-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Relays Patience in Cutting Rate

- MNI BRIEF: Fed's Goolsbee Says Rates On Normalization Path

- HOUSE GOP LEADERS SAY THEY OPPOSE SENATE BORDER BILL, Bbg

- BOSTIC: WAGE GROWTH IS SETTLING BACK INTO MORE NORMAL PATTERNS

- CHINA WIDENS STOCK TRADING CURBS ON QUANTS, SOME OFFSHORE UNITS, Bbg

Key Links: MNI INTERVIEW: Fed Could Cut By May, Inflation Lingers-Kaplan / MNI INTERVIEW2: Fed Assets To Settle Near USD7T Post QT-Kaplan / MNI INTERVIEW: US Service Growth Resilient, Prices Too - ISM / MNI FED: Kashkari Says Fed Can Be Patient With Rate Cut / MNI US: Ukraine Aid Hangs In Balance As Republicans Line Up Against Border Bill / MNI Gilt Week Ahead: Watch MPC speakers this week

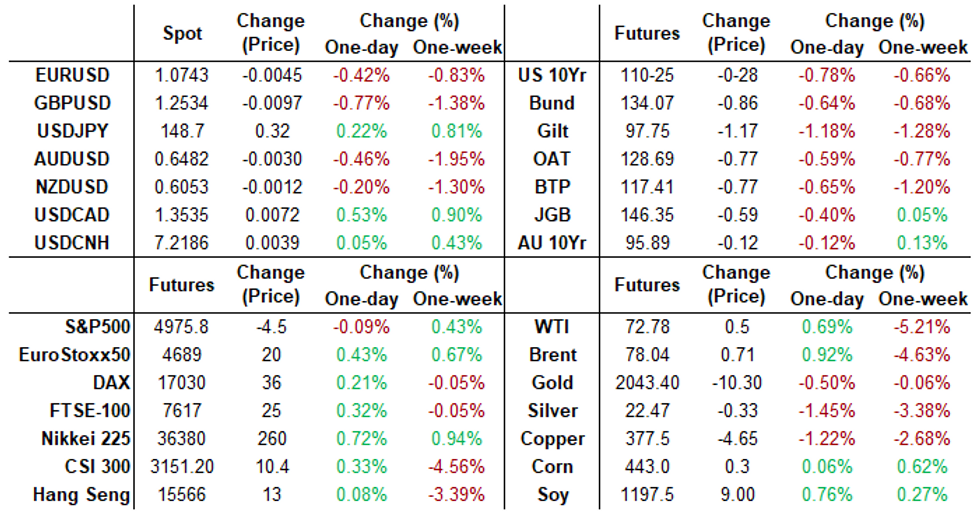

US TSYS Fed Speakers Continue to Temper Mkts Rate Cut Expectation

- Tsys under pressure all day with Mar'24 10Y futures at 110-25 (-28) - pre-Dec FOMC levels as 10Y yield climbs to 4.1637%. Carry over weakness after Fed Chairman Powell's 60 Minutes interview on Sunday underscored more cautious view re: rate cuts: "IT'S UNLIKELY FED WILL HAVE CONFIDENCE TO CUT IN MARCH ... FOMC RATE FORECASTS LIKELY NOT CHANGED MUCH SINCE DEC" Bbg.

- Fed speakers towed the line Monday, MN Fed President Kashkari re: rate cuts, Fed has time to assess before doing so, economic data is not "unambiguously positive".

- Tsy futures extended lows after stronger than expected ISM Services across all items, especially prices. ISM Services bounced more than expected in January to 53.4 (cons 52.0) after 50.5 in Dec – joint highest since Sept. Prices paid far stronger than expected 64.0 (cons 56.7) after 56.7 – highest since Feb’23 after the strongest monthly increase since mid-2012. It builds on a +7.7pt jump in manufacturing prices paid to the highest since Apr’23.

- As a result, projected rate cut chances continued to retreat: March 2024 chance of 25bp rate cut currently -16.4% vs. -18.3% this morning w/ cumulative of -4.1bp at 5.283%, May 2024 at -56.2% vs. -57.1% w/ cumulative -19.1bp at 5.133%, while June 2024 -81.9% from -82.4% (105% pre-NFP for comparison) w/ cumulative -39.6bp at 4.930%. Fed terminal at 5.32% in Feb'24.

- Tuesday focus: no data, but several Fed speakers are scheduled: Cleveland Fed Mester economic outlook at 1200ET, MN Fed Kashkari moderated Q&A, livestreamed at 1300ET, Boston Fed Collins open remarks labor conference, livestreamed, no Q&A at 1400ET, Philly Fed Harker on Fed role in the economy, text, Q&A at 1900ET.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00038 to 5.32249 (-0.01436 total last wk)

- 3M +0.02567 to 5.31613 (-0.02697 total last wk)

- 6M +0.09044 to 5.18654 (-0.06130 total last wk)

- 12M +0.16653 to 4.85933 (-0.10618 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.849T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $689B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $676B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $270B

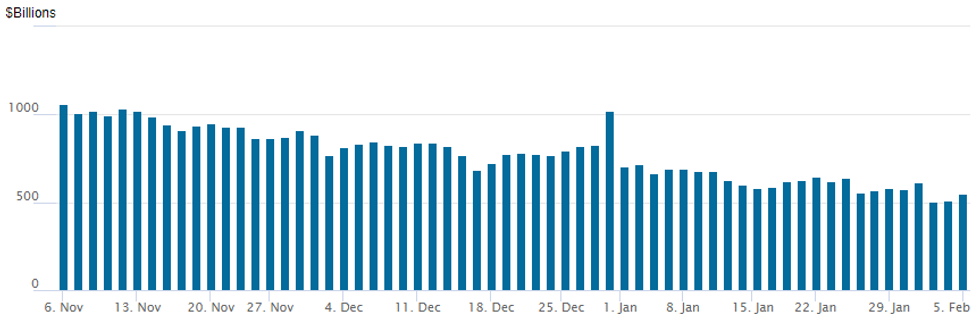

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $552.289B vs. $513.422B on Friday - the lowest level since mid-2021. Compares to recent cycle low of $503.548B on Thursday, February 1.

- Meanwhile, the number of counterparties holds steady at 80 from 74 last Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

Better put volume reported on net in SOFR and Treasury options, SOFR leading on size and breadth of flow Monday. Underlying futures opened weaker and extended lows after stronger than expected ISM Services across all items, especially prices

- As a result, projected rate cut chances continued to retreat: March 2024 chance of 25bp rate cut currently -16.4% vs. -18.3% this morning w/ cumulative of -4.1bp at 5.283%, May 2024 at -56.2% vs. -57.1% w/ cumulative -19.1bp at 5.133%, while June 2024 -81.9% from -82.4% (105% pre-NFP for comparison) w/ cumulative -39.6bp at 4.930%. Fed terminal at 5.32% in Feb'24. Salient second half trade includes:

- SOFR Options:

- Block, 10,000 SFRU4 94.87/95.00/95.12 put flys, 1.0

- Block, 10,000 SFRU4 94.62/94.75 put spds, 1.75/splits

- -15,000 SFRH4 94.75/94.87 put spds 9.25

- Block, -10,000 SFRG4 94.68/94.93 strangles, 1.0 ref 94.78

- Block, 10,000 SFRH5 95.00/95.62/96.25 put flys, 13.0 ref 96.19

- Block, 5,000 SFRH4 96.50/97.50 call spds w/SFRH4 95.50/96.50 put spd, 70.5

- +9,600 SFRK4 95.12/95.87 1x2 call spds, 4.5 vs 95.125/0.17%

- 11,000 SFRM4 95.12/95.31/95.37/95.50 put condors ref 95.12

- +9,000 SFRM4 95.12/95.87 1x2 call spds, 3.25

- +6,200 0QH4 95.50/95.75/96.00 put flys, 4.5

- 1,500 2QH4 96.75/97.00 1x2 call spds ref 96.61

- 4,500 SFRU4 95.37/SFRZ4 95.50 put calendar diagonal spds

- +8,000 SFRM4 94.68/94.87 put spds vs. 95.12/95.25/95.50/95.62 call condors, 2.0 net

- +5,000 SFRU4 95.06/95.18 put spds vs. 95.87/96.00 call spds, 2.0 net ref 95.525/0.10%

- Block, 5,000 SFRM4 95.25/95.37/95.50/95.62 call condors, 1.0 vs. 95.115/0.05%

- over 8,200 0QH4 95.87 puts ref 96.165 to -.17

- +9,000 SFRM4 94.75/94.87 put spds vs. 95.50/95.62 call spds, 2.25 vs. ref 95.12/0.13%

- 2,500 SFRM4 95.25/95.62 call spds vs. 2QM4 96.75/97.12 call spds

- +4,000 0QJ4 94.75 puts, 4.0

- 2,700 0QH4 96.00 puts ref 96.15

- +10,000 SFRH4 94.75 puts, 3.25 ref 94.77

- -9,000 SFRM4 94.87/95.00/95.12 put flys, 2.0

- -8,000 SFRJ4 95.12/95.18/95.37 broken put trees, 0.5 ref 95.135/0.35%

- Treasury Options:

- 4,800 FVH4 108 puts, 60 ref 107-11.5

- over 10,000 TYH4 109 puts, 4 last ref 111-05.5 to -06.5

- 2,000 TYH4 109/110 3x2 put spds, 16 ref 111-07

- 1,500 TYH4 109.25/110 3x2 put spds, 13 ref 111-07.5

- over 7,400 FVH4 107 puts, 16 last

- over 7,600 FVH4 107.5 puts, mostly 29

- over 6,100 FVH4 108 puts, 48 last

- over 4,500 TYH4 110 puts, mostly 12

EGBs-GILTS CASH CLOSE: US-Driven Selloff Continues

Carrying on from last week's theme, upside surprises in US data saw German and UK yields rise sharply Monday.

- German /UK 10Y yields are up 16.7bp/26.2bp respectively in the past two sessions.

- The sell-off has been largely driven by the strong US payrolls Friday and today's upside surprise in US ISM Services price/activity metrics, along with hawkishly-perceived comments by Federal Reserve officials.

- European data was inconsequential, with final Europe Services PMIs in line with final.

- The German curve closed bear steeper with the UK's fairly flat, with 2Y through 10Y yields up in parallel by around 9bp.

- Periphery EGB spreads fell marginally, mostly mirroring the uptick in Eurozone equities as the euro fell against the USD.

- The early highlight Tuesday is German factory orders.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.4bps at 2.613%, 5-Yr is up 7.1bps at 2.237%, 10-Yr is up 7.5bps at 2.316%, and 30-Yr is up 8.1bps at 2.52%.

- UK: The 2-Yr yield is up 8.8bps at 4.509%, 5-Yr is up 8.9bps at 3.998%, 10-Yr is up 8.9bps at 4.007%, and 30-Yr is up 6.5bps at 4.617%.

- Italian BTP spread down 0.7bps at 156.8bps / Spanish down 1.5bps at 91.2bps

EGB Options: Futures Selloff Lures Upside Buyers Monday

Monday's Europe rates/bond options flow included:

- OEH4 118p, bought for 66.5 in 5k

- RXH4 139.50/140.00cs bought for 1 in 10k

- DUH4 106.10/106.40cs, bought for 4 in 15k total

- DUH4 106.20/106.40/106.50/106.70 call condor bought for 1.5 in 20k

- DUH4 105.90/106.30cs vs 105.60/105.40ps, bought the cs for 4.5 in 10k

- SFIK4 94.90/94.80/94.70/94.60p condor bought for 1.75 in 8.8k

FOREX USD Index Extends Advance Amid Further Hawkish Fed Re-Pricing

- Further hawkish re-pricing in the US extended on Monday, assisting further greenback strength following Friday’s above-estimate payrolls report. This prompted the USD index (+0.47%) to briefly trade at the highest level since Nov 14 at 104.60.

- Initial weakness for equities weighed on the likes of AUD and EUR, although GBP is the weakest performing major currency to start the week.

- GBPUSD traded sharply lower Friday and extended the pullback through Monday trade. The pair has breached support at 1.2597, the Jan 17 low and the base of a range that has been in place since mid-January. A clear range breakout would strengthen a bearish condition and pave the way for weakness towards 1.2500, the Dec 13 low.

- Focus is also on AUD, as we approach the overnight decision from the RBA, where the central bank is unanimously expected to leave rates unchanged at 4.35%. The meeting statement is likely to acknowledge the softer data but sound cautious pointing out that the inflation fight has not yet been won and that significant uncertainties persist.

- From a trend perspective, a bearish theme in AUDUSD continues to dominate and the latest sell-off reinforces this condition. The break to fresh cycle lows last week confirms a resumption of the downtrend and signals scope for weakness towards 0.6453, the Nov 17 low.

- Perhaps surprisingly given its continued sensitivity to core rates the Japanese yen is not among the poorest performers in G10 on Monday, as the early weakness for major equity indices likely weighed on Cross/JPY. However, USDJPY’s impressive rally in the aftermath of the US data did briefly extend to a new 2024 high of 148.89, before moderating 30 pips lower ahead of the APAC crossover.

- The trend outlook is unchanged and remains bullish, with bulls next focused on 149.16, a Fibonacci retracement. For reference, notable levels further out include 149.75 and 150.78, the November 22 and 17 highs respectively.

- German factory orders, UK construction PMI and Eurozone retail sales highlight the European docket on Tuesday.

Expiries for Feb06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0740-50(E915mln), $1.0795-00(E2.9bln), $1.0815(E574mln)

- USD/JPY: Y147.00-20($1.3bln), Y148.25($557mln), Y148.50($641mln), Y148.70-75($786mln), Y149.10($658mln)

- AUD/USD: $0.6470(A$708mln), $0.6570-90(A$2.6bln)

- NZD/USD: $0.6005(N$703mln)

- USD/CNY: Cny7.2225($1.6bln)

Late Equity Roundup: Drifting Off Lows, IT, Health Care Leading

- Still weaker in late trade, stocks have drifted off late morning lows, near the narrow overnight range. Currently, the DJIA is down 201.08 points (-0.52%) at 38452.52, S&P E-Minis down 7 points (-0.14%) at 4973.5, Nasdaq down 5.5 points (0%) at 15623.65.

- Leading gainers: Information Technology and Health Care sectors continue to outperform in late trade, chip stocks supported the IT sector: ON Semiconductor +10.45%, Nvidia +4.05%, Qorvo+3.76%. Pharmaceuticals and biotechs buoyed the latter: Catalent +9.39% after Novo Holdings offered to by the multi-national pharma company; Eli Lilly +5.78%, AbbVie +2.21%.

- Laggers: Chemicals and mining stocks weighed on the Materials sector in late trade: Air Products/Chemicals -14.82% after disappointing earnings this morning, Albemarle -4.45%, Vulcan Materials -2.35%. Meanwhile, Real Estate sector shares displaced earlier earlier underperforming Consumer Discretionary stocks, estate management stocks weaker: CoStar Group -2.95%, CBRE -1.62%.

- Looking ahead: corporate earnings expected after the close: Crown Holdings, Palantir Technologies, Rambus and Vertex Pharmaceuticals. Early Tuesday annc from: Aramark, Cummins, GE Healthcare, DuPont, Gartner, Centene, Eli Lilly and Hertz.

E-MINI S&P TECHS: (H4) Northbound

- RES 4: 5100.00 Round number resistance

- RES 3: 5050.14 1.764 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5012.80 1.618 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 5000.00 Psychological round number

- PRICE: 4974.00 @ 1405 ET Feb 5

- SUP 1: 4866.000/4772.82 Low Jan 31 / 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

A broader uptrend in S&P E-Minis remains intact and Friday’s gains reinforce this condition. The contract has traded to fresh cycle highs, confirming a resumption of the uptrend. Recent corrections have been shallow - this also highlights a strong uptrend. The focus is on the psychological 5000.00 handle. On the downside, initial key short-term support has been defined at 4866.00, the Jan 31 low.

COMMODITIES WTI Claws Back Gains Whilst Gold Clears Support Under USD Pressure

- WTI has seen robust gains during US hours to be up on the day but only chip away at last week’s declines. The market is weighing continued concern of Middle East escalation against a stronger US dollar, despite some easing of gains after the USD index briefly climbed to its highest since Nov. 14.

- The US intends to undertake further strikes in retaliation for the US personal killed by an Iranian backed militia: State Dept.

- Houthi Red Sea attacks and surging freight rates have changed crude oil buying patterns boosting the attractiveness of local supplies: Bloomberg.

- Drone attacks on Russia’s energy infrastructure could be a larger disruption to global fuel supplies than attacks on shipping in the Red Sea: Bloomberg.

- WTI is +0.7% at $72.79, with resistance at $76.95 (Feb 1 high).

- Brent is +0.9% at $78.02, with resistance at $81.55 (Feb 1 high).

- Gold is -0.7% at $2026.28, under persistent pressure from a mostly appreciating USD index as Treasury yields have climbed strongly for a second day after Friday's booming payrolls figures. A low of $2015.09 cleared support at $2022.3 (20-day EMA) to open $2001.9 (Jan 17 low).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2024 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 06/02/2024 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 06/02/2024 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 06/02/2024 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 06/02/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 06/02/2024 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 06/02/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2024 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2024 | 1200/1200 |  | UK | Asset Purchase Facility Quarterly Report | |

| 06/02/2024 | 1330/0830 | * |  | CA | Building Permits |

| 06/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/02/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/02/2024 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 06/02/2024 | 1745/1245 |  | CA | BOC Governor speech/press conference in Montreal | |

| 06/02/2024 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 06/02/2024 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/02/2024 | 1900/1400 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 2145/1045 | *** |  | NZ | Quarterly Labor market data |

| 06/02/2024 | 0000/1900 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.