-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY99.5 Bln via OMO Friday

MNI ASIA MARKETS ANALYSIS: Fed On Hold - For Now

- MNI US-ISRAEL: Biden - "US Commitment To Israel Is Ironclad"

- MNI SECURITY: Zelenskyy Appeals For UN Support But Faces Sterner Test In Washington

- MCCARTHY: MAKING SOME PROGRESS, CLOSER TO AVERTING SHUTDOWN, Bbg

- GOLDMAN SAYS BOE LIKELY TO KEEP RATES ON HOLD TOMORROW, Bbg

- GM AND UAW ARE FAR APART IN TALKS, PEOPLE FAMILIAR SAY, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Long Way To Go To 2% Inflation, Yields Mark New 16Y Highs

- Treasury futures continue to extend lows after the be bell, yields climbing to new 16+ year highs as (5YY 4.5689%, 10YY 4.3909%) 2s-10s lead the way after the FOMC held rates steady earlier.

- Hawkish hold, the Fed keeps the door open to tighter policy if warranted in the future. Indeed, a majority of participants see one more hike in 2023 (seven see pause through year end).

- Federal Reserve Chair Jerome Powell said Wednesday the central bank has made progress on bringing down inflation but remains far from bringing consumer price growth sustainably back to its target. "The process of getting inflation sustainably down to 2% has a long way to go," Powell said in a press conference after the two-day policy meeting.

- Dec'23 10Y futures breach round number support, marking 108-26.5 low in the last few minutes - next support at 108-20 (1.000 projection of the Jul 18 - Aug 4 - Aug 10 price swing).

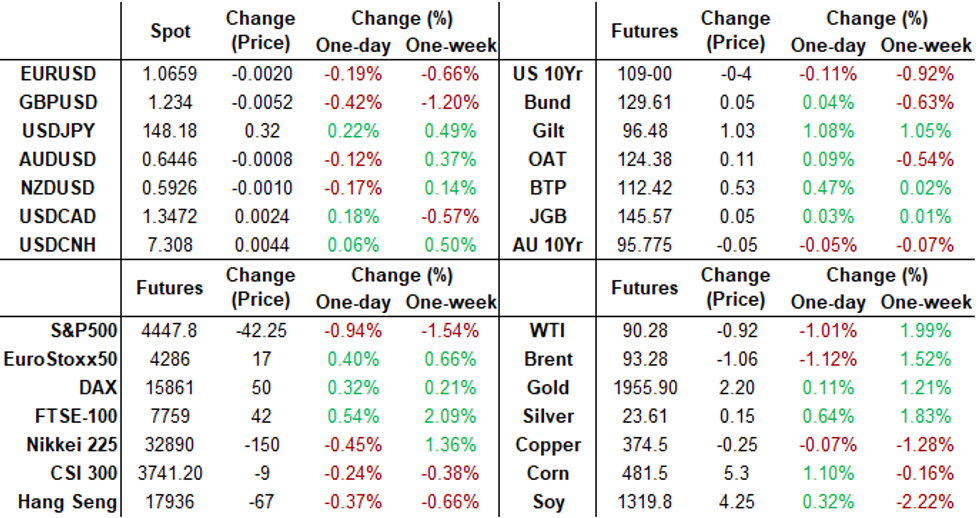

- Cross asset summary: Greenback bounced (DXY +.293 at 105.426), Gold firmer but well off highs (+1.05 at 1932.41), crude weaker (WTI -.92 at 90.28) and stocks selling off late: DJIA down 76.85 points (-0.22%) at 34440.88, S&P E-Mini Future down 44.25 points (-0.99%) at 4446, Nasdaq down 209.1 points (-1.5%) at 13469.13.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00064 to 5.32345 (-0.00359/wk)

- 3M -0.00089 to 5.39613 (-0.00565/wk)

- 6M +0.00048 to 5.46905 (+0.00321/wk)

- 12M +0.00452 to 5.45886 (+0.03742/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $90B

- Daily Overnight Bank Funding Rate: 5.32% volume: $261B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.562T

- Broad General Collateral Rate (BGCR): 5.30%, $567B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $555B

- (rate, volume levels reflect prior session)

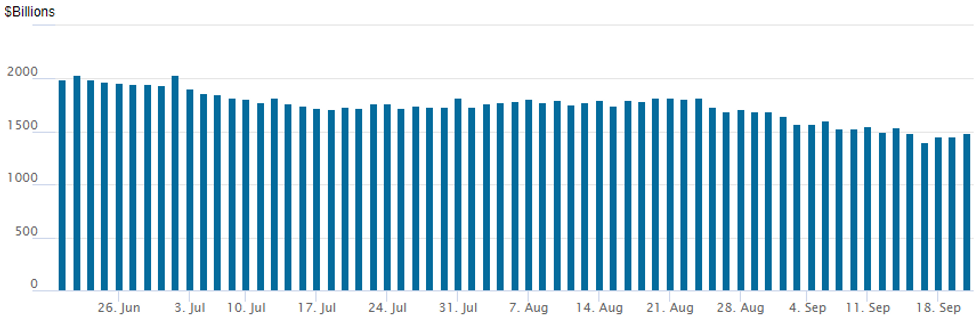

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation up to: 1,486.984B w/96 counterparties, compared to $1,453.324B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed (better buying in low delta calls and puts) after the FOMC held rates steady while majority of participants see one more hike in 2023 (seven see pause through year end). Rate hike projections into early 2024 inched higher: Sep 20 FOMC is 0.8% w/ implied rate change of +0.02bp to 5.333%. November at 29.0% w/ implied rate change of +7.2bp to 5.40%, December cumulative of 12.9bp at 5.457%, January 2024 14.0bp at 5.468%. Fed terminal at 5.47% in Feb'24.

- SOFR Options:

- Block, 5,000 0QV3 95.62/95.87 call spds, 4.0 ref 95.40

- +15,000 SFRM4 98.00 calls, 2.5

- 2,000 SFRX3 94.31/94.38/94.43/94.50 put condors

- +8,000 0QH4 94.25/95.25 put spds, 14.5

- over -3,000 SFRZ3 94.56 straddles, 18.0-18.5

- +5,000 SFRM4 96.00/97.00 call spds, 8.0 (ongoing, +20k+ yesterday at 7.5, position >80K)

- +39,955 0QV3 95.62/95.87 call spds, 5.0 ref 95.47 (well above open interest of 12k and 19k resp)

- +2,000 SFRZ3 94.56/94.68 call spds, 4.25 ref 94.54

- +3,000 0QX3 96.00/96.50 call spds 4.5

- +3,000 SFRM4 94.75/95.75 call spds, 22.25 ref 94.825

- +3,000 SFRZ3 94.43/94.56/94.68 call flys, 2.0 ref 94.54

- 8,250 0QZ3 95.25 puts, ref 95.45

- 2,000 2QZ3 96.62/97.12 call spds ref 96.075

- 1,000 SFRZ3 95.00/95.5 1x2 call spds ref 94.54

- 1,000 SFRZ3 94.37/94.43 put spds

- Treasury Options: (Reminder: October options expire Friday)

- +10,000 TYX3 106/108 put spds, 20 vs. 109-06.5/0.20%

- -3,000 USX3 114 puts, 22 ref 118-25

- 3,500 TYX3 112.5 calls, 19 ref 109-15.5

- 4,000 TYZ3 106.5/112.5 strangles, 38 ref 109-13.5

- +5,000 TUZ3 100 puts, 1.5

- +5,000 TYZ3 106.5 puts, 21-23

- 4,500 FVZ3 111 calls, 2

- over 7,200 TYV3 110.25 calls, 3 last

- over 6,200 TYV3 109.5 calls, 14 last

- over 5,600 TYV3 110 calls, 4-5 ref 109-07 to -08

- 3,000 TYX3 110.5 calls, 26 last

- 1,100 TYZ3 107/111.5 strangles ref 109-05.5

- 1,300 USV3 119 calls, 17 last

EGBs-GILTS CASH CLOSE: Gilts Soar On Soft UK CPI

The UK curve bull steepened Wednesday with yields dropping sharply after August's CPI reading came out much softer than expected. UK and core EGB yields closed near session lows.

- The downside miss in CPI, with core up 6.2% Y/Y (vs 6.9% expected) and the key Services category up just 6.8% Y/Y (vs 7.2%+ expected) saw BoE's tightening prospects altogether thrown into question.

- Pricing for Thursday's BoE decision duly dropped, now around 45% probability implied of a 25bp hike, vs 80% at Tuesday's close, helping the UK short end rally.

- Bunds had a strong day, pulled higher by the UK developments, with the 5-10Y segment outperforming.

- With little Euro-specific newsflow or macro data (German PPI was broadly in line), the biggest headlines were Germany's Buch gaining EU lawmakers' endorsement to become the top ECB bank supervisor, while Ireland's Makhlouf said the ECB was near the top for rates, with March 2024 probably to early for the first rate cut.

- Periphery spreads had a constructive day, with decent spread narrowing led by BTPs.

- The Federal Reserve decision is the focus late Wednesday, while Thursday's key event is of course the BoE decision (MNI's preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.5bps at 3.26%, 5-Yr is down 3.6bps at 2.734%, 10-Yr is down 3.6bps at 2.702%, and 30-Yr is down 2.5bps at 2.842%.

- UK: The 2-Yr yield is down 14.6bps at 4.848%, 5-Yr is down 14.2bps at 4.393%, 10-Yr is down 12.5bps at 4.215%, and 30-Yr is down 8.2bps at 4.632%.

- Italian BTP spread down 3bps at 174.9bps / Greek down 1.6bps at 137.4bps

EGB Options: Tilting Toward Upside Wednesday

Wednesday's Europe rates / bond options flow included:

- RXX3 130.50/133.00 call spread paper paid 55.5 on 9K

- ERM4 96.00/96.125/96.25/96.375 call condor paper paid 2.25 on 4K

- SFIZ3 94.70/94.80 call spread bought for 2.5 in 8k

- 2RZ3 97.25/97.50/97.62 broken call fly / 0RZ3 96.12/96.00 put spread 7K Net paid 2.5 (+cs/-ps)

FOREX Initial Greenback Weakness Reverses As Fed 2024 Dots Rise

- Price action before the FOMC rate decision saw the greenback edging lower, with the USD index declining around 0.45%, largely taking its cues from lower US yields and slightly firmer major equity benchmarks.

- However, a hawkish hold from the FED saw US yields spike higher and the associated greenback strength prompted the USD index to trade back into positive territory. The major standout of course was the substantial rise in the 2024 year-end fed funds rate median to 5.1% which was not expected by any of the analyst previews seen by MNI.

- Despite Chair Powell reiterating his Jackson Hole rhetoric regarding the Fed proceeding cautiously, the USD is holding near session bests as we approach the APAC crossover.

- USDJPY has risen back above 148.00 and will focus on the overnight highs of 148.17 before 148.40, the Nov 4 2022 high. In similar vein, EURUSD maintains its bearish tone and the recent breach of 1.0686, the Sep 7 low, confirmed a resumption of the downtrend. Moving average studies are in a bear mode position, highlighting current sentiment with sights on 1.0611, a Fibonacci retracement.

- Additionally, cable has resumed the softer price action which had categorised early Wednesday trade following the below-expectation CPI data. Some sell-side analysts have adjusted their rate calls to a hold for tomorrow’s Bank of England decision, which highlights the significance of tomorrow’s outcome. 1.2308, the May 25 low, represents the key support

- Elsewhere, we also have central bank decisions for Sweden, Switzerland and Norway. On the data front, New Zealand GDP, US Philly Fed, Jobless Claims and Existing Home Sales highlight the docket.

Late Equity Roundup: DJIA Still Higher Post FOMC

- Stocks trimmed gains after the Fed left rates unchanged but left the door open for further tightening if warranted, Dow stocks outperforming weaker SPX and Nasdaq indexes. Currently, DJIA is up 46.46 points (0.13%) at 34563.63, S&P E-Mini Future down 23.25 points (-0.52%) at 4466.75, Nasdaq down 129.9 points (-0.9%) at 13547.83.

- Leaders: Real Estate, Consumer Staples and Health Care sectors outperformed in late trade, property management names buoyed the former in early trade: CoStar Group +1.75%, CBRE Group +0.5%.

- Consumer Staples led by food & beverage stocks: Molson Coors +1.7%, Hershey and Keurig/Dr Pepper +1.2%. Meanwhile, Health Care buoyed by equipment and servicer names: UnitedHealth +2.85%, McKeeson +2.6%, Humana +2.45%.

- Laggers: Communication Services and Information Technology sectors continued to underperform with media and entertainment weighing on the former: Fox -2.45%, Google -1.95%, Paramount Global -1.62%.

- IT traded weaker again with hardware and semiconductor shares trading weaker: Zebra Tech -5.88%, Intel -3.16%, Microsoft -1.25%. On the flipside, Western Digital gained 4.35% on headline Kioxia merger $13.5B refinance loan as well as upgrade from BNP Paribas.

E-MINI S&P TECHS: (Z3) Outlook Remains Bearish

- RES 4: 4673.50 High Aug 1

- RES 3: 4617.40 76.4% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4566.00/4597.50 High Sep 15 / 1 and a near-term bull trigger

- RES 1: 4518.33 20-day EMA

- PRICE: 4470.25 @ 15:30 ET Sep 21

- SUP 1: 4462.25 Intraday low

- SUP 2: 4444.89 76.4% retracement of the Aug 18 - Sep 1 bull leg

- SUP 3: 4412.25 Low Aug 25

- SUP 4: 4397.75 Low Aug 18 and a bear trigger

A bear cycle in S&P E-minis remains in play and yesterday’s break lower reinforces current conditions. The contract has recovered from yesterday’s low, however, short-term gains are considered corrective. Support at 4483.25, the Sep 7 low, has been breached, confirming a resumption of the bear leg that started Sep 1. A continuation lower would expose 4397.75, the Aug 18 low. Initial key resistance has been defined at 4566.00, the Sep 15 high.

COMMODITIES Crude Reverses Gains With FOMC Decision, Gold Relatively Resilient

- Crude has reversed earlier gains to be trading lower on the day after after FOMC kept the door open for further rate rises and offered a hawkish dot plot with the 2024 rate projection pushed 50bps higher.

- EIA data which showed larger than expected stock draw provides some upside. w/w change week ending Sep 15: Crude stocks -2,136 vs Exp -718, Crude production 0, SPR stocks +600

- GS raised its forecast for Brent crude over a twelve-month period by $7/bbl to $100/bbl because of rising demand and supply restrictions by OPEC+, analysts including Daan Struyven and Callum Bruce said in a note.

- Gazprom expect global oil demand to continue growing until at least 2030, Gazprom Neft CEO Alexander Dyukov told reporters.

- Russia’s oil output is seen falling to 527m tons this year, down from 535m tons last year amid OPEC+ production cuts, Deputy Prime Minister Alexander Novak said.

- WTI is -1.0% at $90.28, back near the day’s lows. The recent drive higher means that support isn’t seen until $86.53 (20-day EMA).

- Brent is -1.1% at $93.34, with support next at $90.37 (20-day EMA).

- Gold is +09.24% with earlier gains trimmed by a rebounding USD index following the FOMC decision. It earlier easily pushed through resistance at $1939.0 (Sep 5 high) for a high of $1947.36 which took a step nearer a key resistance at $1953.0 (Sep 1 high).

- MNI COMMODITY WEEKLY: Bank Forecasts Mixed for $100/bbl Oil - https://enews.marketnews.com/ct/x/pjJscQCIl-0I6ahudxoiTg~k1zZ8KXr-kA8x6nHWpalptIPjO1OcQ

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/09/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/09/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/09/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 21/09/2023 | 0730/0930 | *** |  | CH | SNB PolicyRate |

| 21/09/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 21/09/2023 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 21/09/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 21/09/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 21/09/2023 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 21/09/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 21/09/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/09/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/09/2023 | 1230/0830 | * |  | US | Current Account Balance |

| 21/09/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/09/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/09/2023 | 1400/1600 |  | EU | ECB's Lagarde Lectures in Marseille | |

| 21/09/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/09/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 21/09/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 21/09/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.