-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Swift Action, Not SWIFT Sanction

US TSYS: Late Risk-Off Unwind

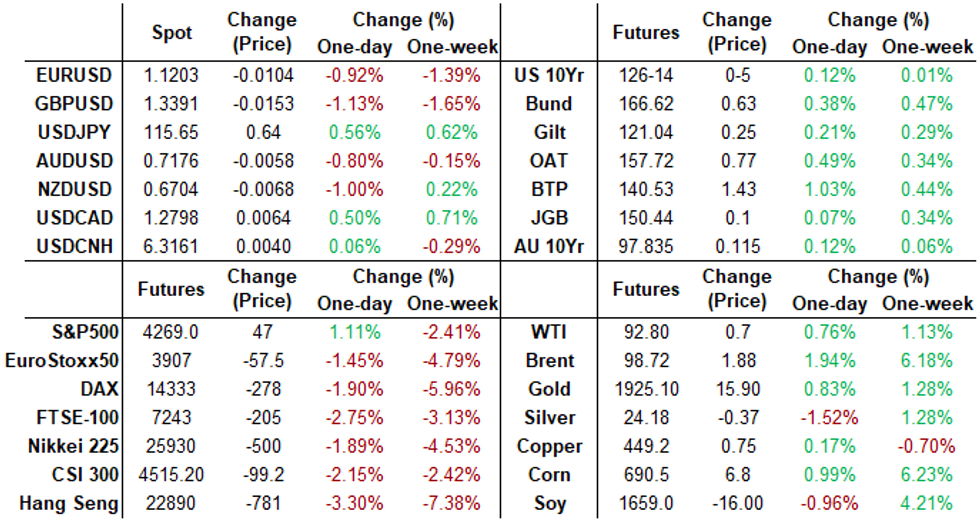

Hectic session on net -- risk appetite improved after US President Biden outlined targeted sanctions against Russia for invading Ukraine overnight, while assurances that US troops would not be sent to Ukraine helped calm markets in late trade.- Not how the session started -- negative reaction to Russia invading Ukraine on multiple fronts: sharp drop in Tsy yields (30YY 2.1590 low), SPX eminis fell to 4101.75 low, Gold soared over $50/oz and WTI crude climbed over $100.0/bbl.

- Heads of state announced more sanctions -- UK PM Boris Johnson called for 'Massive Package Of Sanctions' including access to SWIFT banking system; French Pres Macron include "sanctions against Russia will factor in the energy sector and will be without weakness". But calm didn't emerge until Pres Biden would not limit access to SWIFT (holding in reserve), relief rally as Biden focused on shoring up NATO support and not putting US troops on Ukraine soil.

- Heavy overall volumes (TYH2>3.7M) -- due in large part to ongoing Mar/Jun quarterly roll ahead next Mon's first notice.

- Long-end Tsys inched off session lows, two-way trade on modest reaction to $50B 7Y note auction (91282CEB3) stop: 1.915% high yield vs. 1.905% WI; 2.36x bid-to-cover steady vs. last month.

- Friday Data Roundup: Durables, Cap Goods, PCE, Home Sales, U-Mich, NY Fed buy-op rolled to Friday due to technical difficulties.

- After the bell, 2-Yr yield is down 3.8bps at 1.5637%, 5-Yr is down 4.8bps at 1.8553%, 10-Yr is down 3.1bps at 1.9599%, and 30-Yr is down 1.7bps at 2.2767%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 at 0.07743% (+0.00186/wk)

- 1 Month +0.02171 to 0.20857% (+0.03786/wk)

- 3 Month +0.01029 to 0.50786% (+0.02829/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.02186 to 0.80443% (+0.02314/wk)

- 1 Year -0.05057 to 1.28629% (+0.00043/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $201B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $902B

- Broad General Collateral Rate (BGCR): 0.05%, $334B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $326B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases -- Thursday's operation delayed until Friday:

- Fri 02/25 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

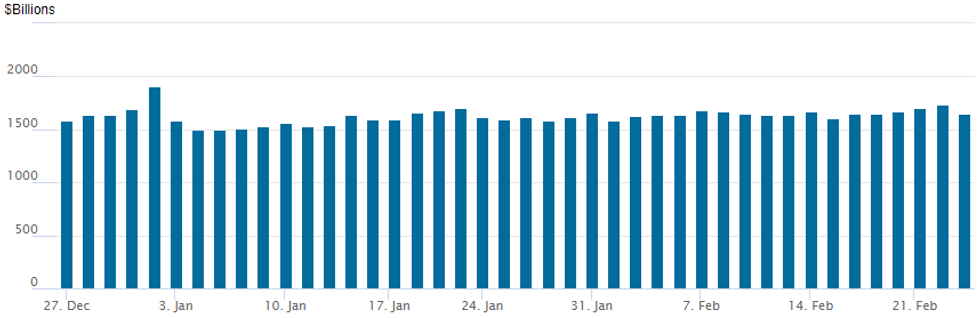

FED Reverse Repo Operation, Usage Recedes

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,650.399B w/ 78 counterparties vs. $1,738.322B (2022 high) prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -5,000 short Jun 98.00/98.25 put spds, 16.5 ref 97.79

- +10,000 Apr 98.87/99.00 put spds, 7

- Overnight trade

- +10,000 Green Mar 98.12 calls, 3 ref 97.84 -.835

- 4,000 short May 97.12/97.43/97.75 put flys

- 4,000 short Jun 97.25/97.50 put spds

- 5,000 short Mar 97.43/97.62/97.81 put flys

- 5,000 Dec 98.75/99.00 call spds

- 5,000 short Jun 98.75 calls, 2.5

- 7,250 Sep 98.37/98.5 put spds

- 1,500 Apr 98.37/98.68 3x2 put spds

- Block, 6,000 short Mar 98.37 calls, 2.0

- Block, 5,000 short Mar 98.25/98.37 call spds, 2.0 vs. 98.01/0.08%

- 20,000 TYJ 127/128 call spds, 19 last

- over 9,000 TYM 124 puts, 31 last

- 5,000 FVJ 116.25/117 put spds, 13 last

- 4,000 FVJ 115.75 puts, 3.5

- +8,000 TYM 132 calls, 10

- -2,000 TYJ 126.5 straddles, 152 ref 126-19

EGBs-GILTS CASH CLOSE: Eyeing A Dovish ECB Shift On Ukraine

The Russian invasion of Ukraine predictably dominated European markets Thursday with yields dropping sharply on the open, and again later in the session on signs that geopolitics could hold back central bank tightening.

- ECB hawk Holzmann said in late afternoon that the Ukraine conflict may delay the bank's exit from monetary stimulus.

- The biggest reaction came from 10Y BTP spreads which dropped 10bp immediately, reversing earlier widening. But short-end Bund yields also came off the highs they had spent most of the session clawing towards after an opening drop.

- Germany outperformed the UK, the latter seen again as potentially less directly impacted by the Ukraine crisis.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.7bps at -0.416%, 5-Yr is down 8bps at -0.072%, 10-Yr is down 5.6bps at 0.172%, and 30-Yr is down 2.4bps at 0.443%.

- UK: The 2-Yr yield is down 3.8bps at 1.258%, 5-Yr is down 3.5bps at 1.296%, 10-Yr is down 3.2bps at 1.447%, and 30-Yr is up 0.9bps at 1.573%.

- Italian BTP spread down 6.8bps at 164.5bps / Spanish down 2.6bps at 100.7bps

EGB Options: Light Flow Of Note On A Heavy Day

Thursday's rates / bond options flow included:

- RXM2 160p, bought for 84 and 85 in 5k

- RXK2 166.50/168.50 call spread 3000 sold 50

FOREX: US Dollar Index Briefly Makes 19-Month High, Advance Limited To 0.85%

- The greenback was firmly back in favour on Thursday as markets sought a flight to safety following the Russian invasion of Ukraine sparked widespread risk-off across global markets.

- At one point the dollar index rose to the best level since June 2020, prompting weakness for all other G10 currencies. A late bounce in equities saw the dollar fall from best levels but remains just under 1% in the green approaching the start of the APAC session.

- In turn, EURUSD fell steeply to a low of 1.1106, breaching the late January lows that resided around 1.1320. The geography of the events exacerbated moves in the single currency with EURUSD close to down 2% at its worst levels before regaining some poise back to 1.12.

- Similar price action across the G10 space, with GBP (-1.03%), AUD (-0.91%), NZD (-1.2%) all bearing the brunt of the dollar strength, however, JPY, CAD and CHF also all retreated just over 0.5%.

- Severe volatility in the Russian Ruble as expected. Early session highs of 88.2670 in USDRUB were approached around midday ET before the relief rally for risk prompted some support for the faltering RUB. Following the Biden press conference, USDRUB fell sharply to 84.00 before consolidating around the 85.00 mark, down 4.5% for the session.

- Souring risk sentiment filtered through to emerging market FX was hit significantly, with CEE and Latam FX notably struggling throughout the day and unable to benefit from the late bounce in equities.

- New Zealand Retail Sales kick off the APAC session before potential comments from Fed’s Waller. Tomorrow in the US, markets will receive US Core PCE Price Index and Durable Goods data. ECB’s Lagarde is then scheduled to hold an online press conference about Russia's invasion of Ukraine.

EQUITIES: Late Equity Roundup: Tailwind

Stocks recovering, Nasdaq lead, SPX following, Dow Industrials still lagging. Risk-off unwind with Tsys trading weaker in long end now, Gold over trades -27.0 lower recently from $50.0 higher this morning. Targeted sanctions (no denial to SWFT system) and no boots on Ukraine soil helping risk appetite:

- SPX Eminis currently trading +8 points (0.19%) at 4230; Dow Industrials -271.67 points (-0.82%) at 32859.52; NASDAQ +235.4 points (1.8%) at 13272.65.

- SPX leading sectors:

- Information Technology now +2.02% from -2.56% earlier

- Communication Services +1.93%

- Real Estate +1.23%

- Laggers: Energy -2.63%; Consumer Staples -2.50%

- TECHNICALS: Strong Rebound Off Today’s Low

- RES 4: 4586.00 High Feb 2

- RES 3: 4508.04 50-day EMA

- RES 2: 4345.50/4429.81 High Feb 23 / 20-day EMA

- RES 1: 4224.50 Intraday high

- PRICE: 4266.50 @ 20:35 GMT Feb 24

- SUP 1: 4101.75 Low Feb 24

- SUP 2: 4055.60 Low May 19 2021 (cont)

- SUP 3: 4029.25 Low May 13 2021 (cont)

- SUP 4: 3990.50 0.764 proj of the Jan 4 - 24 - Feb 2 price swing

E-Mini S&P technical conditions remain bearish however price action has rallied sharply higher from today’s low of 4101.75. Short-term momentum conditions highlight a bullish divergence between price and momentum and this does suggest scope for some unwinding of recent weakness or at the very least, a period of consolidation. The next resistance is at 4345.50, the Feb 23 high. Today’s low of 4101.75 is the bear trigger.

COMMODITIES: Wild Swings Following Russian Invasion

- Commodities prices have seen wild moves today, surging on the Russian invasion of Ukraine before unwinding gains on the rollout of the Western response with sanctions that avoided targeting Russian oil, and in the case of gold more than unwinding gains.

- WTI currently sits +1.3% at $93.36 having been up 9.2% at one point and clearing $100/bbl in the process. It’s through support of $94.95 and next eyes $90.64 (Feb 23 low). The curve remains in firm backwardation.

- Brent has seen larger gains due to its proximity, +3.3% at $99.32 off an earlier high of $105.79. It now sits reasonably close to the firm support of the earlier intraday low of $97.56 after which it opens $95.80 (Feb 22 low).

- Gold has seen a larger swing directionally, currently down -1.3% at $1882.91 having been +3.4% at its peak of $1974.35 and smashing through the medium-term upside target. It now sits close to testing support at $1879.6 (Feb 15 high).

- European natural gas prices closed 50% higher on the day, prior to the further decline in other commodity prices on Biden’s address.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/02/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/02/2022 | 0125/2025 |  | US | Fed Governor Christopher Waller | |

| 25/02/2022 | 0700/0800 | ** |  | SE | PPI |

| 25/02/2022 | 0700/0800 | *** |  | DE | GDP (f) |

| 25/02/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 25/02/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 25/02/2022 | 0745/0845 | *** |  | FR | GDP (f) |

| 25/02/2022 | 0745/0845 | ** |  | FR | PPI |

| 25/02/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/02/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 25/02/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 25/02/2022 | 0900/1000 | ** |  | EU | M3 |

| 25/02/2022 | 0900/1000 | * |  | NO | Norway Unemployment Rate |

| 25/02/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 25/02/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 25/02/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 25/02/2022 | 1115/1215 |  | EU | ECB Lagarde at Eurogroup Press Conference | |

| 25/02/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup meeting | |

| 25/02/2022 | - |  | EU | ECB Lagarde & de Guindos at ECOFIN meeting | |

| 25/02/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 25/02/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 25/02/2022 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 25/02/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 25/02/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/02/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/02/2022 | 1800/1800 |  | UK | BOE Pill unwinding QE remarks at BEAR Conference | |

| 26/02/2022 | 1145/1245 |  | EU | ECB de Guindos at ECOFIN press conference | |

| 26/02/2022 | - |  | EU | ECB Lagarde & de Guindos at ECOFIN meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.