-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA MARKETS ANALYSIS: Late Week Risk On

US TSYS: Risk-On AS Mkt Takes Adaptive Fed Seriously?

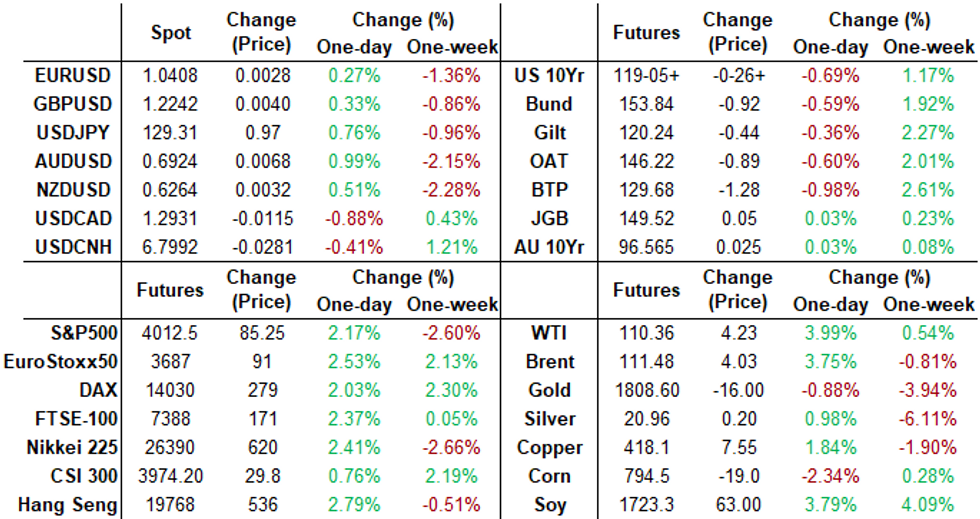

FI markets traded weaker after the bell -- 30Y Bond around upper half of the week's range but well off Thursday's highs. Little react to morning data (import prices lower than exp at +0.0%; U/Mich sentiment 59.1 vs 64 est, "lowest reading since 2013").

- Tsy 30Y Bond futures holding to narrow channel on the way down (30YY taps 3.0959 high vs. 2.9531% early Thu), curves bear steepening: 2s10s +5.017 at 33.449, 5s10s +2.367 at 4.881.

- Rates under pressure w/ focus back on Fed policy after Fed Chair Powell said he's prepared to consider larger than 50bp hikes in Marketplace interview late Thu (after downplaying 75bp moves at his press conference last week), as the committee adapts to "incoming data and the evolving outlook".

- Not that the correlation is a factor these days, but Equities did have a nice rebound on the day, SPX emini futures +99.0 at 4026.25.

- Commodities: WTI Crude Oil (front-month) holding strong +4.05 at $110.18; Gold weaker at $1807.95 -13.77.

- Next Monday Data Calendar:

- Empire Manufacturing (24.6, 15) at 0830ET

- NY Fed Williams moderated discussion, no text at 0855ET

- US Tsy $45B 13W, $42B 26W bill auctions at 1130ET

- Net Long-term TIC Flows ($141.7B, --) Net TIC Flows ($162.6B, --) at 1600ET

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00115 to 0.82571% (+0.00714/wk)

- 1M +0.01200 to 0.88671% (+0.04457/wk)

- 3M +0.03242 to 1.44371% (+0.04185/wk) * / **

- 6M +0.03614 to 1.99500% (+0.03043/wk)

- 12M +0.02228 to 2.65214% (-0.04257/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.44371% on 5/13/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $81B

- Daily Overnight Bank Funding Rate: 0.82% volume: $275B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $922B

- Broad General Collateral Rate (BGCR): 0.80%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $345B

- (rate, volume levels reflect prior session)

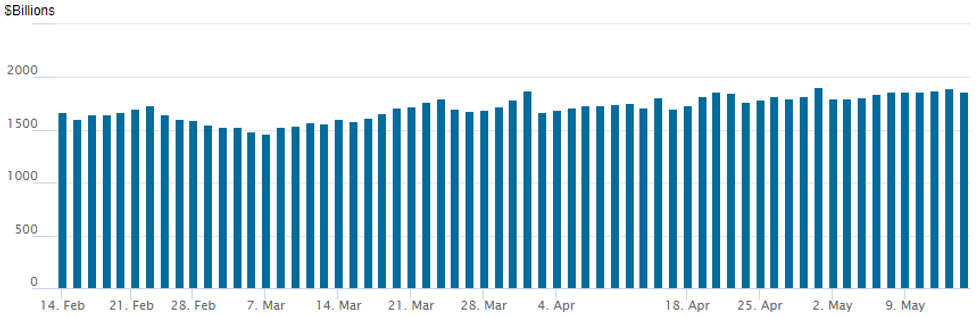

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage currently 1,865.287B w/ 86 counterparties vs. prior session's 1,900.069B (all-time high of $1,906.802B on Friday, March 29, 2022).

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option traders have had a heard go of it this week amid increased rate hike pricing volatility. Thursday's FI option trade remained mixed though upside call and call spread buying lead volumes as underlying Eurodollar and Tsy futures unwound Wed's multiple rate hike pricing.- That was until Fed Chair Powell said he is prepared to consider larger than 50bp hikes in Marketplace interview late Thu (after downplaying 75bp moves at his press conference last week), as the committee adapts to "incoming data and the evolving outlook". Short end weaker while levels adjust lower (again) out the curve to reflect hawkish policy to combat inflation.

- Not really a tone change in regards to Fed policy -- but how the market tries to anticipate forward guidance in light of inflation metrics remains the challenge as Friday's option trade remained mixed but with more consistent interest in buying rate hike insurance via puts and put spreads.

- +6,300 SFRQ2 97.25/97.43/97.50/97.62 2x2x1x1 put condors, 0.75 net cr/belly over at 0950:28ET -- structure also traded 2,500 for 1.0. Loading up on downside/rate hike insurance with SFRU2 futures trading 97.65 (-0.075)

- +10,000 Dec 97.00/97.12/97.25 call flys, 1.0 total 25k on day

- +5,000 short Aug 97.50/97.75 call spds, 3.0 vs. 96.745/0.06%

- 4,000 short Jun 96.25/96.37 put spds

- Overnight trade

- 3,000 short Dec 96.25/96.75 3x2 put spds, 13.0 vs. 96.815/0.08%

- +4,500 short Dec 95.75/96.00 put spds, 4.5 vs. 96.86-.89/0.06%

- 2,500 Sep 97.25/98.25 call spds

- 3,000 May 98.12/98.18 call spds

- Update, over +15,000 TYU 123.5 calls, 30-32 ref 118-21

- 8,200 TYM 120/121.5 1x2 call spds, 9 net ref 119-15

- Overnight trade

- +18,000 TYM2 117.5/118 put spds, 4 vs. 119-09/0.08%

- +5,500 wk2 TY 119.75/120 call spds, 3 vs. 119-16/0.06%

- 7,700 FVN 112 puts, 32.5-34.5

- 1,500 USN 157/161 1x2 call spds

EGBs-GILTS CASH CLOSE: Week-Long Yield Drop Comes To An End

European yields reversed higher to end the week following a 4-day drop, with periphery EGB spreads consolidating their recent narrowing.

- In a fairly quiet session in terms of flows and headlines (in contrast to the rest of the week), bond weakness mirrored a relief rally in equities that gained steam as Friday's session went on, with the Eurostoxx and FTSE erasing the week's losses.

- Gilts underperformed German counterparts at the short end, though were roughly flat to Bunds further out the curve.

- End-2022 rate hike pricing change this week: -13bp for BoE, -6bp for ECB.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 1.6bps at 0.063%, 5-Yr is up 3.2bps at 0.546%, 10-Yr is up 4.9bps at 0.889%, and 30-Yr is up 5.5bps at 1.075%.

- UK: The 2-Yr yield is up 5bps at 1.225%, 5-Yr is up 5.5bps at 1.355%, 10-Yr is up 5.4bps at 1.715%, and 30-Yr is up 5.6bps at 1.977%.

- Italian BTP spread down 2.1bps at 185.1bps / Greek down 3.6bps at 248.4bps

EGB Options: Outright BTP Put Seller, Bund Put Fly Roll Feature Friday

Friday's Europe rates / bond options flow included:

- IKM2 131 put sold at 120 in 3.6k (vs 130.40)

- RXN2 152/151/150.5 vs RXN2 150.5/149.5/149.0 put fly roll 5 paid 6k

- SFIM2 98.60/98.70 call spread bought for 6 in 4k (vs 98.63, 32d)

FOREX: Markets Reverse Course, But Price Action Looks Corrective in Nature

- Markets across equity, fixed income and foreign exchange markets bounced Friday, with sentiment underpinned well into the close and helping the likes of CAD, AUD, NOK and SEK make solid gains against the greenback. There was no prime news catalyst or headline to drive the reversal in fortunes, with short-covering and profit-taking the most likely culprit as the E-mini S&P ripped back above the 4,000 level.

- Focus going forward turns to the longevity of the move, with traders watching for smoother sentiment in stock markets before the likes of EUR/USD and GBP/USD can discount further cycle lows going forward (both of which touched multi-year lows early Friday, before bouncing).

- For the USD Index, the losses look fleeting, with the corrective pullback helping alleviate some of the technically overbought conditions evident on the longer-term chart. Fedspeak came and went, with Mester and Kashkari providing few new details and continuing to indicate another 50bps of tightening at the June FOMC meeting.

- In the coming week, focus turns to Chinese retail sales and industrial production data, UK jobs & inflation numbers and appearances from BoE's Bailey, Fed's Powell and ECB's Lagarde.

FX: Expiries for May16 NY cut 1000ET (Source DTCC)

- AUD/USD: $0.6880(A$696mln)

- USD/CAD: C$1.3000-15($637mln)

- USD/CNY: Cny6.8485($1.5bln)

Late Equity Roundup: Stronger But Off Highs

Stock indexes traded firm late Friday but off midday highs amid two-way position squaring flow, otherwise no obvious headline driver ahead the weekend. SPX emini futures currently +63.25 (1.61%) at 3991 vs. 4034.75H, Dow Industrials +235.79 (0.74%) at 31967.04, Nasdaq +341.9 (3%) at 11714.33.

- Despite the decent rebound S&P eminis remain vulnerable and short-term gains are considered corrective. This week’s continuation lower and fresh cycle lows, reinforces the primary bearish trend condition and signals scope for a continuation lower.

- The next objective is 3843.25, the Mar 25 2021 low (cont). In terms of resistance, the key short-term level is at 4303.50, the Apr 26/28 high. On the flipside, Initial resistance is at 4099.00, the May 9 high.

- Though earning cycle has nearly run it's course, some big names remain for next wk: Home Depot and Walmart early Tuesday, Target early Wed; tech names: Applied Materials and Cisco Wed and Thu respectively.

- SPX leading/lagging sectors: Consumer Discretionary (+3.09%) as autos surge, Energy sector (+3.07%) with rebound in crude, Information Technology trimmed gains but still strong (+2.66%) with semiconductor and hardware makers outpacing software.

- Laggers: Utilities (+0.46%), Consumer Staples and Health Care (+0.69%).

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +5.85 at 305.26, Salesforce (CRM) +5.10 at 165.52, American Express (AXP) +4.86 at 158.13 and Visa (V) +4.78 at 198.75. Biopharmas lagging: Amgen (AMGN) -2.74 at 241.98, JNJ -1.45 at 176.42.

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4297.92 High May 9 / 50-day EMA

- PRICE: 4000.0 @ 1500ET May 13

- SUP 1: 3855.00/3843.25 Low May 12 / Low Mar 25 2021 (cont)

- SUP 2: 3820.25 2.50 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

COMMODITIES: WTI Finishes A Mixed Week Strongly, Gold Slides Further

- Crude oil is finishing the week on a strong note, up almost 4% but it’s only enough to leave WTI up 0.5% on the week and Brent down -1%.

- The largely V-shaped move through the week started with China lockdown-related demand fears before recovering on oil-specific factors such as the EU edging closer to a ban on Russian oil amidst Hungary stalling proceedings before a broader bounce in risk sentiment and increasing tightness in refined product markets ahead of the US driving season.

- WTI is +3.9% at $110.35 having moved nearer to resistance at $111.37 next (May 5 high). Robust increases in the rig count helped briefly pause the rally.

- Brent is +3.6% at $111.33 nearing $114.00 (May 5 high) after which it would open the bull trigger of $115.76.

- Gold finishes a tough week heading another -0.6% on the day for -3.9%, the worst since June, on surging dollar strength. At $1810.5 and briefly dipping under $1800, it moves nearer to the key support of $1780.4 (Jan 28 low).

EU Oil Ban Decision Possible Next Week

EU officials are still hopeful of an EU oil ban against Russia this month according to reports from Reuters.

- The four officials that spoke on the matter rejected suggestions of a delay in the deal or watering down of proposals.

- The deal has been most vocally objected by Hungary, though Bulgaria, the Czech Republic and Slovakia have also been part of the opposition.

- One official said the deal could be as early as Monday as technical talks continue over the weekend while others expect the deal later in the week.

- The majority of the EU will fully ban oil and products by the end of the year, Hungary have gained an exemption until the end of 2024 along with Slovakia, while the Czech Republic have until mid-2024.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 16/05/2022 | 0820/1020 |  | EU | ECB Panetta Speech at Digital Euro Event | |

| 16/05/2022 | 0840/1040 |  | EU | ECB Panetta & Lane in Discussion on Digital Euro | |

| 16/05/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/05/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 16/05/2022 | 1255/0855 |  | US | New York Fed's John Williams | |

| 16/05/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 16/05/2022 | 1400/1500 |  | UK | BOE TSC to discuss May MPR | |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 16/05/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.