-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: CPI Miss Only The First Step

HIGHLIGHTS

- MN FED KASHKARI: `NOT THERE YET' ON STOPPING PROGRESSION OF RATE HIKES, Bbg

- MN FED KASHKARI: US ECONOMY SENDING `SOME WILDLY MIXED SIGNALS', Bbg

- StL FED BULLARD SAYS 5%-5.25% IS MINIMUM LEVEL HE’S AIMING FOR ON RATES, Bbg

- StL FED BULLARD EXPECTS `RAPID DISINFLATION’ ONCE PROCESS TAKES HOLD, Bbg

US TSYS: Take The Fed, Seriously, Please

Tsys weaker after the bell, off early session lows as early volatility subsided in the second half.

- Hawkish comments by StL Fed Bullard that rates are not restrictive and belong above 5%, perhaps well above -- kicked off the session while Tsys bounced off early session lows following weaker than exp Philly Fed Mfg index of -19.4 vs. -6.0 exp. Housing Starts and Permits little stronger than expected (1.425m vs. 1.411m est; 1.526M vs. 1.515M est).

- Key move - continued sell-off in 2s10s curve to new all-time inverted low of -71.249, a measure of market expectations of a coming recession as the Fed moves to stem the rise in inflation. The 2s10s curve off lows after the bell at -68.608 (-1.680).

- Eurodollar/SOFR 2023 futures levels under considerable pressure as Fed terminal rate has climbed to 4.90% from 4.93% in Jun'23 earlier (5.08% pre-CPI). Fed funds implied hike for Dec'22 back to 50.9bp, Feb'23 cumulative +1.5bp to 86.4bps (84.9bp earlier) to 4.713%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00458 to 3.81271% (-0.00215/wk)

- 1M +0.02786 to 3.93857% (+0.06328/wk)

- 3M +0.00114 to 4.67543% (+0.06929/wk) * / **

- 6M +0.04043 to 5.12243% (+0.03843/wk)

- 12M -0.00700 to 5.45786% (+0.00657/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.67543% on 11/17/22

- Daily Effective Fed Funds Rate: 3.83% volume: $98B

- Daily Overnight Bank Funding Rate: 3.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.81%, $1.096T

- Broad General Collateral Rate (BGCR): 3.77%, $423B

- Tri-Party General Collateral Rate (TGCR): 3.77%, $408B

- (rate, volume levels reflect prior session)

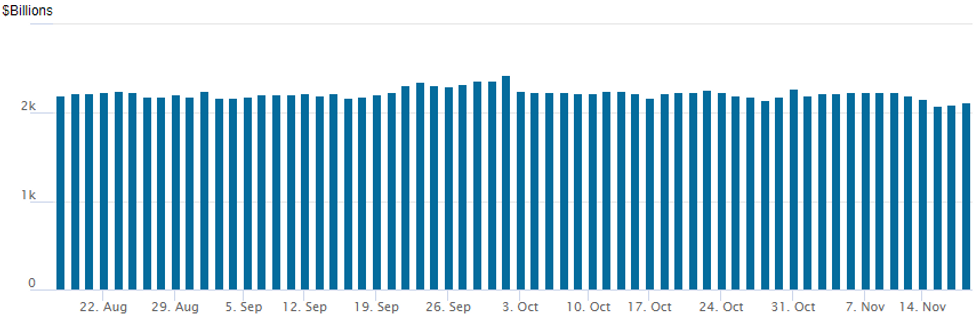

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,114.345B w/ 103 counterparties vs. $2,099.070B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Downside insurance buyers via puts, absent since the Oct CPI miss renewed hopes for rate hike step-down in December into early 2023 (and eventually revitalizing talk of rate cuts later next year), are seeing a comeback on today's sell-off in Eurodollar and SOFR futures: Reds (Dec'23-Sep'24) -0.120-0.140.- SOFR Options:

- Block, 5,000 SFRH4 95.00/95.25/95.50/95.75 put condors, 3.5

- Block, 3,000 short Dec 95.50/Green Dec 96.12 put spds, 14.5

- Block, total 8,000 short Jan 95.25/95.37/95.62 broken put flys, 5.0 ref 95.885

- -15,000 SFRZ2 95.50/95.68 call spds, 2.75-2.25

- 3,500 short Dec 95.12/95.37/95.62 put flys

- Block, 8,000 SFRZ 95.75/95.87 call spds, cab, more on screen

- 4,000 short Dec 96.00 calls, 6.5-7.0 ref 95.63 -64.5

- Block, 4,500 SFRH4 95.00/95.25/95.50/95.75 put condors, 3.5

- Block, 2,500 Green Dec 96.12/96.25/96.50 broken put flys, 4.5

- Eurodollar Options:

- Block, 10,000 Dec 95.06/95.25 call spds, 3.0 ref 95.005

- -5,000 Dec 95.00/95.12 call spds, 4.5

- 2,500 Dec 94.75/94.87/95.00 put flys ref 95.015

- Treasury Options:

- +3,800 TYH 109.5/110 put strip, 135-138

- -2,500 TYH 111/115 strangles, 204

- -4,000 TYZ2 111.75/112.75 call spds, 43 ref 112-21.5

- +5,000 TYZ 111.5 puts, 12 ref 112-17

- 4,400 TYZ 113/114 call spds, 24

- 11,600 FVZ 106.75 puts, 3 ref 108-03.5

- 3,300 FVZ 108.25 calls ref 108-04

- 2,500 TYZ 113.75 calls 5 over 111.75/112.5 put spds ref 112-31

- 7,500 TYZ 114 calls, 12 ref 113-01.5

- 3,600 TYZ 111 calls, 219 ref 113-04.5

- 2,700 TYF 111.5/114.5 call spds ref 113-14

- 3,600 FVF 107.75/108.5 call spds ref 108-18.75

EGBs-GILTS CASH CLOSE: Flatter As Hike Pricing Firms

Gilts underperformed Bunds as the UK government unveiled its budget plans Thursday, with both curves flattening.

- The UK autumn budget statement had relatively few surprises, though next year's expected Gilt remit exceeded consensus.

- ECB but particularly BoE hike pricing firmed (terminal rate up 10bp), fuelled by a US rate sell-off (Fed's Bullard contemplating rates as high as 7%).

- Curves bear flattened, with long-end yields weighed down by recession concerns (Brent fell below $90) and risk-off in equities.

- Periphery spreads narrowed from earlier wides; BTPs round-tripped from near 200bp to Bunds to close at 191.7bp, 2.3bp tighter on the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.9bps at 2.124%, 5-Yr is up 3.6bps at 1.991%, 10-Yr is up 2.4bps at 2.02%, and 30-Yr is down 0.9bps at 1.928%.

- UK: The 2-Yr yield is up 12.3bps at 3.116%, 5-Yr is up 6.5bps at 3.255%, 10-Yr is up 5.3bps at 3.202%, and 30-Yr is up 4bps at 3.353%.

- Italian BTP spread down 2.3bps at 191.7bps /Greek up 0.7bps at 226.2bps

EGB Options: Large Bobl Downside, Euribor Upside Feature

Thursday's Europe rates / bond options flow included:

- RXZ2 137p, bought for 13.5 in 5k

- RXZ2 138.5/137.5/137p fly, bought for 10.5 in 2.5k

- RXZ2 138.50/137.50/137.00 broken put fly, bought for 14 in 2.5k

- DUF3 106.50/106.80/107.00 broken c fly was bought for 7.5 in 3.5k

- DUZ2 107.30/107.60cs, bought for 3 in 1k

- OEG3 118.75/118.25/117.75 put fly bought for 4 in 5k. 10k all day. Targets 2.09% yield

- ERZ2 97.87/98.00/98.125c fly, bought for 2.5 in 20k

- ERZ2 97.87/98.00/98.37c fly 1x3x2, bought for 1.75 in 4k

FOREX: Broad Based USD Strength Moderates In Late US Trade

- The greenback made uniform gains across G10 Thursday, with the USD Index falling just shy of the Tuesday high in the early part of the NY session. However, a late bounce in equity markets helped moderate the greenback’s advance approaching the APAC crossover.

- While the timing does not exactly match with the immediate reaction across currency markets, USD optimism may have waned due to the November Philadelphia Fed manufacturing index coming in at -19.4 vs. Exp. -6.0, the lowest reading since the depths of pandemic lockdowns.

- Despite the trimming of gains, the greenback’s advance has been broad based on Thursday, with all G10’s in the red versus the dollar.

- A slightly larger move has been seen in AUD (-0.83%), brushing off a firmer employment report with a one percent decline in the Bloomberg commodity index likely weighing. This narrows the gap with initial AUDUSD support, which resides at 0.6578, the Nov 11 low.

- Concerns regarding crude demand from China came to the forefront, as Covid cases continue to rise, reducing the hope of any further near-term easing of restrictions. While oil futures recorded a one-month low, weakness was also seen in the Chinese Yuan, extending the bounce in USDCNH to roughly 2% from the week’s lows.

- UK retail sales and US existing home sales are the data points of note on Friday. Potential comments from ECB President Christine Lagarde, due to speak at the European Banking Congress in Frankfurt.

FX: Expiries for Nov18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200(E739mln), $1.0225-50(E1.3bln), $1.0300(E836mln), $1.0450(E2.6bln)

- USD/JPY: Y138.00($770mln), Y138.90-00($615mln), Y139.45($567mln), Y140.50($1.3bln)GBP/USD: $1.1700(Gbp560mln)

- AUD/USD: $0.6650-60(A$1.1bln)

- USD/CAD: C$1.3325($1.2bln)

- USD/CNY: Cny7.0500($3.3bln), Cny7.1500($3.0bln), Cny7.2000($2.2bln)

Late Equity Roundup: Autos Weigh on Consumer Discretionary Sector

Stocks turning weaker in late trade after see-sawing off lows in the second half. Trading desks cited combination of crude oil bouncing off lows, the largest decline in mortgage rates since 1981 falling to 6.61% (Bbg citing Freddie Mac), and a decline in market volatility

- Information Technology and Health Care sectors outperforming as SPX eminis currently trade -35.5 (-0.89%) at 3932.5; DJIA -140.18 (-0.42%) at 33410.86; Nasdaq -107.7 (-1%) at 11075.15.

- SPX leading/lagging sectors: Information Technology (-0.31%) as hardware makers lead semiconductor and software makers (Cisco +4.99%, JNPR +1.94%, HPE +1.90%); Health Care sector next up (-0.33%) w/ pharmaceuticals and biotechs outpaced equipment makers. Laggers: Utilities (-2.16%), Consumer Discretionary (-2.02%) auto makers and retailing names lagging.

- Dow Industrials Leaders/Laggers: United Health (UNH) remained strong +7.72 at 519.24, Amgen (AMGN) +3.04 at 286.81, Cisco (CSCO) +2.20 at 46.59. Laggers: Home Depot (HD) -6.96 at 307.95, Salesforce.Com (CRM) -5.99 at 149.13, Caterpillar (CAT) -3.18 at 228.24.

E-MINI S&P (Z2): Corrective Pullback

- RES 4: 4175.00 High Sep 13 and a key resistance

- RES 3: 4146.63 76.4% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 4100.00 Round number resistance

- RES 1: 4050.75 High Nov 15

- PRICE: 3920.00 @ 14:30 GMT Nov 17

- SUP 1: 3853.35 50-day EMA

- SUP 2: 3750.00 Low Nov 9

- SUP 3: 3704.25 Low Nov3 and key short-term support

- SUP 4: 3641.50 Low Oct 21

S&P E-Minis are trading lower today. The short-term outlook remains bullish and a short-term pullback is considered corrective. A bullish theme follows last week’s strong gains that resulted in a break of 3928.00, Nov 1 high. This strengthens a short-term bullish condition and price has established a sequence of higher highs and higher lows on the daily scale. The focus is on 4100.00 next. On the downside, key short-term support is at 3704.25.

COMMODITIES: WTI Tests Bear Trigger On Recession Fears, Stronger USD

- Crude oil sees WTI hit a 7-week low and Brent fall below $90 for the first time since October on recession fears with risk sentiment suffering as the US dollar firms and Treasury yields rise, stoked initially on renewed hawkish Fedspeak from Bullard. The spread between WTI futures for Dec and Jan delivery hits lows since Dec'21, seen on a pullback of bullish positions that had been built ahead of Europe's ban on Russian oil imports.

- On the latter, ahead of the G7 Dec 5 ban on Russian imports, the US is set to issue oil price cap guidance in the coming days according to Reuters, approaching it with a “spirit of flexibility” with the State Department ready for some “hiccups” along the way.

- WTI is -4.6% at $81.65 with a low of $81.40 that came close to testing the bear trigger of $81.30 (Oct 18 low). The day’s most active strikes in the CLZ2 are seen in $70/bbl puts followed by $75/bbl puts.

- Brent is -3.3% at $89.80, clearing key support at $91.53 (Nov 15 low) and moving closer to the bear trigger at $87.52 (Oct 18 low).

- Gold is -0.7% at $1761.02, moving slightly closer to support at $1729.5 (Oct 4 high) with a low of $1754.55 and going against technicals that looked bullish.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/11/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 17/11/2022 | 0105/2005 |  | US | Fed Chair Jerome Powell | |

| 18/11/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 18/11/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 18/11/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 18/11/2022 | 0830/0930 |  | EU | ECB Lagarde Speech at European Banking Congress | |

| 18/11/2022 | - |  | EU | COP 27 Ends | |

| 18/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 18/11/2022 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/11/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 18/11/2022 | 1500/1000 | * |  | US | Services Revenues |

| 18/11/2022 | 1715/1715 |  | UK | BOE Haskel Panels Ditchley Economics Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.