-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Disinflationary Data

US TSYS: Bonds Near Highs, Yield Curves Flatter

Bonds finished stronger, near late highs on a quiet second half w/ TYU2 just over 1M well after the bell compared to 815k ahead midday, yield curves unwinding a portion of this week's CPI/PPI induced steepening.

- Muted reaction to early deflationary data: Import (-1.4%)/Export (-13.3%) prices come out weaker than expected. Tsys that were already off highs after the open continued to scale back support, albeit on light volumes, equities turning modest gains.

- Dual react: Tsy support faded after preliminary August reading of consumer sentiment from the University of Michigan climbed to 55.1 vs. 52.5 exp (51.5 in July and all-time low of 50.0 in June for comparison).

- Meanwhile, Richmond Fed Barkin midmorning comments on CNBC deemed mixed with "more rate hikes needed to control inflation" and a "lot of time before Sep meeting, keep an eye on data" weighing. Less hawkish tones in the mix with "TIGHT LABOR MARKET DOESN'T HAVE TO CAUSE INFLATION; DEMAND DEFINITELY SOFTENING, ESP FOR LOW-INCOME CONSUMER; MUST BELIEVE BAL-SHEET SHRINKING HAS TIGHTENING EFFECT."

- Blocks contributed to yield curves paring back from wk's steepening post UofM: -11,421 TUU2 104-20.88, sell through 104-21 post-time bid at 1010:56ET vs. +3,960 UXYU2 128-31.5 buy through 128-28.5 post-time offer; -25,033 FVU2 112-09.5 sell through 112-09.75 post-time bid at 1036:45ET, 112-09.25 last -.25.

- Late curve levels:

- 3M10Y -4.974, 26.663 (L: 25.199 / H: 33.589)

- 2Y10Y -7.618, -41.125 (L: -41.125 / H: -32.494)

- 2Y30Y -9.512, -14.282 (L: -14.364 / H: -5.024)

- 5Y30Y -4.728, 13.923 (L: 13.604 / H: 18.841)

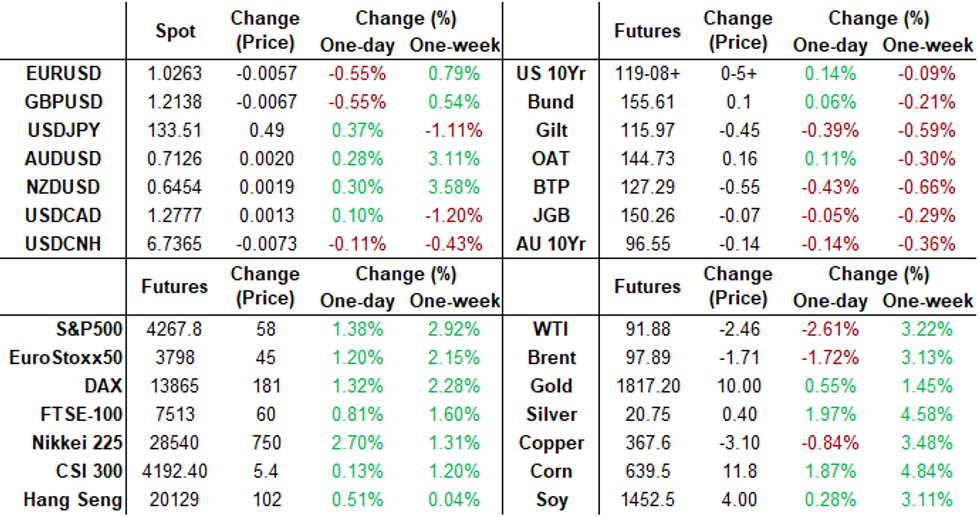

- Cross asset: Stocks trading strong after the bell, SPX eminis +66.0 (1.41%) at 4275.75; Gold +11.30 at 1801.02; Crude weaker (WTI -2.59 at 91.75).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00914 to 2.31486% (+0.00286/wk)

- 1M -0.00414 to 2.38686% (+0.01743/wk)

- 3M +0.01643 to 2.92157% (+0.05486/wk) * / **

- 6M +0.02058 to 3.50292% (+0.08372/wk)

- 12M +0.03086 to 3.95900% (+0.09914/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.92271% on 8/10/22

- Daily Effective Fed Funds Rate: 2.33% volume: $94B

- Daily Overnight Bank Funding Rate: 2.32% volume: $285B

- Secured Overnight Financing Rate (SOFR): 2.28%, $965B

- Broad General Collateral Rate (BGCR): 2.26%, $392B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $380B

- (rate, volume levels reflect prior session)

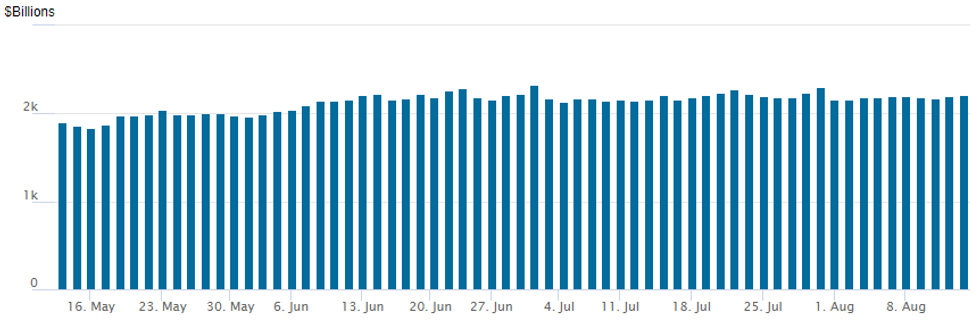

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,213.193B w/ 99 counterparties vs. $2,199.247B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Restrained FI option volumes reported Friday, with a couple standout Eurodollar option spreads (December deep in-the-money put spd adding to early week trade) and two-way 10Y options flow in addition to a late September 5Y vol sale via 112.25 straddles.SOFR Options:

- 1,000 SFRH3 96.25/96.50 put spds vs. 96.75/97.00 call spds

- 1,000 short Oct SOFR 96.50/96.75 put spds

- 1,500 short Aug SOFR 96.68/96.75 put spds

- 1,000 short Aug SOFR 96.00/96.12 put spds

- +10,000 Nov 95.50/95.75 put spds, 4.25

- 36,000 Dec 98.75/99.75 put spds, adds to appr 25k earlier in wk

- -3,000 FVU 112.25 straddles 57.5-56.5

- +3,500 FVU 112.5 calls, 28 vs. 114-14.5/0.48%

- 7,500 TYV 115 puts, 9

- 8,000 TYU 121 calls, 8

- 3,000 wk3 TY 118 puts

- 6,000 FVU 113 calls, 13-14

EGBs-GILTS CASH CLOSE: Gilts Underperform As Europe Enters Long Weekend

The German curve bear flattened Friday, with the UK's bear steepening.

- While core yields had risen early in the session following an upside surprise in UK GDP data, yields began fading by early afternoon. The nascent rally was nipped in the bud by stronger-than-expected US UMichigan consumer confidence data, and European yields finished close to the middle of the day's ranges.

- UK 10Y spreads vs Germany continued to widen, reaching the widest since March 23 (112bp).

- Periphery spreads widened with the notable exception of Greece, which had been underperforming all week.

- BTP spreads widened suddenly in the afternoon (well before the UMichigan data) but narrowed again into the close, with no obvious catalyst seen.

- Note that several Eurozone countries observe holidays Monday, including France, Germany, Italy, and Spain.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.3bps at 0.609%, 5-Yr is up 4.4bps at 0.756%, 10-Yr is up 1.7bps at 0.988%, and 30-Yr is up 0.9bps at 1.238%.

- UK: The 2-Yr yield is up 5bps at 2.052%, 5-Yr is up 4.8bps at 1.93%, 10-Yr is up 5.1bps at 2.11%, and 30-Yr is up 8.6bps at 2.535%.

- Italian BTP spread up 2.1bps at 208bps / Greek down 1.6bps at 225bps

EGB Options: Plenty Of Euribor Trades To End The Week

Friday's Europe rates/ bond options flow included:

- DUU2 109.6/109.8cs 1x1.25 vs 109.4/109.1ps 1x1.25, bought the cs for 5.5 in 2.5k

- OEV2 126/124.25 1x2 put spread bought for 17 in 2.2k. Hearing adding

- RXV2 159.00/160.50 call spread bought for 14 in 5k

- ERU2 99.37/99.25/99.00 broken p fly, bought for 1.5 in 2k

- ERU2 99.50/99.62cs, bought for 1.5 in 2.5k

- 0RU2 98.62/98.87/99.12c ladder, sold at 5.25 and 5 in 5k

- 0RU2 98.25/98.12ps vs 98.62/98.75cs, bought the ps for 0.25 in 15k

FOREX: Greenback Trades With A Bid Tone, EUR Crosses Under Pressure

- Intra-day price action remained more subdued in currency markets on Friday as the post CPI volatility from Wednesday loses steam. Overall, the USD index is set to post a 0.5% gain as the greenback claws back losses incurred since the US inflation data release.

- The greenback advance was mirrored by weakness in EUR, GBP and JPY, however, notable outperformance was seen in the likes of AUD, NZD and CHF. Antipodean FX benefitting from the continued strength of major equity indices and the price action likely being exacerbated by weakness in EUR crosses with both EURAUD and EURCAD close to one percent lower on Friday, both narrowing the gap with the April lows.

- Further downside momentum in EURCHF throughout the day as the pair continues to trade at the lowest levels since the floor was removed in January 2015 with little in the way of technical support.

- The Swedish Krona is the weakest currency in G10 following the weaker-than-expected CPI data early on Friday. USDSEK is +1.4% higher on the session as well as NOKSEK rising over 1% to a three and a half month high. Norway’s above estimate CPI readings earlier in the week potentially exacerbating the divergence for NOKSEK ahead of next week’s Norges Bank rate decision.

- The other notable events on the calendar are the RBNZ rate decision and the FOMC minutes, both due on Wednesday.

- Chinese activity data headlines on Monday, with CPI prints for the UK and Canada later in the week. In the US, July Retail Sales is due for release.

FX: Expiries for Aug15 NY cut 1000ET (Source DTCC)

- USD/JPY: Y133.80-00($950mln), Y135.35($660mln)

- EUR/GBP: Gbp0.8535-50(E1.2bln)

- USD/CAD: C$1.2950($655mln)

- USD/CNY: Cny6.75($655mln)

Late Equity Roundup, IT, Materials, Communication Services Leading

Stocks continue to extend late session highs, Information Technology, Materials and Communication Services sectors outperforming. SPX eminis trade +54 (1.28%) at 4264.25; DJIA +304.71 (0.91%) at 33642.13; Nasdaq +206.8 (1.6%) at 12987.16.

- Modest buying outweighed sellers following deflationary data: Import (-1.4%)/Export (-13.3%) prices come out weaker than expected, UMich sentiment gains and mixed/less hawkish comments from Richmond Fed Barkin on CNBC in the first half.

- SPX leading/lagging sectors: As noted, Information Technology sector +1.62%, lead by semiconductor and hardware makers, Materials (+1.51%) lead by Albemarle (ALB) +5.0%, and Communication Services +1.33% w/ Dish Network (DISH) +3.12% and Disney (DIS) +2.54% after 50% profit surge anncd midweek. Laggers: Energy (+0.09%), Consumer Staples (+0.48%) and Industrials (+0.89%).

- Dow Industrials Leaders/Laggers: United Health (UNH) +8.02 at 540.88, Microsoft (MSFT) +3.02 at 290.04, Apple (AAPL) +2.88 at 171.37, McDonalds (MCD) + 2.40 at 261.68. Laggers: Chevron (CVX) off lows at 158.65 -0.97, Johnson and Johnson (JNJ) -0.90 at 166.24, Verizon (VZ) +0.28 at 45.06.

E-MINI S&P (U2): Bull Cycle Extends

- RES 4: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4306.50 High May 4

- RES 2: 4272.35 1.764 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 1: 4260.50 High Aug 11

- PRICE: 4245.00 @ 14:15 BST Aug 12

- SUP 1: 4080.50 Low Aug 2

- SUP 2: 4023.83/3913.25 50-day EMA / Low Jul 26 and a key support

- SUP 3: 3820.25 Low Jul 18

- SUP 4: 3723.75 Low Jul 14

S&P E-Minis traded higher Thursday, before finding resistance at the day high. The climb reinforces short-term bullish conditions and the extension maintains the positive price sequence of higher highs and higher lows. The focus is on 4272.35 next, a Fibonacci projection. On the downside, initial trend support is at 4080.50, the Aug 2 low. The 50-day EMA intersects at 4023.83 - a key support.

Crude Oil Ends A Solid Weekly Gain On A Sour Note

- Crude oil has slipped today, unwinding yesterday’s gains but still up on the week, falling early on in the session with China aggregate financing disappointing with potential implications for softer demand and with stronger than expected bounce in US consumer sentiment (albeit to still very low levels) making little in-way.

- Thursday’s US Gulf outage seem to have proved temporary as expected, with Shell’s Amberjack pipeline resuming at low rates and Chevron platforms restarting.

- WTI is -1.73% at $92.70, having earlier come close to yesterday’s high of $95.05 before retreating. That continues to form resistance whilst support is seen at $87.01 (Aug 5 low).

- Brent is -1.12% at $98.49, fleetingly clearing yesterday’s high at $100.17 to open the 50-day EMA at $101.79 before pulling back. Support is seen at $92.78 (Aug 5 low). Rhine water levels reaching critically low levels could help explain the outperformance on the day to WTI.

- Gold is +0.6% at $1800.07 as it continues fluctuations seen through the week as it contends with Treasury yield swings and ultimately USD weakness. Resistance is eyed at the bull trigger of $1807.9 (Aug 10 high), clearance of which could open $1829.8 (38.2% retrace of Mar 8 – Jul 21 bear leg).

- Weekly moves: WTI +4.1%, Brent is +3.7%, Gold is +1.4%, HH Gas is +9.5%, TTF Gas +5.9%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/08/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/08/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/08/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/08/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate assn) |

| 15/08/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/08/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.