-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: FI Off Lows, Discounting Jobs Gain

- MNI US: Televised GOP Speaker Debate Set For Monday Called Off

- MNI US: Biden: Its Time For House Republicans To Start Doing Their Job

- UAW reports "significant progress" in negotiations with Detroit Three, Axios

- EL-ERIAN: LONG TERM, `SOMETHING IS LIKELY TO BREAK', Bbg

- ExxonMobil in talks to buy US shale behemoth Pioneer, Bbg

Key Links:MNI BRIEF: September US Jobs Surge Unexpectedly; U-Rate 3.8% / MNI INTERVIEW: Fed Done Hiking, Will Cut As Soon As Q1-Tilley / MNI TV: Key Exclusive Highlights For Week 40 / MNI GLOBAL WEEK AHEAD - US CPI, UK GDP and China Data

US TSYS Markets Roundup: FI Well Off Post-Jobs Data Lows, EQ Near Highs

- Still weaker after the bell, Tsy futures clung to a narrow range since midday after bouncing off post-data lows with stocks, ignoring prospect of tighter policy following this morning's strong Sep job gains (+336k vs. +170k est).

- Further slowing in average hourly earnings and the softening in trend growth for non-supervisory roles makes a further pullback in the Employment Cost Index for the coming quarters.

- Treasury futures still shy of the pre-data levels: TYZ3 currently at 106-27.5 (-14.5) vs. 107-10 high, well off initial technical resistance at 107-14 (Oct 3 high) followed by firm resistance at 108-12, the 20-day EMA.

- Heavy volumes recorded after the bell, TYZ3 >2.1M, curves well off this morning's highs: 3M10Y +5.424 at -73.751 vs. -63.477 high, 2Y10Y +.679 at -29.925 vs. -24.882 high (least inverted since October 2022).

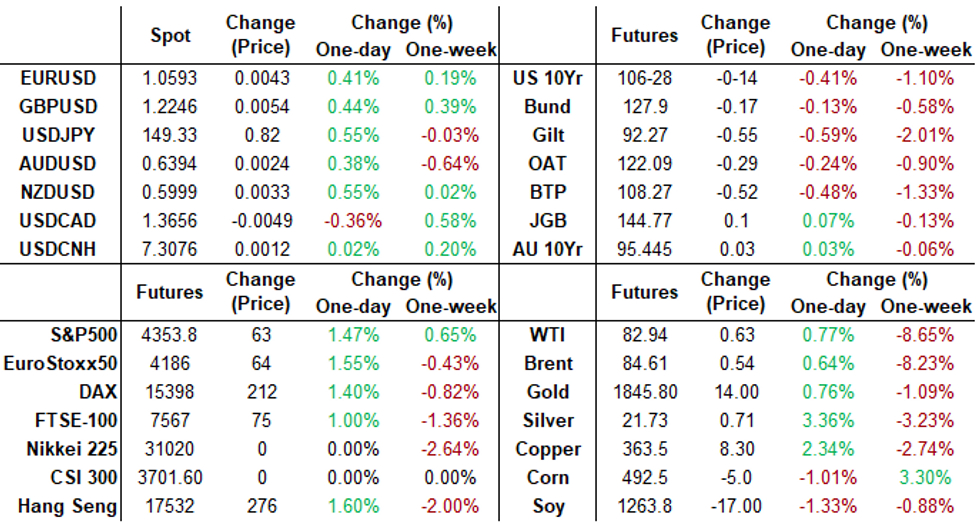

- Cross asset summary: Greenback reversed post data highs - making session lows (DXY -.275 at 106.057 vs. 106.974 high), Gold higher (+10.25 at 1830.55), crude making modest gain (WTI +0.58 at 82.89). Stocks near late session highs: S&P E-Mini futures are up 54.75 points (1.28%) at 4345.25, Nasdaq up 204.4 points (1.5%) at 13423.76, DJIA up 336.95 points (1.02%) at 33455.87.

- Looking ahead to next week: September PPI and FOMC minutes on Wednesday, CPI Thursday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00509 to 5.34107 (+0.02208/wk)

- 3M +0.00054 to 5.40674 (+0.01124/wk)

- 6M -0.00817 to 5.45446 (-0.01281/wk)

- 12M -0.03319 to 5.39656 (-0.06970/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $253B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.520T

- Broad General Collateral Rate (BGCR): 5.30%, $573B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $564B

- (rate, volume levels reflect prior session)

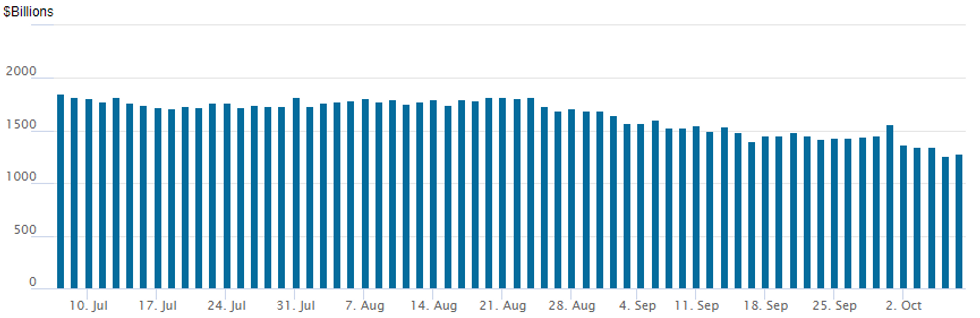

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation usage bounces to $1,283.461B w/95 counterparties vs. $1,265.132B - the lowest since mid-September 2021 in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury options segued from better put trade to calls as this morning's employment data showed nearly twice the amount of jobs gained (+336k) than expected (+170k), quashing hopes of a continued rally in the underlying since Wednesday's lower than expected ADP - on hopes of softer policy ahead. Rate hike projections into early 2024 climbed back to Wednesday highs after this morning's data, spurring better put buying: November at 30.5% (22.2% pre-data) w/ implied rate change of +7.6bp to 5.405%, December cumulative of 12.4bp (9.7bp prior) at 5.452%, January 2024 11.9bp (8.4bp prior) at 5.448%. Fed terminal climbs to 5.45% in Jan'24.

- SOFR Options:

- +10,000 SFRZ3 94.31/94.43 put spds, 3.25

- Block, 6,000 SFRX3 94.50/94.56/94.62/94.68 call condors, 2.75 ref 94.525

- Block, 5,000 2QH4 96.25/97.25 call spds even vs. 2QH4 95.00 puts, ref 95.84

- 2,000 SFRX3 94.56/94.62/94.75 call trees ref 94.52

- +5,000 SFRZ3 94.50/94.56/94.62/94.68 call condors, 1.75

- 1,000 0QV3 95.50/96.00/96.25 1x3x2 call flys

- Block, 4,000 SFRV3 94.37/94.50 put spds, 1.5 pre-data

- 7,000 0QZ3 95.75/96.00 call spds ref 95.415

- 4,000 SFRZ3 94.18/94.37/94.62 put flys, ref 94.555

- 3,600 SFRV3 93.50/93.75/94.00/94.25 put condors, ref 94.55

- 5,000 0QV3 95.25 puts, ref 95.435 to -.42

- Treasury Options:

- Block, 7,991 FVX3 105.25/106.25 2x3 call spreads, 21.5 net ref 104-23.5

- 9,320 FVX3 105.5/106.5 1x2 call spds, 4.5 ref 104-24.5. Same strikes blocked on 2x3 ratio pre-data

- 1,750 TYX33 106/TYZ3 102.5 put calendar spreads

- 7,500 TYZ3 102.5 puts, 13 ref 106-26

- 3,000 TYX3 104.5/106 put spds, 21

- 2,500 FVZ3 105.25/107 call spds 22.5 ref 104-18.75

- 2,500 FVZ3 105.5/107 call spds, 20 ref 104-19.75

- 5,000 FVX3 106.5/107.5 call spds

- +8,000 FVZ3 108/109 call spds, 3

- 7,000 FVX3 106/107 call spds

- 5,500 FVX3 104 puts, 22 ref 104-15.25

- 7,000 FVX3 104.25/104.5 put spds ref 104-14.5

- 4,000 TYX3 108.25/108.75 call spds ref 106-18.5

- 3,450 TUZ3 102 calls, 7 ref 101-06.25

- Block, 15,000 FVX3 105.5/106.5 2x3 call spds, 21 ref 104-28.75, pre-data

- 18,500 FVX3 105.5/106.5 call spds ref 104-29, pre-data

- over 7,550 USX3 105/109 put spds ref 110-30

- over 10,600 FVX3 106 calls, 16 ref 104-31.775

FOREX NFP-Triggered USD Rally Proves Short-Lived

- The September NFP report comfortably topped expectations, with the US adding 336k jobs over the month, helping prompt a surge in the US dollar and a re-steepening of the US yield curve. The very long-end of the sovereign yield curve spiked to put 30y yields back above 5.00% and trigger a broad greenback rally.

- This USD strength was short-lived, however, with yields undergoing a full reversal off highs, undermining the USD Index and cementing the fourth consecutive negative close for the greenback. The reversal came as the focus turned to softer-than-expected average hourly earnings, which spell further downside pressure on the Employment Cost Index and less pressure on the Federal Reserve to hike rates further beyond the end of 2023.

- The NFP report boosted short-end pricing marginally, with OIS-implied pricing for the November 1st FOMC decision rising to 7.5bps, still well short of a 50% chance for a 25bps hike.

- JPY was the poorest performer, hampered by the risk-rally that accompanied a rollover in US yields. High beta currencies, most notably the SEK, which has outperformed NOK through the week on the back of a weaker oil prices, with the cross in close proximity to the June 23 low at 0.9834 as the next clear downside level.

- Focus for the coming week turns to the US CPI release, the last look at inflation before the November 1st FOMC meeting. Expectations for the September print are for a small softening in annual headline rates to 4.1% Y/Y for core and 3.6% Y/Y for the headline, while monthly prints for core and headline are both expected at 0.3% M/M.

FX Expiries for Oct09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E570mln), $1.0550(E1.1bln), $1.0585-00(E2.3bln)USD/JPY: Y147.00-15($1.9bln), Y148.25($735mln), Y150.00($746mln), Y150.50($793mln)

- GBP/USD: $1.2100(Gbp797mln), $1.2150(Gbp543mln)

- EUR/GBP: Gbp0.8800(E893mln)

- USD/CAD: C$1.3480($612mln), C$1.3615($557mln)

Late Equity Roundup: IT, Comm Services and Industrials Outperform

- Stocks continue to drift higher late Friday, ignoring this morning's stronger than expected employment data (+336k vs. +170k est) and it's implication toward tighter monetary policy in the near term. Currently, S&P E-Mini futures are up 54.75 points (1.28%) at 4345.25, Nasdaq up 204.4 points (1.5%) at 13423.76, DJIA up 336.95 points (1.02%) at 33455.87.

- Leaders: Information Technology, Communication Services and Industrials sectors continue to lead in the second half, software and services stocks leading the former as Palo Alto Networks +4.58%, Monolithic Power +4.52% Advanced Micro Devices +3.75%.

- Meanwhile, media and entertainment shares helped Communication Services: Interpublic Group +3%, News Corp +2.7%, Disney +2.66%. Construction and engineering shares buoyed Industrials: United Rentals +3.23%, Eaton Corp +2.93%, Parker-Hannifin +2.36%.

- Laggers: Consumer Staples, Consumer Discretionary and Real Estate sectors underperformed, the former weighed by distribution and retail stocks: Dollar General -2.8% Walmart -2.64%, Costco -2.5%. Off weaker levels in the first half, auto makers underperformed/weighed on the Discretionary sector: Tesla -.37% and Ford +0.4%. Meanwhile, Real Estate Investment Trusts covering office and health care weighed on the Real Estate sector: Boston Properties -2.31%, Ventas -1.55%.

- Technicals: Despite the bounce, a bear cycle in S&P E-minis remains in play after price sequence of lower lows and lower highs and signals scope for weakness towards 4194.75, the May 24 low. Pivot resistance is 4441.61, the 50-day EMA. Ahead of the 50-day average is resistance at 4381.68, the 20-day EMA.

E-MINI S&P TECHS: (Z3) Bear Cycle Still In Play

- RES 4: 4566.00 High Sep 15 and a key resistance

- RES 3: 4514.50 High Sep 18

- RES 2: 4441.61 50-day EMA

- RES 1: 4381.68 20-day EMA

- PRICE: 4344.25 @ 1415 ET Oct 6

- SUP 1: 4235.50 Low Oct 4

- SUP 2: 4194.75 Low May 24

- SUP 3: 4166.25 1.50 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4134.00 Low May 4

A bear cycle in S&P E-minis remains in play. The contract traded lower Wednesday, confirming a resumption of the bear leg once again. This maintains the price sequence of lower lows and lower highs and signals scope for weakness towards 4194.75, the May 24 low. Pivot resistance is 4441.61, the 50-day EMA. Ahead of the 50-day average is resistance at 4381.68, the 20-day EMA.

COMMODITIES

Oil and Product Summary: Oil prices have faced a choppy session Friday remaining positive but are on track for their steepest weekly losses since March.

- Crude markets have been weighed upon by fears high interest rates will slow global growth and hammer fuel demand despite Saudi and Russia this week announcing they still intend to maintain voluntary production/export cuts until the end of the year.

- US oil rigs fell five to 497 this week, their lowest number since February 2022 according to Baker Hughes.

- OPEC has raised its long-term oil demand forecasts in its 2023 World Oil Outlook October 9 report according to Reuters sources.

- Russia has partly lifted its diesel ban that was adding to market tightness since September 21.

- The partial easing of the ban will see the resumption about 1.4-1.5m metric tons of diesel exports in October according to TASS citing Sergey Kondratyev at the Institute of Energy and Finance. The Russian exports would be two times less than before the ban.

- Goldman Sachs expects Brent to hit $100/bbl by next Spring according to Daan Struyven, head of oil research in an interview with CNBC, expecting current bearish factors to be transitory.

- Brent DEC 23 up 0.5% at 84.48$/bbl

- WTI NOV 23 up 0.4% at 82.62$/bbl

- Gasoil OCT 23 down -0.2% at 867$/mt

- WTI-Brent down -0.1$/bbl at -3.3$/bbl

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/10/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 09/10/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 09/10/2023 | 0800/1000 |  | EU | ECB's de Guindos Speaks at Conference | |

| 09/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 09/10/2023 | 1315/0915 |  | US | Fed's Michael Barr | |

| 09/10/2023 | 1500/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 09/10/2023 | 1730/1330 |  | US | Fed Vice Chair Philip Jefferson | |

| 09/10/2023 | 2000/2100 |  | UK | BoE's Mann speaks at NABE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.