-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Oct Real Wages Unchanged Y/Y

MNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI ASIA MARKETS ANALYSIS: Geopol Risks Gradually Het Up Again

US TSYS: Yield Curves Pare Back Steepening Late

Rates finish modestly higher -- bonds at upper half of range since midmorning. Yield curves still steeper but off highs as short end pared gains w/ block sellers in 2s and 5s late. Tsy 2s10s at 34.272 (+3.094) vs. 38.183 high; 5s30s at 4.289 (+1.266) vs. 8.309 high.

- Tsys bounced after delayed buying not necessarily tied to March reading of the Producer Price Index gained +1.4% MoM vs. +1.1% exp (+11.2% YoY vs. +10.6% exp).

- Geopol risk moving closer to front burner again after Russia state media TASS reported US weapons convoy/deliveries to Ukraine to be viewed as valid targets. Meanwhile, Sweden and Finland appear closer in joining NATO (see 0636ET and 0732ET bullets), potentially expanding NATO-aligned country boarders w/ Russia threefold to appr 1000 miles from 300 now.

- Tys pared gains, bouncing back near midday highs after $20B 30Y auction re-open (912810TD0), Bond sale tails slightly: 2.815% high yield vs. 2.804% WI; 2.30x bid-to-cover vs. 2.46x last month.

- Busy day for economic data Thu, Fed speak on early close ahead extended Easter holiday weekend (Friday close): weekly claims, retail sales, import/export prices, business inventories and U-Mich sentiment. NY Fed Williams Bbg interview at 0845ET, Cleveland Fed Mester and Philly Fed Harker after the close.

- The 2-Yr yield is down 3.7bps at 2.3686%, 5-Yr is down 2bps at 2.669%, 10-Yr is down 1.1bps at 2.7101%, and 30-Yr is up 0.2bps at 2.8109%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00100 at 0.32729% (-0.00029/wk)

- 1 Month +0.00285 to 0.55414% (+0.04014/wk)

- 3 Month +0.00586 to 1.04429% (+0.03358/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.01257 to 1.55157% (+0.01114/wk)

- 1 Year -0.05628 to 2.25143% (-0.02014/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $80B

- Daily Overnight Bank Funding Rate: 0.32% volume: $266B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.29%, $883B

- Broad General Collateral Rate (BGCR): 0.30%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

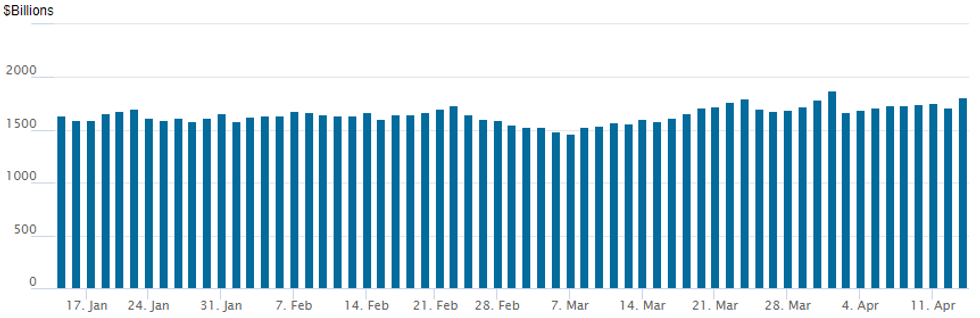

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to 1,815.55B w/ 83 counterparties from prior session 1,710.414B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Implieds inched lower on a mix of two-way positioning Wednesday, active FI accounts squaring up ahead Thursday's early close and extended Easter Holiday weekend.- Block/crosses drove Eurodollar option volumes with buyer of 40,000 Green Dec 97.62/97.87 call spds, 7 after 17,580 short Sep 97.62 puts (deep in the money) blocked at 97.50.

- Net short vol put tree buyer picked up 8,500 Dec 96.87/97.00/97.50 put trees at even vs. 97.185/0.15%.

- Treasury option trade included potential error unwind with paper selling 20,000 FVM 112.5 puts from 20 down to 16 after a block buy of 10,000 at 21.5 ahead the NY open.

- Other highlight, likely consolidation trade included a sale of 15,000 TYM 121/123 1x2 call spds, 23-24 ref 121-01.

- Block, 5,000 short Jun 96.62/96.87 put spds, 6.5

- +5,000 SFRZ2 97.00 puts, 19.5-20.0

- Block, 40,000 Green Dec 97.62/97.87 call spds, 7

- 8,700 Jun 98.18 puts

- 4,500 Red Dec 97.00 calls, 65.0

- 3,800 short Sep 97.62 calls

- Block, 17,580 short Sep 97.62 puts, 97.50

- +8,500 Dec 96.87/97.00/97.50 put trees, 0.0 vs. 97.185/0.15%

- -6,000 Mar 98.75 puts, 186 vs. 96.925/0.90%

- Overnight trade

- 3,000 Dec 97.00/97.50/98.00 put trees

- +9,500 FVM 113/113.5 put spds, 10 vs. 114-01.25

- -15,000 TYM 121/123 1x2 call spds, 23-24 ref 121-01

- -15,000 FVM 113.25 puts from 25.5-25

- 7,750 TYM 118/120.5 put spds, 44

- -2,000 TYM 120.5 straddles, 222

- -20,000 FVM 112.5 puts, 20-18-16 after 10k earlier block said to be a buy

- 2,700 FVK 116 calls, 0.5

- Overnight trade

- Block, +10,000 FVM 112.5 puts, 21.5 ref 113-23.25

- +12,500 TYM 118.5/120 put spds vs. TYM 121.5 calls, 11-13 cr

EGBs-GILTS CASH CLOSE: Pre-ECB Rally

After jumping on the open following above-expected UK CPI data, European yields fell steady throughout Wednesday's session.

- Yields continued to move lower in the afternoon after and despite a US producer price upside surprise. Bunds bull flattened, Gilts bull steepened.

- Periphery spreads reversed earlier widening as well.

- There was no obvious fundamental driver, but with modest volumes and a long weekend / ECB decision imminent, there appeared to be an element of unwinding positions following an extended rise in yields.

- See our ECB preview (and note the title) - "Be Prepared For A Hawkish Surprise".

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.1bps at 0.074%, 5-Yr is down 2.4bps at 0.549%, 10-Yr is down 2.4bps at 0.766%, and 30-Yr is down 2.6bps at 0.901%.

- UK: The 2-Yr yield is down 1.9bps at 1.489%, 5-Yr is down 1.5bps at 1.549%, 10-Yr is down 0.4bps at 1.799%, and 30-Yr is down 0.4bps at 1.946%.

- Italian BTP spread down 1.2bps at 160.7bps / Spanish up 1.4bps at 93.6bps

EGB Options: Mixed Trade Ahead Of ECB Thursday

Wednesday's Europe rates /bond options flow included:

- RXK2/RXM2 154.50/152.50 put spread strip bought for 107.5 in 4k

- RXM2 150/145ps 1x2 vs RXK2 154/151ps 1x2, bought the June for 28 in 3.2k

- SFIK2 98.80/99.00cs, bought for 1.25 in 6.75k

- ERZ2 99.75/99.50/99.12 broken p fly, bought for 1.25 in 20k

FOREX: USD Retreats In Late Session, NZD Remains Poorest Performer

- The greenback has had a strong turnaround over the latter half of Wednesday trade, with the USD index (-0.4%) now looking set to snap its impressive winning streak in April that has seen the index rise from below the 98.00 mark to the earlier peak of 100.52.

- The reversal prompting firm gains in EUR, JPY, GBP and the Canadian dollar following the BOC’s 50bp rate hike and accompanying hawkish rhetoric. CAD has had the additional tailwind of higher crude futures and rising equity indices, placing USDCAD roughly 100 points off session highs.

- EURUSD came within three pips of the March lows and bear trigger of 1.0806, which now marks an interesting inflection point as we head into tomorrow’s ECB rate decision/statement with MNI flagging that markets should be prepared for a potential hawkish surprise.

- The recent failure at 1.1185, Mar 31 high, continues to highlight a bearish threat and last week’s move lower has reinforced this theme, however, a break of 1.0806 is needed to confirm a resumption of the downtrend.

- In similar vein, USDJPY has had a sharp turnaround after breaking the 2015 highs earlier in the session. After breaching 125.86, momentum buying saw the pair clear the 1.26 hurdle and trade as high as 126.32. The broad dollar weakness has seen momentum wane and a close back below the 125.86 mark would be considered a bearish development. With trend conditions still residing in overbought territory – the potential for a consolidation and/or move lower may have been bolstered.

- NZD remains the poorest performing currency in G10 following the RBNZ policy decision overnight. While the bank hiked rates by 50bps against a consensus expectation of a 25bps rise, the decision was perceived as dovish as the bank opted to bring forward the beginning of the tightening cycle, but critically stop short of raising market expectations of a higher terminal rate. The bank's minutes noted that members increased the OCR by more "now, rather than later". NZD weakness followed, putting AUD/NZD at the best levels since mid-2020.

- Aside from the ECB meeting, Aussie Employment and US Retail Sales will headline the data schedule before the long holiday weekend.

EQUITIES: Late Equity Roundup - Session Highs

Equity indexes trading firmer, near late session highs after the FI session close. Early Geopolitical risk tempered risk appetite somewhat in the first half. Focus turned back to start of latest earnings cycle.

- Financials: JP Morgan missed (2.63 vs. 2.72), BlackRock beat (9.52 vs. 8.79). Citigroup, Goldman Sachs, Morgan Stanley and Wells Fargo tomorrow. Meanwhile Delta surged on improved guidance for travel demand despite increased operating costs.

- SPX eminis (ESM2) currently +55.5 (1.26%) at 4449.25 with eye on initial firm resistance at 4519.75 (Apr 8 high) -- a break would ease the bearish threat.

- SPX leading/lagging sectors: Consumer Discretionary sector surged in second half (+2.62%) with autos, consumer services, retailing outperforming.

- Laggers: Utilities (-0.24%) with water services surprisingly weak. Financials sector lagging (-0.11%), banks underperforming as earnings cycle kicks off (JPM -3.2% after 1Q miss).

- Meanwhile, Dow Industrials currently trade +370.49 (1.08%) at 34594.62, Nasdaq +303.7 (2.3%) at 13675.92.

- Dow Industrials Leaders/Laggers: Boeing (BA) extends lead (+6.31 at 182.59) followed by Microsoft (MSFT) +5.94 at 288.00. JPM remains weak -4.49 at 127.04, GS -2.66 at 317.22, Travelers Ins -1.67 at 183.27.

- RES 4: 4730.50 High Jan 1

- RES 3: 4663.50 High Jan 18

- RES 2: 4631.00 High Mar 29 and a key resistance

- RES 1: 4519.75/4588.75 High Apr 8 / High Apr 5

- PRICE: 4389.75 @ 13:59 BST Apr 13

- SUP 1: 4362.63 50.0% retracement of the Feb 24 - Mar 29 rally

- SUP 2: 4499.29 61.8% retracement of the Feb 24 - Mar 29 rally

- SUP 3: 4239.00 Low Mar 16

- SUP 4: 4220.92 76.4% retracement of the Feb 24 - Mar 29 rally

The S&P E-Minis short-term condition remains bearish. The contract has breached the 50-day EMA, which intersects at 4452.17 and this has reinforced a bearish threat. The move through 4400.00 signals scope for weakness towards 4362.63 next, a Fibonacci retracement. Initial firm resistance has been established at 4519.75, Apr 8 high A break would ease the bearish threat.

COMMODITIES: Further Boost For Oil As Russian Oil Looks To Be Shunned

- Oil prices rise solidly throughout most of the day despite IEA cutting its oil demand forecast following China lockdowns early on. The move has been helped by major global trading houses planning to reduce crude and fuel purchases from Russia's state-controlled oil companies as early as May 15 to avoid falling foul of EU sanctions on Russia, according to Reuters sources.

- There was a much larger build than forecast for the headline crude stocks (+9.4mln bbls vs. Exp. +256k) - but partially priced in due to similar pattern in last night's API data.

- WTI is +3.5% at $104.2 as it approaches key near-term resistance of $105.59 (Apr 5 high) after which it opens $108.75 (Mar 30 high).

- Brent is +3.9% at $108.7, also close to initial firm resistance at $109.9 (Apr 5 high) with support materially lower at $97.57 (Apr 11 low).

- Gold is +0.5% at $1976.6 having cleared resistance at $1978.6 (Apr 12 high) but is struggling to hold onto the higher level. A sustained break would open $1980.3 (50% retracement of Mar 8-29 downleg).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/04/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 14/04/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 14/04/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 14/04/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/04/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/04/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2022 | 1230/0830 | *** |  | US | PPI |

| 14/04/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/04/2022 | 1230/1430 |  | EU | ECB President Lagarde Post-meet presser | |

| 14/04/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 14/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/04/2022 | 1920/1520 |  | US | Cleveland Fed's Loretta Mester | |

| 14/04/2022 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.