-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI ASIA MARKETS ANALYSIS: More Yld Curve Inversions

US TSYS: Short End Under Pressure On Hawkish Fed Speak

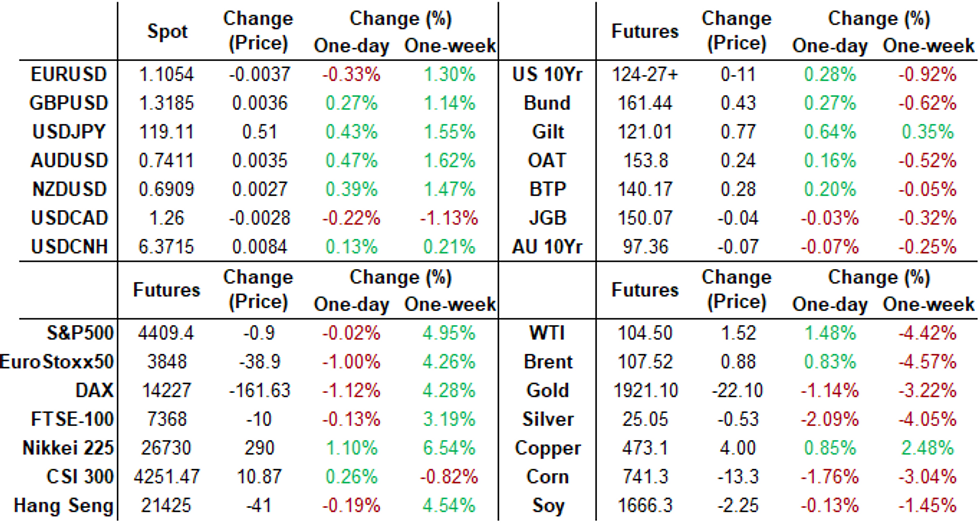

Bonds finished strong Friday, but off early highs to near middle of session range, short end weaker as market digested hawkish comments from Fed Gov Waller on CNBC, StL Fed Bullard dissenter essay and Richmond Fed Barkin in the first half.

- Barkin said the central bank's "gradual" interest rate path shown in forecasts this week depicting seven interest rate increases will not drive an economic decline, while the normalization of the balance sheet can work in the background and will begin soon.

- Yield curves bull flattened with 3s, 5s and 7s inverting vs. 10s in the first half on continued heavy short end selling and strong buying in long end (30YY falling to 2.4014% low. Note: late 2s10s Block steepener:

- +20,000 TUM2 106-17.25, post-time bid vs.

- -10,750 TYM2 124-17.5, well through 124-21 post-time bid

- US Biden/China Xi call headlines filtering through -- Xi sounding dovish Russia war in Ukraine: "confrontation not beneficial to anyone .. conflicts, confrontation not beneficial to anyone".

- Not much substance from Russia Pres Putin address at Luzhniki stadium in Moscow: 'The concert is dedicated to the eighth anniversary of Crimea's reunification with Russia" Tass, before video of event cut out.

- Pres Biden will travel to Brussels, Belgium on Wednesday next week, expected to speak at European council summit on Thursday, followed by G7 meeting. No set times, TBA.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00271 at 0.32871% (+0.24942/wk)

- 1 Month -0.00200 to 0.44657% (+0.05000/wk)

- 3 Month +0.00614 to 0.93400% (+0.10800/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01314 to 1.28757% (+0.15700/wk)

- 1 Year +0.01072 to 1.78643% (+0.19043/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $73B

- Daily Overnight Bank Funding Rate: 0.32% volume: $266B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $1.003T

- Broad General Collateral Rate (BGCR): 0.30%, $374B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $365B

- (rate, volume levels reflect prior session)

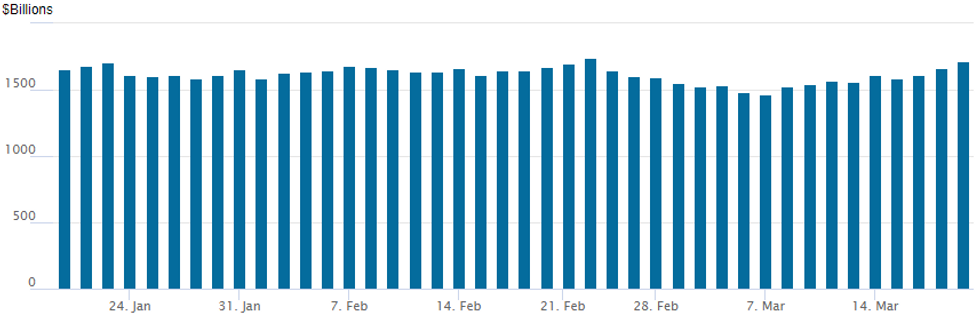

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to highest since Feb 23 at $1,715.148B w/ 84 counterparties vs. $1,659.977B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- Much better Treasury call buying in 5s today:

- +62,000 FVK 117.25 calls, 13.5

- +3,500 TYM 130 calls, 9

- Even so -- put skew holding flat to slightly bid:

- TYK 126/123 risk reversal covered vs. 124-16: -1/0

- FVK 117/115.5 risk reversal covered vs. 116-08: -0.5/0

- Tsy Puts traded little richer in longer expirys, option desks say.

- Eurodollar options, on the other hand saw pick-up in put buying on the day after hawkish policy comments from Fed Gov Waller, StL Fed Bullar and Richmond Fed Barkin weighed on Eurodollar Whites (EDM2-EDH3) -0.005-0.035. Highlight trade:

- Blocks: put spd spds:

- +20,000 Sep'22 97.62/98.00 put spds, 12.5 vs.

- -10,000 Dec'22 97.75/98.00 put spds, 14.0 vs.

- -10,000 Mar'23 97.50/97.75 put spds, 14.0

- Block, 14,000 Dec 99.25/99.37 put spds, 0.5 vs. 97.635/0.05%

- Blocks: put spd spds:

- +20,000 Sep'22 97.62/98.00 put spds, 12.5 vs.

- -10,000 Dec'22 97.75/98.00 put spds, 14.0 vs.

- -10,000 Mar'23 97.50/97.75 put spds, 14.0

- Block, 14,000 Dec 99.25/99.37 put spds, 0.5 vs. 97.635/0.05%

- +5,000 short Apr 97.00/97.12 put spds, 3.5 vs. 97.25

- -5,000 Jun 98.56/98.68/98.81/98.93 put condors, 3.25

- Overnight trade:

- 2,000 short Sep 96.75 puts, 13.0

- 2,000 Jun 98.50/99.31 call spds

- 1,250 Dec 97.62/98.62 call spds

- Over +62,000 FVK 117.25 calls, 13.5

- +3,500 TYM 130 calls, 9

- Block, 15,000 FVK 115.75/116.25 put spds, 14.5

- +12,500 FVK 117.25calls, 10.5-11.5

- 10,000 FVK 114.5/115.5 put spds

- Overnight trade

- 1,250 TYK 124.5/126 2x3 call spds, 37

EGBs-GILTS CASH CLOSE: Front-End UK Rates Continue To Fall Post-BoE

The standout move to end a volatile week was a rally in the UK short-end, as BoE rate hikes continued to be priced out following a more dovish-than-expected meeting Thursday.

- Amid a bull flattening move on the Gilt curve, 2Y UK yields fell sharply, and are now off around 25bp vs pre-BoE. MNI's BoE Review explains some of the reasons why the BoE may hike less than markets are pricing.

- Equities were fairly flat on the day, and periphery spreads likewise.

- The German curve was fairly flat, Bobl modestly outperformed - fairly light volumes overall, especially by comparison to recent sessions.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.338%, 5-Yr is down 1.3bps at 0.09%, 10-Yr is down 1.2bps at 0.373%, and 30-Yr is unchanged at 0.561%.

- UK: The 2-Yr yield is down 8.9bps at 1.209%, 5-Yr is down 7.9bps at 1.244%, 10-Yr is down 6.8bps at 1.497%, and 30-Yr is down 4.3bps at 1.743%.

- Italian BTP spread up 0.1bps at 151.9bps / Spanish up 0.1bps at 94.4bps

EGB Options: Bund Short Unwinds And Euribor Vol Buying

Friday's Europe rates/bond options flow included:

- RXJ2 165.50c, bought for 2.5 in 5.1k

- RXM2 164.5/158.5ps 1x2 sold the 1 at 214 in 8k, done vs 1.6k futures at 161.18 (unwind shorts)

- RXM2 165.00/156.00ps 1x2.25, sold at 357 in 4k (4k x 9k)

- ERU2 99.75/100.00/100.25 1x2x0.5c fly Bought for 1.5 3k

- ERZ2 99.875^, bought for 43 in 5k

FOREX: USDJPY Set For Highest Weekly Close Since Jan 2016

- Another firm session for major equity indices continued to underpin USDJPY strength on Friday. The pair remains on an upward trajectory following last week’s significant break of 116.35 and impressive three big figure extension in just over a week.

- This week’s important technical break was the move through resistance at 118.60/66, the Jan 3 ‘17 and Dec 15 ‘16 highs, strengthening current bullish technical conditions. USDJPY looks set to post its highest weekly close since January 2016.

- The CHF has outperformed, rising 0.85% against the Euro back to 1.0300. EURUSD retraces a part of recent impressive gains, but the bias remains for further corrective rallies.

- Meanwhile the greenback trades more mixed with the ICE dollar index residing 0.3% in the green to finish the week. Despite the overall greenback retreat this week, Friday’s boost comes amid hawkish commentary from both Fed’s Waller and Kashkari, emphasising the latest set of projections from Wednesday’s FOMC meeting.

- Looking ahead, Fed Chair Powell is due to speak on Monday about the economic outlook at the National Association for Business Economics Annual Economic Policy Conference. Japan will be out for a local holiday.

- On the data calendar, UK inflation data precedes the UK budget release on Wednesday. European Flash PMIs are scheduled for Thursday. On the central bank front, SNB and Norges Bank decisions are risk events of note.

FX: Expiries for Mar21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E2.6bln), $1.1150(E646mln)

- USD/JPY: Y116.90-05($1.1bln), Y118.00($635mln), Y118.95-00($635mln)

- USD/CAD: C$1.2740-55($1.4bln)

Late Equity Roundup, Strong Finish, SPX Through 200-DMA

Stock indexes finishing the week at the highest levels in a month: SPX emini through second key resistance of 4446.2 (200-dma) to 4457.5 +55.25 (1.26%). Meanwhile, Dow trades -274.17 (0.8%) at 34754.93, and Nasdaq +279.1 (2%) at 13893.84.

- Carry-over bid from China indexes on hopes of a rate cut, trading desks also cited various factors for support: triple witching expiration buying/squaring, and technical support as SPX eminis trade through first resistance 50D EMA of 4410.0 and second resistance 200-dma opens next key resistance of February highs of 4476.50.

- SPX leading/lagging sectors: Information Technology rebounds (+2.19%) with Semiconductor sector (+2.90%) outpacing Software/Service (+2.01%) outpacing Hardware makers (+1.96%); Consumer Discretionary (+2.18) driven by Auto makers. Laggers: Utilities (-0.90%) and Energy (+0.09%).

- Dow Industrials Leaders/Laggers: Salesforce.com (CRM) +8.09 at 218.5 and NIKE (NKE) +3.79 at 131.22. Laggers: Travelers (TRV) insurance pares earlier losses to -0.88 at 180.19; United Health (UNH) paring losses -1.30 at 505.87.

COMMODITIES: Brent, WTI Firmer, Gold Weaker

Volatile week for oil, Brent and West Texas variants higher but off early Monday levels. Earlier headlines noted Mexico considering a halt to crude export cuts as prices rally off midweek lows.

- Lack of progress in Russia/Ukraine peace talks adding to bid on increased uncertainty over the weekend. That said, Gold is weaker on the day

- WTI is +1.39% at $104.41 and next eyes key resistance at $110.29, the Mar 11 high. A break of this level would signal scope for a stronger short-term rally.

- Brent is +0.83% at $107.52

- Gold is -1.17% at $1920.5, and -3.25% from week ago levels

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/03/2022 | 0300/1100 |  | CN | PBOC LPR decision | |

| 21/03/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/03/2022 | 0730/0830 |  | EU | ECB Lagarde at Institut Montaigne Event | |

| 21/03/2022 | 1000/1100 | ** |  | EU | Construction Production |

| 21/03/2022 | 1200/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/03/2022 | 1600/1200 |  | US | Fed Chair Jerome Powell | |

| 21/03/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.