-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Mkt Left Wanting Post-FOMC Minutes

US TSYS: FOMC Minutes: Little Insight On Balance Sheet Drawdown

Tsy futures making modest gains after the bell, back near top end of the range again after making appr 2-3 round trips on the session. Couple bouts of real vol on the day, first in the minutes after the morning's retail sales release, then again late in the session around the Jan FOMC minutes release.- FI markets reverse gains post-data, knee-jerk reaction to initial headline Retail Sales gain of +3.8% vs. +2.0% est, control group +4.8% vs. +1.3% est.

- Strong data tempered by down revisions and mixed performance on the internals, with a few categories contracting M/M (incl health, personal care, gasoline, sporting goods, misc stores, food services).

- Tsy futures held modest gains following brief two-way after $19B 20Y note auction (912810TF5) came in on target: 2.396% high yield vs. 2.396% WI; 2.44x bid-to-cover vs. last month's 2.48x.

- Long end Tsys futures had already sold off in the minutes lead-up to the Jan minutes release, are off early session lows -- stocks gapped higher, SPX emini near highs late: +12.5 at 4477.0.

- Fed minutes: “Most participants suggested that a faster pace of increases in the target range for the federal-funds rate than in the post-2015 period would likely be warranted.”

- On-tap Thursday: weekly claims, housing data, 30Y TIPS auction while StL Fed Bullard makes another appearance at 1100ET.

- Currently, the 2-Yr yield is down 5bps at 1.527%, 5-Yr is down 2bps at 1.9202%, 10-Yr is up 0.4bps at 2.0469%, and 30-Yr is up 0.6bps at 2.3632%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00043 at 0.07371% (-0.00472/wk)

- 1 Month +0.01700 to 0.13671% (-0.05443/wk)

- 3 Month +0.01943 to 0.48814% (-0.01829/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00557 to 0.78714% (-0.05329/wk)

- 1 Year -0.01285 to 1.32986% (-0.06243/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $65B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $972B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases:

- Thu 02/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

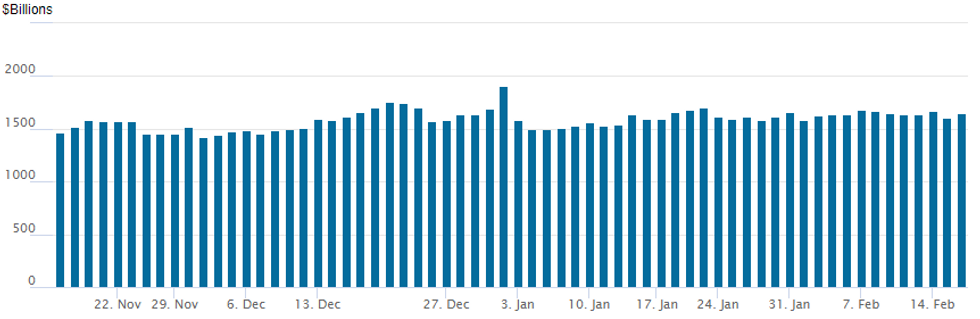

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $1,644.134B w/ 87 counterparties vs. $1,608.494B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -2,000 Gold Jun 97.50 puts, 13.0 ref: 97.755

- 8,300 Sep 96.75 puts, 3.5

- +10,000 May 98.81/98.93/99.12 broke n call flys, 0.5

- -4,000 Blue Mar 97.87/98.25 call spds 6.5 over 97.50 puts

- 8,000 Sep 98.37/98.62 put spds

- -4,000 Blue Mar 97.87/98.25 call spds 6.5 over 97.50 puts

- 8,000 Sep 98.37/98.62 put spds

- Overnight trade

- +5,000 short Mar 97.50/97.75/97.87 broken put flys, 0.0

- +4,000 short Jun 97.18/97.43 put spds 2.5 over 98.25/98.50 call spds

- 2,000 Dec 96.75/97.50 2x1 put spds

- 4,000 Sep 97.75/98.00/98.37 put trees and

- 1,500 Sep 97.75/98.00/98.37 2x3x1 put flys

- Over 9,000 FVJ 117.25 calls, 39, total volume over 36k on day

- 2,500 TYM 127/129 1x2 call spds

- Update, over 10,000 TYJ 125.5/126 put spds, 6

- 6,000 FVJ 117.75 calls, 26

- 1,000 TYH 127/TYM 124 2x3 put spds, 9 net

- 2,000 TYJ 124/125 put spds, 17

- -10,000 FVJ 117.25 calls, 43.5 vs. 117-10 (1-19 synthetic straddle premium)

- Overnight trade

- 3,500 TYJ 124.5 puts, 32

- 2,000 FVH 117/117.25 put spds vs. 118 calls

- Block, 20,000 TYJ 125.5/126 put spds, 14

EGBs-GILTS CASH CLOSE: UK Short End Yields Fall Hard Despite High CPI

Global FI rallied in the European afternoon Wednesday, despite strong US retail sales and industrial production data.

- There was a little more attention on geopolitics once again (renewed concerns that Russia-Ukraine was not de-escalating) and the sense that plenty of central bank hawkishness is already priced in.

- On that note, UK short end yields collapsed over the session alongside a rate strip rally. This was despite a higher-than-expected UK CPI reading and suggests that BoE hikes were richly priced.

- GGBs didn't move on a BBG story that the ECB was working on a plan to extend their refinancing collateral status through 2024 - appeared priced in already.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.7bps at -0.364%, 5-Yr is down 1.3bps at 0.042%, 10-Yr is down 3.2bps at 0.276%, and 30-Yr is down 1.6bps at 0.535%.

- UK: The 2-Yr yield is down 13bps at 1.407%, 5-Yr is down 10.8bps at 1.418%, 10-Yr is down 5.8bps at 1.524%, and 30-Yr is down 2.1bps at 1.588%.

- Italian BTP spread down 1.5bps at 163.4bps / Spanish down 0.2bps at 99.6bps

EGB Options: UK Rate Upside Remains The Key Theme

Wednesday's Europe rates / bond options flow included:

- UBM2 179p, bought for 183 in 2k

- RXJ2 163/164.5/165 call ladder bought for 1.5 in 2k

- DUJ2 111.20/111.50cs vs 111p, bought the put for 4 in 5k

- SFIK2 98.70/98.80/98.90/99.00c condor, bought for 2 in 10k

- SFIK2 98.60/98.80/99.00c fly, bought for 1.75 in 5k

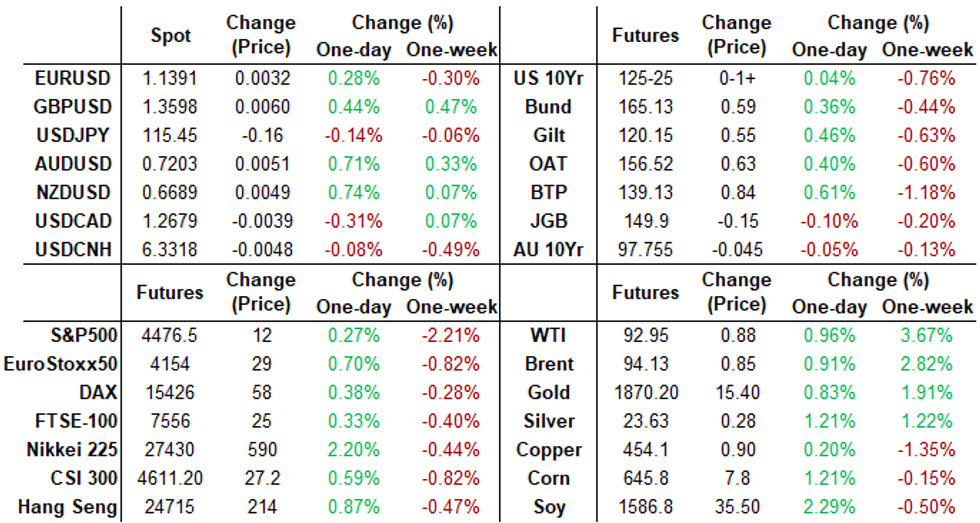

FOREX: US Dollar Remains Under Pressure, Extends Tuesday’s Decline

- The US dollar weakened for the second day in a row with the release of the FOMC minutes adding a late headwind for the greenback. While the information remains dated given the most recent US data, markets interpreted the minutes as dovish at the margin.

- With front-end treasury yields shifting lower and stocks recovering off the lows in the aftermath, the US dollar remained under pressure.

- A firmer commodity complex filtered through to AUD and NZD strength, once again the best performers in the G10 space, rising over 0.7%. With that said, greenback weakness was broad based with GBP, CHF, CAD and JPY all firmer on Wednesday.

- EURUSD (+0.30%) gains mirrored the dollar index, narrowing the gap with next resistance at the Feb11 high of 1.1401. However, the pair remains well within the most notable technical range of 1.1280-1.1495.

- The environment continues to be met with supportive price action for EMFX with the JPM Emerging Market Currency index rising 0.35%. Notable strength in ZAR (+0.85%) and MXN (+0.66%) with the latter currently testing the year’s lows/support around 20.25-28.

- Aussie employment data headlines the APAC data calendar for Thursday, before a light European docket. US Philly Fed Manufacturing index and initial jobless claims will be released at 0830 ET. Fed’s Bullard and Mester both due to speak on Thursday.

FX: Expiries for Feb17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1390-00(E522mln), $1.1435-50(E1.7bln), $1.1500-20(E1.1bln)

- USD/JPY: Y115.00($1.3bln), Y115.75($860mln), Y116.00($1.5bln)

- GBP/USD: $1.3400(Gbp1.0bln), $1.3500(Gbp1.0bln)

- EUR/GBP: Gbp0.8390(E583mln)

EQUITIES: Sizeable Sell Programmes Send Prices Lower

- Some weakness evident in US equities over past few minutes, with the e-mini S&P plumbing a new session low of 4423.25. Largest sell programmes of the session go through on the downtick, with 1232 names sold.

- Moves coincide with further reports that Russia have not withdrawn troops from the Ukrainian border - despite authorities insistence that operations in Crimea and to the east have ceased.

- Ukraine's Zelensky latest to add to that narrative.

- Move also times well with WSJ headlines citing a series of incidents between Russia, US aircraft over the Mediterranean Sea - while the events took place a few days back, still certainly a cause for concern.

- 4354.00 marks first support for stocks, the Feb 14 low. Break below here exposes 4263.25, the lows from Jan 27

COMMODITIES: Oil Slides After Iran Deal Appears Closer

- Crude oil prices are ending the session down on the day after sliding late in the session, potentially on Iran’s top nuclear negotiator saying the JCPOA participants are closer than to an agreement.

- There had been steady gains earlier, with relatively little reaction to a surprising build in US crude inventories earlier.

- WTI is -0.8% at $91.4 but still sits above the key short-term support of $88.41 (Feb 9 low) whilst resistance is $95.82 (Feb 14 high).

- Brent is -0.1% at $92.58, sitting above support at $89.93 (Feb 8 low) with resistance yesterday’s high of $96.78.

- Gold meanwhile has bounced, +1% at $1872.1 as bullish conditions remain and it next eyes $1881.6 (1.00 proj of Dec 15 – Jan 25-28 price swing).

Thursday Data Outlook

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/02/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 17/02/2022 | 0700/0800 |  | EU | ECB Schnabel discussion with SPD | |

| 17/02/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 17/02/2022 | - |  | EU | ECB Lagarde at G20 CB Governors Meeting | |

| 17/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/02/2022 | 1330/0830 | *** |  | US | housing starts |

| 17/02/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/02/2022 | 1400/1500 |  | EU | ECB Lane on MNI Webcast on ECB Policy | |

| 17/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/02/2022 | 1600/1100 |  | US | St. Louis Fed's James Bullard | |

| 17/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 17/02/2022 | 2200/1700 |  | US | Cleveland Fed's Loretta Mester | |

| 18/02/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.