-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly - Russian Flows Reshuffling

MNI ASIA MARKETS ANALYSIS: Better Than Expected June Jobs Data

US TSYS: Strong Data Underscores Need For Second 75Bp Hike

Tsy futures broadly weaker after the bell, yld curves marginally steeper w/ long end underperforming after stronger than estimated June employ report +372k vs. +268k est, net revisions for April/May decline 74k.

- Strong data underscored a 75bp hike at end of month while markets got a little carried away pricing in small chance of 100bp hike (<5%) before moderating the move in the first half (balance of White pack (EDZ2-EDH3 currently -0.085-0.100 vs. -0.100-0.170 lows).

- New York Fed President John Williams said Friday he's revised down his expectations for U.S. economic growth and now expects the unemployment rate to rise past 4% next year as the central bank remains resolutely focused on restoring price stability. Williams later went on to say 75-50bps rate hike at the end of this month is the "right positioning" amid "sky high" inflation.

- Atlanta Fed Bostic was "fully supportive" over a second consecutive 75bps hike in July, confident the move would not hurt the economy.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00714 to 1.56057% (-0.00672/wk)

- 1M +0.02757 to 1.89971% (+0.10214/wk)

- 3M -0.00457 to 2.42300% (+0.13014/wk) * / **

- 6M -0.00771 to 3.04843% (+.14914/wk)

- 12M -0.01257 to 3.64486% (+0.08057/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.42757% on 7/7/22

- Daily Effective Fed Funds Rate: 1.58% volume: $92B

- Daily Overnight Bank Funding Rate: 1.57% volume: $271B

- Secured Overnight Financing Rate (SOFR): 1.54%, $966B

- Broad General Collateral Rate (BGCR): 1.51%, $361B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $355B

- (rate, volume levels reflect prior session)

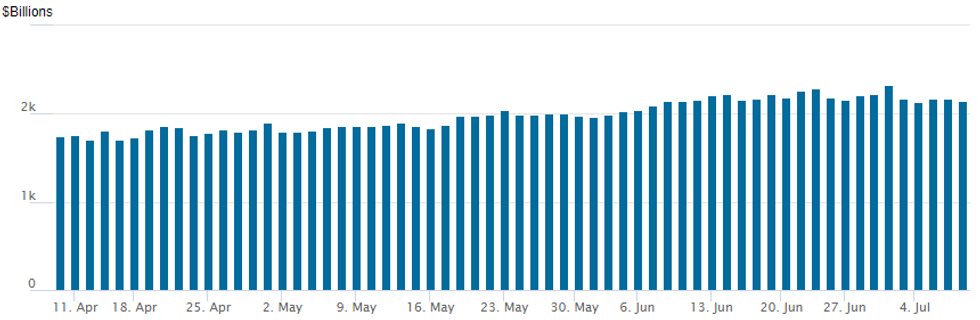

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,144.921B w/ 97 counterparties vs. $2,172.457B prior session. Record high stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Friday's FI option flow centered on wing options with better downside (rate hike) insurance buying via puts as markets adjusted to the stronger than expected June employment report +372k vs. +268k est underscored the likelihood of a 75bp hike at the end of the month.- Despite the sharp post-data sell-off in underlying futures, overall volumes remain light, even in futures (TYU2<1.2M at the close) with traders close to the sidelines in early summer trade.

- Some trade highlights included a block buy of 7,500 FVU 111.25 puts at 54, 5,000 FVQ 110/110.5/111/111.5 put condors and 10,000 TYQ 114/115 put spds at 3. Late Eurodollar options blocks included a buy of 10,000 Jul 96.50/96.75 put spds at 9.0, 10,000 July 96.56/96.75 put spds at 8.0 and 20,000 Dec 97.00/97.50 put spds at 43.5. On the flipside, paper bought 20,000 Red Sep'23 99.00 calls at 9.0 ref 96.555, adding to +40k on Thursday.

- +5,000 SFRZ 97.50/97.75 call spds, 3.0 vs. 96.54/0.05%

- Block, 2,000 SFRZ2 96.37/96.50 put spds 1.0 over SFRU2 96.75/96.87 put spds

- Block, +20,000 Dec 97.00/97.50 put spds, 43.5

- Block, +10,000 Jul 96.56/96.75 put spds, 8.0

- Block, +10,000 Jul 96.50/96.75 put spds, 9.0

- +20,000 Red Sep'23 99.00 calls, 9.0 ref 96.555, ongoing buyer adds to +40k yesterday

- 1,500 TYQ 120/121 call spds, 7

- 1,200 TYQ 115/116.5/118 put flys, 24

- 2,500 TYQ 118.75 calls, 32 ref 117-26.5

- 5,000 TYQ 118.25 calls, 47 ref 117-28

- Block, 7,500 FVU 111.25 puts, 54

- 10,000 TYQ 114/115 put spds, 3

- 5,000 FVQ 110/110.5/111/111.5 put condors

- +2,000 TYU 121.5/123/124.5 call flys, 6 ref 118-01

- Blocks, total 10,000 FVU 111.75 puts, 57.5-58.0

- 3,000 TYU 111/114 put spds

- 2,000 TYU 125 calls, 13

EGBs-GILTS CASH CLOSE: Yields Reverse Higher On Strong US Jobs Number

Bund and Gilt yields reversed sharply higher Friday after June's US Employment report was stronger than expected.

- While the initial bearish move faded somewhat by mid-afternoon, yields ended near/at session highs with Gilts underperforming.

- Moves across the curves were mixed: UK yields rose largely in parallel throughout the day; the German curve had earlier bull steepened but ended up twist steepening.

- There was little European data/newsflow driving, and volumes were low - morning trade was very subdued awaiting the US jobs figure.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 3.1bps at 0.527%, 5-Yr is down 1.1bps at 0.966%, 10-Yr is up 2.7bps at 1.345%, and 30-Yr is up 5.7bps at 1.609%.

- UK: The 2-Yr yield is up 10.3bps at 1.93%, 5-Yr is up 10.1bps at 1.912%, 10-Yr is up 10.5bps at 2.233%, and 30-Yr is up 8.7bps at 2.635%.

- Italian BTP spread down 4.7bps at 194.4bps / Spanish down 1.9bps at 107.2bps

EGB Options: Limited (Largely Euribor) Trade To Close The Week

Friday's Europe rates / bond options flow included:

- ERU2 99.37/99.50/99.625c fly, bought for 2.75 in 4.5k

FOREX: High Beta FX Rallies on Hopes of Further Gas Flows to Europe

- Confirmation from the Kremlin that repairs on the Nordstream pipeline could prompt increased Russian gas flows into the continent helped soothe sentiment Friday, prompting outperformance of global equity futures as well as commodity-tied currencies. This resulted in AUD and NZD being the two best performers in G10.

- Meanwhile, the June Nonfarm Payrolls report effectively gave the greenlight to further tightening from the Fed, with headline job gains coming in ahead of expectations (+372k vs. Exp. +265k) and Y/Y earnings stronger than forecast - complimented by upward revisions to the prior. The USD benefited from the release, but the strength faded swiftly into the close, putting the USD on track to close lower for the first time in over a week.

- Elsewhere, the CHF slowly but surely slipped lower against all others in G10 having initially dropped alongside the EUR in early Friday trade, before a gradual recovery in equities further dented haven currency appeal. USD/CHF printed the best level since mid-June and the last SNB rate decision, putting the pair north of the 0.9740 50-dma.

- Focus in the coming week turns to the US CPI report for June as well as the prelim University of Michigan survey, Chinese trade balance and the Australian jobs report.

- The quarterly US earnings cycle begins, with early focus on the largest US banks and financial institutions. Among the largest in the coming week are JP Morgan, Citigroup, Morgan Stanley and Wells Fargo.

FX: Expiries for Jul11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0050(E897mln), $1.0225(E559mln), $1.0250(E1.3bln), $1.0300(E1.2bln), $1.0400(E1.0bln)

- USD/JPY: Y133.50($1.6bln), Y136.50($855mln)

- AUD/USD: $0.6250(A$1.0bln)

- USD/CNY: Cny6.5484($1.4bln)

Late Equity Roundup: Autos Rebound, Tesla Leads

Stocks trading near modest session highs after the FI close, apparently tracking moves in Crude, posting gains as WTI crude bounced from 102.5 to over 105.0 briefly in the first half and gaining momentum again late. SPX eminis currently trading +8.5 (0.22%) at 3913.25; DJIA +69.55 (0.22%) at 31453.82; Nasdaq +21.4 (0.2%) at 11642.66.

- SPX leading/lagging sectors: Health Care +.71%, Energy firming (+0.54%) followed by Financials (+0.34%) and Consumer Discretionary (+0.28%), the latter lead by autos with Tesla (TSLA) outperforming +3.02%. Laggers: Materials (-0.44%), Communication Services (-0.11%) and Utilities (-0.10%) Information Technology (-0.78%). Twitter trades -4.5% over doubts of Musk buyout spurred by claims of true amount of spam/bot accounts and efforts to delete them.

- Dow Industrials Leaders/Laggers: United Health (UNH) +7.97 at 522.35, Amgen (AMGN) +2.17 at 249.59, American Exp (AXP) +1.77 at 142.80. Laggers: Salesforce.com (CRM) -1.20 at 175.44, Goldman Sachs (-1.19) at 297.41, Disney (DIS) -0.98 at 96.45 and Microsoft (MSFT) -1.07 at 267.33.

E-MINI S&P (U2): Gains Considered Corrective

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 3988.53 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3885.50 @ 14:14 BST Jul 8

- SUP 1: 3735.00/3639.00 Low Jun 23 / 17 and the bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis traded higher again Thursday and price remains above recent lows. The outlook is bearish though following the reversal from 3950.00, the Jun 28 high. The next support lies at 3735.00, the Jun 23 low. A breach of this level would expose key support at 3639.00, the Jun 17 low. On the upside, clearance of resistance at 3950.00 is required to reinstate a bullish theme. This would open the 50-day EMA, currently at 3988.53.

COMMODITIES: Week Of Two Halves For Oil, Not So Gold

- Crude oil prices are finishing the week on a stronger note, moving back closer to where they started after a week of two halves with souring and then improving global growth expectations.

- Supply side issues have also been at play, including OPEC+ boosting its crude production by 390kbpd in June but still well short of quota, whilst US Treasury Secretary Yellen is heading to Asia next week to build support for a Russian oil price touted at $40-60/bbl depending on market conditions.

- Money managers have decreased their ICE Brent crude net longs by 54k to 143k for a 20-month low in the week ending July 5, potentially further shaken

- WTI is +1.6% at $104.34 (-1.3% on the week) having briefly tested yesterday’s high of $104.48, clearance of which would next see resistance at the 50-day EMA of $106.88.

- Brent is +1.9% at $106.6 (-4.5% on the week), clearing resistance at $106.35 (Jul 7 high) and next opening the 50-day EMA of $109.1.

- Gold is +0.2% at $1743.01 after sliding through the week with dollar strength and on balance higher Tsy yields for -3.8%. It breached the bear trigger of $1787 earlier in the week and with a low of $1732.2 on Jul 6 next sees support eyed at $1721.7 (Sep 29, 2021 low).

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/07/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 11/07/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 11/07/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 11/07/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/07/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/07/2022 | 1800/1400 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.