-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Wednesday CPI Focus

US TSYS: Modest Position Squaring Ahead Wed's CPI

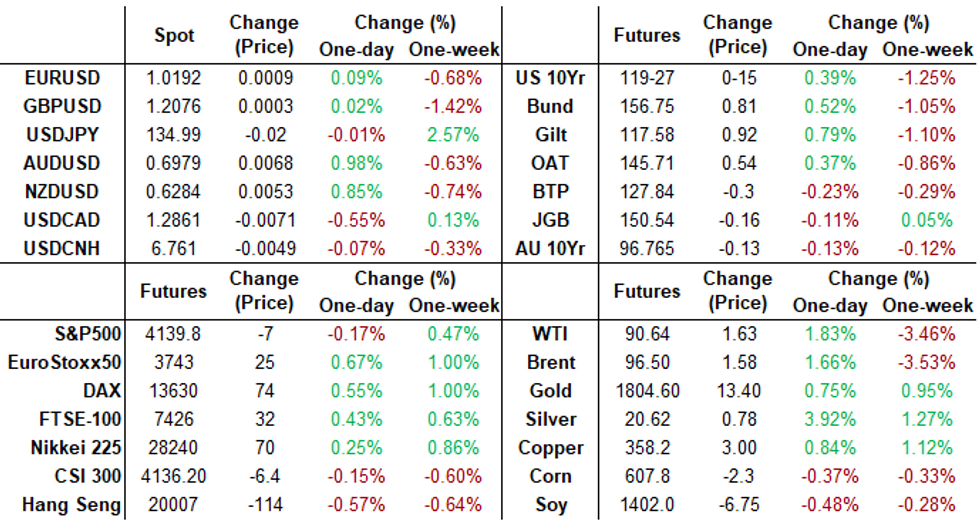

Rates holding narrow range near midday session highs after the close (30YY taps 2.985% low vs. early overnight high of 3.0836%), light volumes (TYU<840k) on modest rebound after Fri's steep sell-off on stronger than expected jobs gains for July: +528k vs. +250k est, dip in unemployment rate to 3.5% while AHE gained 0.5%, a tenth faster than in June.

- Week opens w/ modest squaring ahead of Wed's key CPI data. A moderate read for the inflation metric will continue to soften 75bp hike expectations while another hot read will see today's bounce reverse, most likely spurring chatter over an inter-meeting hike that saw FFQ2 trade 97.64 briefly, 3 bps above the current 233 EFFR.

- Cross asset update: Stocks off midmorning highs/near steady (SPX eminis at 4144.0 -2.75, DJIA +62.95 at 32872.91); Spot Gold stronger +12.70 at 1788.21; Crude firmer (WTI +1.59 at 90.60).

- Data on tap for Tuesday: Nonfarm Productivity (-4.6% est) and Unit Labor Costs (9.8% est), US Tsy $34B 52W bill and $42B 3Y Note auctions. Primary focus on Wednesday's CPI read for July: 0.2% MoM est vs. 1.3% prior, 8.7% YoY vs. 9.1% prior.

- The 2-Yr yield is down 0.8bps at 3.2177%, 5-Yr is down 4.6bps at 2.9095%, 10-Yr is down 6.8bps at 2.759%, and 30-Yr is down 8.1bps at 2.9855%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00529 to 2.31729% (-0.00957 total last wk)

- 1M +0.01914 to 2.38857% (+0.00714 total last wk)

- 3M +0.04486 to 2.91157% (+0.07842 total last wk) * / **

- 6M +0.14329 to 3.56886% (+0.09571 total last wk)

- 12M +0.13485 to 3.99471% (+0.15257 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 24Y high: 2.91157% on 8/8/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $282B

- Secured Overnight Financing Rate (SOFR): 2.28%, $965B

- Broad General Collateral Rate (BGCR): 2.26%, $391B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $380B

- (rate, volume levels reflect prior session)

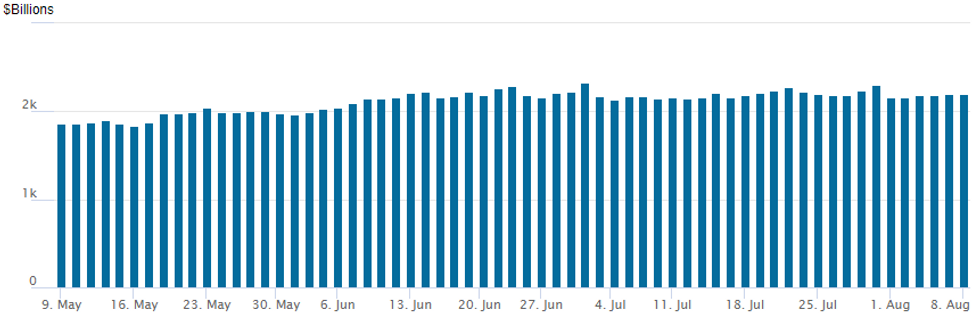

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher to $2,195.692B w/ 102 counterparties vs. $2,194.927B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Continued interest in downside put buying/rate hike insurance Monday despite the modest rebound in underlying rate futures. While some accts took the opportunity to unwind a portion of Friday's post-employment sell-off, option traders look to the potential for further declines in rates if Wednesday's CPI comes in hot again (current MoM 0.2% est vs. 1.3% prior, 8.7% YoY est vs. 9.1% prior).SOFR Options:

- 5,250 Dec 98.87/99.75 put spds

- Block, 2,500 SFRH3 96.50/96.75 call spds 2.0 over SFRZ2 96.00/96.25 put spds

- Block, 5,000 Aug/Sep 96.75/96.87 put spd spd, 0.5 net/Sep over vs. 96.83

- 1,500 SFRQ2 96.87/96.93 1x2 call spds

- +5,000 SFRU2 97.37 calls, 1.25

- 5,000 short Aug SOFR 96.50/96.62 put spds

- 14,500 SFRH2 96.00/96.25 put spds

- 2,500 Dec 98.75/99.75 put spds

- 10,000 Dec 98.87/99.62 put spds

- 7,000 Dec 98.87/99.75 put spds

- 2,000 Dec 99.87 calls, cab

- +5,000 Dec 98.00/99.75 1x3 call spds, 1.0 net

- 3,500 TYU2 118.25 puts, 19

- 5,000 FVU 111.5/113.5 put over risk reversals, 2.5

- 1,000 FVU/FVV 111.5 put spds, 17

- 2,500 TYU 118.5/121

- 3,500 TYV 113/115 put spds

- 8,200 FVV 109/110 put spds

EGB/Gilts - Reverse some of Friday's sell off

- A calm start of the week, although Bund still manages to trade in a 122 ticks range at the time of typing.

- Nonetheless, volumes are still very low and way below averages, not too surprising, with all the action starting on Wednesday this week.

- Real Money are likely sitting on the sidelines, and flow is most likely from Prop desk and Locals.

- Some desk will also likely position for the US CPI, with consensus going for a slowdown median reading of 0.2% MoM versus 1.3% last Month.

- Cross assets have continued to unwind post NFP price action, seen in Govies, Equities and FX.

- Peripheral spreads are all wider, and Greece leads today, by 7.8bps, but within past ranges.

- Gilts outperforms, pushing the Gilt/Bund spread 3.6bps tighter.

- Investors have faded some of the widening after Gilt/Bund spread, after it traded at its highest level since March last week.

EGB Options: Large Euribor Upside And Some Bund Variety

Monday's Europe rates / bond options flow included:

- RXU2 161c, sold at 36 in ~1.6k

- RXU2 153/151ps, bought for 23 up to 26 in 5k

- RXV2 149/159 RR, sold the put at 10.5 in 2k

- OEU2 126/124/122p fly, bought for 25.5 and 26 in 2.5k

- 3RZ2 99.00/99.50cs, bought for 7.5 up to 8.5 in 13.5k

FOREX: Greenback Unwinds Post-NFP Advance, AUD Leads Charge

- The greenback edged lower on Monday as the USD index slowly erased the NFP-inspired gains from Friday with markets potentially squaring positions ahead of a crucial set of US inflation data on Wednesday. While the broad USD index maintained a steady downward trajectory, performance across G10 was mixed.

- Firmer Chinese exports data and an initial rally across major equity benchmarks bolstered a firm 1% rally in antipodean FX and despite the late turnaround for stocks, AUD and NZD have maintained the majority of their advances for the session. In similar vein, CHF and CAD were notable beneficiaries of the Dollar weakness with more tempered gains of around +0.6%.

- EURUSD was happy to trade blows either side of 1.0200 and this marks the 15th consecutive session that the pair holds between 1.01/03. This consolidatory price action placed pressure on EUR crosses with EURAUD trading back below the 1.4600 mark and narrowing the gap with the July lows at 1.4511.

- USDJPY was less volatile than seen in recent memory, however, the pair still registered a 120-pip range on Monday. Despite an initial attempt above Friday’s highs at 135.50 during the APAC session, momentum immediately waned and the pair slowly reversed course throughout Monday in line with the general theme across currency markets. Lows were made at 134.36, however the pair now trades just below its opening level approaching the APAC crossover at 134.80.

- An extremely quiet data calendar for Tuesday may prompt currency markets to trade tentatively ahead of Wednesday’s US CPI, barring any major developments on the geopolitical front that could impact overall risk sentiment.

Late Equity Roundup: Inching (Mostly) Lower

Stock indexes trading mildly weaker by the FI close, poised to extend late session lows save DJIA shares as they make late rebound. Currently, SPX eminis trades -8.0 (-0.19%) at 4139.25; DJIA +17.87 (0.05%) at 32824.18; Nasdaq -26.1 (-0.2%) at 12632.75.

- Technicals: Despite the move off early highs, short-term trend conditions in S&P E-Minis are bullish. Continued gains confirm a resumption of the current bull cycle and maintain the positive price sequence of higher highs and higher lows. This opens 4204.75 next, May 31 high and the next key resistance. On the downside, initial trend support is at 3913.25, the Jul 26 low. The 50-day EMA intersects at 3998.05.

- SPX leading/lagging sectors: Energy sector gains (+0.84%) lead by APA Corp (APA) +2.33%, Occidental Petroleum ((OXY) +2.07% and Diamond Back Energy (FANG) +2.04%; Real Estate and Materials sectors follow both +0.62%. Laggers: Information Technology (-1.02%) weighed by semiconductor makers (Nvidia hammered -8.24%), Consumer Staples (-0.16% and Industrials (-0.10%).

- Dow Industrials Leaders/Laggers: Disney (DIS) +2.27 at 108.90, Honeywell (HON) +1.61 at 193.88 and Boeing (BA) +1.61 at 166.65. Laggers: Visa (V) -3.21 at 212.66, Microsoft -3.09 at 279.82, McDonalds (MCD) -2.73 at 256.50.

E-MINI S&P (U2): Northbound

- RES 4: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4306.50 High May 4

- RES 2: 4204.75 High May 31 and a key resistance

- RES 1: 4177.50 Intraday high

- PRICE: 4136.0 @ 1500ET Aug 8

- SUP 1: 3998.05/13.25 50-day EMA / Low Jul 26 and key S/T support

- SUP 2: 3820.25 Low Jul 18

- SUP 3: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 4: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

Short-term trend conditions in S&P E-Minis are bullish and the contract has traded higher today. Continued gains confirm a resumption of the current bull cycle and maintain the positive price sequence of higher highs and higher lows. This opens 4204.75 next, May 31 high and the next key resistance. On the downside, initial trend support is at 3913.25, the Jul 26 low. The 50-day EMA intersects at 3998.05.

COMMODITIES: Solid Gains For Crude On Day Iran Nuclear Talks End Without A Deal

- A mixed day for crude oil, falling in early trade before rallying and proving resistant to a rolling over in US equities. There have been yet more headlines on the JCPOA, with fifteen months of talks ending without a deal and the US and Iran having just weeks to decide whether they want to revive the deal after EU diplomats presented parties with a finalised draft. Latest headlines from Iran’s Foreign Ministry Spokesman indicate it’s not yet ready to finalise an agreement. Separately, potential mild support from storms brewing in the Atlantic in peak hurricane season, potentially posing threats to offshore production.

- WTI is +2.0% at $90.75, seen vulnerable from a technicals, with support seen at $87.01 (Aug 5 low) and resistance at $95.56 (20-day EMA).

- Brent is +1.8% at $96.62 , also with a technically bearish threat remaining present with support seen at $92.78 (Aug 5 low) and a bear trigger of $91.22 (Jul 14 low) below that, but with resistance equally eyed at $99.992 (20-day EMA).

- Gold meanwhile reverses most of Friday’s post-payrolls slide with the retracement in Treasury yields and USD strength, firming a strong +0.7% to $1788.28. It moves back nearer to resistance at $1795.0 (Aug 4/5 high) and puts trendline resistance at $1799.6 within reach.

- Gas price volatility continues, with US gas prices currently -5.4% on easing temperatures and production gains easing supply concerns whilst European gas prices fell -1.7% as inventories increased to 72% or about the five-year average.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.