Marathon Oil and ConocoPhillips. Chevron lagged the broader market, with the company forced to make temporary adjustments to their oil output from Kazakh sites due to the civil unrest in the country.

- The materials sector underperformed, with precious metals miners making up the most poorly trading stocks. The likes of Freeport-McMoRan and Newmont Mining took a dent from the softer gold price, with the yellow metal consolidating the recent drift below the $1800/oz handle.

- European trade was uniformly negative, putting France's CAC-40 and Italy's FTSE-MIB at the bottom of the pile, while Spanish and UK markets were spared from the bulk of the losses.

COMMODITIES: Oil Boosted By Further Kazakhstan Unrest

- Crude oil prices have been boosted today by growing unrest in Kazakhstan impacting production and Saudi Aramco also signalling smaller than expected price cuts for February supplies early on.

- WTI is +2.5% at $79.8 with rises again heavily concentrated in early contracts. It has cleared two resistance levels with next eyed at $81.73 (Nov 10 high) and then $82.13, the Oct 25 high and major resistance.

- Brent is +1.8% at $82.2., through one resistance level and next eyeing $83.11 (Nov 10 high).

- Gold has slipped -1.2% at $1789.2, through the first support and eyeing $1781.5, the channel base drawn from the Aug 9 low, a key short-term directional trigger.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/01/2022 | 0645/0745 | ** |  | CH | unemployment |

| 07/01/2022 | 0700/0800 | ** |  | DE | industrial production |

| 07/01/2022 | 0700/0800 | ** |  | DE | trade balance |

| 07/01/2022 | 0700/0700 | * |  | UK | Halifax House Price Index |

| 07/01/2022 | 0730/0830 | ** |  | CH | retail sales |

| 07/01/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 07/01/2022 | 0745/0845 | * |  | FR | industrial production |

| 07/01/2022 | 0745/0845 | * |  | FR | foreign trade |

| 07/01/2022 | 0745/0845 | * |  | FR | current account |

| 07/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 07/01/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 07/01/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 07/01/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 07/01/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 07/01/2022 | 1000/1100 | ** |  | EU | retail sales |

| 07/01/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 07/01/2022 | 1330/0830 | *** |  | US | Employment Report |

| 07/01/2022 | 1500/1000 | * |  | CA | Ivey PMI |

| 07/01/2022 | 1500/1000 |  | US | San Francisco Fed's Mary Daly | |

| 07/01/2022 | 1600/1600 |  | UK | BOE Mann at CFR meeting | |

| 07/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/01/2022 | 1715/1715 |  | UK | BOE Mann on panel at AEA | |

| 07/01/2022 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 07/01/2022 | 2000/1500 | * |  | US | Consumer C |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.