-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Kulger, Every Meeting is Live

- FED'S KASHKARI: IF WE CAN SEE A FEW MORE MONTHS OF GOOD INFLATION DATA, WILL GIVE CONFIDENCE ON WAY BACK TO 2% - CNBC INTERVIEW

- FED'S KUGLER: OPTIMISTIC US INFLATION PROGRESS WILL CONTINUE .. MAY BE APPROPRIATE TO CUT RATES `AT SOME POINT', Bbg

- FED’S COLLINS: NEED MORE EVIDENCE TO CONSIDER RATE CUTS .. LIKELY WILL BE APPROPRIATE TO EASE 'LATER THIS YEAR', Bbg

- MNI: Stoltenberg & US' Sullivan Reiterate Need For Ukraine Funding

- NYCB NAMES ALESSANDRO DINELLO AS EXECUTIVE CHAIRMAN, Bbg

- NYCB IN TALKS TO OFFLOAD MORTGAGE RISK, PLANS TO SELL RV LOANS, Bbg

Key Links:MNI BRIEF: Fed Will Cut Rates Before Inflation Hits 2%-Collins / MNI BRIEF: Fed’s Kugler On March: ‘Every Meeting Is Live’ / MNI: BOC Wants To Avoid U-Turn After Any Rate Cut: Minutes / MNI US CPI Revisions Preview - Feb 2024 / MNI INTERVIEW: ECB Could Cut In April Or June- Simkus / US Treasury Auction Calendar: Strong 10Y Auction / US$ Credit Supply Pipeline

US TSYS Fed Tone Remains Balanced

- Tsys modestly weaker across the board after the bell - holding inside a narrow session range (TYH4 -3 at 111-06, 111-01 low/111-16.5 high). Curves held steeper most of the day turned flatter late (2s10s -1.150 at -31.170).

- Light midweek data: MBA Mortgage Applications reported 3.7% earlier, up from -7.2% prior, Trade Balance reported -$62.2B vs. -$62.0B est (-$63.2B prior) wraps up the morning releases.

- Continued focus on Fed speakers: MN Fed Kashkari popped up in morning trade posited he expects 2-3 25bp cuts this year "seems appropriate".

- Federal Reserve Governor Adriana Kugler said she could not close the door to policy action at any upcoming meetings, including March, “Every meeting is live," Kugler added.

- Federal Reserve Bank of Boston President Susan Collins on Wednesday said waiting until 12-month inflation hits 2% for the central bank to begin cutting interest rates would be waiting too long.

- Treasury futures pared losses briefly following decent $42B 10Y sale (91282CJZ5) stops 1.2bp through: 4.093% high yield vs. 4.105% WI; 2.56x bid-to-cover steady to prior.

- Look ahead: Thursday Data Calendar includes Weekly Claims, Fed Speak, 30Y Bond Sale.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00198 to 5.32111 (-0.00100/wk)

- 3M -0.00832 to 5.31426 (+0.02380/wk)

- 6M -0.01759 to 5.19344 (+0.09734/wk)

- 12M -0.03378 to 4.87334 (+0.18054/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.738T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $682B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $672B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $97B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $261B

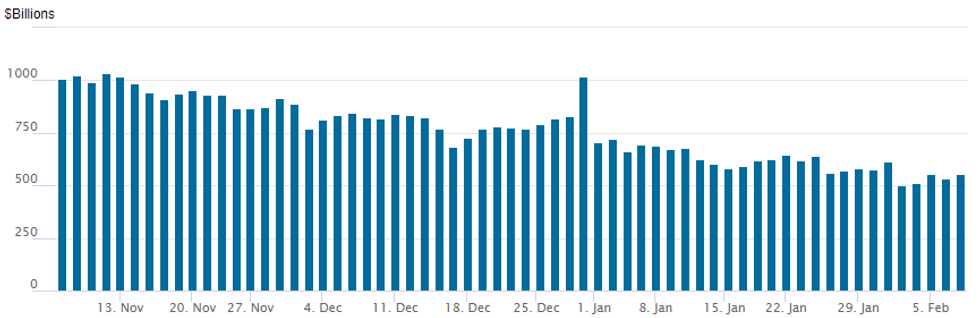

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage backs up to $533.055B vs. $532.439B Tuesday. Holding above recent cycle low of $503.548B from Thursday, February 1, the lowest level since mid-2021.

- Meanwhile, the number of counterparties is at 75 from 71 Tuesday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

Mixed SOFR and Tsy option flow overnight, modest volumes. Continued repositioning with underlying weaker ahead another raft of Fed speakers after Fed rhetoric cooled slightly yesterday. Projected rate cut pricing largely steady vs. late Tuesday lvls: March 2024 chance of 25bp rate cut currently -20.3% w/ cumulative of -5.1bp at 5.270%, May 2024 at -61.2% w/ cumulative -20.4bp at 5.118%, while June 2024 -90% (105% pre-NFP for comparison) w/ cumulative -42.9bp at 4.892%. Fed terminal at 5.3225% in Feb'24.

- SOFR Options:

- Block, 5,000 0QH2 95.68/2QH4 96.12 put spds 0.0

- Block, 8,000 SFRH4 94.81/94.87 call spds, 1.25 ref 94.80

- Block, 7,500 SFRH4 95.06/95.12 call spds, .5 ref 94.805

- Block, 6,000 SFRM4 96.00/96.18 call spds (0.5) vs. 95.25/95.43 put spds (14.0) vs. 95.14

- 8,000 SFRM4 96.25/96.50 call spds, ref 95.165

- -2,500 SFRJ4 95.00/95.12 put spds, 6.0 vs. 95.16/0.14%

- Block, 10,000 SFRM4 95.12/95.25 call spds .75 over 94.81/94.93 put spds ref 95.165

- 2,000 SFRM4 94.87/95.00/95.12 put flys, ref 95.17

- 2,500 SFRZ4 95.25/95.50 put spds vs. 96.12/96.43 call spds ref 95.905

- 1,700 SFRJ4/SFRM4 94.75/95.00 put spd spd

- +6,000 SFRH4 94.87/94.93/95.00/95.06 call condors, 0.5 ref 94.79

- 2,000 SFRJ4/SFRM4 94.87 put calendar spds ref 95.18

- Block, 2,500 SFRJ4 95.06/95.18/96.25 broken call trees, 2.25 net/2-legs over

- 9,000 SFRH4 94.87/94.93/95.00 call flys ref 94.79

- Treasury Options:

- 2,500 TYH4 112.5/113.75 1x2 call spds, 3 ref 111-05.5

- -10,000 TYJ4 110.5/113.5 strangles, 61

- 1,600 USJ4 117/118 put spds, 27 ref 120-28

- 5,000 TYJ4 121/122/123/124 call condors ref 111-27

- +8,000 TYH4 109.5 puts, 7

- 2,500 TYH4 110/111 put spds, 25 ref 111-01.5

- 2,600 FVJ4 105.5/106.5 puty spds ref 108-01.5

- 1,000 TYH4 109/110 3x2 put spds, 18 ref 111-05.5

- 3,000 TYH4 109.5/110.5 3x2 put spds ref 111-08.5 (2k more on 1x1 basis)

EGBs-GILTS CASH CLOSE: Long "Last Mile" For ECB Sees Bunds Weaken

European government bond yields closed weaker Wednesday, with Bund and Gilt yields retracing most of Tuesday's drop.

- Bunds were pressured early in the session after the FT published an interview with ECB's Schnabel who cited concern over the "last mile" of the fight against inflation. That spilled over into Gilt weakness.

- There was little impact from comments by BoE's Breeden who noted a focus on data dependence in the next few months while determining how long to hold rates.

- MNI published an interview with ECB's Simkus who noted cuts could start in April or June.

- Data showed German and Spanish industrial production ended 2023 on a weak note, but there was little reaction.

- The afternoon saw further gyrations stemming from US banking sector uncertainty, with NYCB headlines (and share price) in focus.

- The German curve bear flattened, with the UK's bear steepening. European equities closed flat/lower, mirrored by periphery EGB spreads closing modestly wider, with the exception of GGBs which saw some tightening.

- Thursday's focus will be ECB speakers including Lane, Vujcic and Wunsch, and BoE's Mann.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.5bps at 2.63%, 5-Yr is up 2.8bps at 2.243%, 10-Yr is up 2.4bps at 2.316%, and 30-Yr is up 3bps at 2.54%.

- UK: The 2-Yr yield is up 0.7bps at 4.477%, 5-Yr is up 1.9bps at 3.972%, 10-Yr is up 3.8bps at 3.988%, and 30-Yr is up 1.8bps at 4.57%.

- Italian BTP spread up 1bps at 157.3bps / Spanish up 0.5bps at 92.3bps

FOREX USD Index Holds Narrow Range, EURCHF Rises 0.70%

- Wednesday saw the USD index (-0.14%) trade in a very narrow range, broadly consolidating a moderate early decline. Some further initial weakness for NYCB at the cash open, prompted a brief greenback selloff (most notable for USDJPY), however, stabilisation on this front quickly sapped any downside momentum for the dollar.

- This USDPY downtick saw the pair quickly move from the upper end of the day’s range at 148.20, to fresh session lows of 147.63, before the pair then gradually edged higher throughout the US session. USDJPY is consolidating back around the 148.20 mark as we approach the APAC crossover, with the week’s highs at 148.80 still marking the nearer technical resistance point.

- A phase of CHF weakness followed the publication of FX reserves data for January, which ticked up to 662.4bln from 653.7bln. Revaluation factors are likely at play, however EUR/CHF (0.70%) has subsequently tested and breached the down-trending 50-day moving average, which intersected today at 0.9404.

- The recovery off breakout lows for GBP/USD extended into a second session on Wednesday, coinciding with the very moderate slippage in the greenback. GBP/USD's two-day rally puts spot just shy of the Monday high of 1.2640 as price re-enters the early 2024 range and erases the range breakout posted earlier in the week. Nonetheless, GBPUSD bearish conditions remain intact, with the current recovery deemed technically corrective.

- Chinese January CPI & PPI is scheduled on Thursday, before the focus for global markets turns to the latest jobless claims data from the US and further potential comments from Fed’s Barkin. In the UK, Bank of England member Mann is due to speak on inflation.

FX Expiries for Feb08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0745-50(E2.0bln), $1.0800-20(E2.5bln)

- USD/JPY: Y146.25-30($1.7bln), Y147.50($771mln), Y147.75-80($2.4bln), Y148.00($530mln), Y149.00($518mln), Y150.00($541mln)

- GBP/USD: $1.2585-00(Gbp1.1bln)

- EUR/GBP: Gbp0.8475-85(E1.1bln)

- AUD/USD: $0.6520(A$611mln), $0.6565(A$692mln), $0.6670(A$938mln), $0.6700-20(A$1.7bln)

- NZD/USD: $0.6050-60(N$517mln), $0.6140(N$593mln)

Late Equities Roundup: Auto Makers, Chip Stocks Outperform

- Stocks are holding firmer in late Wednesday trade, SPX Eminis extending new contract highs (5019.25) with Consumer Discretionary and Information Technology sectors outperforming. Currently, the DJIA is up 186.97 points (0.49%) at 38709.06, S&P E-Minis up 42.5 points (0.85%) at 5018, Nasdaq up 152.5 points (1%) at 15762.16.

- Leading gainers: Auto makers supported the Consumer Discretionary sector: Ford +5.43% after announcing a dividend increase and lower investment in EVs. Ford outperformed Tesla +1.98% and GM +1.91%. Meanwhile, chip stocks led IT sector gains in the first half: Enphase +17.7% after matching earnings late Tuesday, optimistic over future demand, First Solar gained +3.97%, Broadcom +2.42%.

- Laggers: Energy and Consumer Staples sectors underperformed in the second half, equipment and services shares weighed on the former: Schlumberger -1.06%, Haliburton -0.8%, Baker Hughes -0.68%. Food and beverage shares weighed on Consumer Staples: Molson Golden -3.25%, Bunge +2.59%, Tyson Foods -2.27%.

- Side bar, NY Community Bank (NYCB) continued to make headlines earlier: Bbg reported the bank shares "jumped" this morning after management change: "NYCB NAMES ALESSANDRO DINELLO AS EXECUTIVE CHAIRMAN" Bbg, but quickly reversed course to new lows earlier ($3.60). NYCB gradually climbed back to $4.36 late (+3.93%) KBW Nasdaq Bank Index gained 0.18% late.

- Looking ahead: corporate earnings expected after the close: McKesson Corp, Monolithic Power, Spirit Airlines, O'Reilly Automotive, Walt Disney, Wynn Resorts, Equifax, PayPal Holdings, Mattel, Allstate.

COMMODITIES Crude Futures Rise ~0.70%, Copper Extends Decline

- Crude markets are approaching US close trading around 0.70% higher Wednesday, despite an above-expectation crude stock build. Support is coming from rising product demand, while comments from Israel’s PM appearing to reject a ceasefire deal or a pause in the fighting in Gaza maintains the geopolitical risk premium.

- WTI futures remain soft following last week’s steep sell-off. The move lower undermines the recent bullish theme, and a continuation would expose support at $70.62, the Jan 17 low, and $69.56, the Jan 3 low. For bulls, a reversal higher would be required to refocus attention on the key short-term resistance at $79.29, the Jan 29 high. Clearance of this level would reinstate a bullish theme. Initial resistance is at $76.95, the Feb 1 high.

- For precious metals, there was a spike in spot gold shortly after the cash equity open which was closely linked to further concerns over New York Community Bancorp. XAU/USD rose to a session high of $2044.60, however, the subsequent stabilisation for broader sentiment halted the rally, and price has since moderated back to unchanged (~$2035) as we approach the APAC crossover.

- Copper futures have extended the most recent decline from Jan 31 to 5.33%. The price action echoes an MNI report that growth in Chinese copper demand will slow to 3-4% y/y in 2024, as work on electrical grids and new energy slows. However, policy support for copper intensive housing completions and new energy industries will underpin consumption into late 2025, analysts told MNI.

- Policymakers’ renewed focus on completing unfinished properties and urban village renewal will support demand until next year before decreasing, said He Tianyu, a Shanghai-based senior copper analyst at CRU.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/02/2024 | 0130/0930 | *** |  | CN | CPI |

| 08/02/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 08/02/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 08/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/02/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 08/02/2024 | 1500/1500 |  | UK | BoE's Mann Speaks At OMFIF | |

| 08/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 08/02/2024 | 1530/1630 |  | EU | ECB's Lane at Brookings Institution | |

| 08/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 08/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 08/02/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/02/2024 | 1705/1205 |  | US | Richmond Fed's Tom Barkin | |

| 08/02/2024 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.