-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Late Month End Rebalancing

US TSYS: Month-End Rebalancing Roils Mky Ahead March NFP

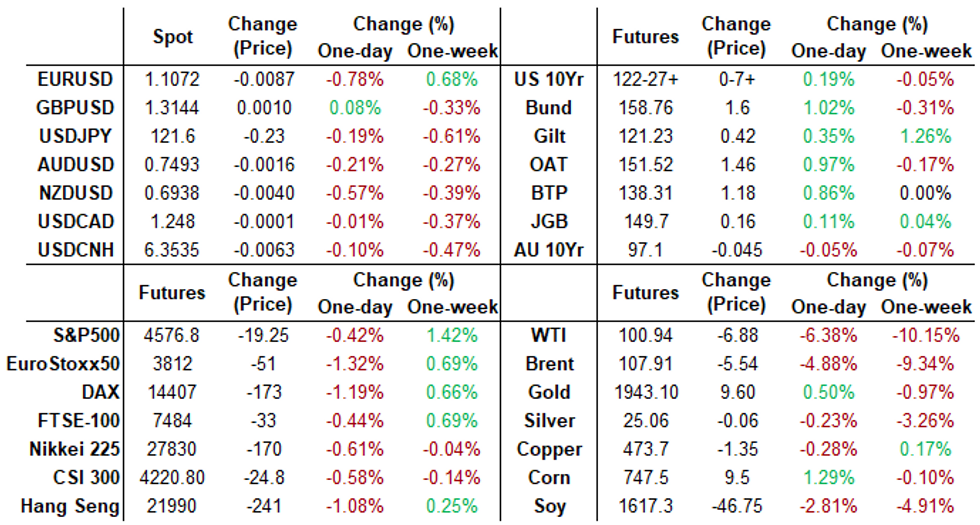

Rates see-sawed higher Thursday, near middle of the session range following late month-end rebalancing trade, volumes spiked on late buying in SPX eminis, ESM2 climbing off lows to 4582.5, before scaling back to 4557.0, while TYM2 trades from 123-00.5 to 122-27 into the FI close, 122-27 (+7) last.- Little react to earlier data, PCE in-line +0.6%; +6.4% Y/Y; MNI PMI recovered to 62.9 in March, after last month's dip to 56.3. Focus on Fri's March employment data.

- March nonfarm payrolls are expected to have risen by 490k (Bbg primary dealer median sits at 520k). We see two-sided risks to May pricing for Fed hikes and somewhat asymmetric risk to the downside for the broader rate path, but acknowledge that there's a long way to go between this report and the next FOMC decision on May 4, especially in the current geopolitical climate.

- FI rallied briefly after headlines aired Russia's Putin expects gas delivery contracts to be paid in Roubles, buyers must have Rouble funds deposited in Russian banks or risk being shut off. Timing over payments in question: initial report was by today; more recent reporting suggests second half of April to early May.

- The 2-Yr yield is down 1.8bps at 2.2882%, 5-Yr is down 1.3bps at 2.4249%, 10-Yr is down 2.2bps at 2.327%, and 30-Yr is down 2.9bps at 2.4453%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00357 at 0.33171% (+0.00514/wk)

- 1 Month -0.00314 to 0.45200% (+0.00686/wk)

- 3 Month -0.00529 to 0.96157% (-0.02129/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00214 to 1.46986% (+0.01872/wk)

- 1 Year -0.02443 to 2.10143% (+0.01272/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $80B

- Daily Overnight Bank Funding Rate: 0.32% volume: $249B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $900B

- Broad General Collateral Rate (BGCR): 0.30%, $324B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $310B

- (rate, volume levels reflect prior session)

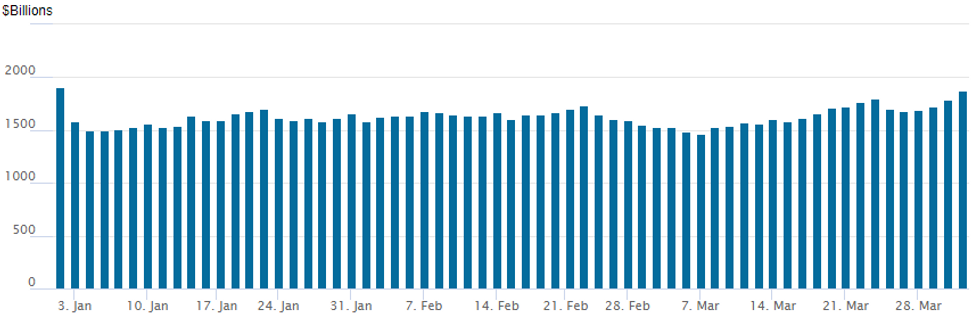

FED Reverse Repo Operation, New Year-to-Date High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new year-to-date high of $1,871.970B w/ 100 counterparties vs. prior session's $1,785.939B. Nearing all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed option trade noted Thursday -- positioning ahead Friday's March jobs report (+490k est), some decent upside Treasury call buying more notable than the earlier two-way as underlying futures climbed back to last week Wednesday's early highs.- Highlight trades included a scale buyer of over 21,000 TYK 123.25 calls from 48-42, and 10,000 TYM 125 calls from 33-29. In 5Y calls, paper bought 10,000 FVK 115.5 calls from 17.5-18.5 overnight.

- Eurodollar options saw better two-way put trade positioning/unwinds as underlying futures continued to scale back from more aggressive (read several 50bp) rate hikes by year end. Two- and three-year midcurve put condors of note included sale of -5,000 short Dec 96.62/96.87/97.12/97.37 put condors with

- -5,000 Green Dec 96.75/97.00/97.25/97.50 put condors, 8.5 total credit on the double sale package. Of note, paper bought 6,000 Green Dec 95.50/96.00/96.50/97.00 put condors at 10.0 vs. 97.28/0.08% overnight.

- -5,000 short Dec 96.62/96.87/97.12/97.37 put condors w/

- -5,000 Green Dec 96.75/97.00/97.25/97.50 put condors, 8.5 total cr

- 1,800 Dec 98.75/98.87 call spds, 1.0

- +5,000 Sep 99.50 calls, 4.0 vs. 96.875/0.07%

- -2,500 Jun 98.56/98.62/98.81/98.87 call condors, 1.25 and offered

- -5,000 Sep 978.37/98.00 call over risk reversals, 7.5 vs. 97.80/0.69%

- -2,500 Dec 98.00 calls, 19.5 vs. 97.33/0.25%

- Overnight trade

- +6,000 Green Dec 95.50/96.00/96.50/97.00 put condors, 10.0 vs. 97.28/0.08%

- +5,000 short Jul 97.62/97.87 call spds, 3.0

- 1,600 TYM 124 straddles, 148

- 2,000 FVK 113.25/114 put spds, 11

- 10,000 TYM 125 calls, 33-29

- 1,600 FVK 112/113/114 put flys, 9

- 5,000 FVK 115 calls, 30

- 2,500 TYK 121.25/122.5 call spds, 63

- 6,000 TYK 119/120 put spds, 5

- over +21,000 TYK 123.25 calls, mostly 48-42

- 3,000 FVK 113.25/113.5 put spds, 2.5

- 4,000 USK 144/147 put spds

- Overnight trade

- -5,000 wk1 TY 122.75/123.25/123.75 call flys, 9

- -4,000 USK 144/147 put spds, 29 vs. 150-00/0.15%

- 1,500 USK 144/146 put spds, 14

- 1,200 USK 144/150 put spds, 138

- +10,000 FVK 115.5 calls, 17.5-18.5

- 1,500 FVK 114 puts, 19.5

EGBs-GILTS CASH CLOSE: German Yields Close Quarter With Sharp Drop

German yields outperformed Thursday, with Bobl and Bund rallying sharply.

- Yields tracked both mixed inflation data (France's beat wasn't as big as feared) and a fall in oil prices, with crude dropping overnight on anticipation the US would release strategic reserves.

- Later in the session, the Bund rally extended as equities slipped. Gilts lagged slightly.

- Periphery EGBs kept pace with BTPs rallying the most in a month. 10Y spreads ended a little wider though; Spain 10s a little tighter.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.6bps at -0.074%, 5-Yr is down 10.9bps at 0.375%, 10-Yr is down 9.8bps at 0.548%, and 30-Yr is down 6.6bps at 0.666%.

- UK: The 2-Yr yield is down 3bps at 1.352%, 5-Yr is down 3.8bps at 1.405%, 10-Yr is down 5.6bps at 1.61%, and 30-Yr is down 5bps at 1.763%.

- Italian BTP spread up 0.9bps at 149.1bps / Spanish down 0.8bps at 88.8bps

EGB Options: Large Bobl Downside Features

Thursday's Europe rates/bond options flow included:

- RXK2 157/156/155.5 put fly, bought for 21 in 3k

- OEM2 127.50/126.50ps 1x1.5, bought for 11.5, 12 and 12.5 in 40k

- DUM2 111.00/111.50 cs bought for 9.25 in 4.7k

- DUM2 111.10/111.60cs, bought for 8 in 5k

- DUK2 110.90/111.40 cs, bought for 10 in 13.5k total

- ERZ2 99.875/100.125/100.375 call fly, sold at 4 in 5k

- 0RM2 99.50/99.37/99.25/99.12p condor, sold at 2 in 6k

Greenback Firms As Putin Roils Markets, Oil Hurts NOK

- The USD index has risen around 0.4% on Thursday and looks set to snap a two-day losing streak for the greenback.

- Headlines from Russia’s Putin surrounding the issue of a decree demanding payment for natural gas in rubles. Despite appearing to temper the order by allowing dollar and euro payments through a designated bank, the headlines weighed on risk with major equity benchmarks grinding lower throughout the session and lending support to the USD.

- The Euro was the main victim of the price action with EURUSD retracing back below 1.11 and settling towards the day’s low around 1.1070. Euro weakness was broad based as EURJPY and EURCHF both reside around 1% weaker.

- The Japanese Yen has continued its unwind from oversold conditions with USDJPY briefly making a fresh low for the week below 1.2130 and nearly 400 pips from the high posted on Monday.

- Substantially lower oil prices weighed heavily on the Norwegian Krona. USDNOK is seen over 2.5% higher approaching the APAC crossover, rejecting the breach of 8.60 and rising towards the best levels of last week around 8.80.

- Eurozone CPI Flash Estimate for March highlights the European session on Friday.

- However, focus remains on the US employment report. March nonfarm payrolls are expected to have risen by 490k according to the Bloomberg survey median. A few much softer analyst forecasts result in a lower average of 466k although the dispersion of views is relatively tightly packed between 450-550k and the primary dealer median sits at 520k.

FX: Expiries for Apr01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1085-00(E844mln)

- USD/JPY: Y120.00($575mln), Y121.50-60($930mln)

- AUD/USD: $0.7525(A$522mln), $0.7550(A$564mln), $0.7600(A$551mln)

- USD/CAD: C$1.2660-80($1.1bln)

- USD/CNY: Cny6.3800($525mln)

EQUITIES: Late Equity Roundup: Extends Session Lows After Brief Month-End Bid

Stocks had climbed higher on good month-end buying in late trade (SPX eminis tapped 4582.25) before selling off/extending session lows after the FI close: ESM2 around 4557.5 puts it near the middle of the week's range and well above initial firm support is at 4437.23, the 50-day EMA.

- Dow currently trades -129.34 points (-0.37%) at 35097.18, and Nasdaq -6.3 (0%) at 14434.68.

- SPX leading/lagging sectors: Utilities sector lead fading but still outperforming for a second consecutive session (+0.10%), underpinned by independent power/renewable electricity producers. Next best performer: Consumer Staples (+0.00%) with food/beverage countering weaker household/personal products. Laggers: Financials underperform late (-1.80%) lead by large global banks and diversified financials.

- Dow Industrials Leaders/Laggers: Caterpillar (CAT) climbs late +1.28 at 224.36, while support for Amgen (AMGN) cools: +0.54 at 243.11. Home Depot continues to underperform, -9.04 at 299.42 while United Health (UNH) recedes -6.86 at 513.96.

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4578.50 High Feb 9 and a key resistance

- RES 1: 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg

- PRICE: 4530 1600ET Mar 31

- SUP 1: 4437.23 50-day EMA

- SUP 2: 4320.25 Low Mar 17

- SUP 3: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 4: 4055.60 Low May 19 2021 (cont)

COMMODITIES: Oil Slides On SPR Release, Gas Prices On Ruble Plan

- Oil prices are down sharply after Biden announced plans to release 1 million barrels of oil per day for up to 180 days from the SPR, widening the Brent-WTI spread in the process.

- Rystad notes that whilst the SPR has the technical capability to release 4mbpd, the maximum seen over the past twenty years has been about 900kbpd.

- OPEC+ ratified a 432kbpd increase scheduled for May, in line with expectations.

- European natural gas prices meanwhile increased 5%, with an intraday move closer to 10%, after Putin signed an order that if EU buyers don’t make gas payments in rubles, shipments will be stopped from tomorrow, April 1.

- WTI is -6.8% at $100.5, close to testing support at Tuesday’s low of $98.44 as it pulls back further from resistance at yesterday’s high of $108.75.

- Brent is -5.4% at $107.3, above initial support of $104.84 (Mar 28 low) whilst resistance remains $114.83 (Mar 29 high).

- Gold is +0.5% at $1942.44, moving closer to resistance of $1966.1 (Mar 24 high) whilst support remains at $1890.2 (Mar 29 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/04/2022 | 2350/0850 | *** |  | JP | Tankan |

| 01/04/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/04/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/04/2022 | 0630/0830 | ** |  | SE | Manufacturing PMI |

| 01/04/2022 | 0630/0830 | *** |  | CH | CPI |

| 01/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/04/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/04/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/04/2022 | 1230/0830 | *** |  | US | Employment Report |

| 01/04/2022 | 1305/0905 |  | US | Chicago Fed's Charles Evans | |

| 01/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/04/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/04/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.