-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: In-Line PCE, Contracting PMI Friday

- Treasuries rebounded from midweek selling after dovish (no-hawkish) economic data Friday.

- PCE in-line with expectations, Chicago PMI weaker than expected and lower than the April read.

- Decent two-way trade going into month end, the Federal Reserve enters Blackout at midnight.

US TSYS Rates Off Midweek Lows Ahead Fed Blackout Start

- Treasuries continued to rebound off midweek lows Friday, rebounding/extending highs after in-line PCE Deflator MoM (0.3% vs. 0.3% est); YoY (2.7% vs. 2.7% est) and PCE Core Deflator MoM (0.2% vs. 0.2% est); YoY (2.8% vs. 2.8% est). Meanwhile, Personal Income (0.5% vs. 0.3% est), Personal Spending (0.2% vs. 0.3% est).

- Treasury futures continued to extend session highs, Sep'24 10Y closing in on initial technical resistance of 108-31 (20-day EMA) after latest Chicago PMI data came out lower than expected at 35.4 vs. 41.1 est, and weaker than prior 37.9 in April.

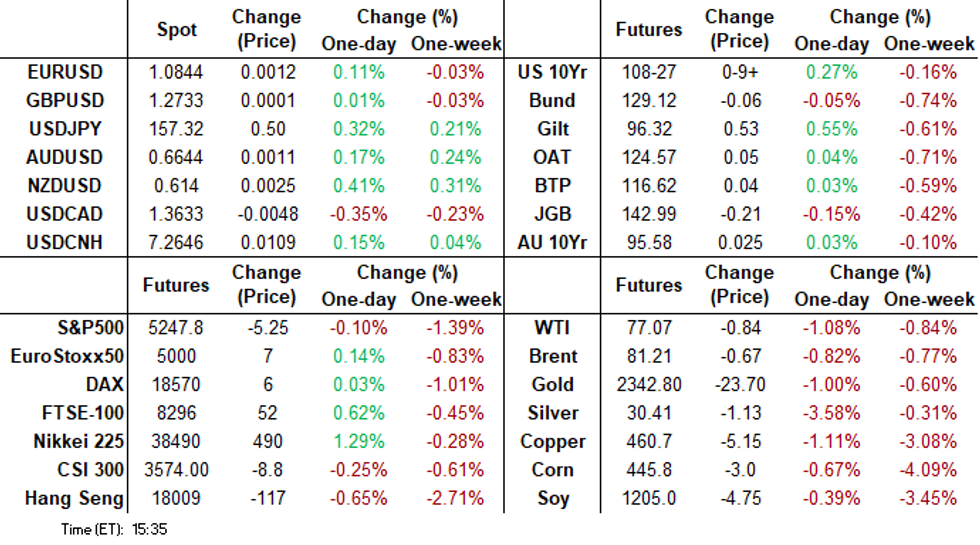

- Current cash yields lower: 2s -.0438 at 4.8810%, 10s -.0396 at 4.5065%, 30s -.0303 at 4.6491%, while curves inch off earlier flatter levels: 2s10s +0.432 at -37.860, 5s30s +1.724 at 12.786.

- Holding steady for the next couple meetings -- late year rate cut projections have gained slightly post data: June 2024 at -0% w/ cumulative rate cut 0.0bp at 5.328%, July'24 at -12% w/ cumulative at -3.5bp at 5.293%, Sep'24 cumulative -14.7bp (-13.9bp pre-data), Nov'24 cumulative -21.7bp (-20bp pre-data), Dec'24 -35.5bp (-32.9bp pre-data).

- Reminder, the Federal Reserve enters it's self imposed policy blackout at midnight, running through June 13, the day after the next FOMC policy announcement.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00063 to 5.32981 (+0.00203/wk)

- 3M -0.00324 to 5.34284 (-0.00004/wk)

- 6M -0.01146 to 5.31419 (-0.00215/wk)

- 12M -0.02604 to 5.20197 (+0.00168/Wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.00), volume: $1.824T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $746B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $725B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $271B

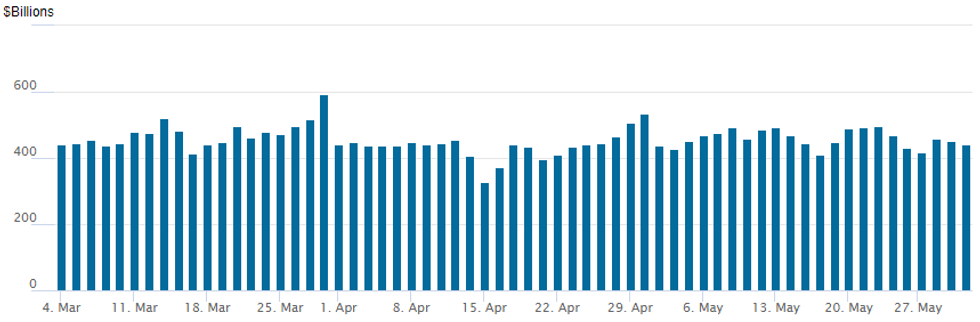

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage recedes to $439.806B from $452.034B prior; number of counterparties 71. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options continued to favor upside calls as underlying futures rallied off dovish (non-hawkish) data this morning. Holding steady for the next couple meetings -- late year rate cut projections have gained slightly post data: June 2024 at -0% w/ cumulative rate cut 0.0bp at 5.328%, July'24 at -12% w/ cumulative at -3.5bp at 5.293%, Sep'24 cumulative -14.7bp (-13.9bp pre-data), Nov'24 cumulative -21.7bp (-20bp pre-data), Dec'24 -35.5bp (-32.9bp pre-data).- SOFR Options:

- -5,000 SFRZ4 94.68/94.81 put spds, 4.5 ref 95.015

- -10,000 0QU4 95.00/96.50 put over risk reversals 1.0-1.5 vs. 95.59/0.28%

- +5,000 0QN4 95.75/96.00 1x2 call spds 1.5 vs. 95.55/0.08%

- -3,000 SFRZ4 94.62/94.87 put spds, 9.5

- 11,800 SFRZ4 96.00 calls, 5.0 ref 95.00 to -00.5

- 2,500 SFRZ4 94.68 puts

- +5,000 SFRV4/SFRZ4 94.68 put spds, 2.0 ref 94.99 to -.995

- 2,000 SFRQ4 95.00/95.12/95.25 call flys, ref 94.805

- 1,000 SFRQ4 94.68/94.81/94.93 put flys, ref 94.805

- Treasury Options: Late weekly midcurve block/strip, more on screen

- Block, +30,000 wk1 (Jun 7 exp) 10Y 109.5 calls at 9 w/

- Block, +50,000 wk2 (Jun 14 exp) 5Y 106.25 calls at 14.5

- 1,800 TUQ4 101.62/102 2x1 put spds

- +4,000 TYN4 107.5/109.5 risk reversals, 4 ref 108-25

- -5,000 TYN4 107 puts, 7 ref 108-24

- 4,000 USQ4 98/103 put spds

- 2,500 USN4 112 puts, 13 last

- Block, +30,000 wk1 (Jun 7 exp) 10Y 109.5 calls at 9 w/

FOREX USD Index Broadly Unchanged, EURJPY Remains on Front Foot

- The USD index remains broadly unchanged on Friday as the mixture of lower US yields and a reversal lower for major equity indices provided mixed signals for the greenback. Marginally higher-than-expected inflation data for the Eurozone keeps EURJPY on the front foot, rising around 0.4% on the session. Sights are on 171.56, the Apr 29 high and a key resistance. A break of this hurdle would confirm a resumption of the uptrend.

- The Swiss Franc goes from the strongest performer in G10 on Thursday to one of the weakest through Friday’s session. We pointed out that moves in both EURCHF & USDCHF appeared corrective at this stage, at least from a technical standpoint, however upcoming CPI data will likely be the key driver of short-term CHF sentiment.

- EUR/CHF remains below the 20-day EMA and the next support to watch lies at the 50-day EMA (0.9778). A clear break of this average would signal potential for a deeper retracement and expose the May 3 low (0.9730).

- Overall conditions for EURGBP remain unchanged and a bearish theme is in play. Key supports have recently been pierced; the 0.8500 pivot level, and an important support zone between 0.8498, the Feb 14 low, and 0.8493, the Aug 23 ‘23 low. We have pointed to a clear break of these price points as strengthening the bearish technical theme.

- However, despite multiple tests below the key 0.8500 mark, both this week and across the past year, EURGBP has been unable to close below this level since August 2022. A stronger recovery would target initial firm resistance at 0.8540, the 20-day EMA. Above here, the Apr 23 high and bull trigger is at 0.8645.

- Next week’s key event risk will be the ECB decision as markets try to gauge expectations for future policy decisions, with today’s data potentially paving the way for a cautious/hawkish hold. Separately, US jobs data will provide the latest key data point heading into the June FOMC meeting.

FX Expiries for Jun03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0805(E881mln), $1.0850-70(E2.0bln), $1.0900(E521mln)

- USD/JPY: Y154.93-00($1.7bln), Y157.00($624mln), Y158.00($832mln)

- USD/CAD: C$1.3520($520mln)

Late Equities Roundup: Chip Stocks, Broadline Retailers Underperform

- Stocks remain mixed in late afternoon trade, the DJIA outperforming weaker S&P Eminis and Nasdaq stocks after the the latter posted moderate gains on the open. Stocks traded firmer after this morning's economic data helped rekindle modest rate cut pricing this morning.

- Support didn't last long, however, amid broader risk-off tone ahead the weekend. Currently, the DJIA is up 267.43 points (0.7%) at 38378.56, S&P E-Minis down 15.5 points (-0.3%) at 5237, Nasdaq down 196.4 points (-1.2%) at 16539.88.

- Information Technology and Consumer Discretionary sectors continue to underperform in late trade, semiconductor makers weighing on the former amid broad based profit taking ahead of the weekend: Monolithic Power -4.25%, Lam Research -4.21%, Broadcom -3.59%. Shares of automakers and broadline retailers weighed on the Consumer Discretionary sector: Amazon -2.87%, Tesla -1.81%.

- On the flipside, Energy and Real Estate sectors led gainers in the second half, oil and gas shares buoyed the former: Valero +3.64%, Marathon Petroleum +2.81%, Phillips66 +2.73%. Investment trusts, particularly office and retail REITs supported the Real Estate sector for the second day running: Boston Properties +3.69%, Ventas +2.69%, Kimco +2.28%.

- Meanwhile, still some notable earnings releases next week: Bath & Body Works, Crowdstrike, HP, Dollar Tree, Campbell Soup, Five Below Inc, Victoria Secret, Toro, Vail Resorts and Docusign.

E-MINI S&P TECHS: (M4) Support At The 50-Day EMA Remains Intact

- RES 4: 5417.75 2.00 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5400.00 Round number resistance

- RES 2: 5372.73 1.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5265.72/5368.25 High May 23 and bull trigger / 20-day EMA

- PRICE: 5236.00 @ 1505 ET May 31

- SUP 1: 5230.75 Intraday low

- SUP 2: 5209.88 50-day EMA

- SUP 3: 5099.25 Low May 3

- SUP 4: 5036.25 Low May 2

The uptrend in S&P E-Minis remains intact, however, a corrective cycle has resulted in a pullback from the recent high of 5368.25 (May 23). The contract has traded through the 20-day EMA and this exposes a firmer support at 5209.88, the 50-day EMA. A clear break of this average would signal scope for a deeper retracement. On the upside, a resumption of gains and a break of 5368.25, would confirm a resumption of the uptrend.

COMMODITIES WTI Lower Ahead of OPEC+ Meeting

- WTI is set to close the day trading lower as the market awaits the OPEC+ meeting June 2. A weaker US economic outlook and a muted start to the US summer driving season are adding pressure.

- WTI Jul 24 is down 1% at $77.1/bbl.

- OPEC+ is working on a complex production cut deal for 2024-2025 for its June 2 meeting according to Reuters sources.

- Spot gold is down by 0.7% to $2,326/oz, leaving the yellow metal marginally lower on the week.

- A short-term bear cycle in gold remains in play, for now, although the recent move down appears to be a correction that is allowing an overbought condition to unwind.

- A resumption of gains would open $2452.5 next, a Fibonacci projection. The 50-day EMA, at $2307.8, represents a key support.

- Meanwhile, silver is underperforming today, down by 2.7% at $30.3/oz, unwinding the previous gains over the week.

- Silver maintains a bullish theme and the latest move down appears to have been a correction.

- On the upside, attention remains on $33.887 next, a Fibonacci projection. A key support zone to watch lies between $30.097-28.351, the 20- and 50-day EMA values.

- Copper has fallen by a further 1.0% today to $461/lb, taking the weekly loss to 3%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/06/2024 | 2300/0900 | ** |  | AU | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0030/0930 | ** |  | JP | S&P Global Final Japan Manufacturing PMI |

| 03/06/2024 | 0145/0945 | ** |  | CN | S&P Global Final China Manufacturing PMI |

| 03/06/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/06/2024 | 0715/0915 | ** |  | ES | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0750/0950 | ** |  | FR | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0755/0955 | ** |  | DE | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (f) |

| 03/06/2024 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 03/06/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/06/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (final) |

| 03/06/2024 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/06/2024 | 1400/1000 | * |  | US | Construction Spending |

| 03/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/06/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.