-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA MARKETS ANALYSIS: Risk Appetite Sours Into Month End

US TSYS: Late Risk-Off or Month End Positioning?

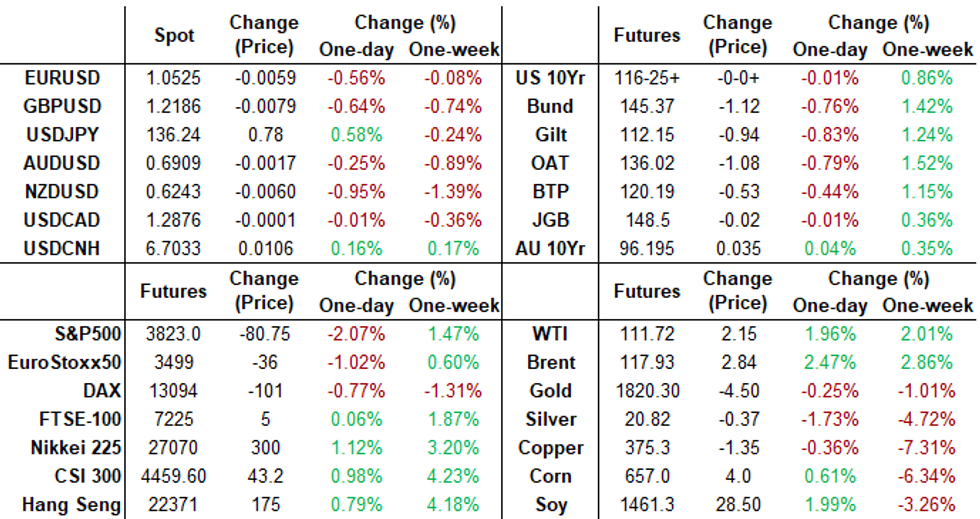

FI futures finishing mildly higher - well off early session lows as weaker than expected data helped kick things off. Debatable, some desks cited headlines that Turkey's agreement to back Finland and Sweden entry into NATO for adding to the late risk-off tone. Lack of support for stocks could be associated with month-end repositioning remains to be seen.

- Stocks reversed early gains following weaker data (June Consumer Confidence of 98.7 vs. 100.0 est while Richmond Fed Index much weaker than expected at -19 vs -7 est) extending lows at the moment: SPX eminis -74.5 (-1.91%) at 3829; DJIA -459.54 (-1.46%) at 30978.22; Nasdaq - 316.3(-2.7%) at 11208.38.

- Bonds sold off briefly following weak $40B 7Y note auction (91282CEV9) tails (third consecutive weak sale): 3.280% high yield vs. 3.260% WI; 2.48x bid-to-cover vs. 2.69x last month. Indirect take-up: recede to 61.86% vs. 77.86% in May; Direct take-up: climbs to 20.41% vs. 15.76%; Primary dealer take-up: rebounds to 17.73% vs. last moth's record low of 6.38%.

- Focus turns to Wed's data calendar: GDP (-1.5% est), PCE (3.1% est) and Fed speakers at ECB Forum including: Fed Chair Powell joined by ECBs Lagarde, BoE Bailey, BIS Carstens at ECB Forum in Sintra.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00014 to 1.57086% (-0.00528/wk)

- 1M +0.01385 to 1.66614% (+0.03343/wk)

- 3M +0.01886 to 2.25043% (+0.01600/wk) * / **

- 6M +0.01472 to 2.87686% (+.01029/wk)

- 12M +0.03529 to 3.60729% (+0.06258/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.19729% on 6/23/22

- Daily Effective Fed Funds Rate: 1.58% volume: $90B

- Daily Overnight Bank Funding Rate: 1.57% volume: $258B

- Secured Overnight Financing Rate (SOFR): 1.50%, $945B

- Broad General Collateral Rate (BGCR): 1.49%, $367B

- Tri-Party General Collateral Rate (TGCR): 1.49%, $345B

- (rate, volume levels reflect prior session)

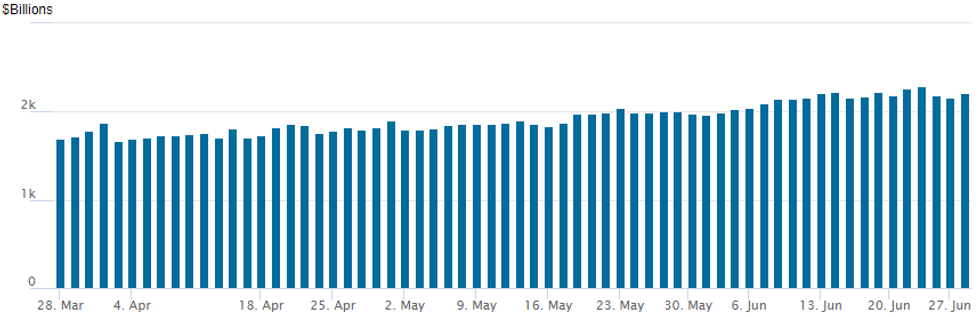

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,213.784B w/ 97 counterparties vs. $2,155.942B prior session. Compares to record high of $2,285.428B from Thursday June 23.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Modest overall FI option volume Tuesday focused on downside puts as near-term 75bp likely to remain the "new baseline" from the Federal Reserve. Nevertheless, underlying rates see-sawed off session lows in late trade. Salient examples in SOFR, Eurodollar and Treasury options include:- Eurodollar blocks included +20,000 Dec 95.5/96.5 put spds, 40.5 vs. 96.20/0.36% as well as +17,000 Dec 95.62/96.62 put spds, 45.5 vs. 96.20/0.42%.

Treasury options saw buy of at least - Treasury options saw buy of at least 25,000 (12.5k Blocked) TYU2 113/115 2x1 put spds at 1.0 in addition to 10,000 TYQ 113/114 put spds, 8.

- SOFR options package structured as a bear flattener with buy of 30,000 SFRZ2 96.25/97.50 put spds 77.5 vs. -20,000 SFRZ3 96.00 puts at 49.5.

- Block, total +30,000 SFRZ2 96.25/97.50 put spds 77.5 vs. -20,000 SFRZ3 96.00 puts at 49.5

- Block, -10,000 SFRZ3 96.00 puts, 50.0 vs. 96.775/0.30%

- +5,000 short Aug 95.87/96.37 put spds, 13.5

- 3,000 (1,750 blocked) SFRQ2/SFRU2 97.12/97.25/97.37 call fly spd, 0.75 net

- Block, 4,000 SFRU2 4,000 97.50/97.62 put spds, 11.0 vs. 96.92/0.05%

- Block, total 20,000 Dec 95.5/96.5 put spds, 40.5 vs. 96.20/0.36%

- Block, 17,000 Dec 95.62/96.62 put spds, 45.5 vs. 96.20/0.42%

- 4,000 Aug 98.18 calls, 0.75

- 2,200 short Jul 96.00/96.25 put spds

- 3,000 short Sep 95.87/97.12 strangles

- 25,000 (12.5k Blocked) TYU2 113/115 2x1 put spds, 1

- 2,000 TYU 120/124 call spds

- +10,000 TYQ 113/114 put spds, 8

- +5,000 wk2 TY 113/114 put spds, 3

- 3,000 TYU 111.5/114/116.5 put flys, 24

- Block, 5,000 TYU 114/116 put spds, 38 vs. 2,000 TYU 119.5 calls, 41

EGBs-GILTS CASH CLOSE: Bobl Underperforms As ECB Talks Tools And Hikes

EGBs and Gilts continued to weaken Tuesday, with some of the move attributable to stronger risk appetite, and a slight hint of ECB hawkishness at Sintra.

- Most of the ECB speak Tuesday focused on the anti-fragmentation tool in the works; a Reuters sources piece in the morning pointed to a cash sterilisation element offsetting the liquidity impact of bond purchases.

- While Lagarde reinforced 25bp hike pricing in July, Kazaks said a 50bp raise should be considered, while Wunsch noted the 200bp in hikes as priced by next March were a "no brainer".

- End-2022 ECB hike pricing closed at a 4-session high (1.05%, +163bp vs current rates), which maintained pressure on the short end/belly of the German curve (Bobl underperformed).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 5.2bps at 0.957%, 5-Yr is up 14.4bps at 1.433%, 10-Yr is up 8.1bps at 1.628%, and 30-Yr is up 7.6bps at 1.828%.

- UK: The 2-Yr yield is up 10.3bps at 2.116%, 5-Yr is up 10.2bps at 2.142%, 10-Yr is up 7.2bps at 2.465%, and 30-Yr is up 6.8bps at 2.712%.

- Italian BTP spread down 3.9bps at 193.2bps / Spanish down 1.2bps at 109.7bps

EGB Options: Bund Call Trades Stand Out Amid Limited Action

Tuesday's Europe rates / bond options flow included:

- RXQ2 152c, sold at 27 and 27.5 in 10k

- RXQ2 152.5/153cs, bought for 3.5 in 7k

FOREX: Greenback Trades On Surer Footing As Equities Head South

- Renewed pressure on major equity benchmarks bolstered the US Dollar on Tuesday with the USD Index rising 0.45%, eliminating the downtick seen over the past two trading sessions.

- JPY weakness was the early story on Tuesday throughout European hours with USD/JPY (+0.55%) touching the week's best levels and continuing to work its way through the pullback from last week's highs. This keeps the cycle best at Y136.71 in view over the medium-term, with the RSI fading back below the technically overbought levels seen early June.

- The EURJPY cross delivered a fresh cycle high of 144.28 today, above the resistance and recent high of 144.25. This print has cancelled a 3-day candle pattern highlighted in recent updates - evening star reversal. Despite the supportive price action, the pair saw a swift reversal and resides close to unchanged approaching the APAC crossover. Key short-term support is at 141.18, the 20-day EMA. A break of this level is required to again highlight a potential top.

- The key reason for the swift reversal was gradual and consistent selling in EURUSD. Today’s high print at 106.06 represents the fourth daily test above the 1.06 mark in the past nine sessions.

- With momentum consistently waning at the highs, the pair gravitated lower amid the weakness in equities. Furthermore, an added tailwind for the greenback may have manifested in the form of value-date month-end dynamics with rebalancing models pointing to strong USD-buying.

- Moving average studies point south and a break lower would open 1.0350, May 13 low and the bear trigger. A clear break of 1.0627 however would alter the picture.

- With risk under pressure, NZD was the key underperformer, falling over 1% with cable also sliding back below the 1.22 mark, narrowing the gap with last week’s lows at 1.2161.

- Wednesday will bring flash estimates of German and Spanish inflation and the Commission's economic sentiment indices, all for June, while Lagarde, Powell and Bailey will all speak on a panel at the Sintra policy forum.

Expiries for Jun29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E898mln), $1.0620-25(E1.1bln), $1.0665-75(E714mln)

- GBP/USD: $1.2750(Gbp1.5bln)

- USD/JPY: Y135.00($505mln), Y136.20($715mln), Y137.50($780mln)

Late Equity Roundup: Extending Lows, Energy Outperforms

After a stronger start, stocks reverse mid-morning highs are extending lows after the FI close. Debatable, some desks cited headlines that Turkey's agreement to back Finland and Sweden entry into NATO for adding to the late risk-off tone. Lack of support for stocks could be associated with month-end repositioning remains to be seen.

- Stocks reversed early gains following weaker data (June Consumer Confidence of 98.7 vs. 100.0 est while Richmond Fed Index much weaker than expected at -19 vs -7 est) extending lows at the moment: SPX eminis -74.5 (-1.91%) at 3829; DJIA -459.54 (-1.46%) at 30978.22; Nasdaq - 316.3(-2.7%) at 11208.38.

- SPX leading/lagging sectors: Energy sector continues to outperform (+2.37%) lead by Hess Corp (HES) +2.78%, Occidental Petro (OXY) +4.36%, Valero (VLO) +3.47%, Diamondback Energy (FANG) +2.86%; Utilities up next (-0.28%) followed by Financials (-0.78%). Laggers: Consumer Discretionary (-3.7%) with retailers and consumer durables lagging weaker autos, followed by Information Technology (-2.75%) and Communication Services (-2.50%).

- Dow Industrials Leaders/Laggers: Chevron (CVX) +1.95 at 149.52 whgile United Health (UNH) pares gains: +1.66 late at 507.28; Caterpillar (CAT) +0.55 at 188.44, Boeing (BA) +1.27 at 139.95. Laggers: Home Depot (HD) extends sell-off: -12.80 at 269.89, Salesforce Inc (CRM) -8.88 at 172.43.

E-MINI S&P (U2): Corrective Cycle Remains In Play

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 4037.17 50-day EMA

- RES 1: 3948.00 High Jun 27

- PRICE: 3831.00 @ 1541ET June 28

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis maintain a positive short-term tone. The contract traded higher Friday to confirm an extension of the current bullish cycle. Price has traded above the 20-day EMA and this signals scope for an extension towards the 50-day EMA, currently at 4037.17. The primary trend direction remains down though and a reversal lower would signal the end of the correction. This would also refocus attention on the bear trigger at 3639.00, the Jun 17 low.

COMMODITIES: Crude Oil Prices Crunch Higher As Supply Disruption Wins Out

- Crude oil prices have churned higher again today on further supply issues, this time from Libya and Ecuador political protest disruptions, whilst concerns for the US economy weigh on the WTI-Brent Spread which reached a fresh low for the month.

- Tomorrow sees both API data plus the EIA release playing catch-up with two weeks of data after technical issues.

- WTI is +2.1% at $111.92, shifting further towards resistance at $113.49 (61.8% retrace of the Jun 14-22 downleg) and moving away from yesterday’s low of $105.60.

- Brent is +2.7% at $118.16, almost testing resistance at $118.25 (61.8% retrace of the Jun 14-22 downleg) which could open $121.25 (Jun 17 high).

- Gold is -0.16% at $1820.00 as it dips with emerging dollar strength and saw relatively little impact from Turkey agreeing to Finland and Sweden accession to NATO. It nears initial support at $1805.2 (Jun 14 low), clearance of which could open a bear trigger at $1787.0 (May 16 low).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/06/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 29/06/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 29/06/2022 | 0600/0800 | ** |  | SE | Economic Tendency Indicator |

| 29/06/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 29/06/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/06/2022 | 0700/0900 |  | ES | Spain Retail sales | |

| 29/06/2022 | 0745/0945 |  | EU | ECB de Guindos on Real Estate Cycles at ECB Forum | |

| 29/06/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 29/06/2022 | 0800/1000 | ** |  | EU | M3 |

| 29/06/2022 | 0845/1045 |  | EU | ECB de Guindos on Global Value Chains & Trade at ECB Forum | |

| 29/06/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 29/06/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 29/06/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 29/06/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 29/06/2022 | 1015/1215 |  | EU | ECB Schnabel on Inflation Expectations at ECB Forum | |

| 29/06/2022 | 1030/0630 |  | US | Cleveland Fed's Loretta Mester speaking at ECB forum | |

| 29/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/06/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 29/06/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 29/06/2022 | 1300/0900 |  | US | Fed Chair Jerome Powell speaking at ECB forum | |

| 29/06/2022 | 1300/1500 |  | EU | ECB Lagarde pm Monetary Policy Challenges | |

| 29/06/2022 | 1300/1400 |  | UK | BOE Bailey Panels ECB Forum | |

| 29/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 29/06/2022 | 1500/1700 |  | EU | ECB Lagarde Closing Remarks at ECB Forum | |

| 29/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 29/06/2022 | 1705/1305 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.