-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

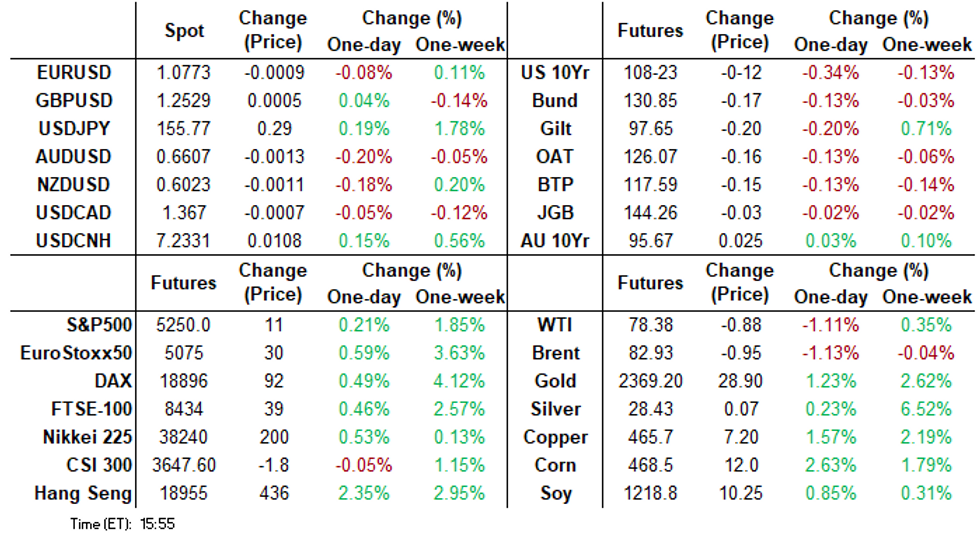

Free AccessMNI ASIA MARKETS ANALYSIS: Dour UofM Sentiment Tempers Risk On

- Treasuries are weaker on the day, near lows for the week after higher than expected UofM inflation exp.

- The move saw Treasuries completely reverse Thursday's rally on higher then expected weekly jobless claims.

- Friday's rate reversal in turn saw projected rate cut pricing from appr 50bp by year end to 40bp on the close.

US TSYS: Dour UofM Sentiment Tempers Post-Claims Rally, Rate Cut Pricing Cools

- Treasuries have traded sideways - near lows since midday by the bell, completely reversing Thursday's post-claims rally following this morning's after higher than expected UofM inflation exp.

- UofM consumer sentiment was much weaker than expected in the preliminary May report at 67.4 (cons 76.2) after an unrevised 77.2. The press release notes the 10pt decline is “statistically significant” and leaves sentiment at the lowest in about six months.

- Additionally, 1Y inflation expectations increased to 3.5% (cons 3.2) after 3.2%, its highest since November, while 5-10Y expectations increased a tenth to 3.1% (cons 3.0) after 3.0%, also its highest since November but still within the 2.9-3.1% typically seen since Aug 21.

- The projected rate cut pricing cooled vs. late Thursday: June 2024 at -5% w/ cumulative rate cut -1.2bp (-2.5bp late Thu) at 5.307%, July'24 at -22% w/ cumulative at -6.7bp (-9bp late Thu) at 5.253%, Sep'24 cumulative -19.2bp vs. -22.4bp, Nov'24 cumulative -27.7bp -31.1bp, Dec'24 -40.9bp vs. -45bp.

- After a slow start to next week, focus is on PPI and CPI on Tue/Wed.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00098 to 5.31987 (-0.00354/wk)

- 3M -0.00155 to 5.32198 (-0.00557/wk)

- 6M -0.00548 to 5.28431 (-0.02262/wk)

- 12M -0.01066 to 5.13893 (+0.04939/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.871T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $717B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $706B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $79B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

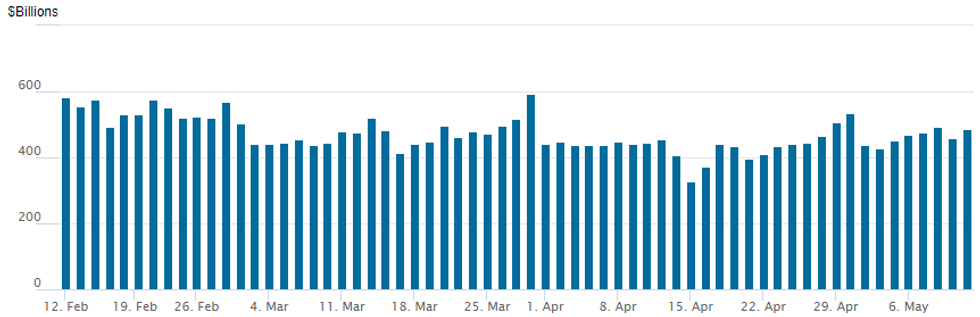

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbed to $486.434B vs. $458.550B Wednesday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021. Meanwhile, the latest number of counterparties slipped from 75 to 72.

SOFR/TEASURY OPTION SUMMARY

With the exception of some large Jul'24 5- and 10Y out-of-the-money puts on the closing bell, Friday's SOFR and Treasury option trade was dominated by upside call structures - discounting the reversal in underlying futures from Thursday's post-weekly claims highs. In turn, projected rate cut pricing cooled vs. late Thursday: June 2024 at -5% w/ cumulative rate cut -1.2bp (-2.5bp late Thu) at 5.307%, July'24 at -22% w/ cumulative at -6.7bp (-9bp late Thu) at 5.253%, Sep'24 cumulative -19.2bp vs. -22.4bp, Nov'24 cumulative -27.7bp -31.1bp, Dec'24 -40.9bp vs. -45bp.

- SOFR Options:

- +8,000 SFRU4 95.25/96.37 call spds 0.75 ref 94.88

- +5,000 SFRU4 95.25/96.00 call spds 2.75 ref 94.88

- +8,000 SFRM4 94.68/94.75/94.81 call flys 0.75 ref 94.70

- Block, 10,000 0QM5 97.50 calls, 10.0 vs. 95.98/0.13%

- +6,000 SRM4 94.68/94.81 1x2 call spreads w/ 94.75/95.00 1x2 call spread/ strip 0.75 total

- +2,500 0QM4 95.62/96.00 1x2 call spreads, +5.25 ref 95.56

- +2,000 0QM4 95.56 straddles +34.5 ref 95.56

- +3,000 SFRU4 94.93/95.06/95.12/95.18 call condors 2.25 ref 94.895

- 2,000 0QZ4 96.25/96.75 call spds vs. 3QZ4 96.50/97.00 call spds

- 2,000 SFRZ4 95.50/95.87/96.00 broken call flys ref 95.145

- 12,000 SFRQ4 94.62/94.75 put spds vs. SFRQ4 95.06/95.18 call spds ref 94.91

- 15,400 SFRZ4 94.87 puts vs. SFRZ4 95.18/95.62 call spds ref 95.14 to -.145

- 5,500 SFRZ4 98.12 calls ref 95.145

- Treasury Options:

- 12,000 TYM4 111/111.5/112 call flys vs. TYN4 113/114/115 call flys, 0.0 net/July over

- +54,000 FVN4 103.25 puts, 3

- +30,000 FVN4 104 puts, 6.5

- +30,000 TYN4 104.5 puts, 3

- +35,000 TYN4 105.5 puts, 6

- 5,000 TYQ4 108/110/112 call flys ref 108-30.5

- +22,500 TYM4 107.75/109.75 call over risk reversals, 3 net vs. 108-27.5/0.45%

- 5,000 TYU4 111.5 calls, 42 ref 109-00

- 5,000 TYN4 112 calls, ref 109-00.5

- 2,500 FVQ4 107 calls ref 105-30.5

- 3,000 TYM4 109.75/110.25/110.75 call trees ref 108-31

- over 5,000 TYN4 109.5/110.5/111.5 call flys ref 109-11.5

EGBs-GILTS CASH CLOSE: Gilts Outperform Bunds On The Week

Core European yields edged higher to close out the week.

- Gilts failed to be dented by a stronger-than-expected UK GDP report to kick off the session, with limited data and supply (Italy) keeping trade constructive if relatively subdued in the morning.

- Afternoon data from North America saw global core FI retreat for the rest of the European cash session, with strong Canadian jobs data and elevated US consumer inflation expectations casting doubt on dovish developments earlier in the week.

- The UK and German curves bear flattened on the day, with Gilts slightly underperforming Bunds.

- The late session weakness ensured that 10Y Bund yields closed the week higher (by 2bp). UK counterparts finished 7bp off their weekly lows but still fell over 5bp on the week, helped by a dovishly-perceived BoE decision on Thursday.

- Periphery EGB spreads were mixed, after coming off early session tights along with the broader FI sell-off.

- UK labour market data is the highlight of the docket early next week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.9bps at 2.967%, 5-Yr is up 2.9bps at 2.55%, 10-Yr is up 2.2bps at 2.517%, and 30-Yr is up 2bps at 2.651%.

- UK: The 2-Yr yield is up 4bps at 4.319%, 5-Yr is up 3.6bps at 4.038%, 10-Yr is up 2.4bps at 4.166%, and 30-Yr is up 2.1bps at 4.645%.

- Italian BTP spread down 0.2bps at 134bps / Spanish up 0.2bps at 79.4bps

EGB Options: Week Concludes With Mixed Rates Trade

Friday's Europe rates/bond options flow included:

- 0RM4 97.12/97.37/97.75c fly 1x3x2, bought for 2 in 6k

- SFIM4 94.95/95.00/95.05c fly sold at 0.75 in 10k

- SFIZ4 95.75/95.85cs vs 95.05/94.95ps bought the cs for flat in 10k

FOREX: Mixed UMich Messaging Underpins Mild USD Recovery

- Having started the session poorly, the greenback headed through the London close toward the top-end of the daily range on the back of the mixed messaging in the University of Michigan sentiment release. While headline sentiment missed expectations and pointed to a deteriorating consumer, inflation expectations firmed - the one-year inflation expectation metric rose to 3.5% from 3.2%, the highest since late 2023.

- While gas pump prices were the likely driver, a fresh run higher in US yields helped underpin USD buying - although the week's ranges were largely respected.

- Canadian jobs data came in notably firmer than forecast, with over 90k jobs added across the month vs. Exp. 20k. This kept a lid on the unemployment rate of 6.1%, which was expected to tick higher to 6.2%. As a result, USD/CAD heads through Friday close toward the weekly lows, with the 50-dma support undercutting at 1.3621.

- Despite a brief reprieve mid-week, JPY weakened further Friday, with markets finding little argument for tighter Japanese monetary policy from the much poorer-than-expected real cash earnings release for March. As such, the trade-weighted JPY remains uncomfortably close to pre-intervention levels, and raising the risk of a pushback from the Japanese authorities should US CPI top expectations next week.

- Focus for the upcoming week turns to US inflation data, with both CPI and PPI data for April due for release. Markets expect CPI to have slowed by 0.1ppts to 3.4%, and for core to slow to 3.6%.

FX Expiries for May13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E2.5bln), $1.0750-55(E3.2bln), $1.0875-80(E893mln)

- GBP/USD: $1.2530(Gbp675mln), $1.2550-65(Gbp867mln)

- USD/JPY: Y155.00-15($2.4bln), Y157.45-50($1.4bln), Y157.65($901mln)

- USD/CNY: Cny7.3000($1.1bln)

Late Equities Roundup: Oil & Gas, Auto Makers Underperforming

- Stocks remain steady to mixed late Friday, off midday lows with Consumer Staples and Information Technology share outperforming. Stocks had reversed gains after higher than expected UofM inflation expectations and weaker consumer sentiment tempered the late week risk appetites. Currently, the DJIA is up 66.18 points (0.17%) at 39454.74, S&P E-Minis up 0.75 points (0.01%) at 5240, Nasdaq down 22.6 points (-0.1%) at 16323.92.

- Laggers: Energy and Consumer Discretionary sectors underperformed in late trade, oil and gas companies weighed on the former: EQT Corp -3.05%, Marathon Petroleum -2.18%, Valero -1.78%. Meanwhile, auto makers continued to weigh on the discretionary sector: Tesla -2.11%, Ford -1.20% while parts maker Aptiv declined 1.15%.

- Leading Gainers: Consumer Staples and Information Technology sectors outperformed in late trade. Food and beverage companies buoyed Consumer Staples in the second half: Hershey +1.82%, Kraft Heinz +1.32%, Mondelez Int +1.28%. Semiconductor makers supported the IT sector with Micron +2.81%, Broadcom +2.20%, Applied Materials +1.75%. But cyber security provider Gen Digital soared 14.65% after better than expected earnings announced late Thursday.

- Late cycle earnings releases expected next week include: Home Depot, CIsco, B Riley, Walmart, Deere & Co, Applied Materials and Take Two Entertainment.

COMMODITIES WTI Slips During US Hours, Gold Rallies For Second Session

- WTI has sunk during US hours, erasing all of yesterday’s gains. Front month remains up modestly on the week by around 0.3%. Focus today remains on geopolitical risks and the Middle East, OPEC+ output policy, and global demand.

- WTI Jun 24 is down 1.3% on the day at $78.3/bbl.

- OPEC+ crude production fell 210,000 b/d m/m to 41.04 million b/d in April according to a Platts survey.

- For WTI futures, a bearish theme remains intact, with attention on $76.07 next, the Mar 11 low. Initial firm resistance is at $84.46, the Apr 26 high.

- Meanwhile, Henry Hub is continuing to ease back following yesterday’s rally, driven by a below-expectation build in US natural gas storage inventories. However, front month is up around 5.5% on the week.

- US Natgas Jun 24 is down 1.6% on Friday at $2.27/mmbtu.

- Spot gold is up by 1.0% today at $2,369/oz, taking the weekly gain to around 3%.

- Gold has rallied well for two consecutive sessions as markets undergo a corrective bump higher. This breaks the consolidation phase and concludes the bearish short-term condition.

- The end of the corrective leg lower has unwound the overbought condition and allows markets to focus on next resistance at $2431.50 - the bull trigger. Any return lower would eye $2255.0, the 50-day EMA.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/05/2024 | 0700/0900 |  | EU | ECB's Cipollone in Eurogroup meeting | |

| 13/05/2024 | 1230/0830 | * |  | CA | Building Permits |

| 13/05/2024 | 1300/0900 |  | US | Cleveland Fed's Loretta Mester | |

| 13/05/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/05/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.