-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Recession Fears Overblown?

US TSYS: Risk-On Ahead June Employment Data

Early skittishness gave way to steadily higher bond yields by Thu's close, 30YY topping 3.2032%. Early session swings unlikely related to session data: Trade Deficit slightly wider than expected (-$85.5B vs. -$84.7B exp), weekly claims slightly higher than expected at 235k vs. 230k, continuing claims +1.375M vs. 1.328M.- Early moves more likely associated to positioning ahead Friday's June employment report (268k est vs. 390k prior) while late session comments from StL Fed Bullard and Fed Gov Waller underscored recent pricing of another 75bp hike at the end of the month (Bullard), Waller sees recession fears as overblown.

- Further curve inversion after the minutes keeps recession talk in the foreground while the FOMC admits inflation is job 1 and tightening will weaken the economy. Markets price in 75bp hike at the end of the month, but struggle with forward guidance: looking at rate cuts one year hence.

- Strong stocks (SPX eminis currently trading +61.5 (1.6%) at 3909.75; DJIA +358.03 (1.15%) at 31394.56; Nasdaq +266.7 (2.3%) at 11628.23), underscored the late risk-on tone.

- Decent pick-up in swappable corporate debt issuance ($10.6B total) generated two-way hedging/unwind flow across the curve

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00528 to 1.56771% (+0.00042/wk)

- 1M +0.06528 to 1.87214% (+0.07457/wk)

- 3M +0.03700 to 2.42757% (+0.13471/wk) * / **

- 6M +0.05728 to 3.05614% (+.15685/wk)

- 12M +0.10343 to 3.65743% (+0.09314/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.39057% on 7/6/22

- Daily Effective Fed Funds Rate: 1.58% volume: $95B

- Daily Overnight Bank Funding Rate: 1.57% volume: $270B

- Secured Overnight Financing Rate (SOFR): 1.54%, $966B

- Broad General Collateral Rate (BGCR): 1.51%, $359B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $349B

- (rate, volume levels reflect prior session)

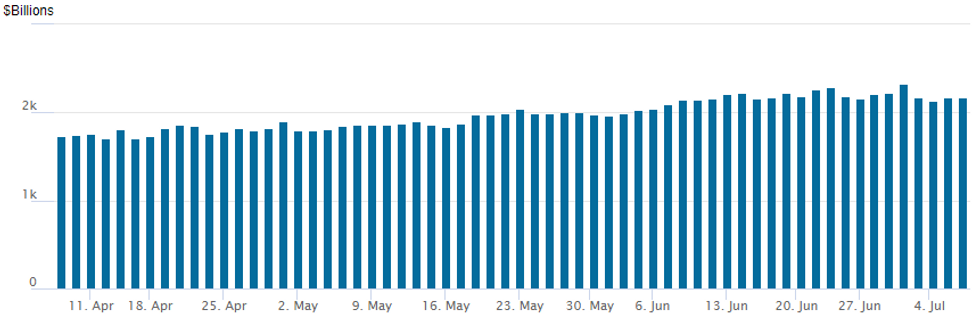

FED Reverse Repo Operation

NY Fed reverse repo usage climbs to $2,172.457B w/ 102 counterparties vs. $2,168.026B prior session. Record high stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Modest overall FI option volumes noted Thursday, focus on wings with better downside (rate hike) insurance buying via puts. Underlying futures extended the midweek sell-off, focus on Friday's June employment report (268k est vs. 390k prior).- Late session comments from StL Fed Bullard and Fed Gov Waller underscored recent pricing of another 75bp hike at the end of the month (Bullard) while Waller sees recession fears as overblown.

- Salient trade included Block buy of +10,000 short Jul SOFR 96.00/96.50 put spds at 2.0 w/ +15,000 short Jul SOFR 96.12/96.62 put spds at 3.0. Eurodollar option trade was more evenly mixed around year end with buyer of +6,000 Dec 97.50 puts, 129.5 vs. 96.28/0.90% and 6,000 Dec 96.50/96.75/97.00/97.25 call condors, 4.0. Treasury options included buy of 8,500 TYQ 118.5 puts at 105 and 3,300 FVQ 110.5/111/111.5/112 put condors at 9 as well as 8,000 FVQ 112/112.5 put spds at 14.5.

- Block, total +10,000 short Jul 96.00/96.50 put spds 2.0 w/

- Block, total +15,000 short Jul 96.12/96.62 put spds 3.0

- Block, 10,000 Jul 96.68/97.06 call spds, 9.5 at 1424:44ET, ref 96.735

- Block, 10,000 Jul 96.87/97.06/97.12 2x1x1 call trees, 5.0 net

- +2,500 short Mar 97.00/98.00 2x3 call spds, 52.5 vs. 97.02/0.36%

- +6,000 Dec 97.50 puts, 129.5 vs. 96.28/0.90%

- +6,000 Dec 96.50/96.75/97.00/97.25 call condors, 4.0

- +6,000 Dec 97.00 deep in the money 97.00 puts at 87.5 vs. 96.28/0.80%

- +1,000 Red Jun'24 95.00/99.25 put over risk reversals, 15.5 vs. 97.125/0.30%

- -2,500 Aug 96.62/97.00 strangles, 16.5-17.0

- Block, 23,250 TYQ 118.75 calls, 48 vs. 118-08/0.42%

- +8,500 TYQ 118.5 puts, 105

- 3,300 FVQ 110.5/111/111.5/112 put condors, 9

- +3,000 USQ 139 calls, 133 vs. 138-15/0.46%

- 8,000 FVQ 112/112.5 put spds, 14.5

- Block, -16,400 TYQ 118/120 call spds 29 over TYU 120.5/122.5 call spds

- Block, +5,000 FVU 112.25 puts, 100 vs. 104-31.5/0.50%

- Block, +5,000 FVU 112 puts, 58 vs. 104-31.5/0.50%

EGBs-GILTS CASH CLOSE: Gilts Outperform As Johnson Set To Depart

The German curve sold off sharply at the short end/in the curve belly Thursday, while Gilts easily outperformed despite a knee-jerk move weaker following UK PM Johnson's resignation as party leader.

- Both the UK and German curves bear flattened as ECB/BoE hike pricing rebounded, with equities gaining strongly but the Euro falling to fresh 2-decade lows versus the USD.

- Periphery spreads widened (though mostly recovered) following a Bloomberg sources piece that suggested the ECB's anti-fragmentation tool might not be fully agreed by the July 21 meeting.

- Attention swiftly turns to Friday's US Employment report data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 17bps at 0.558%, 5-Yr is up 15.6bps at 0.977%, 10-Yr is up 11.2bps at 1.318%, and 30-Yr is up 2.9bps at 1.552%.

- UK: The 2-Yr yield is up 7.4bps at 1.827%, 5-Yr is up 6.5bps at 1.811%, 10-Yr is up 3.6bps at 2.128%, and 30-Yr is up 1bps at 2.548%.

- Italian BTP spread up 4.3bps at 199.1bps / Greek up 13.1bps at 222.3bps

EGB Options: Large Euribor Put Fly Buying Thursday

Thursday's Europe rates / bond options flow included:

- RXQ2 155.5/157.0cs, bought for 14.5 in 2k

- ERU2 99.875/100.00cs, bought for half in 14k

- ERZ2 99.125/98.875/98.625p fly, bought for 3 in 4.5k

- ERZ2 99.125/99.00/98.875 put fly bought for 1 in 10k and 4k

- Bund rolling position (paid flat for the package):

- RXQ2 154.00/155.00/156.00c fly sold at 6 in 3k

- RXU2 152.00/153.00/154.00c fly bought for 6 in 4k

FOREX: EUR/USD Retains Primary Downtrend

- EUR/USD printed a lower low for the 8th time in the past nine session, putting the pair at new multi-decade lows of 1.0151. This retains the primary downtrend inside the bear channel drawn off the February 10 high. Reports from Bloomberg cited sources in saying that the ECB's anti-fragmentation tool may not be ready and prepared for the July 21st governing council meeting, tilting the currency lower still. The single currency following Italian bond futures lower, with the 10y yield rising by 15bps Thursday.

- Political tumult continued in the UK, with the PM Johnson formally announcing his resignation and his intention to carry on as a caretaker PMI until a new leader is elected by the Conservative Party. GBP took the news in its stride, showcasing how well priced the currency was for political uncertainty. GBP traded better against most others into the London close, putting EUR/GBP on track to test key 50-day EMA support at 0.8536. Weakness through here opens the Jul 6 low at below.

- Lastly, AUD and NZD were among the session's best performers, rallying against most others in G10 as the risk-off backdrop faded. Equity futures globally improved, helping high beta and commodity currencies outperform.

- Focus Friday turns to the June nonfarm payrolls report, with markets on watch for any slowdown in hiring and the resulting implications for the Fed's policy path. See the full MNI preview here: https://marketnews.com/markets/pdfs/mni-us-payrolls-preview-growth-concerns-thrown-into-the-mix ).

- Outside of payrolls, the Canadian jobs report is also due, while ECB's Lagarde, Visco, Muller and Villeroy are due to speak as well as Fed's Williams.

FX: Expiries for Jul08 NY cut 1000ET (Source DTCC)

- USD/JPY: Y135.00($1.1bln)

- EUR/GBP: Gbp0.8585-00(E996mln)

- AUD/USD: $0.7100(A$2.2bln)

Late Equity Roundup: Near Highs, Energy Sector Strong

Stocks trading firmer, near late session highs, risk-on tone gathers momentum with 30YY back up to 3.2032% ahead Fri's June employment data. SPX eminis currently trading +61.5 (1.6%) at 3909.75; DJIA +358.03 (1.15%) at 31394.56; Nasdaq +266.7 (2.3%) at 11628.23.

- Support for stocks tracked strong bid for crude amid supply concerns, WTI back over 100.0 at 102.75 +4.22. Reminder, next earnings cycle that kicks off next week.

- SPX leading/lagging sectors: Energy sector surges higher (+4.01%) on back of rebound in crude, Marathon, Diamondback, Valero, Schlumberger all leading rally. Consumer Discretionary (+2.6) lead by autos: Borg Warner, Aptiv, Ford and GM outpacing Tesla for once. Laggers: Utilities (+0.12%), Consumer Staples (+0.16%) weighed by weaker household and personal products, followed by Real Estate (+0.18%).

- Dow Industrials Leaders/Laggers: Caterpillar (CAT) rebounds +8.13 at 180.44, Goldman Sachs (GS) +5.24 at 299.00, and Boeing (BA) +4.30 at 141.08. Laggers: United Health (UNH) -2.10 at 513.19, Verizon (VZ) -0.68 at 50.83, Coca-Cola (KO) -0.32 at 63.09, and Merck (MRK) -0.17 at 92.96.

E-MINI S&P (U2): Bearish Threat Remains Present

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 3991.94 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3903.00 @ 1455ET Jul 7

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis remains above recent lows. The contract remains vulnerable though following last week’s bearish cycle and reversal from 3950.00, the Jun 28 high. The next support lies at 3735.00, the Jun 23 low. A breach of this level would expose key support at 3639.00, the Jun 17 low. On the upside, clearance of resistance at 3950.00 is required to reinstate a bullish theme. This would open the 50-day EMA, currently at 3991.94.

COMMODITIES: Risk-On Sees A Strong Reversal Of Yesterday’s Declines

- Crude oil prices have bounced strongly today, currently 4+% boosted by risk-on sentiment despite higher than anticipated US inventories taking the edge off even larger earlier gains.

- WTI is +4.4% at $102.91 having cleared resistance at $102.14 (Jul 6 high) after recent bearish focus. Next resistance is eyed at the 50-day EMA of $106.88.

- Brent is +4.2% at $104.90, also having cleared $104.35 (Jun 22 low) which next opens the 50-day EMA of $109.28.

- Other commodities tied to economic activity have also increased strongly, with both copper (HG1) and DCE iron ore rising 3+%.

- Gold lags though after its recent slide, only rising +0.07% to $1740.11 with mixed impact from rising Tsy yields but a softer dollar. It sits close to yesterday’s low of $1732.3 (Jul 6 low), clearance of which could open $1721.7 (Sep 29, 2021 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/07/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/07/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/07/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 08/07/2022 | 1155/1355 |  | EU | ECB Lagarde at Les Rencontres Economiques | |

| 08/07/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/07/2022 | 1230/0830 | *** |  | US | Employment Report |

| 08/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/07/2022 | 1230/0830 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/07/2022 | 1500/1100 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.