-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI ASIA MARKETS ANALYSIS - Geopolitical Risk At The Fore [corrected]

- Treasuries see a sizeable bear steepening despite paring losses after the 20Y auction traded through to break a four-auction streak of tailing offerings across tenors in late Sept-early Oct.

- Heightened geopolitical risk, evidenced by gold earlier clearing a key resistance level, has helped boost USD strength and seen equities slide.

- Ahead, Australian employment figures for September headline the overnight docket on Thursday, but attention will more firmly be on Chair Powell's appearance at the Economy Club of NY at 1200ET. It will be preceded by US initial jobless claims for a payrolls reference week plus Philly Fed manufacturing and existing home sales earlier in the US session.

US TSYS: Bear Steepening With TY Futures Firmly Clearing Latest Support

- Cash Tsys are off lows but have nevertheless seen a sizeable bear steepening today, with the front end currently little changed on the day but the longer end some 6-6.5bps cheaper. Gaza aid headlines appear to have helped the steepening.

- 20s have led, despite the 20Y auction trading through by 1.2bp to break a 4-auction streak of tailing offerings across tenors in late Sept-early Oct. That auction did however elicit a quick 3bp rally on the results that has ultimately held after some gyrations.

- TYZ3 has firmly cleared prior support at 106-03+ (Oct 4 low) with a low of 105-24, currently at 105-29 (-10) to next open 105-05+ (2% 10-dma envelope).

- You can see a round-up of Fedspeak from today’s US session in the previous STIR bullet, with Harker (’23 voter) currently speaking but no headlines as of yet after earlier telling the WSJ the Fed should extend its pause on rate hikes.

- Powell is clearly the main focus tomorrow at 1200ET, whilst data could provide some interest with initially jobless claims for a payrolls reference week along with existing homes sales and the Philly Fed manufacturing survey.

US STIR: Fed Cut Expectations Drift Lower Still, More Fedspeak Still To Come

- Fed Funds implied rates have unwound an intraday lift and are back close to where they were at the NY crossover, although a tilt higher further out to 2024 sees new recent lows for cut expectations.

- It sees a rate path hold about half of yesterday’s retail sales induced increase for near-term meetings but implied rates for later into 2024 has slightly extended those increases.

- Cumulative hikes from 5.33% effective: +1.5bp Nov (-1.5bp on the day), +10.5bp Dec (-1bp) and +14bp Jan for a terminal 5.47% (-1bp).

- Cuts from terminal: 23bp to Jun’24 and 68bp to Dec’24, the latter on track for closing at a new low for recent months, pushing below the 71bp seen after the hawkish Fed dot plot on Sep 20 even if the Dec’24 rate of 4.79% remains below the 2024 median dot of 5-5.25%.

- Fedspeak recap: Hawkish commentary from Gov. Waller, including: robust supercore in the last two months is not at a level needed to make progress toward our goal and we need to watch and see if these numbers indicate that inflation is reaccelerating; additional policy tightening would likely be needed if the real economy continues showing underlying strength and inflation appears to stabilize or reaccelerate, and don’t want to address rate cuts when hikes not stopped).

- NY Fed’s Williams meanwhile noted there are still a ways to go despite inflation progress and need to keep rate restrictive for some time.

- Still to come, Harker ongoing and Gov. Cook on the Fed’s mandate at 1855ET, both with text. Plenty more Fedspeak lined up tomorrow, headlined by Powell at the Economic Club of NY, including prepared remarks.

FOREX: NZDUSD Trades To Fresh 2023 Lows, Pressure On EMFX

- The greenback traded with a consistent upward bias throughout Wednesday’s session, with waning equities prompting haven demand, however, gains for the USD index have been limited to 0.25% as we approach the APAC crossover.

- Losses for G10 majors were broad based but particular weakness was seen for the likes of the Australian dollar and specifically NZD, which extended Tuesday’s downward momentum following the lower-than-expected inflation data in New Zealand.

- This prompted NZDUSD to register losses of 0.60% and in the process, the pair has traded to fresh 2023 lows of 0.5851, with not much in the way of short-term meaningful technical support.

- GBP also shrugged off some post-CPI demand to trade in negative territory as we approach the close. As previously noted, GBPUSD trend conditions remain bearish, and bounces continue to be considered corrective. A continuation lower would refocus attention on support and the bear trigger, at 1.2037, the Oct 4 low.

- A quick mention for USDJPY, which despite remaining void of any notable volatility, continues to tick higher and narrow the gap once more with 150.00. Market participants have been unable to brush off the rising yields, however, remain wary of both looming verbal and actual intervention from the MOF.

- Elsewhere the higher long-end US yields and wilting equities induced some substantial weakness for some emerging market currencies. In particular, the Mexican peso declined 1.3% with the likes of PLN and ZAR also declining 1%.

- Australian employment figures for September headline the overnight docket on Thursday, which will be followed by US jobless claims, Philly Fed and potential comments from Fed Chair Powell, due to speak at the Economic Club of New York Luncheon.

FX Expiries for Oct19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0560(E823mln), $1.0600(E515mln)

- USD/JPY: Y147.90-00($564mln), Y149.45-50($724mln), Y150.00($753mln), Y150.50($769mln)

- GBP/USD: $1.2142-60(Gbp1.1bln), $1.2200-15(Gbp2.8bln)

- EUR/GBP: Gbp0.8600-15(E1.1bln), Gbp0.8700(E618mln)

- NZD/USD: $0.5920-40(N$980mln)

- USD/CNY: Cny7.2500($1.1bln), Cny7.2825($1.2bln), Cny7.3500($1.4bln)

EGBs-GILTS CASH CLOSE: UK Yields Test Month's Highs Post-CPI

Gilts sold off sharply Wednesday, as both core EGB and UK curves steepened.

- A variety of factors weighed on global core FI, with geopolitics at the fore once again in European afternoon trade with news that Israel would allow humanitarian aid to move from Egypt to Gaza.

- The Gilt selloff came despite a relatively muted immediate reaction to the September UK inflation data which was not seen as significantly altering the BoE outlook (readings were slightly above consensus, but headline and services CPI were below the BoE's August forecasts - see our review here).

- Only later in the session did UK rates really begin to weaken, with 5Y Gilts ultimately underperforming on the day.

- Periphery EGB spreads widened amid a weak session for equities. Spread widening was led by Italy, with an exchange auction potentially also weighing.

- Supply remains a theme Thursday, with Spanish and French bond auctions. The data docket is comparatively light, with French confidence indicators the highlight; we also hear from ECB's Visco and Valimaki.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.9bps at 3.199%, 5-Yr is up 2.8bps at 2.841%, 10-Yr is up 4.2bps at 2.924%, and 30-Yr is up 4.5bps at 3.097%.

- UK: The 2-Yr yield is up 12.3bps at 5.007%, 5-Yr is up 15.1bps at 4.7%, 10-Yr is up 14.5bps at 4.657%, and 30-Yr is up 10.3bps at 5.039%.

- Italian BTP spread up 5.1bps at 205.8bps / Greek up 2.4bps at 150bps

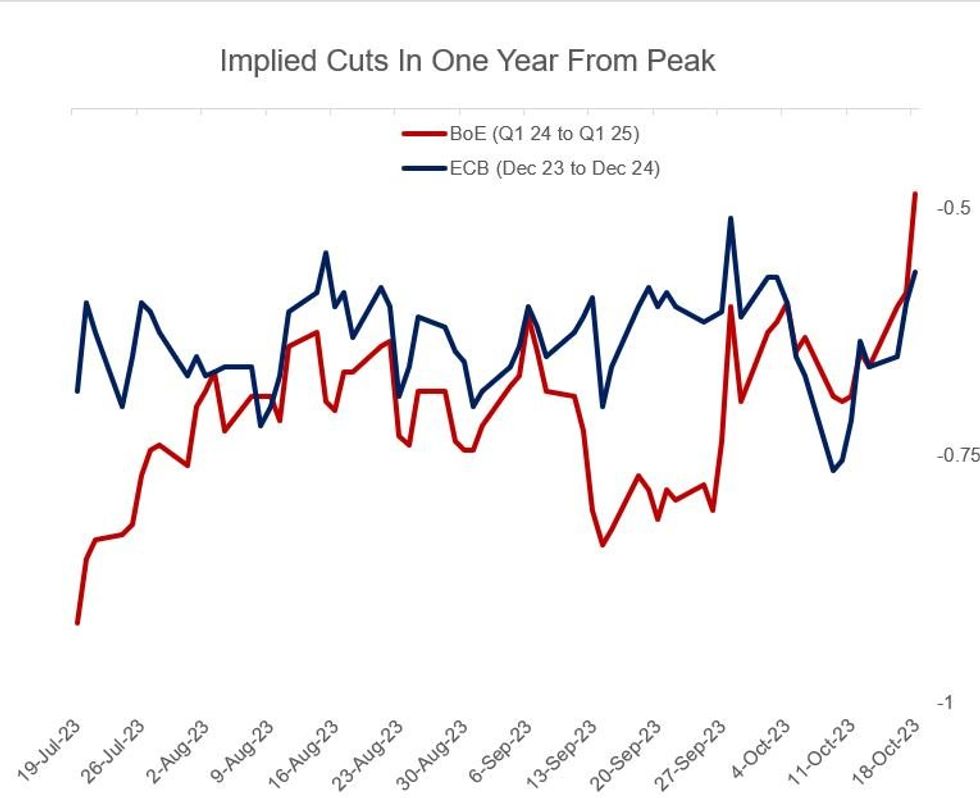

EU STIR: Implied BoE / ECB Cuts Pull Back

Implied ECB and BoE rate cuts were priced out Wednesday, with UK terminal rates sharply higher after today's CPI report.

- The September UK CPI report was not seen as game-changing (a beat on likely transitory factors), and pricing for the November MPC actually pulled back slightly on the day (1bp, currently implying 22% prob of a 25bp hike).

- But in a sell-off that kicked off in the afternoon session, terminal pricing picked up 4bp - now suggesting more than 18bp of hikes left in the cycle to Feb 2024. Rate cuts were priced out, with roughly 48bp in reductions seen in the year following the peak - 10bp less cuts than had been seen at Tuesday's close and vs 80bp as recently as late September.

- ECB hike pricing was little changed, though like the UK, implied rates suggested a pullback in cut expectations - by 3bp (from 60bp to 57bp) in 2024 after the peak in Dec 2024. There's still just 3bp of further hikes seen to the peak, with zero chance foreseen of a hike next week.

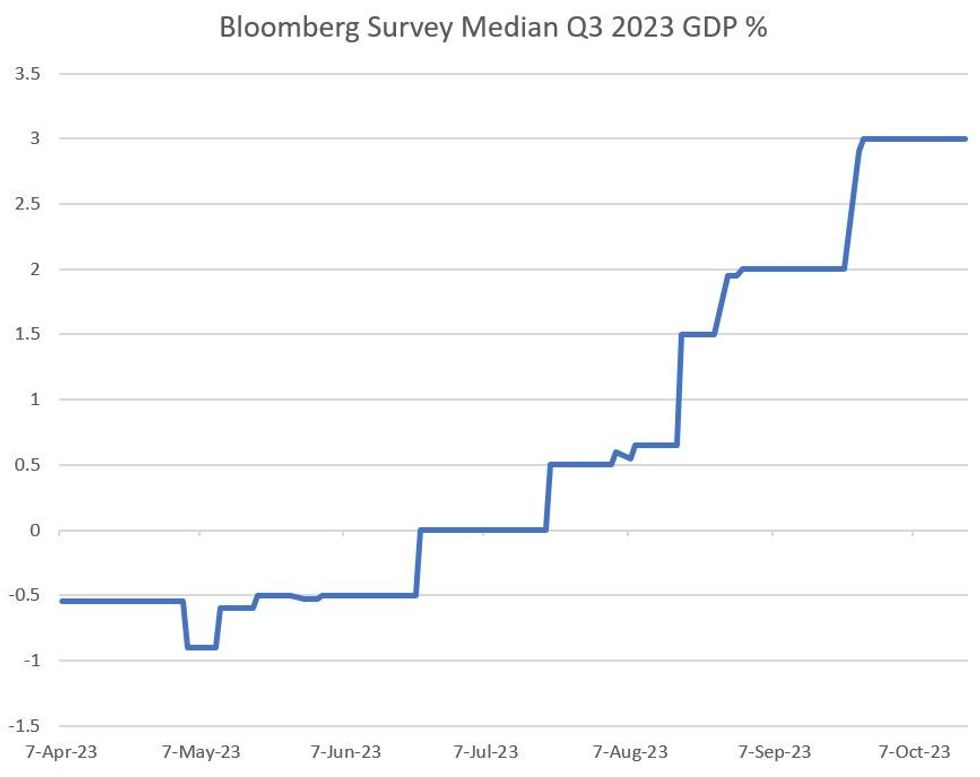

US: Q3 GDP Growth Eyed Above 4%, Led By Consumers

Tuesday's strong September retail sales control group reading (which is an input to GDP) of 0.6% M/M has spurred some upward revisions to Q3 GDP estimates, not least yesterday's Atlanta Fed GDPNow from 5.15% to 5.44%.

- Expectations are building that Q3 annualized GDP will come in well above the 3.0% BBG September survey median and 2.1% in Q2, and in any case well above potential growth - led by strong private consumption and residential investment, with government consumption and net exports also likely boosting the headline figure.

- Post-retail sales, Deutsche Bank upped its estimate from 4.1% to 5.2%; JPMorgan similarly, from 3.5% to 4.3%; Goldman Sachs from 3.7% to 4.0%. CIBC noted potential upside risks to their 3.9% projection but also noted that the strength in consumption momentum "implies a very strong start to GDP growth in 23Q$, where we had expected a slowdown just below 1%).

- We get the Q3 advance GDP reading on Oct 26 - less than a week from the FOMC decision on Nov 1 and in the midst of the pre-meeting blackout period for Fed speakers.

- A blowout number won't spur a November hike but will be hard for the FOMC to ignore in the deliberations and communications, with participants at the Sept meeting having seen Q3 growth running at a "solid" pace which may be understating the case.

- There hasn't been a 3%+ GDP reading since 2021 and as recently as June the Bloomberg median expectation was negative.

EQUITIES: Higher Yields And Geopolitical Risk Weigh Heavily

- Equities have been increasingly under pressure today, hit by a combination of a small further trimming of Fed rate cut expectations, a more notably push higher in long-term yields (~7bps cheaper) and geopolitical tensions which saw gold earlier clear a key resistance level and with spot currently +1.6% on the day.

- A reasonable bounce after the 20Y Tsy auction traded through proved short-lived, with the S&P e-mini since extending to a new low of 4343.75, currently only a few points higher for -1.2% on the day. Support is still some way off though, at 4299.5 (Oct 10 low).

- Moves lower have come with multiple large sell programs with collections of greater than 1000 name clips in the TICK index.

- The Nasdaq 100 e-mini trades in line at -1.3% as it pulls back from yesterday’s underperformance, whilst the Russell 2000 slips -2.0% for stark underperformance after strong relative gains yesterday.

- Earnings: Some large names still to come with or after the close, including Netflix (~0.4% SPX weighting, 1600ET) and Tesla (2%, after). Tomorrow includes Philip Morris, Union Pacific and AT&T (cumulatively almost 1%) ahead of the open.

COMMODITIES: Gold Clears Key Resistance And Crude Takes Step Closer To Bull Trigger

- WTI rallied off earlier lows during US trading amid a large crude draw for decade low stock levels. Tight market and concerns over escalation in the Middle East add further support.

- The US plans some oil-related sanctions relief for Venezuela beginning almost immediately in response to Tuesday’s election deal between Venezuela govt and opposition, according to a senior state dept official. The US is issuing licenses to broadly ease sanctions on Venezuela’s oil and gas sector, including its business with Caribbean nations.

- The Iranian Foreign Minister Hossein Amirabdollahian calls for a “full and immediate boycott” of Israel by Muslim countries, the expulsion of Israeli ambassadors and an oil embargo against Israel, according to statement by ministry on Telegram.

- OPEC is not planning to hold an extraordinary meeting or to take immediate action following calls by Iran for Muslim countries to impose an oil embargo on Israel, according to Reuters’ sources.

- WTI is +2.0% at $88.42, off an earlier high of $89.88 which pushed through $89.59 (Oct 4 high) to open a bull trigger at $95.03 (Sep 28 high).

- Brent is +1.7% at $91.46, off a high of $93.00 which took a step closer to a bull trigger at $95.35 (Sep 28 high).

- Gold is +1.5% at $1951.00 as geopolitical risk dominates a further climb for US Treasury yields and renewed USD strength. It cleared a key resistance at $1953.0 (Sep 1 high) to open $1965.5 (61.8% retrace of May 4 – Oct 6 bear leg), coming close with a high of $1962.64 before it was helped lower by headlines of Gaza humanitarian aid being allowed to pass from Egypt.

US FI OPTIONS: Rate Upside Faded

Wednesday's US Treasury/rate options flow included:

- TYF4 116/118cs, bought for 2 in 10k

- SFRM4 94.37/95.75 RR, sold the call at half in 6k

- SFRZ3 94.62/94.68/94.75/94.81c condor, bought again for 0.75 in 7.5k total

- SFRX3 94.56/94.68/94.81c ladder, traded 1 in 5k

- SFRX3 94.50/94.68/94.87c fly, traded 4.25 in 5k

- SFRZ3 95.00/94.43/94.37/94.25p condor traded 2 in 2.5k

- SFRZ3 94.62/94.68/94.75/94.81c condor traded 0.75 in 2.5k

- SFRF4 94.62/94.75/94.87/95.00c condor traded for 1.5 in 2k

- SFRG4 94.25/94.00ps, traded 2.25 in 7.5k

- SFRG4 94.43/94.18ps 1x2 traded 2.75 in 2.5k

- SFRG4 94.25/94.00ps traded 2.25 in 2.6k (Block)

- SFRH4 94.37/94.62/94.87c fly traded 6.5 in 5k (block)

- 0QX3 95.25p traded 15.5 in 8.5k

- 0QX3 96.00/96.50/95.00p ladder traded 29 in 4k

- 0QZ3 95.87/96.25/96.50c fly traded 2 in 2.5k

- 2QX3 97.75/97.50/95.93/95.68p condor, traded 10 in 10k

- 0QX3 95.25^ sold at 30.5 in 1k

- 0QX3 95.50c, sold at 7 in 2.5k

EU FI OPTIONS: Leaning Toward Downside Wednesday

Wednesday's Europe rates / bond options flow included:

- RXX3 127/126ps 1x2, bought the 1 for 6 in 2.5k

- RXZ3 129/131/133c fly, bought for ~28 in 6k

- ERZ3 95.87/95.75ps 1x2, bought for half in 3.5k

- SFIX3 94.65/94.8/94.9 broken call fly bought for 5.25 in 4.2k

- SFIZ3 94.40/94.50cs, sold at 8.25 in 5k

FED: Reverse Repo Usage Lifts With Counterparties Spike

- *108 COUNTERPARTIES TAKE $1.151 TLN AT FED REVERSE REPO OP. – bbg

- Usage lifted by $68B from yesterday as 14 additional counterparties take part.

- The rise in counterparties around the 18th is expected as GSE cash enters funding markets, but it's nevertheless the highest since the month-/quarter-end on June 30 with 109 counterparties.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/10/2023 | 0030/1130 | *** |  | AU | Labor Force Survey |

| 19/10/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 19/10/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 19/10/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 19/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/10/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/10/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/10/2023 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 19/10/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/10/2023 | 1600/1200 |  | US | Fed Chair Jerome Powell | |

| 19/10/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 19/10/2023 | 1720/1320 |  | US | Chicago Fed's Austan Goolsbee | |

| 19/10/2023 | 1730/1330 |  | US | Fed Vice Chair Michael Barr | |

| 19/10/2023 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic | |

| 19/10/2023 | 2130/1730 |  | US | Philadelphia Fed's Pat Harker | |

| 19/10/2023 | 2240/1840 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.