-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stocks Get Diamond Hand Treatment

US TSYS: Week Opener: Risk-On

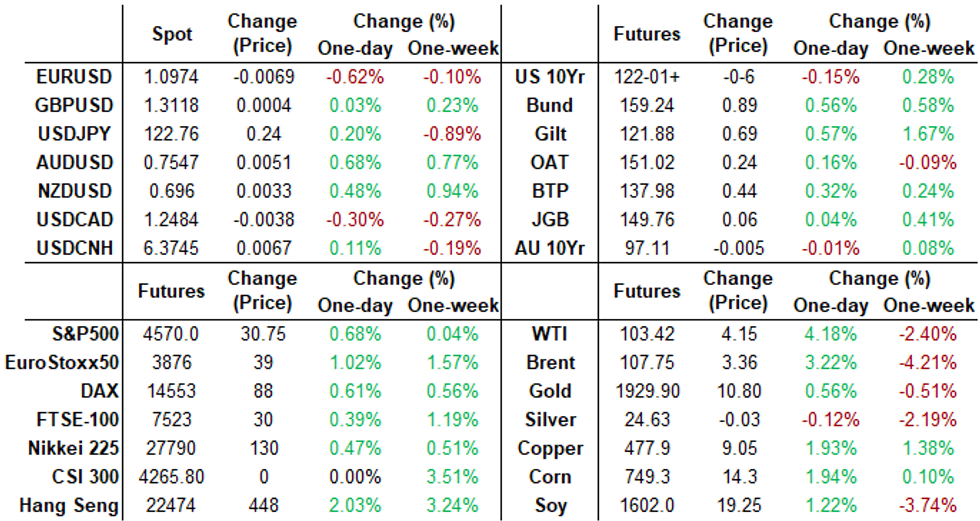

Rates trading weaker after the bell, near session lows -- long end underperforming after ECB Vasle headline that "negative rates may end by year end." Tsy 30YY hit 2.4882 high. Yield curves steeper but still inverted: 2s10s climbing +7.314 to -.717 while 5s30s climbed 3.499 to -14.188.

- Contributing Blocks: sales in 2s and 5s prior to ECB Vasle headline. Large 2s/ultra-Bond steepener late: +19,730 TUM2 105-22.62 vs. -2,484 WNM2 176-19.

- Stocks continued to extend session highs in late FI trade, SPX eminis back to late Thursday range amid ongoing focus on tech shares and micro bloggers.

- No react to data: Rates holding near lows after Feb factory orders -0.5, ex-trans +0.4, while equities holding decent gains (ESM2 +16.75 4556.0).

- On tap Tuesday:

- 0830 Trade Balance (-$89.7B, -$88.5B)

- 0945 S&P Global US Services PMI (58.9, 58.9); Comp PMI (58.5, 58.5)

- 1000 ISM Services Index (56.5, 58.5)

- 1005 Fed Gov Brainard virtual forum on inflation, text, Q&A

- 1230 SF Fed Daly on US economy, text, Q&A TBA

- 1400 NY Fed Williams virtual discussion on health & economy

- By the close, the 2-Yr yield is down 3bps at 2.4262%, 5-Yr is unchanged at 2.5587%, 10-Yr is up 3.1bps at 2.4135%, and 30-Yr is up 4.3bps at 2.4751%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00028 at 0.32757% (+0.00072 total last wk)

- 1 Month -0.00900 to 0.42857% (-0.00757 total last wk)

- 3 Month +0.00700 to 0.96900% (-0.02086 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00357 to 1.49271% (+0.03800 total last wk)

- 1 Year +0.02986 to 2.20143% (+0.08286 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $243B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $974B

- Broad General Collateral Rate (BGCR): 0.30%, $348B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $321B

- (rate, volume levels reflect prior session)

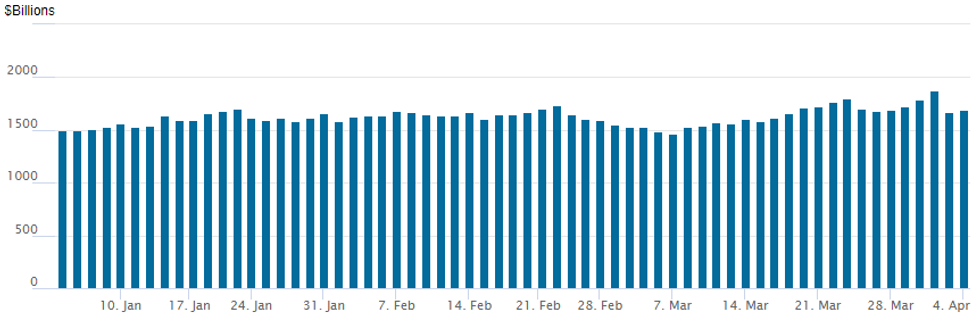

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to 1,692.936B w/ 81 counterparties from prior session 1,666.063B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better overnight call trade, albeit on lighter volumes, evaporated around midmorning. Underlying rates weakened after block sales in 2s and 5s -- extended lows/risk-on following ECB Vasle headline that "negative rates may end by year end." Tsy 30YY climbed to 2.5013 high. Yield curves steepened off deeper inverted levels.- Looking for futures to continue to rebound off last Frida's rout, overnight call buying noted in Eurodollar May 98.25/98.31/98.43/98.56 call condors. Treasury options saw buyers of May 119/120 call spds and Jun 5Y 114.75 calls outright and 114.5/115.5 call spds.

- Salient put trade as underlying futures sold off included limited downside put condors in Eurodollar midcurves:

- +5,000 short Dec 95.25/95.50/95.87/96.12 put condors, 3.25

- +5,000 short Dec 95.62/96.00/96.37 put flys, 3.75 vs. 96.87/0.02%

- and Tsy 30Y options:

- 5,000 USM 140/142/144/146 put condors

- +9,000 2QZ2 98.75/99.25 call spds, 3.5 vs. 97.435/0.05%

- -5,000 short Dec 97.00 calls, 37.0 vs. 96.77/0.42%

- Block, -10,000 Jun 98.12/98.25/98.37/98.50 1x2x1x1 put condor, 1.5 cr

- +5,000 short Dec 95.25/95.50/95.87/96.12 put condors, 3.25

- +5,000 short Dec 95.62/96.00/96.37 put flys, 3.75 vs. 96.87/0.02%

- over 8,000 May 98.25 puts, 2.5

- Overnight trade

- 4,900 May 98.25/98.31/98.43/98.56 call condors

- 1,900 May 99.12 calls, 0.5

- 2,000 TYM 120/124 put over risk reversals, 3 ref 122-03

- 4,200 TYM 125 calls, 20

- 5,000 USM 140/142/144/146 put condors

- 6,000 wk2 TY 120.5/121 call spds, 3

- Overnight trade

- 8,000 TYK 119/120 put spds

- 5,000 FVM 114.75 calls, 28.5

- 3,500 FVM 114.5/115.5 call spds,

EGBs-GILTS CASH CLOSE: Yields Fall On Modest Geopolitical Risk-Off

Bund and Gilt yields range traded for most of Monday's session, finishing lower, with UK instruments outperforming.

- Core FI strengthened in the morning on headlines that the EU would add further sanctions on Russia "urgently", before drifting for most of the session. Though notably the bond rally lagged an initial drop in equities.

- Yields picked up later in the session, both as equities gained steam, and ECB's Vasle said policy rates could be out of negative territory by end-year.

- Periphery EGB spreads widened by 2-3bp, mostly on the initial safe haven bid.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 1.4bps at -0.082%, 5-Yr is down 3.3bps at 0.345%, 10-Yr is down 4.8bps at 0.507%, and 30-Yr is down 3.6bps at 0.636%.

- UK: The 2-Yr yield is down 0.8bps at 1.366%, 5-Yr is down 3bps at 1.387%, 10-Yr is down 6.1bps at 1.547%, and 30-Yr is down 6.9bps at 1.668%.

- Italian BTP spread up 2bps at 155.8bps / Spanish up 2.6bps at 94.3bps

EGB Options: Big Bobl Put Spread Selling

Monday's Europe rate / bond options flow included:

- OEK2 131.25/129.75/128.75 put fly sold at 66 in 1.4k

- RXK2 157/155.5 1x2 put spread bought for 2 in 1.75k

- OEM2 129.25/130.25/131.25 put ladder bought for 14/14.5/15 in 7k

- OEM2 127.50/126.50 1x1.5 put spread sold at 8.5 in 17k, 30k all day (earlier sold at 10.5 / 9)

- RXK2 157/155 put spread bought for 27.5 in 2k

- RXK2 155/154/153 put fly bought for 4.5 in 3k (hearing unwind)

FOREX: EUR Grinds Lower, AUD To Five-Month High Ahead Of RBA

- The single currency underperformed its G10 counterparts on Monday as markets assess the impact of additional Russian sanctions and the lack of any meaningful breakthrough in diplomatic negotiations surrounding the war.

- EURUSD price action remained slow but directional as the pair extends its pullback from last week’s highs of 1.1185, grinding back through the 1.10 mark to print fresh lows of 1.0966. The pair has narrowed the gap with last week’s low at 1.0945, a key short-term support to watch. The dollar index extends its winning streak to three days, rising another 0.44% on Monday.

- Perhaps more significant are the moves witnessed in Euro crosses with EURAUD (-1.32%) and EURNZD (-1.18%) both resuming the sharp downtrends witnessed across February and March. EURAUD in particular is sitting right on fresh cycle lows around 1.4535 as the Australian dollar receives a boost from the uptick in commodity indices as well as the buoyancy of global equity benchmarks.

- Additionally, AUDUSD saw some interest headed into the WMR fix, which helped the pair clear last week's peak at 0.7540, then briefly matching the 0.7556 key resistance point (late Oct 2021 high).

- The April RBA meeting/decision is the highlight overnight. Despite markets expecting policy to remain unchanged, focus will quickly move to the Bank’s guidance paragraph, with the board likely to reaffirm that it is “prepared to be patient as it monitors how the various factors affecting inflation in Australia evolve”.

- Tomorrow’s US docket will be headlined by ISM Services PMI data ahead of Wednesday’s release of the FOMC minutes.

FX: Expiries for Apr05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.0bln), $1.0915-25(E500mln), $1.1050-65(E671mln), $1.1095-10(E1.6bln)

- USD/JPY: Y122.00($656mln)

- GBP/USD: $1.3335-40(Gbp619mln)

- EUR/GBP: Gbp0.8390-00(E661mln), Gbp0.8460(E793mln)

- AUD/USD: $0.7300(A$1.6bln), $0.7500(A$1.1bln)

- USD/CAD: C$1.2510-25($599mln), C$1.2570-80($916mln)

EQUITIES: Late Equity Roundup: Extending Session Highs

Stocks continued to extend session highs in late FI trade, SPX eminis back to late Thursday range amid ongoing focus on tech shares and micro bloggers.

- S&P eminis trading +31.25 (0.69%) at 4570.75 -- eyeing key resistance of 4578.50 (Feb 9 highs). Breach opens up 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg. Meanwhile, Dow Industrials climbed 94.36 (0.27%) at 34914.25, Nasdaq + 246.1 (1.7%) at 14507.26.

- SPX leading/lagging sectors: Communication Services continued to outperform (+2.20%) with Twitter (TWT) climbing +11.67 (29.51%) to 50.88 following reports Elon Musk bought 9.2% outstanding shares. Netflix gained +19.57 (+5.24%) at 393.04.

- Laggers: Utilites (-1.24%) lead by water/gas providers, followed by Health Care sector (-0.74%) w/equipment and service providers underperforming. Industrials bounced to -0.15 from -0.75 earlier.

- Dow Industrials Leaders/Laggers: SalesForce.com (CRM) +7.80 to 220.05 with US listed China stocks outperforming. Microsoft (MSFT) +4.75 at 314.17 and Apple (AAPL) +3.25 at 177.55. United Health (UNH) continued to underperform: -4.45 at 508.15, Mcdonald's (MCD) bounced off lows to 245.95 -3.30.

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg

- RES 1: 4578.50 High Feb 9 and a key resistance

- PRICE: 4537.50 @ 14:32 BST Apr 4

- SUP 1: 4444.75 50-day EMA

- SUP 2: 4320.25 Low Mar 17

- SUP 3: 4129.50/4094.25 Low Mar 15 / Low Feb 24 and a bear trigger

- SUP 4: 4055.60 Low May 19 2021 (cont)

COMMODITIES: Oil Prices Climb Despite Potentially Large IEA Release

- Oil prices have firmed today as geopolitical tensions ratchet up as the EU works on new tougher sanctions on Russia (Macron wants to discuss oil & coal), following evidence of mass civilian killings as Russian forces pulled back from positions in area around Kyiv.

- Separately, Saudi Arabia raised prices for customers in all regions whilst IEA had been rumoured to be considering releasing 120million barrels of oil but no official confirmation of that yet.

- WTI is +4.2% at $103.47. Resistance is seen at $108.75 (Mar 30 high) whilst support is seen at $98.44 (Mar 29 low).

- Brent is +3.3% at $107.80 as it moves further away from the 50-day EMA of $100.04. Resistance is $112.28 (Mar 30 high) after which it could open the bull trigger of $119.74 (Mar 24 high).

- Gold is +0.3% at $1931.6. Support remains the bear trigger of $1890.2 (Mar 29 low) whilst resistance is seen at $1966.1 (Mar 24 high).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/04/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/04/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 05/04/2022 | 0630/0830 | ** |  | SE | Services PMI |

| 05/04/2022 | 0645/0845 | * |  | FR | industrial production |

| 05/04/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/04/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/04/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/04/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/04/2022 | - |  | EU | ECB's de Guindos attends Ecofin | |

| 05/04/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 05/04/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/04/2022 | 1400/1000 |  | US | Minneapolis Fed's Neel Kashkari and Fed Governor Lael Brainard | |

| 05/04/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/04/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 05/04/2022 | 1800/1400 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.