-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Further Equity Gains Weigh On The Greenback

HIGHLIGHTS:

- Treasuries see a day lacking in direction, whilst more typical risk on flows see equities firm, in some cases to fresh record highs, and the USD index come under pressure.

- Crude futures are buoyed by the macro backdrop along with the continued fallout from Red Sea disruption.

- UK November inflation data headlines Wednesday’s early docket (preview below). Later on, US consumer confidence and existing home sales will also cross before 20Y Treasury supply.

US TSYS: Back Near Unchanged Whilst Lacking Direction

- Tsys trade back near unchanged, sitting between 1bp richer and 0.5bp cheaper in a session lacking direction on underwhelming volumes.

- The broad themes have been some dovish spillover from the BoJ overnight before paring those gains with particularly strong housing starts (caveated heavily by volatility within the report and a small miss for building permits).

- TYH4 has remained within yesterday’s range throughout, currently at 112-12 with volumes not yet ticking over 1M. Technical trends point to a bullish signal that highlights resistance at 112-28+ and 113-12+ (Fibo projection points).

- There is still Goolsbee (’25 voter) to come at 1800ET before tomorrow’s docket is headlined by existing home sales and Conf Board consumer confidence before the 20Y re-open.

US STIR: Fed Rate Path Intraday Lift Falls Short Of Yesterday’s Close

- Fed Funds implied rates haven’t been able to claw back earlier declines seen overnight post a non-hawkish BoJ and which carried on until stronger than expected US housing starts.

- There is a cumulative 20bp of cuts priced for March (vs 19bp yesterday), 43.5bp for May (from 40.5bp) and 142bp for end-2024 (from 141bp).

- Today’s two 2024 voters saw Barkin hold his cards close to his chest in an interview with Yahoo Finance whilst Bostic spoke in more detail, noting progress but still seeing a ways to go to get inflation back to target (whilst reiterating Friday’s comments about seeing two rate cuts in 2024, starting 2H24).

- Chicago Fed’s Goolsbee (’25 voter) is next up late today at 1800ET on Fox before returning for a WSJ podcast tomorrow.

EGBs-GILTS CASH CLOSE: BTP Outperforms Amid Broad Rally

European FI had a constructive session Tuesday, with BTPs outperforming in the space as risk assets gained.

- The German and UK curves bull flattened, initially helped by a dovish tone overnight from the BoJ at its meeting appearing to lack conviction on future policy normalisation. Yields didn't quite close on the lows, but thereabouts. Bund yields closed above 2%, with Gilts holding the May lows.

- But peripheries, led by Italy, were the star performers: 10Y BTP spreads posted their tightest close to Bunds since early August, now approaching the June 2023 low just above 156bp.

- No particular triggers were evident, with the benign PEPP runoff outlined by the ECB last week, and a risk-on atmosphere (equities gaining) today, helping narrow the spread. ECB speakers were largely shrugged off (Villeroy eyeing a rate "plateau" before cuts, Simkus pushing back on cuts).

- In data, final Nov Eurozone HICP was revised a touch lower on the M/M but unch from flash Y/Y; the underlying ECB metrics showed significant further disinflationary progress however.

- Wednesday's early highlight is UK CPI (our preview is here); later is a speech by ECB's Lane.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4bps at 2.513%, 5-Yr is down 5.2bps at 2%, 10-Yr is down 6.3bps at 2.016%, and 30-Yr is down 7.4bps at 2.205%.

- UK: The 2-Yr yield is down 2.7bps at 4.293%, 5-Yr is down 7.3bps at 3.676%, 10-Yr is down 4.3bps at 3.652%, and 30-Yr is down 2.5bps at 4.152%.

- Italian BTP spread down 7bps at 161.5bps / Spanish down 3.2bps at 94.4bps

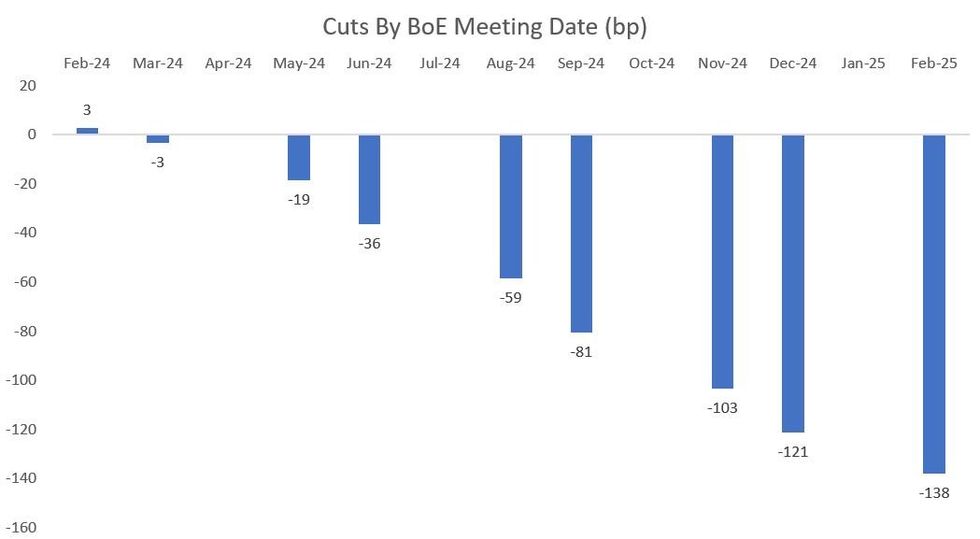

EU STIR: ECB / BoE Cut Pricing Extends

ECB and BoE cut pricing extended slightly Tuesday amid a wider fixed income rally, helped in part by a less hawkish BoJ meeting than had been expected overnight.

- There are 155bp of ECB rate cuts priced for 2024, around 4bp more than had been seen Monday - with the first cut firmly priced by April (32bp) and a decent chance implied of March (~40%).

- Two hikes are fully priced by June, a third (and nearly a fourth) by July, and a fourth/fifth by September and October respectively.

- Rates markets largely shrugged off ECB commentary included an arguably less dovish Villeroy (noting a "plateau" of rates ahead before a 2024 cut). ECB's Lane speaks Wednesday.

- BoE cut pricing currently shows 121bp of 2024 cuts priced, up 5bp on the day - with the first reduction by June, and two cuts by August / three by September, and four by November (the December pricing doesn't quite imply a 5th full cut).

- Comments by BoE's Breeden today didn't really move the needle. UK CPI is eyed as the next key catalyst Wednesday.

FOREX: 145.00 Caps Strong USDJPY Bounce, Risk On Weighs On Greenback

- An extension of recent risk optimism across equity markets on Tuesday weighed on the greenback overall, with the USD index falling around 0.35%, and in the process, narrowing back in on last week's four-month lows.

- Bucking this trend was a higher USDJPY, as a product of some notable JPY weakness overnight that extended across European hours. This was as a result of the Bank of Japan board deciding unanimously to keep yield curve control policy, including the negative interest rate, and pledged to continue patiently with monetary easing amid high uncertainty on economies and financial markets.

- Price action saw USDJPY rise to as high as 144.96, an impressive 271 pips off the earlier session lows. Given its previous significance, this seemed a good area for the rally to halt and the broader greenback weakness in US hours saw the pair fade back to just below the 144 handle.

- EUR/JPY was an outperformer, rising 1.25% on the session. Options volumes have been buoyed by trades consistent with sizeable call spreads that crossed in early Europe/very late Asia, and again at the NY crossover. Trades target upside in the cross via a 160/162 call spread, and captures the next BoJ rate decision on January 23rd. 6m implied vols in the cross remain supported despite the pullback from BoJ-inspired highs. The gauge trades either side of 10 points and looks to have bottomed out at end-November.

- Relentless optimism in equity markets also bolstered the likes of AUD and NZD. AUDUSD convincingly cleared $0.6735 (as well as $0.6691, the former bull trigger) to print the best levels since late July. The moves further narrow the gap with the next upside level of 0.6821, the Jul 27 high. Options markets moving in sympathy with spot so far Tuesday, prompting AUD/USD 1m risk reversals to edge to just 0.4 points in favour of puts, the small put premium since mid-2020.

- UK November inflation data headlines Wednesday’s docket. US consumer confidence and existing home sales will also cross.

FX OPTION EXPIRIES

Expiries for Dec20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0890-00(E1.3bln), $1.0950-60(E598mln), $1.0975(E547mln), $1.0990-00(E1.2bln)

- USD/JPY: Y143.45-50($854mln), Y144.00($1.1bln), Y145.00($1.8bln)

- AUD/USD: $0.6790-00(A$1.5bln)

- NZD/USD: $0.6200(N$547mln)

- USD/CAD: C$1.3390-00($1.0bln)

- USD/CNY: Cny7.1000($1.7bln)

Larger FX Option Pipeline

* EUR/USD: Dec21 $1.0850(E1.8bln), $1.0900-20(E2.5bln), $1.0950-70(E2.7bln), $1.1000(E1bln); Dec22 $1.0945-60(E1.7bln)

* USD/JPY: Dec21 Y144.75-80($1.0bln), Y145.00($1.2bln); Dec22 Y143.00($1.1bln), Y144.00($1.1bln), Y145.00($2.7bln) * GBP/USD: Dec21 $1.2600-20(Gbp1.3bln), $1.2745-50(Gbp1.0bln)

* AUD/USD: Dec21 $0.6800-15(A$1.3bln); Dec22 $0.6650(A$1.6bln), $0.6775(A$1.1bln)

* USD/CAD: Dec22 C$1.3500($1.3bln)

US FI OPTIONS: Tuesday Options Summary

Tuesday's US rates / bond options flow included:

- SFRF4 94.62/94.68cs sold at 6 in 7k

- SFRM4 94.00p, bought for 1.5 in 4k

- SFRM4 vs 0QM4 97.00/98.00cs spread, bought the mid for half and 0.75 in 2k

- SFRU4 97.00/98.00cs sold at 8 in 5k

- SFRU4 96.50/98.00cs vs 2QU4 97.00/97.37cs, bought the front for 4.5 in 7.5k.

- TYH4 108/111/114c fly sold at 62 in 25k.

EU FI Options: Large Call Structures Trade In Euro Rates Tuesday

Tuesday's Europe rates / bond options flow included:

- RXG4 135.50/132.50/129.50p fly bought for 41.5 in 3k

- 0RH4 98.00/98.25/98.50c fly, bought for 3 in 5k

- 0RH4 96.87/97.12/98.12/98.37c condor sold at 17.5 in 2.5k

- ERU4 97.25/97.50cs bought for 10.25 in 3k

US STOCKS: Maintaining Earlier Broad Gains After Fresh Record Highs For The Nasdaq 100

- US equity indices have held onto strong gains seen in the 90 minutes after the cash open, with ESH4 currently at 4813 still close to its earlier high of 4817.

- It has extended clearance of a major resistance at 4808.25 (Jan 4, 2022 high) and opens 4862.08 (Fibo projections of Nov-Dec price swing).

- In contrast to yesterday’s mega-cap driven increase, today’s gains are broader-based amidst broader risk-on flows with WTI strength and the USD index slipping.

- Within SPX, gains are led by energy (+1.1%) with crude futures seeing further strong gains in the face of the timeframe needed to establish a coalition in the Red Sea, communication services (+0.95%) and materials (+0.9%).

- As has been the case throughout the session, IT and consumer staples lag with near unchanged on the day.

- The Russell 2000 outperforms (+1.8%) although it would only be its largest increase since Thursday. It’s followed by the Dow (+0.5%), S&P 500 (+0.4%) and Nasdaq 100 (+0.3%), the latter trimming gains after touching fresh record highs of 16800.45.

COMMODITIES: Crude Supported By Continued Red Sea Fallout, Gold Boosted By USD Slipping

- Crude prices are approaching the US close trading solidly higher on the day, supported by a weakening in the US dollar and continued concerns over freight disruptions in the Red Sea.

- It pushes prices back towards yesterday’s highs as several companies shipping energy products have announced to pause shipments via the Red Sea, including Equinor and BP, sparking fears for supply passing through the Suez Canal.

- The US has put together a new naval task force to patrol the troubled area and protect commercial vessels, potentially taking weeks to be put in place according to Maersk. The Houthis warned the US they will be legitimate targets if they interfere in its ongoing operations against Israel-linked vessels.

- A new OPEC+ meeting is possible in the near future for the group to discuss the market situation but currently there is no need for new decisions, Russia Dep. PM Novak said, cited by Interfax.

- WTI is +1.3% at $73.44, with resistance seen at yesterday’s high of $74.61.

- Brent is +1.8% at $79.34, having peaked at $79.67 to push above yesterday’s high of $79.51 and open $80.65 (50-day EMA).

- Gold is +0.6% at $2039.48, gaining directly along with the drop in the USD index. An intraday high of $2046.97 saw it come close to last week’s highs after which lies resistance at $2054.3 (50% retrace of Dec 4-13 bear leg).

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX

1M 5.35756 -0.00036

3M 5.37462 0.00423

6M 5.25379 0.00252

12M 4.91941 0.0047

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.32%, no change, $1665B

* Broad General Collateral Rate (BGCR): 5.30%, no change, $629B

* Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $618B

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $95B

* Daily Overnight Bank funding Rate: 5.32%, no change, volume: $250B

FED: RRP Uptake Lifts For Second Day Off Lows

- RRP usage lifted $48B to $773B today, a second similar increase to move off Friday’s recent low of $683B.

- It came with the number of counterparties increasing by 1 to 87.

- Whilst pulling off latest lows, it doesn’t materially change the sizeable downward trend in take-up.

US DATA: Housing Starts Much Stronger Than Expected But With Large Caveats

- Housing starts were far stronger than expected in November (1560k vs 1360k) but the gloss was taken off by a small miss for building permits (1460k vs 1465k), with the latter typically far less volatile.

- With October starts actually revised down, it left starts surging 14.8% M/M in Nov and surprisingly driven by a 18% jump in single family vs 7% for multi-units.

- There were some particularly volatile readings by region: northeast starts surged 100% (single unit 43%) whilst Midwest starts increased just 1% but with single unit starts jumping 50%.

- Building permits meanwhile fell -2.5% after +1.8 M/M, comprised of single family +0.7% M/M vs multi-unit -8.5% M/M.

- The permits details continue to grow a growing divide between single and multi-unit permissions, although that’s only been a correction back closer towards historically relative shares.

CANADA DATA: BoC’s Preferred Core CPI Beats Expectations But Still Slows To 2.5% Annualized

- Headline CPI surprisingly held steady at 3.1% Y/Y (cons 2.9, analyst range 2.7-3.1) in November.

- Core rates should get more attention and these also were stronger than expected, with trim/median averaging 3.45% Y/Y (cons 3.35%), unchanged after a downward revised 3.55% Y/Y.

- The average of trim/median increased a seasonally adjusted 0.3% M/M whilst revisions in latest monthly were relatively limited - see below charts.

- It left 3-month core inflation slowing from 2.9% to 2.5% annualized (slowest since Feb’21) but the 6-month run rate increased a tenth to 3.3% annualized.

CANADA DATA: All Main Core Inflation Metrics See Acceleration On 6-Month Trend Basis

- The drift higher in the 6-month run rate of the BoC’s preferred trim and median core measures was more pronounced in traditional core metrics.

- Ex food & energy prices rising a second consecutive 0.40% M/M in Nov (Oct revised up from 0.34 to 0.40%) meant the 3-month lifted to 4.1% from 3.6% (initially 3.3%) and the 6-month rate lifted to 3.7% from 3.2% (initially 3.0%).

- CPIX meanwhile accelerated to 0.33% M/M after an unrevised 0.26%. This saw an unchanged 2.1% on a 3-month basis but the 6-month bounced from 2.3% back to 2.7% annualized.

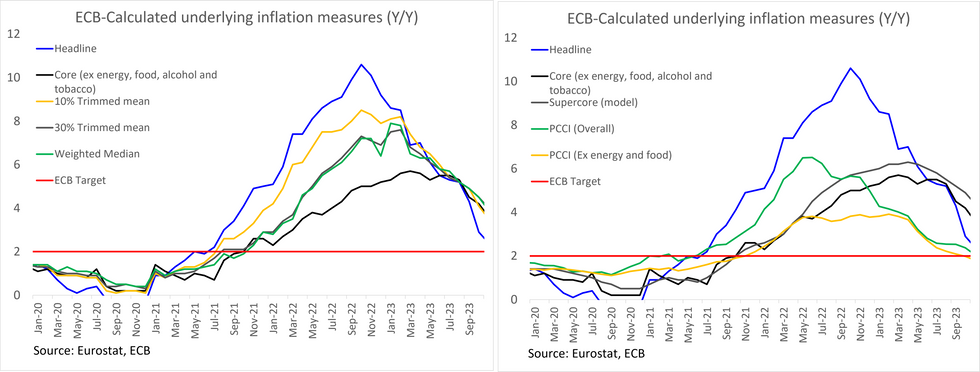

EUROZONE DATA: ECB's Underlying Metrics Show Further Deceleration In November

The ECB's underlying inflation metrics have been updated for the final Eurozone November HICP, and provide more evidence of strong disinflation.

- The overall PCCI (Persistent and Common Component of Inflation) index was 2.05% Y/Y (vs 2.37% in October, downwardly revised from 2.46% prior).

- The updated PCCI ex-energy and food readings were below 2% in October and November. The latest reading was 1.80% Y/Y, with October's revised down to 1.98% Y/Y (vs an unrevised 2.01% prior).

- The other underlying measures calculated by the ECB (Supercore, weighted median and 10/30% trimmed mean) also decelerated by -0.5 to -0.6pp in November.

- The 10% trimmed mean and weighted median measures fell below 4% for the first time since December 2021 and March 2022 respectively.

- A reminder that December HICP is expected to bounce back in December, in large part due to higher German energy prices (after subsidies depressed prices back in December 2022). However, focus will as always be on the progress of disinflation in core metrics.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 20/12/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/12/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 20/12/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 20/12/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 20/12/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 20/12/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 20/12/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 20/12/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/12/2023 | 1330/0830 | * |  | US | Current Account Balance |

| 20/12/2023 | 1400/1500 |  | EU | ECB Lane Speech On Euro Area Outlook | |

| 20/12/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/12/2023 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 20/12/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/12/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 20/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/12/2023 | 1830/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.