-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

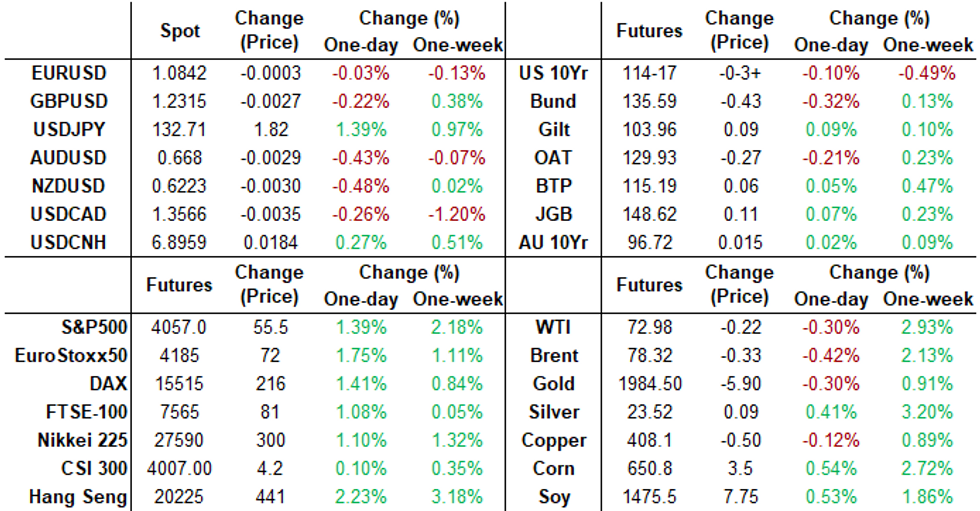

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Powell One More Hike, Forecasts

HIGHLIGHTS

- FED CHAIR POWELL CITES FORECASTS SHOW ONE MORE HIKE, HERN, Bbg

- MNI BOC SAYS MKTS STILL WORKING AFTER STRESS OF SVB COLLAPSE

- MNI BOC SAYS QT MAY END NEAR END OF 2024 OR 1ST HALF OF 2025

- MNI US-CHINA: Yellen-US Working Hard To Counter China On Developing Country Lending

- FED VC BARR: THERE WAS ACTION REQUESTED OF THE BANK, WHY THEY WERE NOT ENFORCED I DON'T YET KNOW THE ANSWER, Rtrs

Key links: MNI: BOC QT May Finish By End of 2024, Ample Reserves Stay / MNI: EU Fiscal Rules Reform Unlikely During Spanish Presidency

Tsys Weaker, Little New From Fed Chairman Powell Citing Forecasts

- Treasury futures hold modestly weaker in late trade, near the middle of a relatively narrow session range after mirroring moves in German Bunds in the first half. Not much coverage and little market reaction to Fed Chairman Powell meeting with the Republican Study Committee for lunch, expecting one more hike this year citing Fed forecasts.

- Meanwhile, futures traded weaker after the $35B 7Y note auction (91282CGS4) tailed 1.1bp: 3.626% high yield vs. 3.615% WI; 2.39x bid-to-cover vs. 2.49x last month. Treasury and corporate bond-tied hedging contributed to the range while yield curves see-sawed off steeper levels to marginally flatter: 2s10s -.379 at -52.280 vs. -47.063 high.

- From a technical perspective 10Y futures prices remain below last Friday’s high of 117-01+. Price action on Mar 24 is a potential reversal signal - a shooting star candle pattern. It suggests scope for further weakness towards the 20-day EMA, at 114-05. The average represents a key support ahead of 113-26, the Mar 22 low. Key resistance and the bull trigger has been defined at 117-01+.

- Items in focus for Thursday: Weekly Claims, GDP and Personal Consumption at 0830ET. Afternoon Fed Speakers: Richmond Fed Barkin and Boston Fed Collins will answer questions at separate events at 1445ET, MN Fed Kashkari will speak at a town hall event, moderated Q&A at 1300ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 4.81157% (+0.00271/wk)

- 1M -0.01842 to 4.84029% (+0.00972/wk)

- 3M -0.00372 to 5.15914% (+0.05771/wk)*/**

- 6M -0.03714 to 5.20957% (+0.22,228/wk)

- 12M -0.02728 to 5.16043% (+0.32457/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.16286% on 3/28/23

- Daily Effective Fed Funds Rate: 4.83% volume: $98B

- Daily Overnight Bank Funding Rate: 4.82% volume: $268B

- Secured Overnight Financing Rate (SOFR): 4.84%, $1.345T

- Broad General Collateral Rate (BGCR): 4.80%, $515B

- Tri-Party General Collateral Rate (TGCR): 4.80%, $504B

- (rate, volume levels reflect prior session)

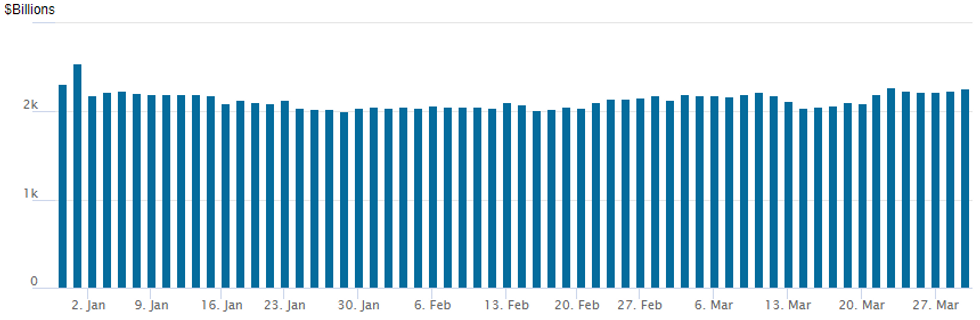

FED Reverse Repo Operation: Second Highest For 2023

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,264.862B (second highest for 2023 after $2,279.608B on March 22) w/ 104 counterparties, compares to yesterday's $2,231.749B. Record high of $2,553.716B from December 30, 2022 remains intact.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, 5,000 SFRJ3 95.25/95.43/95.50 broken call flys, 3.0 vs. 95.19

- +5,000 SFRJ3 94.75 puts, 1.0 vs. 95.17/0.04%

- 2,500 SFRU3 94.50 puts ref 95.425

- -20,000 SFRZ3 98.00/98.50 call spds, 4.0

- +5,000 SFRM3 94.50 puts, 2.0

- Block, +10,000 SFRJ3 95.12/95.43/95.50 2x1x1 call trees, 2.5 vs. 95.19/0.80%

- Block, 5,000 SFRU3 95.50 straddle vs. 96.50/97.25 call spd, 90.0 net/straddle over

- 4,000 OQM3 97.00/97.12 call spds ref 96.49

- 4,000 OQK3 98.50 calls, 2.0 ref 96.53

- 1,000 SFRZ3 94.50/94.75/95.00 put flys ref 95.82

- 1,000 OQJ3 94.50/94.75/95.00 put flys ref 96.525

- 2,100 SFRM3 94.87/95.00/95.25/95.37 call condors ref 95.24

- 1,500 SFRZ3 94.75/94.87/95.00/95.25 put condors ref 95.785

- Block, 6,000 SFRZ3 96.25/96.62 call spds, 9.0 ref 95.745

- 1,000 OQM3 97.75/98.00 1x2 call spds

- 1,000 SFRJ3 95.31/95.43/95.56 call flys, ref 95.22

- Note on Tuesday's Massive Block: +140,000 OQJ3 (April midcurve) 95.00 puts, 1.0 vs. -80,000 OQJ3 95.37 puts, 1.75 splits. Open interest for the 95.00 put only declined 7,600 to 140,433 while the 95.37 put OI held steady at 113,355. Some option desks said the 95.37 leg was a buy yesterday, while others report the package as a ratio put spd for even net. Elsewhere, ongoing Dec'23 put volume said to be covering shorts, particularly in 95.50 puts. Yesterday saw 49,801 SFRZ3 95.50 puts trade while open interest declined 7,992 to 240,370. Total Dec SOFR put volume Tuesday was 257,497 while open interest declined -8,168 according to CME Group data.

- Treasury Options:

- Block, +7,500 TYK 114.5/116.5 1x2 call spds 12 w/ 112.5/114.5 2x1 put spd, 26 Iron condor for 38 total

- 2,400 TYM111.5/117.5 strangles, 106

- 3,800 TYK3 118.5 calls, 9 ref 114-08

- 1,300 TYK3 119/121/123 call flys ref 114-16

EGBs-GILTS CASH CLOSE: Bear Flattening Continues In Germany

The German curve bear flattened for the third consecutive session, with the UK's twist flattening Wednesday.

- 2Y German yields were the underperformer again, punctuated by a close on the session highs. 10Y UK and German yields peaked in early afternoon, with notable macro / cross-asset drivers few and far between.

- Periphery EGB spreads tightened as Greece held a successful 5Y GGB syndication and risk assets (notably equities) rallied throughout the session.

- Terminal ECB and BoE hike pricing rose very slightly on the day(2-3bp).

- ECB's Lane says under the bank's baseline scenario more hikes will be needed; Kazimir said hikes should continue, "maybe at a slower pace".

- The BoE FPC's minutes noted tighter credit conditions but resilient banks.

- BoE's Mann and ECB's Schnabel speak after the cash close.

- Data was again a sideshow (French consumer confidence was in line, UK lending/money supply data was on the strong-side), with attention firmly on Thursday's CPI releases.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.2bps at 2.654%, 5-Yr is up 4.8bps at 2.328%, 10-Yr is up 3.9bps at 2.329%, and 30-Yr is up 3.5bps at 2.408%.

- UK: The 2-Yr yield is up 4.8bps at 3.412%, 5-Yr is up 3.1bps at 3.316%, 10-Yr is up 1.6bps at 3.472%, and 30-Yr is down 3bps at 3.831%.

- Italian BTP spread down 2.7bps at 182.1bps / Spanish down 2.1bps at 101.6bps

EGB Options: Mostly Upside, With Notable Euribor Downside

Wednesday's Europe rates / bond options flow included:

- WK1 RX 135.00/136.50/138.00c fly bought for 34.5 in 2k

- RXK3 134.50/136.00/137.50c fly bought for 22.5 and 23 in 2k

- ERJ3 96.375/96.50/96.625c fly, bought for 3 in 2.5k

- ERM3 96.75/96.50ps, bought for 15 in 10k, and 30k total since yesterday.

FOREX: Greenback Trades On Surer Footing, USDJPY Leads The Charge

- The USD index (+0.30%) looks set to snap its losing streak this week with few new headlines/drivers providing a more stable backdrop and prompting some moderate relief for the greenback.

- The dollars ascent has been led by weakness in the Japanese Yen which sees USDJPY trade roughly 200 pips off the overnight lows, hovering just below the day’s peak of 132.76 as we approach the end of Wednesday trade.

- While there has been an element of the JPY playing some catch up with rising US Yields over previous sessions, the firmer price action for major equity indices on Wednesday has provided a much more benign environment from which USDJPY has rallied.

- Despite the overall trend conditions remaining bearish for USDJPY, the pair is in close proximity of two resistance levels. Firm resistance is seen at the 20-day EMA, at 132.82 and 133.00, the March 22 high, where a break is required to ease the bearish technical pressure.

- Core rates may take their cues from Eurozone CPI prints tomorrow, China PMIs & US Core PCE price index data both on Friday.

- On the domestic docket, March Tokyo core CPI will be published Friday, along with unemployment, industrial production and retail sales figures for February.

FX: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675-80(E1.3bln), $1.0700(E2.8bln), $1.0825-40(E784mln), $1.0950(E1.5bln), $1.1000(E1.9bln)

- USD/JPY: Y130.00($1.1bln), Y130.40-50($658mln), Y131.00($1.6bln), Y131.50($1.2bln), Y132.00($1.4bln), Y132.90-10($1.1bln), Y134.19-20($647mln)

- AUD/USD: $0.6600(A$834mln), $0.6650(A$850mln), $0.6745(A$530mln)

- USD/CAD: C$1.3312($1bln)

- USD/CNY: Cny6.8630($601mln), Cny6.8805($568mln)

Equities Roundup: Holding Above Key Resistance

- US stocks continue to drift higher in the second half, S&P Eminis nearing last Wednesday's 4073.75 high is currently trading at 4049.0 (+47.50) above key resistance. Technicians watching to see if Eminis can hold/finish above the 50-day EMA pivot/resistance of 4019.45 where a clear break of the average is required to strengthen bullish conditions.

- On the downside, support lies at 3937.00, the Mar 24 low. A breach would instead open 3897.25 next, the Mar 20 low. 4073.75, the Mar 22 high, is the bull trigger.

- Current sector leaders are Real Estate, Information Technology and Utility sector shares outperforming while bank shares trading firmer but paring gains in the last few minutes.

- KBW Bank index (BKX) is trading near midday high (82.12) at 81.82 (+1.19 Current index leaders are: M&T Bank (MTB), Capital One Financial (COF) and PNC Financial Services (PNC), while Regions Financial (RF), Huntington Bancshares (HBAN) and Keycorp (KEY) underperform.

E-MINI S&P (M3): Testing The 50-Day EMA

- RES 4: 4148.48 76.4% retracement of the Feb 2 - Mar 13 downleg

- RES 3: 4119.50 High Mar 6

- RES 2: 4089.39 61.8% retracement of the Feb 2 - Mar 13 downleg

- RES 1: 4019.45/4073.75 50-day EMA / High Mar 22

- PRICE: 4049.00 @ 14:00ET Mar 29

- SUP 1: 3937.00/3897.25 Low Mar 24 / 20

- SUP 2: 3839.25 Low Mar 13

- SUP 3: 3822.00 Low Dec 22 and a key support

- SUP 4: 3778.00 Low Nov 3

S&P E-Minis are firmer today but remains below resistance at 4073.75. The pullback from last week’s high means that price has - so far - failed to remain above pivot resistance at the 50-day EMA - the EMA intersects at 4019.45. A clear break of the average is required to strengthen bullish conditions. Support lies at 3937.00, the Mar 24 low. A breach would instead open 3897.25 next, the Mar 20 low. 4073.75, the Mar 22 high, is the bull trigger.

COMMODITIES: Crude Oil Breaks Recent Gains Despite Surprise Inventory Draw

- Crude oil has dipped to minor declines for the day after recent gains, with the intraday move lower coming despite larger than expected draws for crude oil and gasoline inventories in EIA data.

- Russia oil production fell by 300kbpd in the first three weeks of March according to Reuters sources, as part of its target to cut 500kbpd to 9.5mbpd on average through June.

- WTI is -0.4% at $72.89. Resistance remains at $75.12 (50-day EMA) with support at $66.82 (Mar 24 low).

- Brent is -0.65% at $78.14. Resistance is set at the intraday high of $79.64 after which sits the 50-day EMA of $80.81, whilst support is seen at $72.68 (Mar 24 low).

- Gold is -0.3% at $1968.10, slipping with a reversal of yesterday’s USD weakness. Resistance remains at the bull trigger of $2009.7 (Mar 20 high) with support at $1924.5 (20-day EMA).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/03/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2023 | 0800/1000 | *** |  | DE | Hesse CPI |

| 30/03/2023 | 0900/1100 | ** |  | IT | PPI |

| 30/03/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/03/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 30/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/03/2023 | 1230/0830 | *** |  | US | GDP |

| 30/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/03/2023 | 1645/1245 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2023 | 1645/1245 |  | US | Boston Fed's Susan Collins | |

| 30/03/2023 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 30/03/2023 | 1945/1545 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.