-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: ECB Stole Fed's Thunder?

US TSYS: Double Shot of Hawkish Policy

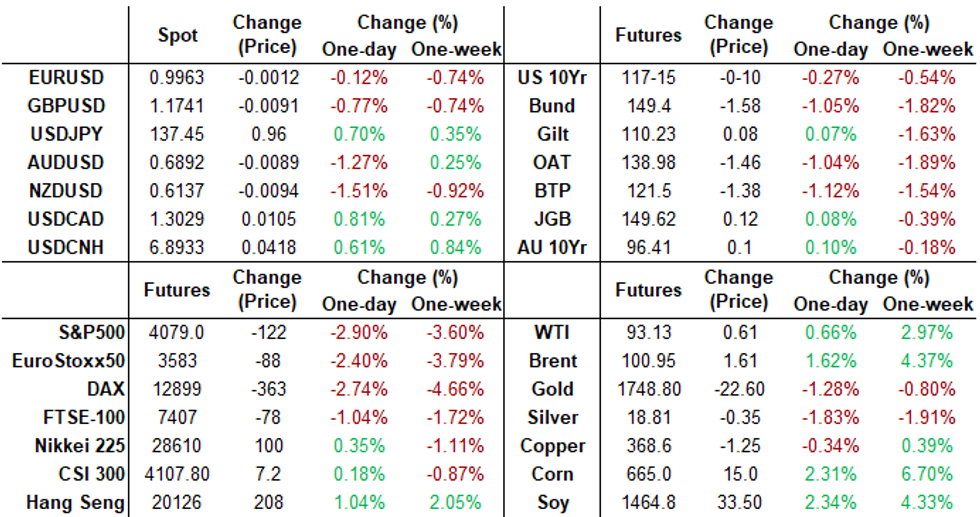

FI futures mostly weaker (30Y Ultra still in the green) after the bell, real vol gradually evaporated in the second half as rates scaled off midday highs. Yield curves flatter (but off lows on wide range: 2s10s at -36.154 vs. -39.584 low/-29.102 high) as short end remains under pressure following this morning's hawkish tone from Fed and ECB.

- Volatile pre-Jackson Hole trade after fog of early Fed speak (generally less-hawkish comments from Bostic, Harker and Bullard) saw 30YY slip to initial 3.2298% low (3.2113% low in the last few minutes).

- Fast reversal (30YY bounced back to 3.2704%) well ahead Chairman Powell opening remarks at JH summit. ECB stole the Fed's thunder one desk quipped, others a little indignant at ECB interest over discussing 75bp rate hike next month. Caveat from Reuters story: "I won't necessarily back 75 but there is no reason it shouldn't be discussed," one of the sources, who asked not to be named, said.

- Rates gapped lower again after Chairman Powell's opening remarks deemed hawkish: the Fed needs to get restrictive and STAY restrictive for an extended period of time. Bonds gapped to new session highs briefly following better than expected U-Mich sentiment (58.2 vs 55.5 est).

- Futures continued to gyrate higher into late morning trade - heavy volume more related to Sep/Dec rolling (near 90% complete ahead next Wed's First Notice), not to mention Sep quarterly Tsy option expiration that gave traders fits as underlying futures repeatedly see-sawed through several strikes across the board.

- Jackson Hole eco summit continues Saturday, Link to the: agenda.

- The 2-Yr yield is up 3.5bps at 3.4007%, 5-Yr is up 5.5bps at 3.2068%, 10-Yr is up 1.7bps at 3.0427%, and 30-Yr is down 3.5bps at 3.2062%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.01129 to 2.30914% (-0.01200/wk)

- 1M +0.03043 to 2.52386% (+0.09858/wk)

- 3M +0.02643 to 3.06957% (+0.11186/wk) * / **

- 6M +0.03957 to 3.56643% (+0.01886/wk)

- 12M +0.02600 to 4.12329% (+0.10473/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.01000% on 8/24/22

- Daily Effective Fed Funds Rate: 2.33% volume: $96B

- Daily Overnight Bank Funding Rate: 2.32% volume: $280B

- Secured Overnight Financing Rate (SOFR): 2.28%, $970B

- Broad General Collateral Rate (BGCR): 2.26%, $396B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $385B

- (rate, volume levels reflect prior session)

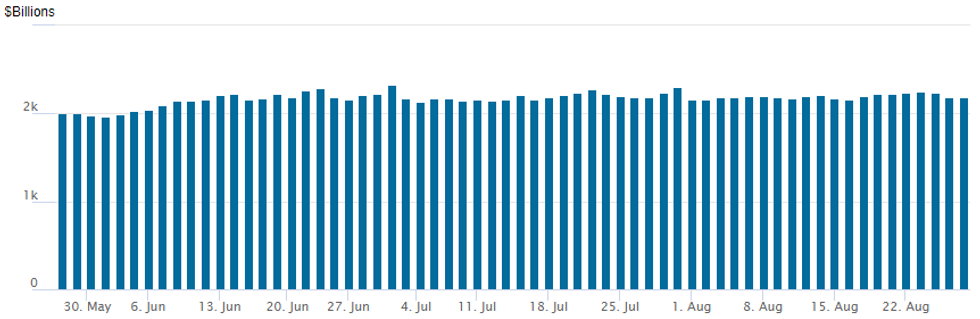

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usages slips to $2,182.452B w/ 98 counterparties vs. $2,187.907B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Really limited volumes as option traders pulled up stakes well ahead of Friday's event risk surrounding the Jackson Hole eco-summit. Thu's buy of 70,000 short Dec SOFR 95.50/96.00/96.50 put flys at 8.5 had the right idea: hedging higher rates for longer as short end underlying futures start pricing in more rate hikes through year end. Continued put spd buying and vol selling via strangles reported with today's event risk in the rear view mirror.

- SOFR Options: fading the post-data/Fed-speak short end bounce

- Block, -10,000 SFRU3 95.75/96.75 strangles, 72.75

- -2,500 SFRZ2 96.25/96.50 strangles, 30.0

- +5,000 SFRH3 95.50/95.75 put spds, 5.5 vs. 96.26/0.08%

- +5,000 SFRZ2 96.00/96.50 2x1 put spds, 4.0

- Eurodollar Options:

- +8,000 Dec 97.06 calls, 2.5 ref 96.02

- Treasury Options:

- -2,500 TYV 117.5 straddles, 201

- 2,000 USV 128/130/132/134 put condors, 37

- 2,700 TYV 116 puts, 25

- 2,100 TYU 117.5 puts, 4

FOREX: Greenback Ends On Firmer Footing As Equities Plummet

- Lower-than-expected data for US PCE and Core PCE weighed on the greenback ahead of Chair Powell’s address on Friday with a notable kneejerk to the downside as the data was released.

- This dollar weakness was exacerbated by a strong pop higher for the Euro following source headlines suggested some ECB policymakers want to discuss a 75 basis point interest rate hike at the September policy meeting, prompting EURUSD to rally to the best levels of the week above 1.0050.

- Powell’s mention of a restrictive policy ‘for some time’ prompted a kneejerk spike higher for the greenback but the reiteration of data dependency saw the initial move reverse course very swiftly as market participants analysed Friday’s data points.

- Given the earlier moves in the Euro, USDJPY was a good barometer for USD sentiment and an indication of the whippy price action. Opening at 136.70, the pair briefly rallied to 137.30 before sharply plummeting to fresh lows of the day at 136.23. However, with US yields holding at higher levels and subsequent pressure on major equity benchmarks throughout the rest of the US session, the greenback steadily advanced approaching the close.

- The pressure on stocks has seen significant weakness for the likes of NZD (-1.54%) and AUD (-1.29%) and despite more modest daily adjustments, the broad greenback strength saw strong reversals for most other G10 currencies.

- The USD Index has firmed around half a percent on the week and looks set to post the highest weekly close for six weeks.

- Aussie Retail Sales data on Monday is the only notable release on the Calendar. Monday sees the UK out for the bank holiday. The focus will quickly turn to Eurozone inflation data on Wednesday before Friday’s August Employment report from the US.

FX: Expiries for Aug29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0000-10(E1.6bln), $1.0020-25(E502mln)

- USD/JPY: Y137.00-10($808mln), Y138.00($570mln)

- AUD/USD: $0.6940-50(A$737mln)

- USD/CNY: Cny6.7750($706mln)

Late Equity Roundup: SPX Just Through 50D EMA Support

Stocks continue to extend session lows in late trade, SPX eminis just through 50DMA of 4089.67. Double-tap of hawkish policy headlines from the ECB contemplating a 75bp move next month underscoring Fed Chairman Powell higher rates for longer/restrictive stance took air out of early bid/triggered sell-off in early trade. Potential DOJ antitrust suit vs. Apple weighing on Tech and Communication Services share late in the session.

- Early support: SPX traded mildly higher early that US/China regulators were near agreement on audit inspections -- forestalling concerns some 200 China firms could be delisted - unsure where that leaves the half-dozen that said they would voluntarily delist themselves last week.

- Currently, SPX eminis trade -112 (-2.67%) at 4089.25; DJIA -754.74 (-2.27%) at 32538.18; Nasdaq -406.3 (-3.2%) at 12233.

- SPX leading/lagging sectors: Energy (-0.39%), Utilities (-1.04%) and Consumer Staples (-1.53%) weathered the sell-off the most. Laggers: Information Technology (-3.42%, Communication Services (-3.28%) and Consumer Discretionary (-3.25%) close behind. Aside from APPL, media and entertainment reversed the prior session gains w/Google -4.62%, Dish Network (DISH) -3.85%.

- Dow Industrials Leaders/Laggers: Merck (MRK) -0.38 at 89.89, Verizon (VZ) -0.40 at 43.34, Walgreens Boots (WBA) -0.62 at 36.18. Laggers: Home Depot -10.10 to 299.68, Goldman Sachs (GS) -9.11 to 337.38, Salesforce.COM (CRM) -8.14 at 165.77.

E-MINI S&P (U2): Impulsive Move Lower

- RES 4: 4419.15 2.236 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 2: 4288.00/4327.50 High Aug 19 /16 and the bull trigger

- RES 1: 4221.50 High Aug 22

- PRICE: 4091.00 @ 16:39 BST Aug 26

- SUP 1: 4089.67 50-day EMA

- SUP 2: 4000.00 Round number support

- SUP 3: 3994.50 Low Jul 28

- SUP 4: 3913.25 Low Jul 26 and a key support

S&P E-Minis reversed off the day’s high of 4217.25 Friday, slipping to new weekly lows in the process. The impulsive sell-off following Powell’s speech highlights the downside risk, and increases focus on the 50-day EMA, at 4089.67 - a key pivot support. Key resistance and the bull trigger is at 4327.50, Aug 16 high. Initial resistance to watch remains 4221.50, Monday’s high. A break would ease the bearish threat.

COMMODITIES: Oil Sees Solid Weekly Gains Whilst Gas Soars

- Crude oil is ending a week of solid gains by continuing to increase, but with gains heavily front-dated on the day and with declines in WTI for Jan’23 contracts and beyond as Powell talks of maintaining a restrictive policy for some time with strong caution historically against prematurely loosening policy.

- Gains for the week are helped by solid US inventory draw plus prospects of OPEC production cuts.

- WTI is +0.7% at $93.13, moving closer to resistance at $96.68 (Aug 1 high) as it follows through on a short-term trend needle that had been pointing north.

- Brent is +1.7% at $101.02, also moving closer to resistance at $102.47 (Aug 25 high) and trading above the 50-day EMA.

- Gold is -1.2% at $1737.47, sliding with a return of dollar strength and reversing what had been seen as a corrective bounce. Initial support is eyed at $1727.8 (Aug 22 low) but with sights on $1711.7 (Jul 27 low).

- European gas meanwhile has surged again, with TTF prices +5.5% on the day for 39% on the week and settling at a fresh record high as a squeeze on gas flows continues, further hindered by the delayed re-opening of the Freeport terminal in the US and maintenance at gas facilities in Norway.

- Weekly moves: WTI +2.5%, Brent +4.4%, Gold -0.55%, TTF Nat Gas 38.7% and HH Nat Gas -0.55%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/08/2022 | 1625/1825 |  | EU | ECB's Isabel Schnabel speaks at Jackson Hole | |

| 29/08/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 29/08/2022 | 0600/0800 | *** |  | SE | GDP |

| 29/08/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/08/2022 | 1300/1500 |  | EU | ECB chief economist Philip Lane speaks | |

| 29/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 29/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/08/2022 | 1815/1415 |  | US | Fed Vice Chair Lael Brainard | |

| 29/08/2022 | 2000/1600 | ** |  | US | Dallas Fed manufacturing survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.