-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: US Looking To Halt Russia Expansion

US TSYS: US Sanctions Russia, First Tranche Start Wednesday

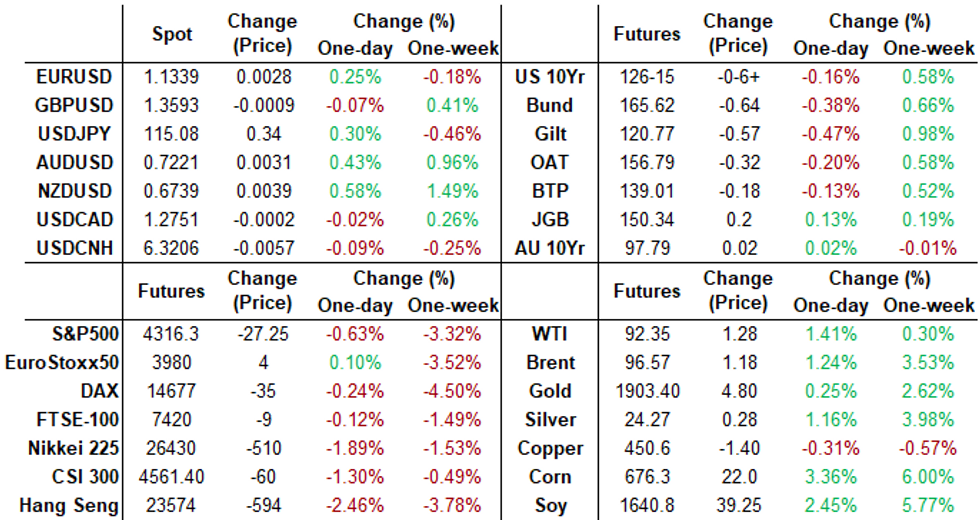

US Tsy trade mixed after the bell, curves flatter with long end outperforming, stocks well off late session lows (SPX emini -25.0 at 4317.0), Gold weaker -5.84, WTI crude gained $1.28/bbl to 92.35.- Markets reacted the way one would expect following the Russia/Ukraine news last night: gap bid in rates/safe havens on Russia formally recognizing and in short order inserting "peacekeeping" forces into Ukraine separatist regions of Donetsk and Luhansk.

- Risk-off/safe-haven support evaporated through the session -- perhaps tied to to measured response via sanctions from US and allies lending to relative calm, Pres Biden annc sanctions similar to EU later in the session: 'We are implementing full blocking sanctions on VEB and military bank. Comprehensive sanctions on Russian sovereign debt. Russia can no longer raise money on US or EU markets.'

- Decent 2Y note sale, short end Tsy futures held weaker but off lows after $52B 2Y note auction (91282CEA5) small stop through: 1.553% high yield vs. 1.57% WI; 2.64x bid-to-cover vs. last moth's 2.81x, well over five auction avg: 2.56x.

- Indirect take-up: eases to 65.58% vs. 66.00% in January;

- Primary dealer take-up falls to 15.65% vs. 24.61% last month;

- Direct take-up: climbs to 18.77% vs. last month's 1+ year low of 9.39%

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00100 at 0.07657% (+0.00100/wk)

- 1 Month +0.01386 to 0.17586% (+0.00515/wk)

- 3 Month +0.0240 to 0.48786% (+0.00829/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.02314 to 0.78143% (+0.00014/wk)

- 1 Year +0.03086 to 1.28857% (+0.00271/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $245B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $931B

- Broad General Collateral Rate (BGCR): 0.05%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- TIPS 1Y-7.5Y, appr $1.001B accepted vs. $2.747B submission

- Next scheduled purchases:

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

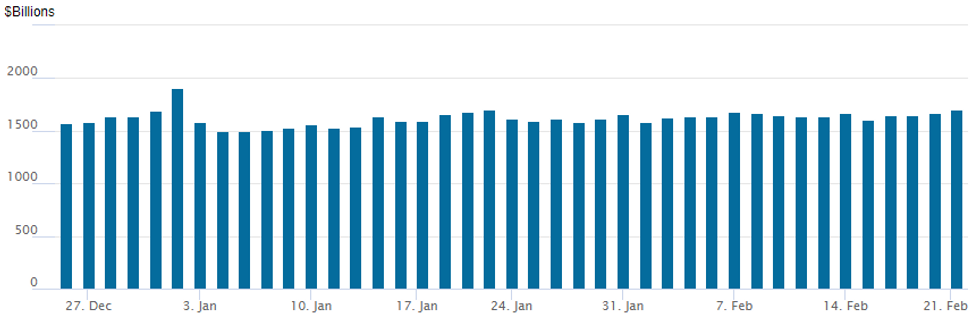

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,699.432B w/ 81 counterparties vs. $1,674.929B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:- +3,000 SFRZ2 97.68/97.93/98.18/98.43 put condors, 5.5 -- adds to +3k last Fri

- +10,000 Apr 99.12 calls 2.0

- Overnight trade

- 7,500 Dec 98.43/98.56 call spds

- -10,000 short Apr put spds, 19.0 ref 97.765

- -7,500 Apr 98.87/99.00 put spds, 8.0 ref 98.805

- +5,000 Jun 98.50/98.68 put spds, 5.0 vs. 98.815/0.12%

- Block, +15,000 wk1/wk2 125 put calendar spd, 6

- +5,000 FVJ 117.25 puts, 27.5, total +20k/day

- -5,000 TYJ 125.5/128.5 strangles, 50-48

- Overnight trade

- Block, 4,000 USJ 160 calls, 33 vs. USM2 at 155-03/0.19%

- Block, 10,000 FVJ 117.25 puts, 27

- Blocks, total 15,000 FVJ 118.25 calls, 30.5-32

EGBs-GILTS CASH CLOSE: Reversal On Geopolitical Relief

Markets entered Tuesday firmly in risk-off mode, but faded the move later in the morning - with geopolitics driving throughout once again.

- The risk-on reversal came as both Russia and the US/Europe appeared more measured in their approach to the Ukraine crisis than had been feared late Monday.

- After showing some signs of short covering last week (see today's Europe Pi for more), Bund futures sold off sharply this morning.

- Short end rates sold off; one exception was March UK which further faded 50bp hike probability following relatively dovish comments by BoE's Ramsden.

- BTP spreads fell sharply thanks to the broader risk-on move.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.5bps at -0.399%, 5-Yr is up 4.9bps at 0.001%, 10-Yr is up 3.7bps at 0.243%, and 30-Yr is up 2.2bps at 0.496%.

- UK: The 2-Yr yield is up 5.4bps at 1.338%, 5-Yr is up 6bps at 1.362%, 10-Yr is up 6.3bps at 1.471%, and 30-Yr is up 5.6bps at 1.548%.

- Italian BTP spread down 2.4bps at 168.1bps / Spanish down 1.7bps at 102bps

EGB Options: Nothing But Downside

Tuesday's Europe rates / bond options flow included:

- RXM2 169c, sold at 42.5 in 2.75k (closing)

- RXJ2 162/159.50ps sold at 41/40 in 10k (ref 167.04). Said to be an unwind

- OEJ2 131.00/130.00ps 1x1.5, bought for 18.5/19 in 5k (bought yesterday in 10k)

- OEJ2 131.25/130.50/130.00/128.50 put condor vs 132.25/133.00 call spread bought for 6 in 11.3k (bought condor, sold c/s)

- DUJ2 111.20/111.00/110.80p fly, bought for 1.75 in 2kDUJ2 111.30/111.10/110.90p fly, bought for 3.25 in 4k

- ERU2 100.25/100.125/100.00p fly, bought for 1.25 in 4k (ref 100.225)

- 2RH2 99.125/99.00/98.875p fly, bought for 1.25 in 4k2RH2 99.125/99.00ps, bought the 1 for 0.75 in 5.75k

- 2RH2 99.125/99.00ps, 1x2 bought the 1 for 0.75 in 4k and in 5.75k

FOREX: Swiss Franc Retraces Monday Strength, Scandinavian FX Outperforms

- Price action for the majors remains subdued as equity markets continue to have large swings amid the geopolitical headline turbulence. A strong initial rally across equity/commodity markets was met with some US dollar weakness, however, renewed pressure on risk throughout US hours leaves the DXY unchanged for Tuesday.

- EURUSD appears content trading between 1.1300-50 while USDJPY resides close to the week’s open just below the 115 mark.

- More notable move seen in the Swiss Franc as the majority of yesterday’s risk-off induced strength was unwound. EURCHF climbed 0.73% to 1.0436, after the downward move fell shy of the 1.0300 support level.

- Scandinavian FX were the strongest performers in the G10 space with commodity-tied currencies leading the way as Brent crude futures touched $99.50/bbl, the highest level since 2014. NOK leads the way, rising 1.38% against the greenback as the Russia - Europe Nordstream 2 gas pipeline falls victim to sanctions responses.

- Late post-Biden relief rally in equities lent strong support to the Russian Ruble which is also seen over 1% in the green against the dollar with markets potentially expecting a wider array of strict sanctions from the US.

- Australian Wage Price Index data overnight before the February RBNZ rate decision/statement. There is very limited scheduled event risk for Wednesday’s US session.

FX: Expiries for Feb23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200(E1.0bln), $1.1250(E601mln), $1.1275(E1.1bln), $1.1300-15(E1.6bln), $1.1350-60(E1.4bln), $1.1380-85(E575mln)

- USD/JPY: Y114.00($860mln)

- AUD/USD: $0.7190-00(A$1.3bln), $0.7225($637mln)

EQUITIES: Stocks Dip After Three-Day Break, Retailers Nosedive

- Wall Street settled lower Tuesday, catching up with the volatile price action evident across Monday's market holiday. Futures also fared poorly, with most key indices shedding around 1% or so as developing Ukraine crisis worked against sentiment.

- Consumer discretionary sectors bore the brunt of the downtick, with automakers a particular source of weakness. The likes of Tesla, Ford and General Motors shed as much as 5.5% Tuesday as markets anticipated possible global supply chain issues that may result from sanctions pressure headed toward Russia from the West.

- Elsewhere, retail had a poor session, with Home Depot and Best Buy the worst performers on the S&P 500 as Home Depot's earnings detailed a lower than expected gross margin for Q4, raising questions about profitability for retail names across 2022.

- The e-mini S&P recovered off the 4250 low printed on the resumption of trade, but recovered modestly since. Technical conditions remain bearish and the contract has traded lower today. The moving average set-up and the contracts recent inability to remain above the 50-day EMA - at 4528.69 - suggest the broader path of least resistance remains down. The focus is on this year’s low of 4212.75 on Jan 24.

COMMODITIES: Oil Fades As Russian Sanctions Rolled Out

- Oil prices saw a strong start to the day on the Russian escalation theme before fading in London hours on a move triggered by the Russian parliament planning to ratify agreements that don’t specify the exact borders of the self-proclaimed separatist entities with further headlines that seemingly limited sanctions pressure for Russia.

- This set the tone for much of the day, with a levelling off following Biden’s speech on Russian sanctions after they appeared less aggressive than perhaps had been expected after a delay in giving the speech.

- WTI is +1.4% from Friday’s settlement at $92.35 having briefly cleared the bull trigger of $95.82 (Feb 14 high) before retreating. It sits above key short-term support of $88.41 (Feb 9 low).

- Within the Apr’22 contract, the most active strikes by far have been $100/bbl calls.

- Brent is +1.1% at $96.43 having earlier touched highs of $99.5 and by doing so clearing resistance at $98.94 (2.764 proj of the Dec 2-9-20 price swing) before retreating.

- Gold has dipped -0.4% to $1899.3 after a string of large gains on Russian escalation, maintaining its bull rally. Resistance is the $1914.3 intraday high whilst initial support is $1879.6 (Feb 15 high).

Wednesday Data Roundup

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2022 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 23/02/2022 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 23/02/2022 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 23/02/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 23/02/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 23/02/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/02/2022 | 0915/1015 |  | EU | ECB Elderson Intro & panel participation at Eurofi Seminar | |

| 23/02/2022 | 0930/0930 |  | UK | BOE Governor Bailey et al at TSC | |

| 23/02/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2022 | 1130/1230 |  | EU | ECB de Guindos Q&A at El Español & Invertia symposium | |

| 23/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/02/2022 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/02/2022 | 1500/1500 |  | UK | BOE Tenreyro speaks at NIESR Institute lecture | |

| 23/02/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 23/02/2022 | 2030/1530 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.