-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Core Non-Housing Services Ease

- MNI CANADA: Canada GDP Slowed in Second Quarter, Contracted in June

- MNI NATO: Foreign Min-Turkey 'In Coordination' w/Hungary On Sweden Bid

- MNI JAPAN: Defence Ministry Issues Report Highlighting 'New Era Of Crisis'

- MNI SLOVAKIA: EU, NATO Eyes On Sep Election As Pro-Russia Candidate Gains In Polls

- ECB Member Villeroy states the "FRENCH ECONOMY GRADUALLY EXITING INFLATION", Bbg

- Germany "Exits Recession But Economy Only Stagnated Last Quarter", Bbg

- BIDEN SET TO SIGN ORDER ON US INVESTMENT IN CHINA BY MID-AUGUST - MEASURE WOULD CURB TRANSACTIONS ON SOME CRITICAL TECHNOLOGIES - CHINA HAS THREATENED TO RETALIATE OVER ANY US RESTRICTIONS, Bbg

Key Links: MNI INTERVIEW: Tough Credit Terms Squeeze US Homebuilding-NAHB / MNI US EARNINGS SCHEDULE - Season So Far Remains Ahead of Expectations/ MNI EGB Issuance, Redemption and Cash Flow Matrix - W/C Jul 31 / MNI BOJ WATCH: Ueda Says Flexible YCC Not Move To Easy Policy / MNI GLOBAL WEEK AHEAD: Earnings, Inflation & Payrolls / MNI TV: Key Exclusive Highlights For Week 30

Late Roundup: Tsys Hold Midrange, Focus on July Employ Next Friday

- Treasury futures remain in positive territory, off early session highs following a knee-jerk bid on lower than est Employment Cost Index gains 1.0% vs. 1.1% est, Core PCE 4.1% vs. 4.1% est.

- Rates quickly reversed the gap move as markets deemed it an overreaction to near in-line data. Services saw a mild acceleration from 0.25% to 0.275% M/M but importantly the Fed’s preferred indicator of core non-housing services eased a tenth to 0.22% M/M. Softer ECI data an afterthought while benign price pressure evinced from UofM survey helped buoy rates back to middle of the range.

- Tsy curves off early highs, currently mixed w/ 3M10Y -2.594 at -146.816, 2s10s +.600 at -92.849 (vs. -86.190 high) as short end rates lagged the rally in intermediates. As such, rate hike projections through year end remained subdued (18-36% chance of 25bp hike before year end). Markets much more eager to price in rate CUTS in 2024 (first 25bp cut in May '24, second in July'24.

- Focus turns to next week's ISMs on Tue (Mfg 46.98 est, prices paid 44.0 est), ADP on Wednesday (+188k est vs. 497k prior), and July employment data next Friday, current estimate of +200k job gains vs. +209k in June.

- Equity earnings resume Monday, premarket: Immunogen; after the close: Diamondback Energy, Tenet Health, Monolithic Power, Welltower, Rambus, and Western Digital.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00055 to 5.31810 (+.02011/wk)

- 3M +0.00279 to 5.37191 (+.02070/wk)

- 6M -0.00483 to 5.44800 (+.01957/wk)

- 12M +0.00536 to 5.40788 (+.04638/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.32% volume: $261B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.501T

- Broad General Collateral Rate (BGCR): 5.28%, $591B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $583B

- (rate, volume levels reflect prior session)

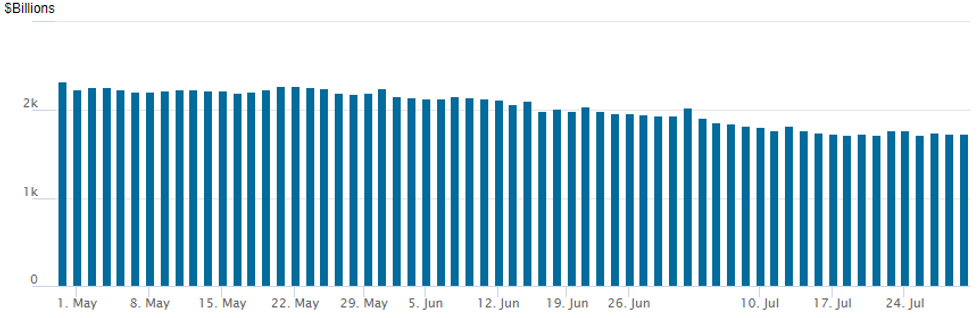

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation recedes to $1,730.227B, w/99 counterparties, compared to $1,735.783B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Mixed overnight flow carried over to the NY session Friday, some chunky wing flow noted below included strike re-positioning and outright squaring as underlying futures traded firmer - rate hike projections through year-end remained muted. Futures bounced off near three week lows overnight after BOJ left rate steady but adjusted yield curve control, allowing 10Y yield "to fluctuate around 0.5", kept 10Y yield target at appr 0.0%. Rates and stocks sold off late Thus after Nikkei sources story aired possibility of YCC tweak. Salient trade:

- SOFR Options:

- +20,000 SFRX3 94.31/94.50 2x1 put spds 2.5-2.75

- Block, -20,000 SFRH4 96.75 calls, 6.5 vs. 94.86/0.10

- Block, +30,000 SFRU3 94.37/94.50 put spds, 2.0 ref 94.59

- 3,900 SFRH4 96.00/96.37/96.62/97.00 call condors ref 94.86 to -.865

- +100,000 SFRH4 97.00/97.25 call spds, 1.0 ref 94.83

- -2,500 SFRV3 94.50/94.62/94.75 iron flys, 9.0

- 3,000 SFRZ3 94.68/95.00 call spds, ref 94.625

- 1,000 SFRM4 95.18 straddles 97.5 ref 95.175

- 1,500 SFRV3 94.18/94.50/94.81 2x3x1 put flys ref 94.62

- Block/screen, over 40,000 SFRV3 94.43 puts, 27k blocked 6.0 vs. 94.595/0.29%

- 3,000 SFRZ3 94.75/94.87/95.12 broken put trees, ref 94.62

- Blocks, total 10,000 SFRH4 94.62/95.12/95.62 call flys, 8.5 ref 94.835 -.84

- 4,000 SFRV3 94.12/94.37/94.50/94.62 broken put condors, ref 94.62

- 5,100 SFRV3 94.56/94.62/94.68/94.81 broken call condors ref 94.615

- 1,500 SFRX3 94.56/94.62/94.68/94.81 broken call condors

- 2,000 OQU3 95.25/95.50/95.75 put trees, ref 95.46

- Treasury Options:

- 21,800 TYU3/TYV3 114 call spreads, 19 net (Oct over)

- +18,500 FVU3 107.5/107.75/108.5/109 broken call condors, 2 cr vs. 106-31.5/0.05%

- over 5,700 USU3 120 puts, 26 last ref 123-31

- over 18,000 wk4 TY 111 puts, 2 last

- over 14,400 wk4 TY 111.5 calls, 5 last ref 111-13

- 8,000 TYU3 110/111 put spds, 20-22 ref 111-13.5 t o-16

- 8,100 TYU3 110.5 puts, 35 ref 111-11.5

- 3,300 FVU3 108.25 calls, 9.5 last

- 3,000 FVU 107.25 calls, 28.5 last

- 3,700 TYU3 112 calls, 37 last

- over 3,000 TYU3 113, 113.5 and 114 calls

- over 5,100 TYU3 110 puts, 24 last

- 1,000 TYU3 110.25/111.5 put spds

- over 23,000 wk4 TY 112 calls, 6 down to 1 ref 111-02.5

USDJPY Grinds Towards Highs Post BOJ-Induced Volatility, EURAUD Surges

- USDJPY looks set to close just below session highs despite the earlier BOJ decision to tweak its yield curve control policy. An impressive 300 point range in the direct aftermath of the decision has capped the price action throughout the remainder of Friday’s session, however, the pair has remained well supported on dips and currently trades just shy of the day’s peak of 141.07.

- Two early attempts back below 139.00 were met with stiff demand and given the more optimistic price action, markets will turn their focus to the topside, where clearance of 141.96 would reinstate a bullish technical theme.

- Mixed numbers from the US that also came in close to expectations, kept the greenback in check overall. The USD index (-0.13%) is just marginally softer on the day, with broad outperformance for major equity benchmarks weighing at the margin.

- The Euro and GBP are outperforming, while Antipodean currencies are among the laggards on Friday. There is little to explain this divergence apart from AUD/USD breaking a series of key supports to hit the lowest levels since early July. Additionally, early substantial weakness across Monday and Tuesday for EURAUD has now entirely reversed and the pair is pressing fresh weekly highs at typing, ahead of the weekend close.

- China manufacturing and non-manufacturing PMI will kick off the global data calendar next week before Eurozone July CPI takes centre-stage. Highlights next week include the RBA and BOE rate decisions, both preceding the July US non-farm payrolls release.

FX: Expiries for Jul31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E1.2bln), $1.1000(E1.3bln), $1.1085-00(E1.8bln)

- USD/JPY: Y138.00($2.5bln), Y139.00($1.2bln), Y140.00($1.2bln), Y141.00($778mln)

- EUR/JPY: Y153.50(E510mln)

Late Equity Roundup: Comm Services, IT, Consumer Shares Hold Support

- Stocks are moving higher again in late trade after paring back from midday highs (SPX appr 18.0 off Thu's two-year highs before a Nikkei sources story on re: BoJ tweaking yield curve control spurred a sell-off in stocks and rates). Currently, DJIA is up 178.83 points (0.51%) at 35463.71, S&P E-Mini Futures up 44.5 points (0.98%) at 4609, Nasdaq up 277 points (2%) at 14327.38.

- Communication Services, Information Technology and Consumer Discretionary sectors continue to lead gainers Friday. Communication Services led by strong gains in Meta up another +4.0% after earnings and forward guidance beat expectations early Thu. Warner Bros +3.95% and Netflix +3.1%. Underlying demand by AI applications continued to buoy chip stocks/IT sector: Intel +5.85% after returning to profitability following two consecutive quarter losses, First Solar +5.55%, KLA +5.25%, Applied Materials +4. Auto makers leading Consumer Discretionary w/ Tesla +4.1%.

- Laggers: Utilities, Energy and Financials underperformed late. Exxon -2.12%, Kinder Morgan -1.4% and Chevron -1% weighed on broader but smaller gains elsewhere in the Energy sector. Meanwhile, Insurance companies weighed on financials in the second half, Hartford -4.95%, AON -4.65%, PFG -4.17%

- Technical focus on today's rebound puts focus on 4634.50/38.27 (High Jul 27 / Bull channel top) where clearance of the channel top is required to resume the uptrend.

E-MINI S&P TECHS: (U3) Channel Resistance Holds

- RES 4: 4711.68 3.0% 10-dma envelope

- RES 3: 4670.25 2.00 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 2: 4639.79 1.764 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 1: 4634.50/38.27 High Jul 27 / Bull channel top

- PRICE: 4610.00 @ 1510 ET Jul 28

- SUP 1: 4526.43 20-day EMA

- SUP 2: 4470.00 Low Jul 12

- SUP 3: 4425.13 50-day EMA

- SUP 4: 4391.67 Bull channel base drawn from the Mar 13 low

The E-mini S&P contract traded to a high of 4634.50 Thursday before reversing. This highlights a possible short-term bearish signal. Price has found resistance at the top of a bull channel drawn from the Mar 13 low - the channel top is at 4638.27 today. A continuation lower would expose the 20-day EMA - at 4526.43 and a break of this level would strengthen bearish conditions. Clearance of the channel top is required to resume the uptrend.

COMMODITIES WTI Holds $80/bbl Clearance And Fifth Consecutive Weekly Gain

- Crude oil has edged higher today to increase in six of the past seven sessions for its highest closing price since Apr 18, having capped off the fifth consecutive weekly gain. Tighter supply conditions have coincided with some stronger demand expectations, buoyed primarily by China stimulus hopes.

- The middle of today’s session saw some volatility with a sharp fall lower on few clear drivers leaving positioning flow as the potential culprit.

- More recently, the WSJ reported that Rosneft Oil has struck a deal to sell a substantial portion of its petroleum output to a group of previously little-known oil traders.

- WTI is +0.4% at $80.39 off a pre-settle high of $80.68 that cleared $80.60 (Jul 27 high) as it continues to drift towards key resistance at $81.44 (Apr 12 high).

- Brent is +0.9% at $84.99 off a high of $85.06 vs key resistance at $85.47 (Apr 12 high).

- Gold is +0.7% at $1959.46 as it climbs strongly against a background of modest USD weakness. It only reverses about half of Thursday’s post-US data slump though which saw a low of $1942.7 that now forms initial support. Resistance remains at a bull trigger of $1987.5 (Jul 20 high).

- Weekly moves: WTI +4.3%, Brent +4.6%, Gold -0.1%, US nat gas -2.5%, EU TTF nat gas -8.3%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/07/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/07/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/07/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 31/07/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 31/07/2023 | 0800/1000 | *** |  | IT | GDP (p) |

| 31/07/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 31/07/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/07/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/07/2023 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 31/07/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/07/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 01/08/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.