-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: July Funds Pricing in 25Bp Hike

- MNI US: Debt Limit Talks To Continue Virtually Today

- MNI US: McCarthy-'Progress' Made On Debt Ceiling, But Now In 'Crunch Time':

- REPUBLICAN NEGOTIATOR GRAVES SAYS NO PROGRESS MADE IN DEBT CEILING TALKS AFTER 7:30 P.M. (2330 GMT) ON THURSDAY -CNN PRODUCER ON TWITTER - Reuters

- MESTER: 'EVERYTHING IS ON THE TABLE' AT JUNE FED MEETING, Bbg

- FED'S MESTER: DATA CONFIRMING INFLATION IS STILL TOO HIGH .. PCE INFALTION DATA UNDERSCORED SLOW PROGRESS ON INFLATION - Reuters

Key Links: MNI INTERVIEW: Fed Needs Limit On Reverse Repo - McAndrews / MNI INTERVIEW: Companies' Contribution To US Inflation Falling / MNI GLOBAL WEEK AHEAD: Eyes on EZ CPI & US Nonfarm Payrolls

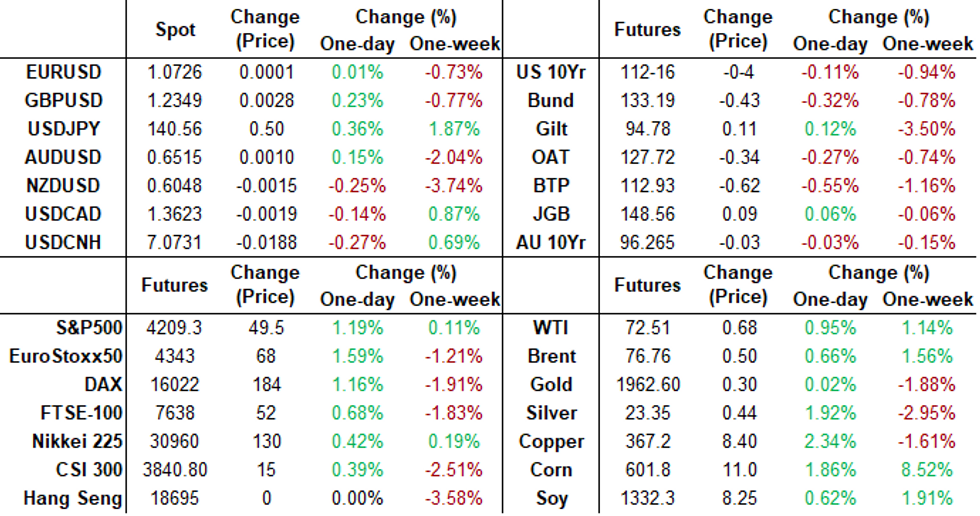

US Tsys: Markets Roundup July Funds Pricing 25Bp Hike

Treasury and SOFR futures trading weaker after the early exchange close ahead of the Memorial Day holiday weekend. Front month 10Y futures are currently trading -5 at 112-15 vs. 112-05.5 lows, curves extending inversion on the day are off session lows: 2s10s at -76.594 (-4.832) vs. -78.792 low.- Fast two-way trade reported as Treasury futures reversed gains following flurry of data: Durable Goods Orders +1.1 vs. -1.0% est, PCE +0.4% vs. +0.3% est. Core PEC and Non-Housing Services Surprisingly Accelerate In April.

- Core PCE inflation was stronger than expected in April at 0.380% M/M (cons 0.3) after a stronger skew to Q1 revisions from yesterday’s quarterly data. Q1 was revised up from 4.94% to 4.96% annualized but it consisted of larger upward revisions in Feb and Mar with a partly offsetting lower figure back in January.

- Rates bounced briefly following slightly higher than expected UofM Sentiment at 59.2 vs. 58.0, 1Y inflation expectation lower than estimated at 4.2%.

- Projected policy moves have risen to the top of the range since Wednesday's FOMC minutes showed officials split on the early May hike: Fed funds implied 25bp hike at the next FOMC on June 14 has climbed to 16.1bp.

- July cumulative is +25.5bp at 5.328%, November cumulative 7bp at 5.144%, Dec'23 cumulative -7.7bp at 4.994%, while Jan'24 cumulative is -22.9bp (vs. over a full point earlier in the month) at 4.743%. Fed Terminal has climbed to 5.32% in Aug'23 this morning.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01765 to 5.15344 (+.05971/wk)

- 3M +0.03846 to 5.26374 (+.10027/wk)

- 6M +0.06018 to 5.29836 (+.15183/wk)

- 12M +0.09923 to 5.10171 (+.22405/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00257 to 5.06543%

- 1M -0.00629 to 5.15371%

- 3M +0.01257 to 5.47571 */**

- 6M +0.01686 to 5.58100%

- 12M +0.03772 to 5.66029%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.47571% on 5/26/23

- Daily Effective Fed Funds Rate: 5.08% volume: $131B

- Daily Overnight Bank Funding Rate: 5.07% volume: $285B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.537T

- Broad General Collateral Rate (BGCR): 5.05%, $602B

- Tri-Party General Collateral Rate (TGCR): 5.05%, $590B

- (rate, volume levels reflect prior session)

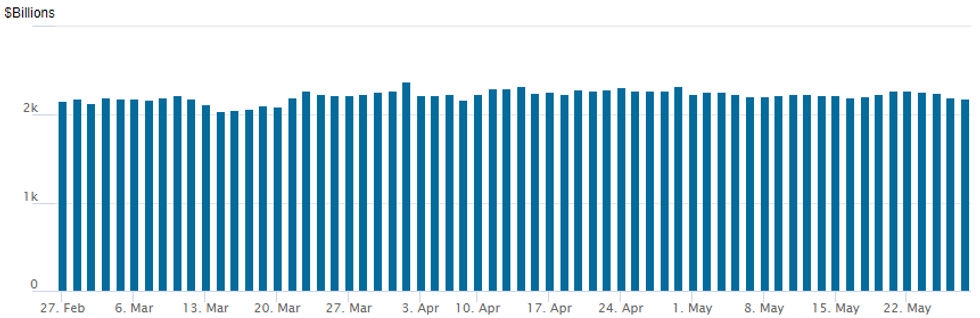

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo slips to $2,189.638B w/ 107 counterparties, compares to prior $2,197.638B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Relatively mixed SOFR option trade overnight, segued towards two-way put structures prior to underlying futures selling off. Treasury options saw some consolidation in 10Y puts well ahead of the early session close.- SOFR Options

- Block, 13,000 SFRN3 95.00 puts. 40.0 vs. 94.745/0.66%

- Block/screen, 19,000 SFRN3 95.00 puts, 37.5 vs. 94.775/0.64%

- Block, +5,000 SFRN3 94.62/94.75/94.87 put flys, 2.0

- Block, 10,000 SFRH4 97.50/98.50/99.00 broken call flys, 6.0 net ref 95.44

- +6,000 SFRZ3 94.43/94.56/94.81/94.93 put condors, 3.5

- Block/screen -8,000 SFRU3 94.00/94.50, 9.0

- Blocks, -10,000 SFRU3 94.00/94.50 put spds, 9.0, 5k vs. 94.78/0.17%

- 9,500 SFRZ3 96.00/97.00 call spds ref 95.125

- 4,000 SFRM3 94.50/94.56 put spds ref 94.7275

- 11,000 SFRM3 94.68/94.75/94.81/94.87 put condors, ref 94.705

- 1,000 SFRM3 94.62/94.75/94.87 put flys ref 94.70

- 1,000 SFRU3 94.87/95.12/95.37 call flys ref 94.80

- 2,000 SFRU3 94.25/94.50/94.62 broken put trees ref 94.80

- 2,000 OQM3 95.62/95.75 put spds ref 95.92

- Treasury Options:

- 2,000 TYU3 110/113 3x2 put spds ref 113-04.5

- 6,000 TYU3 110.5/112.5 put spds, 46

- 5,000 TYM3 112 straddles, 29

- over 9,900 FVN3 109 calls, 35-36

- Block, 3,000 TUU3 102.62 calls, 44 ref 102-18.25

- Block, -22,000 TYN3 112/113 put spds, 23 ref 113-03.5

- 10,000 wk3 TY 117 calls, ref 113-17.5

EGBs-GILTS CASH CLOSE: Gilts In Rare Outperformance Of Bunds

Gilts outperformed Bunds Friday for the first time since May 16, with short ends in particular moving in opposite directions.

- The German curve bear flattened modestly, with the UK's bull steepening as some of the previous two sessions' sharp moves saw a partial unwind.

- 1bp was added to the ECB hike path to a fresh 1-month high close of 3.86% - 61bp of hikes left in the path, in accordance with ECB Makhlouf's comments today pointing to hikes in Jun and July and open to more later.

- BoE hike expectations dialled back (UK retail sales beat but downward revisions dampened the hawkish read). But the implied peak Bank rate was still 60bp higher than it began the week, with 107bp further hikes now expected.

- Periphery EGB spreads were mixed, with BTPs outperforming modestly.

- Attention will be on US debt limit negotiations over the weekend, but trade Monday will be thinned as UK and US markets are closed for a holiday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.1bps at 2.943%, 5-Yr is up 2.7bps at 2.558%, 10-Yr is up 1.7bps at 2.539%, and 30-Yr is up 1bps at 2.674%.

- UK: The 2-Yr yield is down 6.1bps at 4.495%, 5-Yr is down 4.9bps at 4.279%, 10-Yr is down 3.5bps at 4.339%, and 30-Yr is down 0.3bps at 4.647%.

- Italian BTP spread down 2.4bps at 185.2bps / Spanish down 0.7bps at 106.2bps

FOREX: Greenback Consolidates Strong Weekly Gains, JPY Pressure Continues

- Despite some early weakness on Friday, the greenback was well supported following a set of strong US data and the USD index looks set to consolidate solid 1% gains on the week.

- Continuing the similar themes from prior sessions, the New Zealand Dollar and the Japanese Yen are the weakest across G10. Kiwi weakness continues to stem from the dovish RBNZ and the higher US yields continue to exacerbate the widening yield differentials that have underpinned Cross/JPY longs.

- USDJPY in particular has established itself back above the 140.00 handle with initial resistance (bull channel top drawn from the Jan 16 low) around 140.70 capping the price action for now. The next obvious target for the move resides at 141.61, the Nov 23 2022 high.

- Elsewhere, performance across G10 was mixed with the likes of the GBP, AUD and CNH benefitting from more buoyant stock markets on the back of greater optimism over the debt ceiling heading into an extended holiday weekend.

- Bearish conditions for EURUSD have been reinforced and the 1.0713 objective was briefly breached, the Mar 24 low. This signals scope for an extension towards 1.0653 next, a Fibonacci retracement point.

- Holidays across Europe and the US should keep currency markets subdued on Monday. Looking forward, inflation readings across Europe and Australia will be in focus as well as manufacturing and non-manufacturing data from China. The week will be highlighted by an important jobs report from the US on Friday.

EGB Options: Rate Upside Resumes

Friday's Europe rates / bond options flow included:

- DUN3 105.30/105.00/104.70/104.30p condor, bought for 7.5 in 10k (ref 105.46 in Sep)

- SFIQ3 94.90/95.00/95.10/95.20c condor, bought for 1.5 in 5k

- ERM4 100c, bought for 2.75 in 5k

FX: Expiries for May29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0655(E828mln), $1.0870-80(E894mln), $1.1000(E709mln)

- USD/JPY: Y137.92-00($511mln)

- EUR/GBP: Gbp0.8700(E779mln)

- USD/CAD: C$1.3590($968mln)

- USD/CNY: Cny7.0000($739mln)

Equities Roundup: Risk Appetite Improved on Debt Ceiling Optimism

Stocks continue to make gains early in the second half, carry-over support after Nvidia's unprecedented surge on Thursday helped a broad based rally in tech stocks and indexes in general that carried over to Friday.- Of course, optimism over a debt ceiling deal before the US runs out of money on or after June 1's "X" date, helped improve risk appetite going into the extended Memorial Holiday weekend. Currently, S&P E-Mini futures are up 53.25 points (1.28%) at 4212.75; Nasdaq up 278.5 points (2.2%) at 12976.14; DJIA up 309.69 points (0.95%) at 33075.7.

- SPX levels bounced after testing the 50-day EMA support at 4124.40 Wednesday. A continuation higher would refocus attention on initial key resistance at 4227.25, the May 19 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

- Leading laggers: Consumer Discretionary sector lead by auto makers outpaced Information Technology shares, followed by continued strength in Communication Services and Real Estate sectors.

- Leading laggers: Energy, Utilities and Health Care sectors underperformed Friday.

E-MINI S&P TECHS: (M3) Watching Support At The 50-Day EMA

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4231.00 High Feb 3

- RES 1: 4227.25 High May 19

- PRICE: 4212.50 @ 1300ET May 26

- SUP 1: 4114.00 Low May 24

- SUP 2: 4062.25 Low May 4 and key support

- SUP 3: 4052.50 Low Mar 30

- SUP 4: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

S&P E-minis traded lower Wednesday and this resulted in a test of the 50-day EMA at 4125.76. A clear break of this average would highlight a stronger short-term reversal and expose 4062.25, the May 4 low and a key support. Price has recovered from Wednesday’s low, a continuation higher would refocus attention on initial key resistance at 4227.25, the May 19 high. Clearance of this hurdle would resume the uptrend that started on Mar 13.

COMMODITIES: Oil Grinding Higher, Gold Under USD Pressure, Gas Slumping

- Crude oil has lifted today with optimism surrounding the chances of raising the US debt limit and avoiding a default, chipping away yesterday’s slide.

- Markets are also weighing up the possibility of further production cuts after differing signs from Russia and Saudi Arabia. Russia’s Deputy Prime Minister Novak yesterday said that OPEC+ are unlikely to adjust targets at the 3-4 June meeting however the Saudi Energy Minister sent a warning to oil speculators earlier this week giving support to prices.

- WTI is +1.0% at $72.52, not troubling resistance at the 50-day EMA of $74.31. Ahead of next week's OPEC meeting and a Memorial Day-shortened week, $82/bbl calls have lead today's options activity in the CLN3.

- Brent is +0.7% at $76.77, not troubling resistance at the 50-day EMA of $78.46.

- Gold is +0.2% at $1944.7, with a paring of earlier larger gains as the USD index rebounded after a swathe of stronger than expected US data.

- In gas space, European prices have seen their eighth consecutive weekly loss for month-ahead contracts in the longest run of weekly losses since 2007, as economic activity shows few signs of meaningful recovery. Bloomberg reports that the situation has raised concerns that some demand for gas might now be permanently lost or substituted after last year’s record prices hit manufacturers particularly hard. Fuller-than-average gas inventories, mild weather and an abundance of liquefied natural gas have also lowered demand, raising questions about how much lower prices can go before producers start curbing output.

- Weekly moves: WTI +1.45%, Brent +1.65%, Gold -1.7%, US nat gas -14.2%, EU TTF nat gas -18.7%.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/05/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/05/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 30/05/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 30/05/2023 | 0600/0800 | *** |  | SE | GDP |

| 30/05/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/05/2023 | 0700/0900 | *** |  | CH | GDP |

| 30/05/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/05/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 30/05/2023 | 0800/1000 | ** |  | IT | PPI |

| 30/05/2023 | 0900/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/05/2023 | 1230/0830 | * |  | CA | Current account |

| 30/05/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/05/2023 | 1300/0900 | ** |  | US | FHFA Quarterly Price Index |

| 30/05/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/05/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/05/2023 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 30/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.