-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Carry-Over Bid For Stocks

US TSYS: 30YY Comfortably Over 3% Again

Rates finished broadly weaker Monday, near session lows on deceptively robust volumes (TYM2> 1.5M, FVM2>1.4M) for an otherwise quiet session. Yield curves bear steepened with bonds leading the sell-off, 30YY comfortably above 3% at 3.0696% (+.0837) after the close. Robust futures volumes tied to increase in Jun/Sep rolls ahead May 31 First Notice w/ FVM/FVU near 600k by the close.- Rates extended lows prior to positive but not market moving April Chicago Fed National Activity Index 0.47 vs. 0.50 est (March down-revision to 0.36 from 0.44).

- Otherwise, no obvious headline driver or block print to explain the initial move save carry-over risk-on tone with banks leading the rally in stock indexes: (JPM and Citi +7.12%, Bank of America +6.38%).

- Nothing new from Atlanta Fed Bostic as he commented on economic outlook: COMFORTABLE WITH 50 BPS HIKES NEXT COUPLE OF MEETINGS .. OPEN TO MOVING MORE AGGRESSIVELY IF INFLATION HIGHER, Bbg

- Tuesday focus:

- S&P Global US Mfg PMI (59.2, 57.7), Services PMI (55.6, 55.2) and Composite PMI (56.0, 55.7) at 0945ET; May-24 1000 Richmond Fed Mfg Index (14, 10) and New Home Sales (763k, 750k); MoM (-8.6%, -1.7%) at 1000ET.

- Fed Chair Powell recorded open remarks eco-summit, text, no Q&A at 1220ET

- US Tsy $47B 2Y note auction (91282CER8) at 1300ET

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00157 to 0.82314% (-0.00100 total last wk)

- 1M +0.03214 to 1.00571% (+0.08686 total last wk)

- 3M +0.01743 to 1.52386% (+0.06272 total last wk) * / **

- 6M -0.00371 to 2.06186% (+0.07057 total last wk)

- 12M -0.01200 to 2.71800% (+0.07786 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.52386% on 5/23/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $82B

- Daily Overnight Bank Funding Rate: 0.82% volume: $261B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $943B

- Broad General Collateral Rate (BGCR): 0.79%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $346B

- (rate, volume levels reflect prior session)

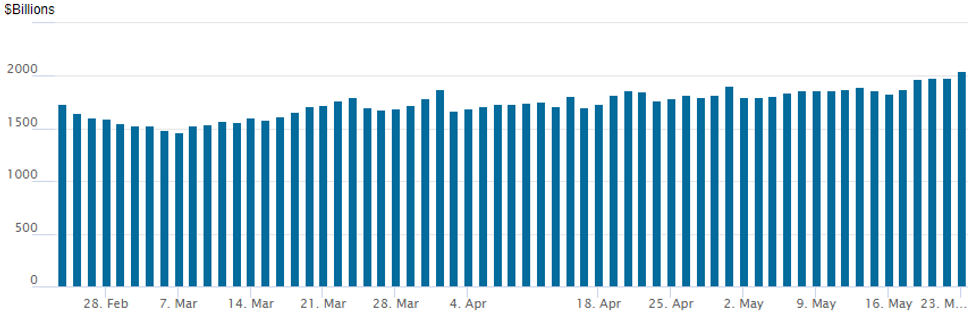

FED Reverse Repo Operation, Fifth Consecutive New High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new all-time high of 2,044.658B w/ 94 counterparties vs. last Friday's record $1,987.987B.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options- Block, 2,500 SFRM2 98.25/98.37/98.43/98.62 iron condors, 1.75 ref 98.4025

- +12,000 SFRU2 97.37/97.43/97.56/97.62 call condors, 2.0-1.75, mostly 1.75

- Blocks, 10,000 SFRU2 97.43/97.56/97.68 put flys, 2.25, another 7k at 2.0/screen

- 4,000 SFRZ2 97.25/97.37/97.50 put flys

- +2,500 Jun 98.31 calls, 1

- Block, 5,000 short Jul 96.25/96.62 put spds, 10.0 vs. 96.785/0.20%

- 10,000 short Jun 96.50 puts

- +5,000 short Jun 96.50/96.62 2x1 put spds, 1.5 vs. 96.685/0.33%

- Blocks, total 26,580 Sep 97.62 calls, 10.0 vs. 97.38/0.33%

- Block, 19,500 TYN 120.5/122 call spds, 20 ref 119-09

- +10,000 TYN 121 calls, 22 re. 119-04.5

- 3,300 TYN 121.5 calls, 21 ref 119-18.5

- +2,000 TYU 122/123 call spds, 15 vs. 120-01/0.07%

- +10,000 FVN 114 calls, 14.5 ref 112-27.25

EGBs-GILTS CASH CLOSE: Lagarde Sets The Path To September

European yields rose Monday, with Gilts outperforming Bunds (reversing morning underperformance vs Germany in the afternoon as equity gains accelerated).

- ECB President Lagarde set a hawkish tone for the session with her unusually explicit forward guidance in a morning blog post. She confirmed that a July hike was on the cards, with rates exiting negative territory by end-Q3.

- A BBG sources piece in the afternoon said some officials were dismayed by the effective ruling out of a 50bp hike option for now; little market reaction.

- BTP spreads tightened, having initially reacted negatively to Lagarde's comments.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 7.9bps at 0.421%, 5-Yr is up 8.3bps at 0.738%, 10-Yr is up 7.3bps at 1.017%, and 30-Yr is up 8.2bps at 1.198%.

- UK: The 2-Yr yield is up 6.5bps at 1.572%, 5-Yr is up 6.6bps at 1.669%, 10-Yr is up 7.7bps at 1.97%, and 30-Yr is up 5.5bps at 2.185%.

- Italian BTP spread down 4bps at 201.7bps / Greek down 5.4bps at 272.4bps

EGB Options: Mixed Trade

Monday's Europe rates/bond options flow included:

- DUN2 109.50/109.20 ps for 10/10.25 in 3k

- ERU2 99.87^ v 99.75p, bought the straddle up to 13 in 4.1k

- ERU2 99.75/100.00/100.25 c fly 1x2x0.5, sold at 3.25 in 19k

FOREX: Greenback Under Pressure As EURUSD Breaks Resistance

- The US Dollar has been on the backfoot from the open and the USD index is around 1% lower on Monday. US yields are higher on the day, however, markets continue to consider the lowering yield differentials last week that has halted the greenback rally for now.

- Adding to the USD pressure, the early mover in FX was in late Asia trade, with USDCNY and USDCNH falling close to 3 big figures, after Biden said that Chinese tariffs imposed by the Trump administration were under consideration.

- Furthermore, comments from ECB President Lagarde via a blog post provoked some very supportive price action for the single currency. Lagarde stated “we are likely to be in a position to exit negative interest rates by the end of the third quarter.” The comments have prompted some sell-side analysts to indicate the next steps for the ECB have been ‘rubber stamped’ with likely 25bp hikes in both July and September.

- Following EURUSD clearing the 20-day EMA at 1.0570 overnight, technical conditions had suggested scope for a stronger short-term recovery which has manifested following a print above key resistance at 1.0642, the May 5 high.

- The current bull cycle started at 1.0350, May 13 low and from the base of a bear channel, drawn from the Feb 10 high. The channel top intersects at 1.0857 and is a potential short-term objective. Initial support is at 1.0533, May 20 low.

- In similar vein, the next upside target for Cable is at 1.2600, followed by 1.2638 High May 4 and a key resistance.

- Focus in the euro area tomorrow remains on economic sentiment surveys with the key preliminary PMIs for May due. Highlights for the week remain Wednesday’s RNBZ meeting/decision as well as the release of the FOMC minutes.

Late Equity Roundup: Banks, Energy Equipment/Services Plow Higher

Stocks firmer near the top session highs after the FI close, banks leading financial shares as major indexes continue to bounce off last Fri's Mar'21 lows.

- SPX emini futures currently +65.75 (1.69%) at 3964.75, Dow Industrials +601.3 (1.92%) at 31859.36, Nasdaq +147.4 (1.3%) at 11500.64.

- SPX leading/lagging sectors: Financials sector outperforms (+3.72%) w/banks gaining (JPM and Citi +7.12%, Bank of America +6.38%). Energy (+2.88%) lead by energy equipment and services, Consumer Staples (+2.21%).

- Laggers: Off lows, Consumer Discretionary continue to lag (+0.52%) w/ auto shares outperforming retailers; Health Care sector (0.81%) followed by Real Estate (+0.18%).

- Dow Industrials Leaders/Laggers: As noted banks outperforming: Goldman Sachs (GS) +12.27 at 319.07, JPM +8.26 at 125.65. United Health Care gaining UNH) +7.13 at 492.86.

- Laggers: Home Depot (HD) -1.35 at 285.84, followed by Dow Inc (DOW) -0.92 at 67.19, Salesforce (CRM) -0.31 at 159.34.

E-MINI S&P (M2): Trend Needle Still Points South

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4227.44 High May 9 / 50-day EMA

- PRICE: 3936.50 @ 14:16 BST May 23

- SUP 1: 3807.50 Low May 20

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain vulnerable following the reversal from last Wednesday’s high of 4095.00. This left the initial key resistance - 4099.00, May 9 high - intact. The reversal lower, and Friday’s fresh trend low, signals a resumption of the downtrend and opens 3801.97, 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont). Clearance of 4099.00 is required to ease the bearish threat and signal a potential short-term reversal.

COMMODITIES: Oil Mixed Whilst European Gas Touches Three-Month Low

- A mixed session for crude oil, steadily firming overnight, sliding in the US morning before a partial bounce on German hopes that the EU Russian oil embargo can be agreed within days, although countered by Hungary signalling talks may go into June.

- Larger price rises are seen further out the forwards curve, presumably on the assumption of incoming tighter supply.

- WTI is unch at $110.31. It hasn’t troubled resistance at $113.20 (May 17 high) or support at $103.24 (May 19 low).

- Brent is +0.6% at $113.27. It hasn’t troubled resistance at $115.69 (May 17 high) or support at $105.70 (May 13 low).

- Gold is +0.5% at $1856.44 as it’s buoyed by a further slide in the US dollar. Touching an intraday high of $1856.15, it moved nearer to resistance at the 50-day EMA whilst support remains far below at $1807.5 (May 18 low).

- Separately, European natural gas prices fell to a three-month (pre-Ukraine war) low as storage recovered, with the Dutch front-month contract settling -5.3% on the day.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2022 | 2330/1930 |  | US | Kansas City Fed's Esther George | |

| 24/05/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/05/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 24/05/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/05/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/05/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/05/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 24/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/05/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/05/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/05/2022 | 1620/1220 |  | US | Fed Chair Jerome Powell | |

| 24/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/05/2022 | 1715/1815 |  | UK | BOE Tenreyro Panels Discussion | |

| 24/05/2022 | 1800/2000 |  | EU | ECB Lagarde Opens World Economic Forum Dinner |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.