-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Eminis Mark New Contract Highs

- MNI US: DeSantis Drops Out, Trump Above 90% Implied Probability For GOP Nomination

- MNI SECURITY: Biden And Sunak Discuss "Continued Multilateral" Approach In Red Sea

- MNI UK: PM Confirms Chancellor To Remain In Place As Tax Cut Expectations Rise

- Christine Lagarde makes a poor central banker, ECB staff say - Politico

- Commodity Giant ADM Must Act Fast to Restore Trust, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US Tsys Recover Some Ground With the Fed in Blackout

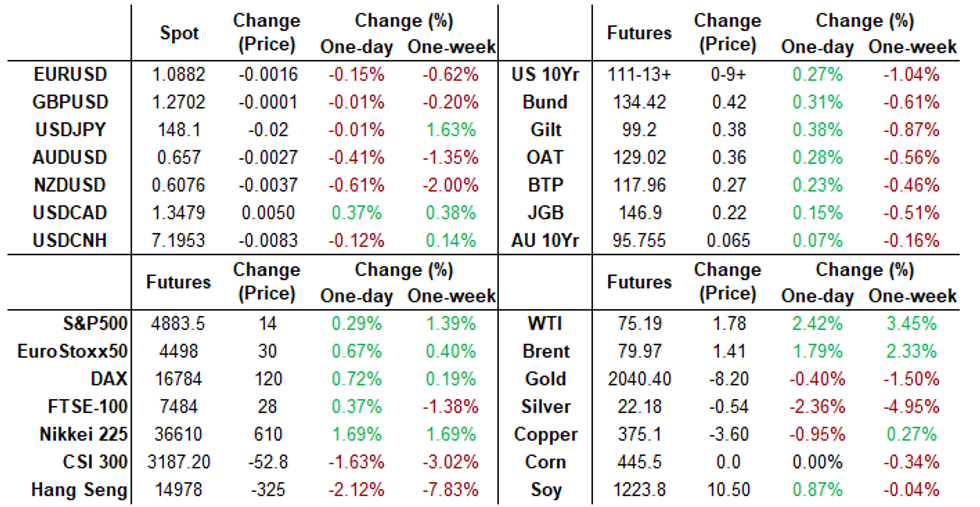

- Markets started the new week with a risk-on tone with S&P eminis making new contract highs (ESH4 4898.25), while FI markets recovered some ground lost to last week's pushback from the Fed regarding projected rate cut pricing through mid-2024.

- Fed entered blackout regarding monetary policy late Friday (through February 1, day after the first policy annc for 2024). The Bank of Japan kicks off the latest central Bank policy annc cycle sometime after 2130ET tonight, BoJ Ueda presser follows appr 4 hours later.

- Moderate volumes, TYH4 over 1.1M as the contract see-sawed in the upper half of the session range, trading 111-13.5 (+9.5) after the bell -- well inside technicals: with resistance at 111-26/112-26+ (20-day EMA / High Jan 12) vs. support at 110-26 (Low Jan 19).

- Lone data point on the day: Conference Board leading economic index fell by less than expected in December, down -0.1% M/M (cons -0.3) after -0.5%. It marks the first beat since the August report and is only the third beat for the past year, whilst it’s also the smallest decline since a flat print in Mar 2022.

- Tuesday focus: Regional Fed Mfg Data, and Tsy 2Y Note Sale. The main focus, however, is on estimate of Q4 GDP released Thursday, followed by consumer spending and PCE deflators on Friday.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00091 to 5.33503 (-0.00204 total last wk)

- 3M +0.00278 to 5.31858 (-0.00073 total last wk)

- 6M +0.01769 to 5.17702 (+0.00586 total last wk)

- 12M +0.03874 to 4.83723 (+0.00871 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.688T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $674B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $665B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $269B

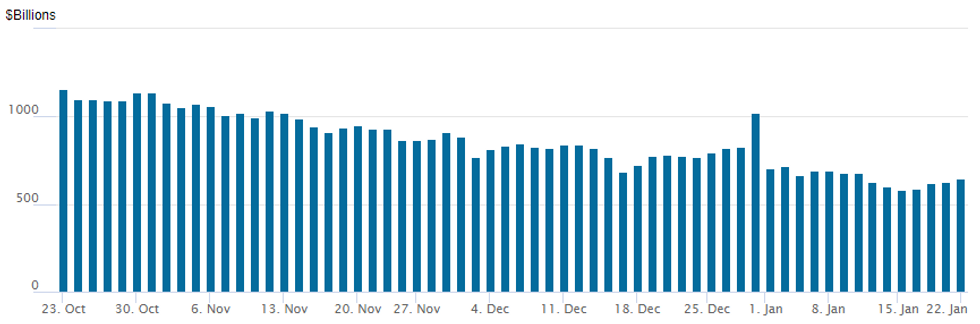

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $647.103B vs. $625.182B last Friday. Compares to $583.103B on Tuesday, January 16 - the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties inches up to 84 from 79 on Friday (65 Tuesday last Tuesday, the lowest since July 7, 2021)

SOFR/TREASURY OPTION SUMMARY

SOFR options leaned toward downside puts looking to fade Monday's rate rally -- accts are taking heed of rate cut pricing pushback from the Fed last week. Projected rate cuts for the first half of 2024 continue to recede: January cumulative -0.1bp at 5.328%, March chance of rate cut -39.7% vs. -49.4% this morning w/ cumulative of -10.6bp at 5.223%, May at -78.8% w/ cumulative -30.3bp at 5.026%. June steady at -96.6% w/ cumulative -55.4bp at 4.785%. Fed terminal at 5.330% in Feb'24.- SOFR Options:

- +20,000 SFRU4 94.62/94.93 put spds, 4.0

- -2,000 SFRJ4/SFRK4/SFRM4 95.62/96.25/96.87 call fly strip, 11.0

- +5,000 SFRH4 94.81/95.00/95.18 call flys, 5.5

- -4,000 SFRZ4 96.87/97.12 call spds, 4.5

- -25,000 SFRH4 94.62/94.87 put spds vs. 0QH4 95.62/95.87 put spds, 4-5cr conditional bear curve steepener.

- Block, 2,500 SFRG4 95.12/95.25 call spds 0.5 vs. 94.885 0.05%

- Block, 2,500 SFRM4 97.00 calls, 2.25 ref 95.28

- 6,000 0QG4 95.62 puts, cab

- 2,000 SFRZ4 95.50/96.00 2x1 put spds ref 96.04

- 2,000 SFRH4 94.68/94.81/94.87/94.93 put condors ref 94.86

- 2,500 SFRH4 94.75/95.00/95.25 call flys

- 5,000 SFRH4 94.68/94.75 put spds ref 94.845

- 4,000 SFRJ4 95.25/95.50/96.00 broken call flys

- 2,500 SFRJ4 94.81/94.93/95.18 broken put flys

- 12,000 SFRG4 94.75/94.87/94.93/95.00 broken put condors

- 13,000 SFRH4 94.87/95.00 call spds ref 94.855/0.22%

- 10,000 SFRU4 96.25/97.00/98.00 broken call trees ref 95.665

- Treasury Options:

- 6,000 TYH4 116 calls vs. TYK4 119.5

- 1,500 TYH4 108/108.5/109/109.5 put condors 0.0 ref 111-15.5

- 3,100 FVJ4 110 calls, 18 last

- 5,900 FVJ4 109.5 calls, 24.5 last

- over 7,700 TYG4 110.5 puts, 4 last

- 3,000 TYG4 109.5/110.75/112 put flys, ref 111-14

- 1,800 USH4 114 puts, 13 ref 120-11/0.09%

FOREX Broader Themes Intact as Markets Pre-Position for BoJ Decision

- Commodity-tied currencies and namely the CAD and AUD underperformed modestly on Monday, but broader trends and themes were unchanged given the proximity to the BoJ and ECB rate decisions as well as the FOMC entering their pre-decision media blackout period.

- The Bank of Japan rate decision due Tuesday takes focus going forward. While consensus looks for no change in policy, any guidance or suggestion toward potential tightening in April will be carefully watched by markets. JPY vols suitably bid ahead of the decision, with overnight implied marked higher to 17 points, implying a ~105 pip swing - around double the swing implied average background vol this year.

- GBP/USD traded generally well, despite a lack of domestic newsflow. The pair extends the winning streak to four consecutive sessions of higher lows to keep the 50-dma trending higher, and acting as intraday support at 1.2646. Pre-BoE comms and the prelim January PMI data could be key for any test of these levels, particularly any standout trends for services inflation, after the ONS Y/Y services CPI topped forecast by 0.3ppts.

- Particular pessimism on wages or the impact of recent earthquakes could prove JPY negative, and 148.80 will be eyed as the initial upside level - comfortably captured by the options-implied swing in spot.

- Elsewhere, focus for the Tuesday session shifts to UK public finances data, the prelim Eurozone consumer confidence release and the latest ECB bank lending survey.

FX Expiries for Jan23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0915-25(E557mln)

- USD/JPY: Y145.00($1.3bln), Y146.94-03($672mln)

- USD/CAD: C$1.3200($970mln)

- USD/CNY: Cny7.2050($1.1bln)

Late Equities Roundup: IT, Industrials Lead Late Gainers

- Stocks holding modest gains in late trade, off midmorning highs after S&P eminis made new cycle highs (ESH4 4898.25). Currently, S&P E-Mini futures are up 12 points (0.25%) at 4881, Nasdaq up 47.1 points (0.3%) at 15357.41, DJIA up 104.57 points (0.28%) at 37963.97.

- Leading gainers: Information Technology and Industrial sector shares managed to lead gainers in the second half amid broad based profit taking/position squaring. Hardware makers outperformed: Western Digital +5.09%, Zebra Tech +2.46%, Seagate +2.38%. Meanwhile, Industrials were buoyed by broad based gains in transportation and capital goods: JB Hunt +3.39%, Norfolk Southern +3.04%, Builders FirstSource Inc +2.67%.

- Laggers: Consumer Staples and Consumer Discretionary underperformed in late trade. Food and beverage shares weighed on the former for the second day running: ADM hammered -22.5% after the CFO was put on administrative leave "and cut its earnings outlook pending an investigation into the agricultural trading giant’s accounting practices" Bbg reported. A distant second/third underperformers included Bunge Global -4.39% and Monster Beverage -1.46%. Meanwhile, automakers weighed on Discretionary stocks: Tesla -2.5%, GM -.35%, Ford -.31%.

- Reminder, corporate earnings on Tuesday: a lot of big names on the schedule: GE, JNJ, Procter & Gamble, 3M, Lockheed Martin, Verizon, Netflix and Texas Instruments tomorrow.

E-MINI S&P TECHS: (H4) Bullish Price Sequence

- RES 4: 4952.45 1.382 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 4915.11 1.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 4900.00 Round number resistance

- RES 1: 4898.25 Intraday high

- PRICE: 4880.00 @ 1500 ET Jan 22

- SUP 1: 4785.75/46.25 20-day EMA / Low Jan 17

- SUP 2: 4699.31 50-day EMA

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

The uptrend in S&P E-Minis remains intact and Friday’s gains confirmed a resumption of the trend. Resistance at 4841.50, the Dec 28 high has been cleared, marking an extension of the price sequence of higher highs and higher lows. Moving average studies remain in a bull-mode condition, reinforcing the current bullish condition. Sights are on 4900.00 next. Key support lies at 4699.31, the 50-day EMA.

COMMODITIES WTI Nears Bull Trigger On Escalation In Attacks On Russia Energy Infrastructure

- WTI is on course for its highest close since late December, driven by geopolitical concerns in the Red Sea and Russia. Ongoing Houthi threats to vessels in the Red Sea and the escalation in attacks on Russia’s energy infrastructure by Ukraine are adding support

- Libya’s NOC has lifted the force majeure at the 300kbpd Sharara oil field and will restart oil production and exports, NOC said in a statement on Sunday.

- North Dakota’s oil production is further recovering and is estimated to be down by around 250-300kbpd on Monday, compared with 350-400kbpd on Friday according to the pipeline authority.

- US Gulf Coast refineries are gradually recovering from the effects of Winter Storm Geri, which took around 15% of its crude-processing capacity offline, according to Wood Mackenzie, cited by Bloomberg.

- WTI is +2.4% at $75.19, off an earlier high of $75.75 that pushed above the resistance at $74.23 (50-day EMA) to come close to the bull trigger at $76.31 (Dec 26 high).

- Brent is +1.8% at $79.96 off a high of $80.55 which stopped short of resistance at $80.75 (Jan 12 high)

- Gold is -0.5% at $2019.82, coming under pressure from a modest increase in the USD index. Support is seen at $2001.9 (Jan 17 low).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2024 | 0300/1200 | *** |  | JP | BOJ policy announcement |

| 23/01/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 23/01/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/01/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 23/01/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 23/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/01/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/01/2024 | 2145/1045 | *** |  | NZ | CPI inflation quarterly |

| 24/01/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/01/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.