-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly: Oil Markets Assess Trump Impact

MNI Gas Weekly: Winter Weather Takes the Driver's Seat

MNI ASIA MARKETS ANALYSIS: Discounting Higher for Longer

- MNI US: UAW Strike Set To Expand Today

- MNI US-EU: USTR Tai-Hopeful US & EU Will Clinch Green Steel Deal By End-Oct

- BOSTON FED COLLINS: EXPECT RATES MAY HAVE TO STAY HIGHER FOR LONGER, Bbg

- SF FED DALY: UNLIKELY INFLATION WILL REACH 2% GOAL IN 2024, Bbg

- SF FED DALY: NEED TO BRING INFLATION DOWN AS GENTLY AS WE CAN, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Discounting Higher for Longer Policy Messaging

- Generally quiet end to a hectic week, 10Y Treasury yields off new 16Y high of 4.5064% tapped early overnight to 4.4377% after Friday's close as markets discounted the Fed and BOE "hawkish hold" or higher for longer messaging Friday.

- Federal Reserve Governor Michelle Bowman on Friday called for "further rate hikes" to bring inflation back to target, citing too-high inflation and risk that rising energy prices could reverse past progress.

- Boston Fed President Susan Collins said Friday further tightening is not off the table and emphasized that she expects rates to stay higher for longer. "I fully support the FOMC statement and agree with the policy guidance in the median SEP projections. I expect rates may have to stay higher, and for longer, than previous projections had suggested, and further tightening is certainly not off the table," she said in prepared remarks.

- Meanwhile, San Francisco Fed President Daly said it's "unlikely inflation will reach 2% goal in 2024.

- Treasury futures drew support after Flash PMI data comes out mixed: S&P Global US Manufacturing PMI (48.9 vs 48.2 est), Services PMI (50.2 vs. 50.7 est), Composite PMI (50.1 vs. 50.4 est).

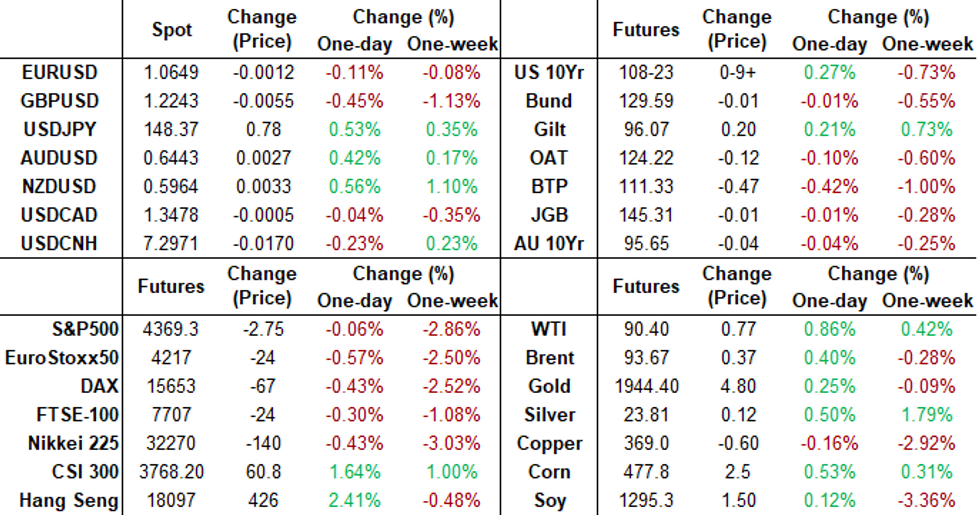

- Cross asset summary: Greenback firmer (DXY +.195 at 105.558), Gold firmer (+4.92 at 1924.94), crude firmer (WTI +.77 at 90.40) and stocks marking modest gains again after retreating late: DJIA up 45.93 points (0.13%) at 34119.34, S&P E-Mini Futures up 12.25 points (0.28%) at 4384.5, Nasdaq up 62.1 points (0.5%) at 13287.28.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00221 to 5.31751 (-0.00953/wk)

- 3M -0.00028 to 5.39981 (-0.00197/wk)

- 6M +0.00668 to 5.47951 (+0.01367/wk)

- 12M +0.01967 to 5.48563 (+0.06419/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $87B

- Daily Overnight Bank Funding Rate: 5.32% volume: $252B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.522T

- Broad General Collateral Rate (BGCR): 5.30%, $577B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $559B

- (rate, volume levels reflect prior session)

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

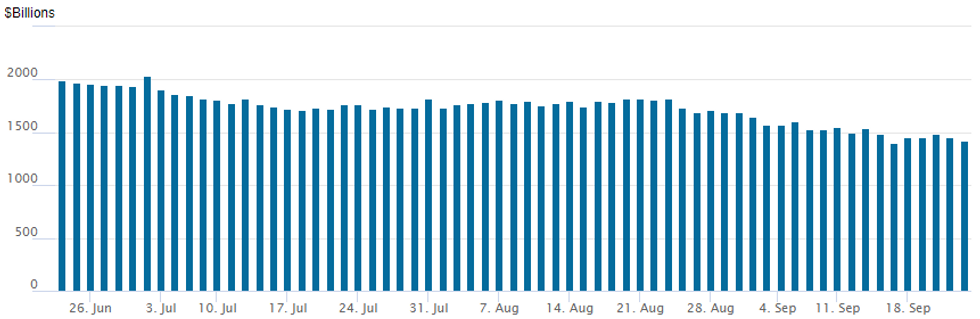

Repo operation recedes to 1,427.575B w/96 counterparties, compared to $1,454.115B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR/Treasury option volumes were well off Thursday's heavy pace Friday. Early put trade segued to more interest in buying wing insurance as underlying rates bounced off lows in the first half - discounting Wed's FOMC hawkish hold messaging. as such, rate hike projections into early 2024 continued to cool in late trade: November at 22.8% w/ implied rate change of +5.7bp to 5.384%, December cumulative of 12.6bp at 5.453%, January 2024 13bp at 5.458%. Fed terminal at 5.455% in Feb'24.

- SOFR Options:

- +5,000 SFRX3 94.62/94.81 call spds, 1.0 ref 94.53

- Block, 20,000 SFRX3 94.43/94.50/94.62/94.68 put condors, 3.5 ref 94.525

- Block, +20,000 SFRF4 93.87/94.37/94.43 broken put flys, wings bought, 1.25 net cr

- Block, 10,000 SFRH4 93.75/94.50 2x1 put spds, 9.5 ref 94.61

- Block, 5,000 0QV3 95.50/95.75/96.00 call flys, 3.0 vs. 95.365/0.10%

- Block, 10,000 SFRH4 94.75/94.87/95.00/95.12 call condors, 1.0 net vs. 94.65/0.05%

- +8,000 SFRF4 94.56/94.62/94.75/94.81 call condors, 1.5

- Block, 15,000 SFRZ3 96.00 combos vs. 94.53/100%

- 5,000 0QZ3 94.87/95.12 2x1 put spds ref 95.325

- 8,000 0QZ3 94.87/95.12/95.25/95.37 put condors ref 95.325

- 12,000 0QV3 95.43 calls, 10.0 ref 95.345

- 2QV3 95.56/95.81 put spds ref 96.005

- Treasury Options:

- over 14,000 TYX3 17.5 puts, 27 ref 108-24

- 5,000 FVX3 106/107 1x2 call spds

- -9,750 FVZ3 105.5 puts 32.5 over FVZ3 106.5/108 call spds ref 105-16

- +2,400 TYF4 106-111.5 strangles, 113

- Update, over 45,400 TYV3 108.25 puts, 1-3 ref 108-15

- over 7,000 TYX3 106/108 put spds, 30 ref 108-17 to -17.5

- 1,500 USV 114/116 put spds, 13 ref 116-02

- over 2,300 USX3 114 puts, 102 ref 116-06

- 2,000 TYV3 108.5/108.75 put spds, 7 ref 108-16.5

- 1,500 FVV3 105.75 calls, 1 ref 105-12.5

US TSY OPTIONS: Oct'23 Serial Expiration; Pin Risk in 5Y, 10Y Options

October'23 serial ops expire today. Decent amount of options coming off the sheets for a serial expiry. Option accts have been active unwinding/rolling to avoid pin risk, some work to be done on 5Y and 10Y strikes. Options 0.5 tic ITM (0.25 tic for 5-, 2-yr opt's) auto-exercised.

| EXPIRY | CALLS | PUTS | TOTAL | NEAREST ATM STRIKE TOTALS |

| Oct 30Y | 168,312 | 121,537 | 289,849 | 115.50 w/ 2,830 (41c, 2,789P) |

| 116.00 w/ 8,580 (640c, 7,940P) | ||||

| 116.50 w/ 4,093 (679c, 3,414P) | ||||

| Oct 10Y | 616,448 | 436,927 | 1,053,375 | 108.25 w/ 17,308 (1,100c, 16,208p) |

| 108.50 w/ 36,263 (5,681c, 30,582p) | ||||

| 108.75 w/ 22,848 (8,425c, 14,423P) | ||||

| Oct 5Y | 373,782 | 239,657 | 613,439 | 105.00 w/ 10,429 (1,314c, 9,115p) |

| 105.25 w/ 15,163 (3,474c, 11,689p) | ||||

| 105.50 w/ 22,606 (13,151c, 9,455p) | ||||

| Oct 2Y | 46,444 | 27,172 | 73,616 | 101.12 w/ 3,618 (201c, 3,417p) |

| 101.25 w/ 2,451 (620c, 1,831p) | ||||

| 101.37 (10,633C, 9,499P) |

EGBs-GILTS CASH CLOSE: Gilts Outperform Amid Weak PMIs

Gilts easily outperformed Bunds Friday, with core FI recovering some ground after Thursday's sell-off.

- The European session opened on the front foot following a "dovish hold" by the BoJ overnight. Weak French September flash PMI data accelerated the rally, but a stronger-than-expected German composite reading reversed gains. UK data was poor but was seen largely priced in with the BoE having seen the data before deciding to pause at yesterday's meeting.

- Apart from PMIs and in-line UK retail sales, little else was on the docket. Comments by ECB officials had little impact, including from Lane (underscoring need to keep rates at 4% for a sufficiently long period, alongside data dependence), while de Cos said it was too soon to start talking about rate cuts.

- The UK curve ended bull steeper, with 2Y yields benefiting from a continued pullback in BoE hiking expectations; Germany's curve was a little steeper, with the belly outperforming.

- BTPs underperformed overall, with spreads widening into the weekly close on a Reuters report that the 2023-24 fiscal deficit forecasts would be upwardly revised.

- Ratings reviews after hours include S&P on Germany. Next week's highlight will be the September round of preliminary Eurozone inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.1bps at 3.258%, 5-Yr is down 0.6bps at 2.75%, 10-Yr is up 0.2bps at 2.739%, and 30-Yr is up 2.3bps at 2.893%.

- UK: The 2-Yr yield is down 7bps at 4.803%, 5-Yr is down 6.2bps at 4.364%, 10-Yr is down 5.6bps at 4.249%, and 30-Yr is down 2.6bps at 4.683%.

- Italian BTP spread up 5.1bps at 185.5bps / Greek bond up 4.4bps at 146.4bps

EGB Options: Limited Euro Rates Trade To Close Out The Week

Friday's Europe rates / bond options flow included:

- 0RZ3 97.00/97.50 call spread paper paid 5.5 on 2.5K

- ERH4 96.25/96.00 1x2 put spread bought for 4.5 in 6k

FOREX USD Index Edges Higher, USDJPY Set To Close Above 148.00

- Following this week’s hawkish hold from the Fed, the USD index edged higher on Friday, trading within ten pips of the 2023 highs, printed earlier in March at 105.88. A 0.25% increase for the index this week extends the streak of consecutive weekly advances to ten.

- USDJPY led the advance on Friday as Bank of Japan Governor Ueda stuck to a dovish script in his post-meeting address. USDJPY looks set to close above 148.00, the highest weekly close since late 2022. The focus is on a climb towards 148.60 next, a Fibonacci projection, with scope seen for a climb towards the 150.00 handle.

- GBPUSD (-0.46%) has also underperformed following a softer-than-expected UK services PMI, pointing to increased recession worry and continued loosening in the labour market. Support at 1.2308, the May 25 low, has been breached this week. The move down confirms a resumption of the bear trend and maintains the bearish price sequence of lower lows and lower highs.

- The Euro trades closer to unchanged as mixed flash PMI data across France and Germany kept downside momentum in check for the single currency. The Antipodeans outperform G10 FX peers, probably looking to firmer Chinese equities as a source of support. The likes of NZDJPY and AUDJPY have risen around 1% to close the week.

- Highlights on the global calendar next week include Eurozone inflation releases and US Core PCE. Additionally, there are a number of emerging market rate decisions to look out for.

Late Equity Roundup: Reversing Gains, Ford Navigating UAW Strikes

- Support for stocks has evaporated over the last hour, not headline driven but acct squaring up ahead the weekend. Currently, the DJIA is down 20.04 points (-0.06%) at 34049.67, S&P E-Mini Futures up 4.5 points (0.1%) at 4376.75, Nasdaq up 42.5 points (0.3%) at 13266.62.

- Leaders: Information Technology and Communication Services sectors continued to outperform in late trade. Semiconductor stocks continued to lift IT sector: ON Semiconductor +3.0%, Lam Research +2.3% and Micron +2.2%.

- Communication Services sector shares were supported by a rebound in media and entertainment: Take Two Interactive +2.0%, Activision +1.75%, Meta +1.45%.

- Laggers: Financials and Consumer Discretionary sectors underperformed Friday. Banks continued to lag insurance companies in the second half: Wells Fargo -2.25%, Fifth Third -1.7%, Regions Fncl -1.6%. On the flipside, Arch Capital Grp +1.35%, Assurant +1.22% while Arch Capital +1.15%.

- Autos weighed on Consumer Discretionary sector as the UAW strike expanded: Tesla -2.35%, GM -0.5%. Ford, however, gained 2.6% as they are navigating union strike discussions better than their peers.

E-MINI S&P TECHS: (Z3) Remains Vulnerable

- RES 4: 4673.50 High Aug 1

- RES 3: 4617.40 76.4% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4566.00/4597.50 High Sep 15 / 1 and a near-term bull trigger

- RES 1: 4447.00/4502.22 High Sep 21 / 50-day EMA

- PRICE: 4386.00 @ 14:23 BST Sep 22

- SUP 1: 4366.00 Intraday low

- SUP 2: 4352.50 Low Jun 8

- SUP 3: 4318.00 Low Jun 2

- SUP 4: 4300.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

A bear cycle in S&P E-minis remains in play and this week’s break lower reinforces current conditions. Thursday’s sell-off resulted in a break of support at 4397.75, the Aug 18 low. The breach reinforces bearish conditions and signals scope for a continuation lower near-term. Sights are on 4352.50, the Jun 8 low. Further out, scope is seen for a move to 4318.00, the Jun 2 low. Initial firm resistance is 4502.22, the 50-day EMA.

COMMODITIES Crude Nudges Higher But Can’t Prevent Weekly Dip, Gold Resilient

- Crude is trading higher but has relinquished some of the gains seen earlier in the day. The Baker Hughes’ rig count data showed rig numbers fall for the first time in three weeks to offer some upside (630, -11, of which oil 507, -8). Despite a mid-week spike, crude is now down compared to last Friday, with WTI falling by around 80 cents/bbl.

- The US Coordinator for MENA Brett McGurk and Senior Advisor to the President for Energy and Investment Amos Hochstein emphasized the urgency of reopening the Iraq-Turkey pipeline as soon as possible, according to a White House e-mailed statement.

- Onshore crude inventories in China have been drawn down over the past three weeks to the lowest since mid-June according to data tracked by satellite firm Ursa Space Systems.

- Russia’s government expects the average price of its crude grades to average $71.30/bbl in 2024, up from an average of $63.40/bbl so far in 2023.

- WTI is +0.7% at $90.26, as it holds above support at the 20-day EMA of $86.58 and off resistance at $92.43 (Sep 19 high).

- Brent is +0.3% at $93.56, as it holds above support at the 20-day EMA of $90.64 and off resistance at $95.96 (Sep 19 high).

- Gold is +0.25% at $1924.84, proving resilient to the climb in the USD with an offset from a rally in Treasuries after yesterday's large twist steepening had weighed on the yellow metal. Support remains a way off at $1947.5 (Sep 20 high), the high shortly before the FOMC decision.

- Weekly moves: WTI -0.5%, Brent -0.4%, Gold almost unch, US nat gas -0.4%, EU TTF nat gas +9%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/09/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/09/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/09/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/09/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Lagarde speaks at ECON Hearing | |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Schnabel speaks at JHvT Lecture | |

| 25/09/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/09/2023 | 2200/1800 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.