-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS - Equities Strike ATH For Third Session

HIGHLIGHTS:

- Equities firm further, European, US curves steepen

- Gold under pressure, hits new multi-month low

- MNI Chicago PMI, ADP Employment Change in focus

US TSYS SUMMARY: Curve Modestly Steepens, Early Pressure on Treasuries Fades

- US Treasury futures traded inside an eight tick range Tuesday, with early pressure on prices fading as the session progressed.

- Key speaker Tuesday was Richmond Fed President Barkin, who stated that he prefers a simple, yet flexible approach to any tapering of asset purchases, but maintains an open mind about phasing out mortgage bond purchases. He also added that he favours concluding tapering before raising interest rates.

- Treasuries initially dipped as Salesforce launched an $8bln six-parter, which offered a 70bps premium over Treasuries for the 10y line and a sizeable yield of 115bps above the 40y Treasury.

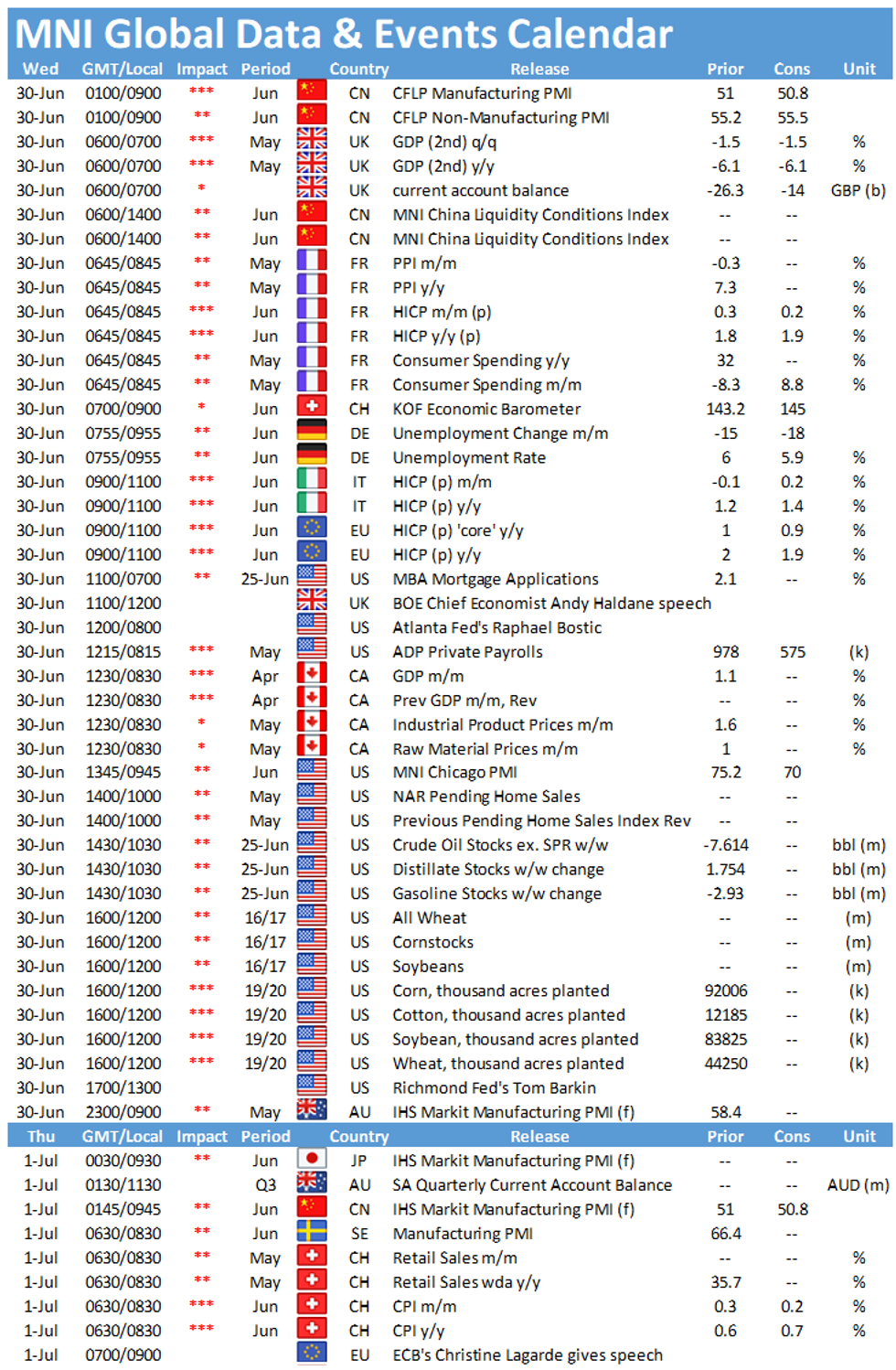

- Data releases pick up Wednesday, with MNI Chicago PMI the highlight. Activity is expected to have slowed to 70.0 from 75.2, while the ADP Employment Change release will be eyed for clues ahead of Friday's payrolls.

- The curve modestly steepened, with 2s10s steeper by around 1bps.

- 2y yield down 0.4bps at 0.250%

- 5y yield down 0.3bps at 0.893%

- 10y yield up 0.7bps at 1.483%

- 30y yield up 0.4bps at 2.099%

EGBs-GILTS CASH CLOSE: Bear Steepening In Modestly Risk-On Session

Bunds weakened over the course of Tuesday as equities gained steam, while Gilts traded mostly sideways with little conviction. Both curves bear steepened modestly.

- Periphery spreads tightened slightly, in a modestly risk-on session with equities in the green.

- German CPI data for June edged slightly lower than expectations, while Eurozone economic confidence for the same month improved. Eurozone CPI out Wednesday.

- In supply, EU sold total E15bln of 5-/30Y NGEU. Wednesday sees E6bln of BTP auctioned.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.652%, 5-Yr is up 1.1bps at -0.563%, 10-Yr is up 1.9bps at -0.171%, and 30-Yr is up 2.1bps at 0.332%.

- UK: The 2-Yr yield is up 0.3bps at 0.06%, 5-Yr is up 0.5bps at 0.346%, 10-Yr is up 1.4bps at 0.736%, and 30-Yr is up 2.8bps at 1.249%.

- Italian BTP spread down 1.2bps at 105.1bps / Spanish down 0.7bps at 62.5bps

EUROPE OPTION FLOW SUMMARY: Primarily Spread Buyers

Tuesday's options flow included:

- UBU1 213/216cs, bought For 17 in 4.4k

- 0RN1 100.50/100.62cs, bought for 0.25 in 2.5k

- 0RU1 100.12p, bought for 0.25 in 2k

- 3LU1 98.37/98.25ps, bought for 0.25 in 2k

FOREX: Antipodeans Resume Decline, AUDUSD Approaches Dec 2020 Low

- AUD (-0.7%) and NZD (0.57%) led weakness in G10 on

Tuesday as the greenback regained some poise. An MNI event with Richmond Fed's

Barkin was a highlight, at which the FOMC voter highlighted further progress

was needed on the Fed's employment goal.

- The dollar index crept gradually higher throughout the day, holding onto 0.2% gains despite a partial reversal approaching the WMR fix. As noted yesterday, Citi's prelim month-end model for June indicates slight USD sales with their signal strength under half the historical norm.

- The Japanese Yen also strengthened leading cross/JPY to extend yesterday's losses. AUDJPY the notable underperformer, currently down 0.78%.

- Technically, the outlook for AUDUSD remains bearish. Recent price action confirmed a resumption of the reversal that occurred Feb 25 and signals scope for a deeper pullback towards 0.7462 next, the Dec 21, 2020 low.

- Despite the firm bounce off the lows in crude benchmarks, CAD was pulled lower in tandem with other risk-tied currencies. USDCAD bounced 0.45% and is approaching the June 22nd highs just above the 1.24 handle. Attention remains higher at 1.2501 resistance, a key Fibonacci retracement.

- Chinese Manufacturing PMI will be released overnight, while Eurozone Flash CPI estimate headlines the European data. During the US session markets will await the ADP Employment figures, Canadian GDP and the MNI Chicago Business Barometer.

Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2010-25(E829mln)

- USD/JPY: Y109.45-50($1.4bln-USD puts), Y110.20-25($1.5bln-USD puts), Y110.50($1.7bln-USD puts), Y110.70-75($1.4bln)

- EUR/GBP: Gbp0.8500-05(E505mln)

- AUD/USD: $0.7505(A$671mln)

- USD/CNY: Cny6.39($1.8bln-USD puts)

Price Signal Summary - S&P Bulls Still In Charge

- In the equity space, S&P E-minis maintain a bullish theme and sights are set on the 4300.00 handle. EUROSTOXX 50 futures found support Jun 21 at 4015.00. Attention is on the Jun 18 sell-off that in pattern terms is a bearish engulfing candle, signaling a potential S/T top. The key directional triggers are; 4015.00, Jun 21 low and 4153.00, Jun 17 and the bull trigger

- In FX, the USD remains on a bullish path despite the recent corrective pullback. The EURUSD focus is on 1.1837 next, 76.4% of the Mar 31 - May 25 rally. GBPUSD remains vulnerable. Attention is on 1.3717 next, Apr 16 low. The bear trigger is 1.3787, Jun 21 low. USDJPY needle still points north. Attention is on 111.30/64, Mar 26, 2020 high and 1.0% 10-dma envelope.

- On the commodity front, Gold continues to consolidate. The outlook remains weak and the current consolidation appears to be a bear flag. This reinforces a bear theme and the focus is on $1756.2, low Apr 29. The Oil market trend condition remains bullish and pullbacks are considered corrective. Brent (Q1) focus is $76.97, 1.23 projection of Mar 23 - May 18 - May 21 price swing. Support lies at $73.22, the 20-day EMA. WTI (Q1) sights are set on $75.01, 1.382 projection of Mar 23 - May 18 - May 21 price swing. Watch support at $70.93, the 20-day EMA.

- Within FI, Bund futures is consolidating. The contract last week probed support at 171.80, Jun 17 low. A stronger sell-off would expose 171.37, Jun 3 low and 170.99, Mar 31 low and a key short-term support. Key support to watch in Gilt futures is unchanged at 126.70, Jun 3 low and remains an important pivot level. The key resistance is at 128.39, Jun 11 high.

EQUITIES: Stock Tear Continues, Three Days of New Highs

- Equities across the US extended their winning streak Tuesday, with the e-mini S&P running to new alltime highs for a third consecutive session. The new high watermark at 4291 brings prices well within range of the next bull trigger at 4230.

- The US tech sector was the primary driver, with consumer discretionary and industrials names also solid. The only notable lagging sectors were utilities and consumer staples.

- Notable outperformers were Morgan Stanley, with shares adding over 3% after announcing plans to double their dividend after passing the Fed stress tests late last week.

- The picture across Europe was similarly positive, with Germany's DAX leading with gains of 0.9%, while French and Spanish indices were more muted.

COMMODITIES: Oil Finishes Flat, Awaiting OPEC+ Cues

- WTI and Brent crude futures finished in minor positive territory, with markets awaiting this week's OPEC+ meeting, at which the group are expected to further ease their output curbs and boost supply by 550,000bpd.

- The JTC met ahead of this week's full videoconference, and ended without any specific discussion of an output hike, however the JMMC meeting was moved to Thursday from Wednesday in order to allow for more protracted talks - possibly a sign that a production boost is in the offing.

- Gold and silver traded under pressure, with gold slipping as much as $27/oz as stops were triggered on the way through the late April/June lows. The outlook remains bearish, opening first support at $1734.3, the 76.4% retracement of the March - June rally.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.