-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

MNI ASIA MARKETS ANALYSIS - Long End Leads Curve Steeper Still

HIGHLIGHTS

- Sterling falls sharply, markets rush to protect against further downside via options

- US yield curves steepens further still, with long-end leading yield rise

- Lagarde looks through structural issues to support easy policy

US TSYS: Curve Steepens Further, 2y10y Highest Since June

- Another session of bear steepening continued to work in favour of longer-end yields, boosting 10y, 20y, 30y yields to their highest levels in at least three months. The steepening bias put 2y10y spreads above 125bps for the first time since June, as the normalization message put through by last week's Fed continues to filter into prices.

- Lack of a clear path for an extension of the US debt ceiling further unsettled investors, with Republicans and Democrats still at loggerheads on the most viable path to avoid a looming government shutdown.

- The US Treasury completed this week's bond issuance schedule with a 7yr sale. The deep concession built into the auction supported demand, with the sale resulting in only a relatively small tail.

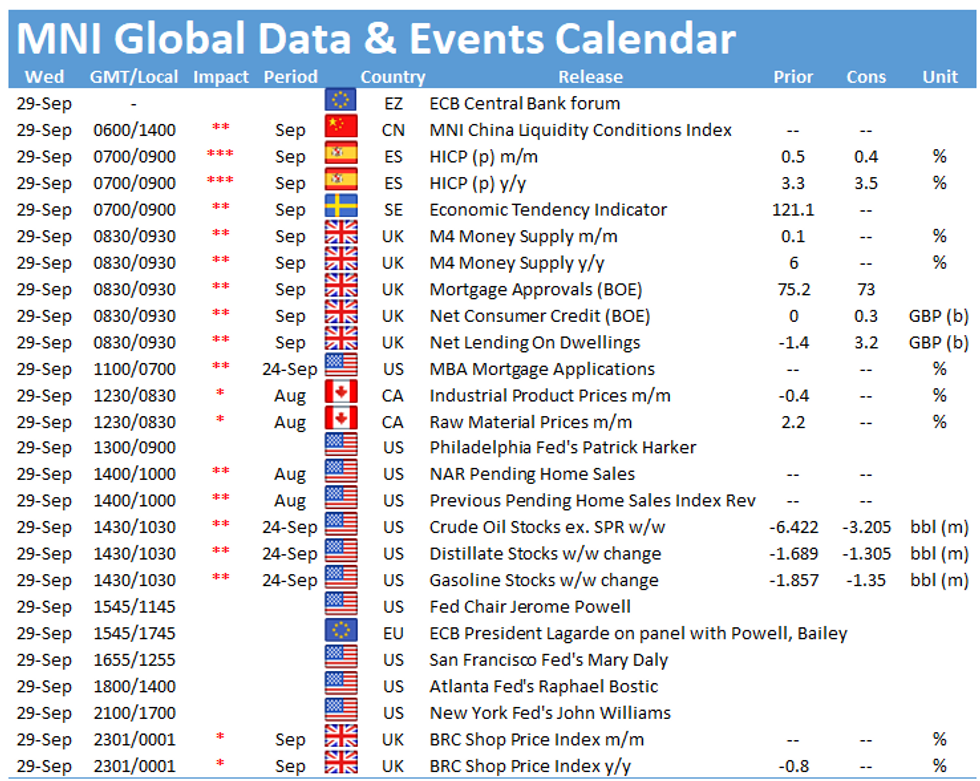

- Focus Wednesday turns to pending home sales numbers as well as comments from Fed's Bullard, Harker Daly and Bostic. Fed Chair Powell appears at the ECB forum for central banking, speaking alongside Lagarde, Bailey and Kuroda.

Levels Update:

- The Dec 21 T-Note future is down 9+ ticks at 131-16. The 2-Yr yield is up 2.3bps at 0.301%, 5-Yr yield up 3.3bps at 1.018%, 10-Yr yield up 4.3bps at 1.5305% while the 30-Yr yield is up 7.2bps at 2.0668%.

7yr Note Auction Results

Relatively Small Tail on 7yr Auction Sees Sale Go Alongside Expectations

7yr auction tails by 0.8bps relative to the when-issued with the bid/cover dipping to 2.24 - that's below the recent average of 2.31 on the line. Dealer takedown is a lower-than-average 18.99%. 7yr yield jumps slightly on the results, adding around 1bps to trade 1.3217%last.

Full results:

- HIGH YLD 1.332%; ALLOTMENT 68.26%

- DEALERS TAKE 18.99% OF COMPETITIVES

- DIRECTS TAKE 20.92% OF COMPETITIVES

- INDIRECTS TAKE 60.09% OF COMPETITIVES

- BID/CVR 2.24

EGBs-GILTS CASH CLOSE: Gilts And BTPs Underperform

The UK and German curves bear steepened Tuesday, with BTPs underperforming the European FI space as risk appetite was clawed back again.

- Skyrocketing European energy costs and US dollar strength were underlying themes.

- Gilts disconnected from sharp weakness in GBP, with the bond market more focused on the hawkish BoE. 10Y Bunds printed a -0.174% high, but Gilt/Bund spread eyeing 2019 high (just above 121bp). All that said, cash yields finished off the session highs.

- A few ECB speakers today, including Kazimir who set off a brief EURUSD spike (but not much fixed income response) saying the ECB wouldn't automatically boost APP when PEPP ends.

- UK sold GBP2bln 30Y Gilt, Netherlands E4.9bln Jan-29 DSL.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at -0.683%, 5-Yr is up 1.1bps at -0.549%, 10-Yr is up 2.4bps at -0.199%, and 30-Yr is up 1.4bps at 0.264%.

- UK: The 2-Yr yield is up 2.3bps at 0.409%, 5-Yr is up 3.2bps at 0.628%, 10-Yr is up 4.2bps at 0.994%, and 30-Yr is up 5bps at 1.325%.

- Italian BTP spread up 3.7bps at 105.4bps / Spanish up 0.7bps at 64.1bps

EUROPE OPTIONS FLOW SUMMARY: Decent SONIA Action Tuesday

Tuesday's European rates/bonds options flow included:

- RXX1 169/168ps, bought for 26 and 26.5 in 20k

- RXX1 171/169.5/168.50/168 put condor sold at 72 in 2.75k

- DUZ1 112.10/112.00ps, bought for 2.25 in 4k

- DUZ1 112.20/30 call spread vs 112.10 put bought for 0.5 in 5k

- SFH2 99.80/99.70/99.60p fly 1x3x2, bought for -0.25 in 7,565x23,695x15,130

- SFIH2 99.80/99.90/99.95 broken call fly, bought for 1.5 in 2k

- SFIH2 99.70/99.80 1x1.4 call spread bought for up to 2.75 i n15k

- SFIZ1 99.85/99.90cs 1x2, bought for 1 in circa 13k

GBP: Downside Protection the Theme in Options as Spot Slides

- Very healthy volumes across both GBP futures and options on today's weakness in the currency.

- Across DTCC-tracked trade, downside protection is the theme, with over $2 trading in vanilla put notional for every $1 in calls. Sizeable downside strikes include 1.3625, but also decent interest in OTM 1.34 and even 1.31 puts.

- The more sizeable trades in options space are consistent with legs of a large put spread targeting an end-November (two-month) expiry and breaks even on a move below ~1.3350 in GBP/USD spot. Trades captures next BoE meeting (Nov4) as well as prelim November PMIs just ahead of expiry (Nov23).

- Reflecting the solid interest in GBP today, futures volumes are well ahead of average for this point in the trading day, with total traded around 50% ahead of a regular session. Particularly sizeable volumes crossed at 1154BST just ahead of the session low at 1.3594.

FOREX: Rising Yields/Falling Equity Indices Buoy Greenback, GBP Plummets

- Pound Sterling came under significant selling pressure on Tuesday as market concerns surged over the fuel crisis sweeping the UK potentially leading to a sharp slowdown in growth.

- GBP rose over 1% against both the Euro and the Dollar and in the process has cleared a host of key supports. The triangle base at 1.3637 in cable, drawn from the Jul 20 low has been breached and this has led to a move below 1.3602, the Aug 20 low. While 1.3520 support has held for now, the focus is on weakness towards 1.3462 next, 50.0% of the Sep '20 - Jan bull phase.

- Rising US yields and pressure on equity indices kept broad dollar indices in favour, rising just shy of 0.5%. Three straight days of gains has prompted the DXY to rise to the best levels since November 2020. Key resistance at 93.73, Aug 20 high has been breached and a sustained break of this hurdle would confirm a resumption of the underlying uptrend and target 94.30 Nov 4, 2020 high.

- Elsewhere, antipodean FX were clear underperformers, retreating well over half a percent. Evidence of the broad dollar theme developing was most notably signalled by JPY and CHF also losing ground against the greenback, matching CAD losses of around 0.4%.

- Risk dynamics also weighed on EM FX with the JPM emerging market currency index falling 0.65%. Noteworthy moves were seen in USDMXN (+1.20%) and USDZAR (+1.07%).

FX OPTIONS: Expiries for Sep29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700($994mln), $1.1750(E1.2bln), $1.1800-15(E709mln)

- USD/JPY: Y109.90-00($1.3bln), Y111.00-05($558mln)

- GBP/USD: $1.3680(Gbp997mln)

- USD/CAD: C$1.2620($1.4bln), C$1.2630-40($531mln), C$1.2900($2.0bln)

- USD/CNY: Cny6.4400($1bln), Cny6.4965($700mln)

EQUITIES: Stocks Sink as Tech Undermines NASDAQ, S&P 500

- The fierce rally in US yields following last week's FOMC decision continued apace Tuesday, undermining growth and cyclical stocks to pressure tech and communication services lower.

- Volumes were solid as evidenced in futures, with the E-mini S&P clearing the daily average volume of 1.45mln at the London close, marking a very active session.

- Tech responded to the sharp uptick in yields, with the 10y now solidly above 1.5% and potentially spooking some of the more cyclical/growth-oriented plays.

- Weakness in chipmakers and semiconductor names was noted across European trade, and the likes of AMD, NVIDIA and NXP Semi joining their European counterparts. As a result, the NASDAQ led with losses of 2.5% while the Dow Jones dropped around 1.5% or so.

COMMODITIES: Oil Fades Off Highs Amid Buoyant Dollar, But Uptrend Intact

- WTI and Brent crude futures traded solidly throughout the European morning, with Brent seeing strength into new 2021 highs of $80.75/bbl. The gains reversed course into the US session, with a higher, steeper US yield curve boosting the dollar.

- The modest correction lower in both WTI and Brent prices has done little to deter the near-term uptrend in oil prices, however, with the technical picture still very much bullish. The White House further voiced their view on energy markets, stating that they continue to speak with OPEC on pricing matters, and is looking at every means they have to address the cost of oil.

- Gold remains bearish amid the overriding USD strength. The yellow metal last week traded through former support at $1742.3, Sep 20 low. This confirms a resumption of the current short-term bear cycle and signals scope for a move towards key support at $1690.6, Aug 9 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.