-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI ASIA MARKETS ANALYSIS: FI Rally Extends But No Lasting Tailwind For Stocks

HIGHLIGHTS

- Treasuries have seen a further sizeable rally as Fed rate cut expectations dial up with 50/50 odds of a first cut at the March FOMC, despite real GDP being revised even higher in Q3 with some softer underlying details.

- The USD index has held up well after yesterday's decline as bond yields fall globally, with CHF an outperformer.

- Stocks were initially a firm beneficiary but have seen a notable rejection of key resistance and are ending slightly lower on the day, whilst WTI has extended a bounce with WSJ sources that OPEC+ could be considering an additional cut up to 1mbpd.

- China manufacturing and non-manufacturing PMI data highlight the overnight calendar on Thursday before further Eurozone CPI releases are published (French preview below). Attention then turns to the US monthly PCE report and US jobless claims, along with Canadian GDP, before the MNI Chicago Business Barometer and US pending home sales close the Thursday docket.

US TSYS: Rally Extends, Helped By Softer Details Undermining GDP Beat

- Cash Tsys sits 5.5-9bp richer on the day, bull steepening as 2s lead the rally in an extension of yesterday’s Waller-instigated rally. 2s10s of -37.5bps (+3.5bp) sits back at mid-Nov levels.

- The day’s moves started with a bias from softer external inflation in Australia and Germany, and were further supported by softer than expected US core PCE inflation and real personal consumption growth despite an overall upward revision to real GDP growth to an even stronger 5.2% annualized in Q3 (from an initial 4.9%).

- Fedspeak hasn’t provided any pushback, with Bostic (’24) seeing evidence that tighter monetary policy is biting harder into economic activity and Mester (’24 voter retiring in June) reiterating she sees Fed policy on a good footing. The Beige Book then went on to show moderation compared to the mid-October update across output, pricing and labor markets.

- It sees Fed Funds futures firmly pricing a first cut in May (cumulative 28bp), with 50/50 odds it comes in March, building to a cumulative 117bp of cuts through 2024.

- TYH4 at 110-09+ sits off the earlier high of 110-15+ but has marked another strong extension of the bull cycle. Focus is on 110-25, a Fibonacci projection, whilst initial key support has been defined at 108-18+ (Nov 27 low).

- Tomorrow sees the monthly PCE report, weekly jobless claims, the MNI Chicago PMI and pending home sales, before Chair Powell swings into focus on Friday.

EGBs-GILTS CASH CLOSE: Rally Extends As Euro Inflation Fizzles

Gilt and Bund yields dropped sharply again on Wednesday, as rate cut expectations continued to mount on the basis of disinflationary progress in the Eurozone.

- A softer-than-expected Eurozone flash November inflation round was presaged by German state CPI data, starting with the early North Rhine Westphalia release, and followed through with an unexpected deceleration in Spanish inflation.

- The national German figure confirmed the state-level findings, but by that time core FI had done most of its rallying for the day, having already been on the front foot as Tuesday's dovish Fed communications reverberated.

- There's now well over 100bp of cuts priced in 2024 for the ECB, a rise of over 10bp on the day, with UK cut pricing following suit.

- The German curve bull steepened, with the belly outperforming on the UK curve.

- Periphery spreads tightened, led by Portugal.

- Thursday's European highlights will again be flash inflation readings, with the Netherlands and France reporting early, and Italy out alongside the Euro aggregate later in the morning. MNI expects the headline EZ print to come in below the 2.7% Y/Y expected coming into today, but there is some debate over the degree of downside potential to the 3.9% core expectation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 8.2bps at 2.836%, 5-Yr is down 8.1bps at 2.366%, 10-Yr is down 6.5bps at 2.432%, and 30-Yr is down 4.6bps at 2.681%.

- UK: The 2-Yr yield is down 6.4bps at 4.568%, 5-Yr is down 11.2bps at 4.1%, 10-Yr is down 7.8bps at 4.096%, and 30-Yr is down 4.7bps at 4.598%.

- Italian BTP spread down 1.5bps at 174.2bps / Portuguese PGB spread down 4bps at 63.9bps

EU STIR: ECB/BoE Pricing Implies 100bp In First Year Cuts

Soft flash November Eurozone inflation data helped tip pricing for ECB cuts in 2024 to well over 100bp on Wednesday, with BoE cut pricing keeping pace.

- Around 107bp of ECB rate reductions are now priced by futures markets for 2024, up 11bp on the day - by comparison, at the start of the week, the ERZ3-ERZ4 spread implied 80bp of reductions (see chart).

- The first 25bp cut is just about cumulatively priced for April 2024 (vs June prior), with 50bp by July and 75bp by the September meeting.

- For the BoE, there is around 100bp of Bank Rate cuts priced in the year following the Feb 2024/Mar 2024 peak - up 9bp on the day.

- The first 25bp cut remains fully priced by Aug 2024 but that's creeping into June (around 85-90% implied cumulatively), with 50bp of reductions through September 2024.

Euribor Dec23-Dec24 Spread Source: BBG, MNI

Euribor Dec23-Dec24 Spread Source: BBG, MNI

FOREX: Mixed US Data Keeps Greenback Range Contained, Swiss Franc Outperforms

- After a moderate extension of weakness in early trade, the USD index then grinded higher across APAC and European hours. A mixed set of US growth/PCE data prompted some two-way price action within contained ranges and the USD index remains close to unchanged on the session.

- The Swiss franc is higher against nearly all its G-10 peers amid the drop in global bond yields and as gold prices extend on their most recent strength. USDCHF has declined as much as 0.5% to 0.8736, the lowest level since mid-August. Additionally, EURCHF has fallen 0.65 to a three-week low below 0.9600 playing into the soft German CPI report.

- Some analysts have also noted that USD/CHF 2-week implieds, which include the Dec. 13 Fed decision, rose to fresh three-week high of 6.55%.

- NZD is also among the firmest currencies across G10, after the RBNZ rate decision kept headline policy unchanged, but signalled strongly that further hikes will follow in 2024 should CPI remain stubbornly high in the interim. NZDUSD is well off the overnight high of 0.6208, but the uptrend remains intact. Further strength would open 0.6274 ahead.

- Antipodeans worked against each other following softer than expected Australian inflation data, prompting AUDNZD to spend the majority of the session consolidating a sharp 0.8% decline to six-week lows for the pair.

- China manufacturing and non-manufacturing PMI data will highlight the overnight calendar on Thursday before further Eurozone CPI releases are published. Canada GDP, US PCE and core PCE deflator and US jobless claims are also due. The MNI Chicago Business Barometer and US Pending home sales close the Thursday docket.

FX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0855(E658mln), $1.0895-05(E534mln), $1.0925(E603mln), $1.0965-75(E1.3bln), $1.1000(E589mln), $1.1030(E565mln)

- USD/JPY: Y145.96-10($817mln), Y146.80-85($610mln), Y147.70($1.0bln), Y148.10-30($2.8bln), Y149.00($3.1bln), Y149.50-65($1.9bln), Y149.85-05($1.5bln), Y150.50($730mln), Y151.00($1.0bln)

- GBP/USD: $1.2700(Gbp527mln)

- EUR/GBP: Gbp0.8670-80(E513mln), Gbp0.8700(E662mln)

- AUD/USD: $0.6580-00(A$1.2bln)

- USD/CAD: C$1.3000($2.7bln)

- USD/CNY: Cny7.1000($725mln), Cny7.1700($770mln)

Larger FX Option Pipeline

* EUR/USD: Dec01 $1.0900(E1.4bln), $1.0995-00(E2.2bln); Dec04 $1.0820-35(E1.6bln), $1.0860-65(E1.1bln), $1.0925-30(E1.2bln), $1.1025-30(E1.1bln)

* USD/JPY: Dec01 Y151.00($1.0bln); Dec04 Y147.00($1.1bln), Y148.00($1.5bln); Dec05 Y148.00($1.4bln)

* USD/CAD: Dec01 C$1.3600-20($1.8bln)

US FI OPTIONS: Largely Upside Wednesday

Wednesday's US rates/bond options flow included:

- TYF4 110.25/111.25cs vs 109p, sold the p at 1 in 5.5k

- SFRZ3 94.6875/94.8125 call spread, 3K blocked at 0.25 (indicated buyer)

- SFRF4 94.62/94.68/94.87/95.00c condor traded 2 in 2k

- SFRF4 95.00c traded 3.5 in 6k.SFRF4 94.75/95.00cs traded for 7 and 7.5 in 2k

- SFRH4 94.68/94.81/94.87/95.00c condor vs 94.62p, sold the put at 2.5 in 10k

- SFRM4 95.37/95.87/96.37c fly traded for 5 in 7.5k

- 0QZ3 95.75/95.43/95.06p fly 1x3x2 traded 5 in 2k

- 0QZ3 95.87c, traded 12.5 in 4k

- 0QZ3 95.43/95.62/95.81c fly traded 3.5 in 7k

- 0QZ3 95.62/95.50/95..7/95.12p condor traded 2 in 8k

- 0QH4 96.25/96.75/97.12c fly 1x3x2, traded 3 in 5.5k

EU FI OPTIONS: Large Euro And Bund Put Spread Buying Features Weds

Wednesday's Europe rates/bond options flow included:

- DUF4 105.70/105.50/105.20p ladder, sold at 6 in 2k

- RXF4 128.5/127ps, bought for 5.5 in 11.7k total now

- ERH4 96.25/96.375cs, bought for 3 in 4k

- ERH4 96.25/96.12ps 1x1.5, bought the 1 for 5.25 in 9k

- 0RZ3 96.87/96.75/96.62/96.50 put condor sees 4K given at 1 (potentially closing position)

- SFIF4 94.60/94.85/95.00c fly sold at 10.5 in 2k

US STOCKS: Late Weakness With Further Pullback From Earlier Resistance Rejection

- The S&P e-mini has tilted into mild negative territory (-0.1%) late in the session on no clear macro headlines. It more than erases what had been strong rally across European hours as the Waller-triggered rally extended into the NY open.

- The pullback came after ESZ3 touched 4597.00 (currently 4558) to stop fractionally short of key resistance at 4597.50 9 (Sep 1 high). The bull trigger is further out at 4685.25.

- In cash markets, real estate (+0.8%) is a clear beneficiary of the rates rally, along more surprisingly with financials (+0.6%), which in turn is led by banks (+1%) with gains across the board (the separate KBW index shows 2.1% gains for both major and regionals).

- Communication services (-1.1%) lag, hindered by heavy declines for Google (-1.6%) and Meta (-1.9%). Tech meanwhile is near unchanged, masking solid declines for large names with Microsoft (-1%) and Apple (-0.65%), Microsoft suffering as Amazon chose to enter the corporate AI space.

COMMODITIES: Crude Spikes Amid WSJ Reports Regarding OPEC Cuts

- Crude futures are nearing intraday highs as the US close approaches, with front-month WTI up 1.95% at typing. Prices spiked following headlines from the WSJ that OPEC is pondering production cuts of up to 1m b/d, pushing WTI towards its highest closing level since Nov. 14. OPEC+ is likely to rollover the existing output curbs but is considering additional production cuts up to 1m b/d, delegates told the WSJ Nov. 29.

- The trend outlook in WTI futures is unchanged and remains bearish, with moving average studies in a bear-mode position, highlighting a downtrend. However, as we approach the OPEC+ meeting, prices have narrowed the gap to key resistance, which remains unchanged at $79.65, the Nov 14 high.

- For Natural Gas, US Henry Hub has weakened on the day, despite some gains seen earlier in European hours, as strong domestic production and warmer weather put pressure on prices.

- Precious metals have consolidated the impressive move higher on Tuesday, moderately extending their rising trend. Spot gold stands 0.28% higher on the session, having briefly eclipsed the 2050 mark and closing in on the yearly highs.

- Unsurprisingly, the trend condition in gold remains bullish and this week’s strong rally reinforces this set-up. The clear break of resistance at $2009.4, the Nov 7 high, has confirmed a resumption of the uptrend and signals scope for an extension towards 2063.0, the May 4 high and a key resistance. Note the all-time high is at $2070.4 (Mar 8 ‘22).

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX:

1M 5.34281 -0.00554

3M 5.37709 -0.01113

6M 5.37111 -0.02329

12M 5.21319 -0.0506

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.32%, no change, $1593B

* Broad General Collateral Rate (BGCR): 5.30%, no change, $594B

* Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $578B

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $97B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $250B

Unchanged EFFR and Fed Funds volumes yesterday compared to Monday.

FED: RRP Usage Lifts Off Lowest Levels Since July 2021

- RRP usage increased $41B to $914B today, off the tight range of $866-873B seen since Friday for lows since Jul 2021.

- The number of counterparties was unchanged at 91, its lowest since mid Nov 2022.

- TD Securities before today's data: “The rapid decline in RRP usage has likely been fueled by expectations that the Fed is finished hiking rates and the sharp increase in bill issuance, which has led money funds to extend their WAMs. We expect RRP usage to fall to around zero by the end of 2024, allowing reserves to remain ample for the time being. If RRP facility usage continues to decline rapidly and the Fed does not cut rates, we estimate that QT could theoretically proceed until early 2025 before reserves reach levels consistent with scarcity.”

US DATA: GDP Surprises Stronger But Consumption Misses And Core PCE Softer

- Real GDP was stronger than first thought in Q3, revised to 5.15% annualized (cons 5.0, initial 4.88) in the 2nd Q3 release, from 2.06% in Q2.

- However, personal consumption was weaker than first thought, lowered to a still strong 3.59% (cons 4.0, initial 3.98) after 0.8% in Q2.

- Non-resi fixed investment (+0.18pps), public consumption (+0.15pps) and resi investment (+0.09pps) drove the revisions, offset a 0.25pps drag from personal consumption. Changes in inventories also were revised higher (+0.1pp to a strong +1.4pps).

- The story from the advance release was domestic demand strength landing alongside a strong bounce in changes in inventories. That still stands although the domestic demand strength is now seen as less driven by private consumption than first thought.

- Adding to the softer than expected real personal consumption growth, core PCE inflation also came in softer than expected at 2.31% (cons 2.4, initial 2.43%) in Q3.

- Looking ahead, the latest Atlanta Fed tracker for real GDP puts Q4 growth at 2.1%, i.e. back at the 1H23 pace of 2.15% for minimal payback from the booming Q3. GDPNow will be updated tomorrow after monthly PCE.

US DATA: GDI Continues To Offer A More Subdued Take Than GDP In Q3

- This release also sees the first release of gross domestic income (GDI), which increased just 1.47% annualized in Q3 after a downward revised 0.45% in Q2 (initial 0.72).

- It’s particularly lacklustre considering GDP growth was notched at 5.15% and it follows an average of just 0.5% annualized in 1H23.

- Averaging the two, real economic growth accelerated to 3.3% annualized in Q3 after an average 1.3% in 1H23. It follows two mixed years, with a tepid 0.3% Y/Y in 4Q22 after 4.9% in 4Q21 from the post-pandemic recovery.

BOE: A new era of more frequent communication? (1/2)

- It is notable that there has been a recent ramp up in communication from MPC members since the November meeting. It is also notable that there seems to be a much more coherent and consistent message in all the MPC speeches and comments.

- 2 week ago Greene (one of 3 members to continue to vote for a 25bp hike in November) seemed to subscribe to the Table Mountain view to some extent. She asked if rates were restrictive enough, but also said that she didn't think that markets had "clocked on" to higher for longer on a global basis yet (see more on here comments here).

- Another of November's hawkish dissenters Haskel said yesterday that "Rates will have to be held higher and longer than many seem to be expecting." Yesterday was the first time that he really seemed to be more aligned with Table Mountain rather than Matterhorn.

- We have also seen a number of interviews with Bailey recently in regional press. And the message at last week's TSC testimony was very much of higher for longer and risks are for more hikes.

BOE: A new era of more frequent communication? (2/2)

- The main question this raises: Are the MPC really uncomfortably with the number of cuts being priced in or are they communicating so frequently so as to stop a more aggressive rate cut path being priced for 2024 (which would therefore mean policy is less restrictive now).

- It only seems to be Mann (who has previously conformed more to Matterhorn) and Dhingra (who has serially dovishly dissented) that have now not publicly backed the Table Mountain view.

- We would also note that during the hiking cycle, MPC communication was a lot more sparse (and this dry spell of communication seemed to follow a Broadbent speech that said market participants overreact to MPC comments and don't interpret data enough themselves). It appears we are now in a new era of communication.

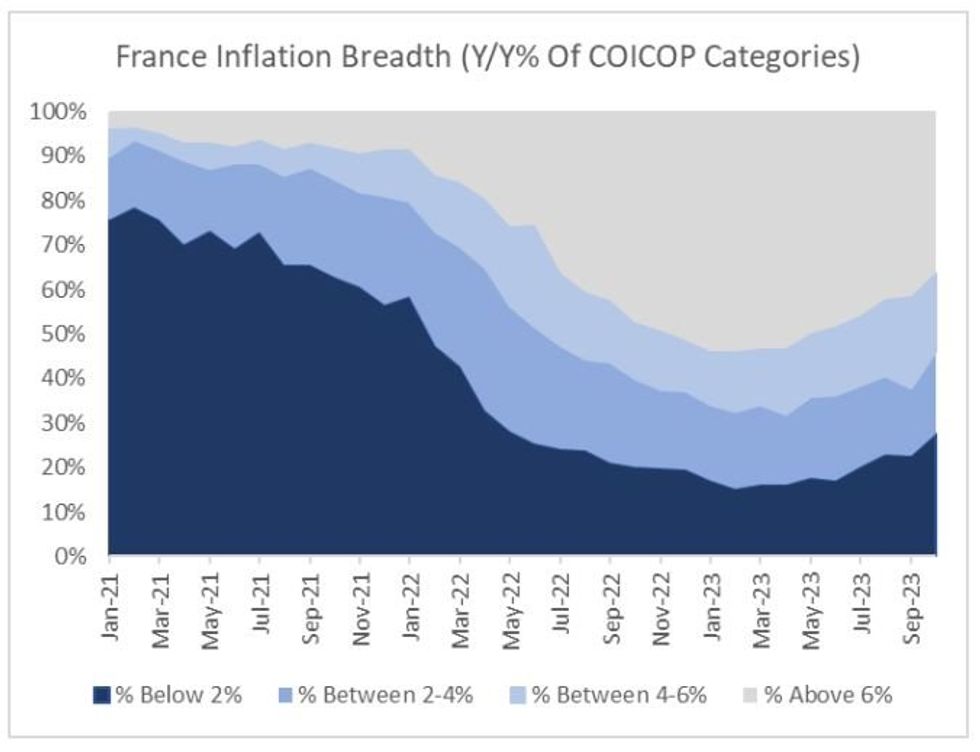

FRANCE: Nov Inflation Preview: Further Disinflationary Progress

France (20% of EZ HICP) – 0745UK Thu 30 November

- Consensus: HICP: 4.1% Y/Y (4.5% prior) / 0.0% M/M (0.2% prior)

- CPI: 3.7% Y/Y (4.0% prior) / 0.1% M/M (0.1% prior)

- French inflation is expected to continue moderating in November, with most estimates for headline HICP that we've seen in the low 4.0% Y/Y area (vs 4.5% prior).

- French October inflation came broadly in line with expectations for both CPI and HICP, with the annual CPI print driven lower by a slowdown in energy, food and non-energy industrial goods prices. Services prices were relatively sticky, however.

- MNI’s inflation breadth metrics indicate that 72% of components had Y/Y inflation rates above 2% in October, down from 77% in September.

- In November, energy price inflation is seen pulling the headline print down significantly with Goldman Sachs forecasting a fall in the category to 2.9% Y/Y (vs 4.9% prior).

- The November flash PMI indicated that rising output prices were driven by service sector firms, with higher input costs stemming from wage pressures.

Source: INSEE, MNI Calculations

Source: INSEE, MNI Calculations

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/11/2023 | 0030/1130 | * |  | AU | Building Approvals |

| 30/11/2023 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 30/11/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/11/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/11/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 30/11/2023 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 30/11/2023 | 0730/0830 | ** |  | CH | Retail Sales |

| 30/11/2023 | 0730/0730 |  | UK | DMO to publish gilt operations calendar for FQ4 | |

| 30/11/2023 | 0745/0845 | ** |  | FR | PPI |

| 30/11/2023 | 0745/0845 | ** |  | FR | Consumer Spending |

| 30/11/2023 | 0745/0845 | *** |  | FR | GDP (f) |

| 30/11/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 30/11/2023 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 30/11/2023 | 0800/0900 |  | EU | ECB General Council Meeting | |

| 30/11/2023 | 0855/0955 | ** |  | DE | Unemployment |

| 30/11/2023 | 0930/0930 |  | UK | Decision Maker Panel Data | |

| 30/11/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 30/11/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 30/11/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 30/11/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 30/11/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/11/2023 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 30/11/2023 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/11/2023 | 1330/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 30/11/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 30/11/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 30/11/2023 | 1330/1430 |  | EU | ECB's Lagarde at 5th ECB Forum | |

| 30/11/2023 | 1405/0905 |  | US | New York Fed's John Williams | |

| 30/11/2023 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 30/11/2023 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 30/11/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 30/11/2023 | 1600/1600 |  | UK | BOE's Greene speech at Leeds University | |

| 30/11/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/11/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 01/12/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.