-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Yields New Cycle Highs

US TSYS: Tsy Yield Curves Reverse Early Flattening

Tsys see-sawed in weaker range all session, near lows after the bell. Generally quiet end to the week: no react to Wholesale inventories (2.5%)/trade sales (1.7%) earlier. Two-way positioning/squaring up ahead the weekend, markets keeping wary eye on geopol headline risk re: Russia war in Ukraine, continued global sanctions.- Yield curves inched steeper, however, after trading flatter in early trade. Currently, 2s10s nearly 30bp off Sunday evening inverted low of -9.531 at +19.542 (+.320) while 3s, 5s and 7s remain inverted vs. 10s (-1.872, -4.547, -8.477 respectively).

- Limited data (NY Fed survey of consumer expectations at 1100ET) kicks off next week's shortened* pre-Easter holiday trade though several Fed speakers scheduled on Monday:

- Atl Fed Bostic open remarks: Fed Listens event in Nashville; Fed Govs' Bowman and Waller closing remarks at same event at 0930ET

- NY Fed John Williams CME/Economic Club of New York event

- Chicago Fed Evans economic outlook at 1240ET

- Treasury supply:

- US Tsy $57B 13W, $48B 26W bill auctions at 1130ET

- US Tsy $46B 3Y Note auction (91282CEH0) at 1300ET

- * Note: CME floor closes early Thursday, April 14 at 1300ET, markets closed next Friday for Easter holiday.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00643 at 0.32757% (+0.00028/wk)

- 1 Month +0.02586 to 0.51400% (+0.07643/wk)

- 3 Month +0.02185 to 1.01071% (+0.04871/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.03786 to 1.54043% (+0.05129/wk)

- 1 Year +0.05671 to 2.27157% (+0.10000/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $257B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.30%, $906B

- Broad General Collateral Rate (BGCR): 0.30%, $335B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

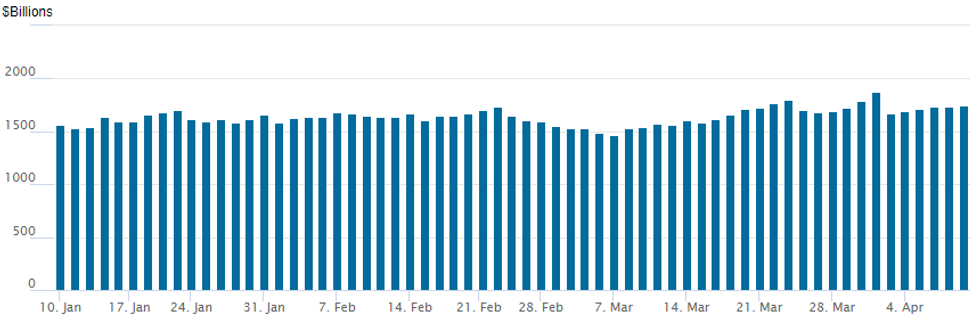

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher: 1,750.498B w/ 84 counterparties from prior session 1,734.424B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

New cycle highs for Treasury yields and broadly weaker underlying rate futures continued to spur continued interest in downside puts Friday, though overall volumes were rather muted ahead the weekend and next week's shortened pre-Easter holiday.- Always an exception, Eurodollar option trade included a scale buyer of over 20,000 Blue June 98.00 calls from 2.0 to 2.5. Blue June options use June'25 futures as their underlying but expire at same time as front June.

- Meanwhile, paper bought 5,000 Green Jul 96.62/96.81 put spds, at 7.0 vs. 96.92-.925.

- Treasury options saw more consistent put volumes, particularly in 10s with carry-over buying of May 10Y 119.5 puts of 15,000 from 29 overnight to 33 in late NY trade.

- Likely a roll-down in strikes, paper sold -7,500 TYM 117.5/120.5 put spds, 105 with -7,500 TYM 118/120 put spds, 43 -- 148 total cr package in late trade.

- Another +10,000 Blue Jun 98.00 calls, 2.5, total volume 22.4k

- +10,000 Blue Jun 98.00 calls, 2.0

- +5,000 Green Jul 96.62/96.81 put spds, 7.0 vs. 96.92-.925

- Overnight trade

- 3,000 Green Jun 96.62/97.25 strangles

- -7,500 TYM 117.5/120.5 put spds, 105 w/

- -7,500 TYM 118/120 put spds, 43 -- 148 total cr package

- +15,000 FVK 114.5 calls, 5

- +4,000 FVK 114.5/115 call spds, 2.5

- -10,000 wk3 TY 119.5/120 put spds, 13

- -4,000 TYM 120/121 put spds 27 over TYM 124/125 call spds

- 10,000 TYM 124/125 put spds

- Overnight trade

- 5,000 TYM 122.5 puts, 233

- +12,000 TYK 119.5 puts, 29-37

- +2,000 wk3 US 148/150/152 call flys, 5

EGBs-GILTS CASH CLOSE: Yields Up Again, French Election In Focus

The German curve bear flattened, while the UK's steepened Friday, though yields finished off their peaks.

- Periphery spreads reversed earlier widening on a Bloomberg sources story saying that the ECB "is working on a crisis tool to deploy in the event of a blowout in the bond yields of weaker euro-zone economies"; though later widened again.

- While the ECB decision next week is in view (MNI Sources piece here), the 1st round of the French presidential election takes focus going into the weekend (MNI's Preview), with Macron nursing a slender (and recently shrunken) lead over Le Pen.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.3bps at 0.049%, 5-Yr is up 5bps at 0.527%, 10-Yr is up 2.5bps at 0.706%, and 30-Yr is down 0.3bps at 0.808%.

- UK: The 2-Yr yield is up 0.9bps at 1.479%, 5-Yr is up 1.2bps at 1.529%, 10-Yr is up 1.9bps at 1.749%, and 30-Yr is up 3.4bps at 1.898%.

- Italian BTP spread up 3.4bps at 168.7bps / Spanish up 1.3bps at 99.6bps

EGB Options: Rate Hike Plays And Bond Downside

Friday's Europe rates / bond options flow included:

- DUM2 110.50/110.10 put spread vs 110.90 call, received net -3/-2.75 in 6.5k (bought PS, sold C)

- DUK2 111.00 call bought for 4.5/5 in 11k

- DUM2 110.90/111.10 call strip sold at 8.25 in 4.3k

- OEM2 127p bought for 48 in 3k

- RXU2 145/142/139 put fly, bought for 9 in 2k

- ERU2 100.25/100.12/99.87 broken p fly, sold at -2 in 4k

- ERZ2 99.25/99.625/100.00 call fly, bought for 9.5 in 10k

- ERH3 98.75p bought for 22.75 in 5k (ref 99.175)

- 0RM2 98.50/98.25ps, bought for 5.5 in 14k

- 0RZ2 9837/9800/9762 pfly, bought for 4.5 in 6k

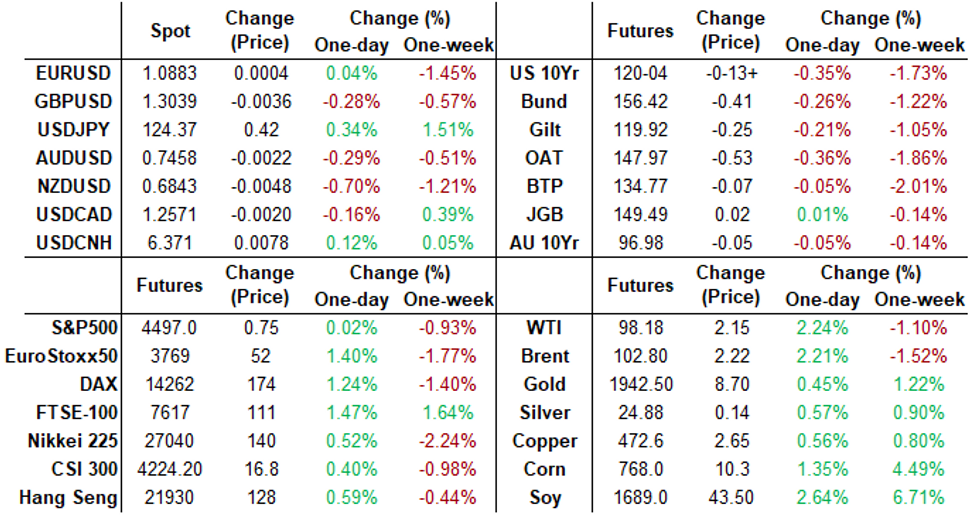

FOREX: DXY Set To Extend Winning Streak To Seven Days, Breaches 100

- The greenback has edged slightly higher (DXY +0.12%) on Friday and looks set to extend its winning streak to seven consecutive trading sessions, breaking 100 for the first time since May 2020. Despite this, G10 currency ranges remained narrow and price action once again subdued amid a light data calendar.

- Following on from prior sessions, the likes of AUD, NZD extended their short-term downward bias and are bottom of the G10 pile to finish the week, matched closely by a weaker GBP.

- USDCAD bucked the trend following a solid labour report, which keeps the probability of a 50bp hike high. With employment gains centred on full-time jobs and the unemployment rate fell a tenth more than expected to new lows of 5.3%, the Canadian dollar rose a tenth of a percent in the face of the firmer US dollar.

- 2.5% gains for crude futures also underpinned strength in the Norwegian Krona, rising around 1.25% on Friday.

- EURUSD remains close to unchanged despite printing fresh lows for the week at 1.0837. However, the single currency was well supported off the lows following a Bloomberg sources story saying that the ECB "is working on a crisis tool to deploy in the event of a blowout in the bond yields of weaker euro-zone economies". EURUSD bounced back towards 1.0880 before running out of steam ahead of the weekend close.

- USDJPY also caught a strong bid off the overnight 123.67 lows to trade as high as 124.68 in early NY trade. On the upside, clearance of 125.09, the Mar 28 high and bull trigger, is required to confirm a resumption of the primary uptrend.

- The focus over the weekend will be on the results of the French Presidential Election before Chinese CPI and PPI data kicks off the shortened pre-Easter holiday week.

EQUITIES: Late Equity Roundup, SPX Back Near Steady

Stocks held mixed levels after the FI close, SPX paring gains back near steady while Dow components continued to outperform Friday. Focus on latest earnings cycle that kicks off next week with financials make up the bulk of releases. JP Morgan and BlackRock are due to set the tone on Wednesday, before Citigroup, Goldman Sachs, Morgan Stanley and Wells Fargo follow

- S&P eminis currently trades +1.25 (0.03%) at 4497.75 vs. 4469.50 session low -- above key support of 4455.32 50-day EMA. On the flipside, a resumption of gains and an ability to remain above the 50-day EMA would be seen as a bullish development -- key resistance at 4588.75 High Apr 5.

- Meanwhile, Dow Industrials currently trade +213.79 (0.62%) at 34798.7, Nasdaq -128.5 (-0.9%) at 13771.29.

- SPX leading/lagging sectors: Energy sector continued to outperform (+2.79%) with energy equipment servicers outpacing oil & gas consumables. Financials next up (+1.11%) as banks and diversified financial names outpacing insurers.

- Laggers: Information Technology sector extended losses (-1.16%) as semiconductors continued to lag on chip scarcity, software outpacing hardware. Consumer Discretionary next up (-0.54%) weighed down by autos.

- Dow Industrials Leaders/Laggers: United Health (UNH) took the lead climbing +10.61 to 547.56, outpacing the rebound in Home Depot +9.02 to 311.72. Tech shares weaker: MSFT -3.11 at 298.19, HON -2.54 at 190.16, AAPL -1.76 at 170.44.

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4633.44 76.4% retracement of the Jan 4 - Feb 24 downleg

- RES 1: 4588.75 High Apr 5

- PRICE: 4497.00 @ 1515ET Apr 9

- SUP 1: 4455.32/4444.50 50-day EMA / Low Apr 6/7

- SUP 2: 4425.96 38.2% retracement of the Feb 24 - Mar 29 rally

- SUP 3: 4400.00 Round number support

- SUP 4: 4362.63 50.0% retracement of the Feb 24 - Mar 29 rally

S&P E-Minis are trading closer to this week’s lows. The contract has tested its key support area at the 50-day EMA, which intersects at 4455.32 today. This EMA marks a key pivot level and has so far provided support. A clear break would strengthen a bearish case and allow for a deeper pullback towards 4425.96 initially, a Fibonacci retracement. For bulls, a recovery and an ability to remain above the 50-day EMA would be a bullish development.

COMMODITIES: Oil Prices On For Down Week, Net Long Positions Trimmed

- Oil prices see a second relatively subdued day compared to recent moves although are still almost 2% higher. Little impact from a larger than expected climb in the US rig count to the highest since very early in the pandemic.

- Weekly ICE Futures Europe data show the net-long position in Brent as the least bullish in about 17 months.

- WTI is +1.9% at $97.8 with gains seen across the forward curve out to Jun’23. Support is $93.81 (Apr 6 low) and resistance $105.59 (Apr 5 high).

- The most active strikes by far have been $90/bbl puts.

- Brent is +1.9% at $102.5. Support is $98.41 (Apr 7 low) and resistance $109.9 (Apr 5 high).

- Gold is +0.6% at $1943.2 on a day of a Russian missile attack on Kramatorsk station. It edges nearer to resistance seen at $1966.1 (Mar 24 high) whilst support remains the bear trigger of $1890.2 (Mar 29 low).

- Weekly moves: WTI -1.6%, Brent -1.9%, Gold +0.9%, Euro Nat Gas -7.4%, Iron Ore +10.4%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 11/04/2022 | 0600/0700 | *** |  | UK | UK Index of Services |

| 11/04/2022 | 0600/0700 | *** |  | UK | UK Industrial Production |

| 11/04/2022 | 0600/0700 | ** |  | UK | UK Trade Balance |

| 11/04/2022 | 0600/0700 | *** |  | UK | UK Monthly GDP |

| 11/04/2022 | 0600/0700 | ** |  | UK | UK Construction Output |

| 11/04/2022 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/04/2022 | 1330/0930 |  | US | Fed Governors Michelle Bowman and Christopher Waller | |

| 11/04/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/04/2022 | 1600/1200 |  | US | New York Fed's John Williams | |

| 11/04/2022 | 1640/1240 |  | US | Chicago Fed's Charles Evans | |

| 11/04/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.