-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Nov-Dec CPI Revisions Little Hotter

HIGHLIGHTS

- SENATE PANEL SAYS SEMI-ANNUAL MONETARY POLICY HEARING MARCH

- MNI BRIEF: US Treasury Sees $460B Deficit Thru January

- US DATA: CPI M/M Inflation Revised Higher In Seasonal Adjustment Revision

- ECB SCHNABEL: EXPECT EFFECTS OF QE AND QT TO BE LARGELY SYMMETRIC, Bbg

- ECB SCHNABEL: HIGH INFLATION NOT CAUSED BY FLAWS IN ECB FRAMEWORK, Bbg

Key links: MNI: Fed’s Peak Rate Looking Perkier As Jobs Boom-Ex-Officials / MNI INTERVIEW: Lockhart Sees Fed Lifting Rate Estimates in SEP / MNI: Philly Fed Survey Trims Year-End Jobless Rate Call /

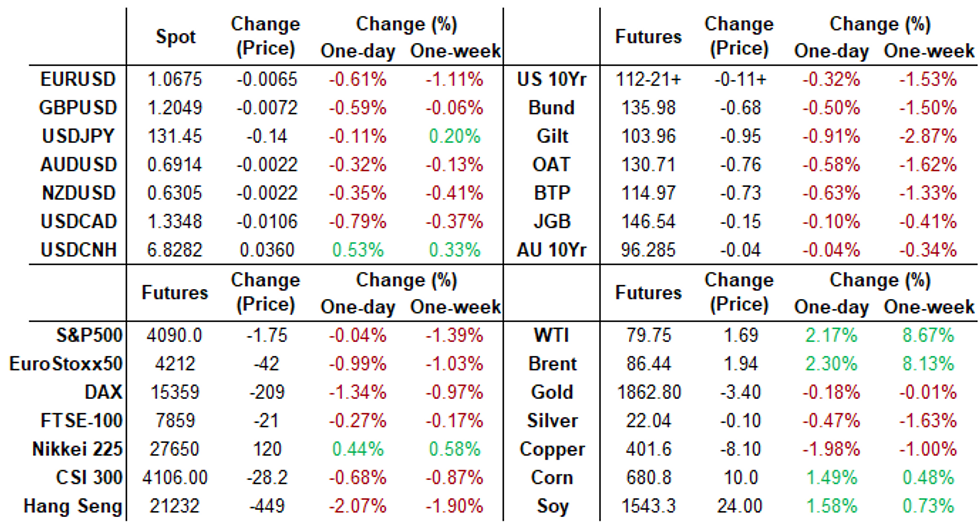

US TSYS: Market Roundup: Nov-Dec CPI Revision Little Hotter, Jan CPI Next Tue

Tsys holding near session lows in afternoon trade, yield curves see steepening relief after 2s10s fell to lowest inverted levels in 40 yrs Thu (-87.193), currently +5.900 at -76.929 (-76.407 high).

- Knock on pressure after Canada employment data came out much stronger than expected (+150k vs. +15k est), underscoring CB bank messaging this week to continue to hike rates (data dependent) until inflation meets targets.

- Session focus on BLS Seasonal Adjustment revisions to CPI. Core CPI inflation running 0.1pps hotter in M/M terms in both Nov and Dec at 0.31% and 0.40% M/M respectively, with a weaker than first thought period in the spring.

- However, potentially supporting the muted market reaction to the annual revision is that most of this recent strength came through core goods.

- Muted react to UofM February Consumer Sentiment of 66.4 vs. 65. est, 64.9 prior.

- No react to midday comments from Philly Fed Harker: favours getting rates above 5% and then pausing (previously slightly above 5%). In other comments, he sees it “more probable now” that we can pull off a soft landing, with a good chance of doing so if inflation keeps easing.

- Focus turns to Jan CPI next Tue: MoM (0.1% rev, 0.5%); YoY 6.5%, 6.2%).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00072 to 4.55929% (+0.00658/wk)

- 1M +0.00543 to 4.57800% (+0.00614/wk)

- 3M -0.00314 to 4.86943% (+0.03529/wk)*/**

- 6M +0.01457 to 5.12714% (+0.06971/wk)

- 12M +0.02886 to 5.48457% (+0.23343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.87257% on 2/9/23

- Daily Effective Fed Funds Rate: 4.57% volume: $111B

- Daily Overnight Bank Funding Rate: 4.57% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.212T

- Broad General Collateral Rate (BGCR): 4.52%, $481B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $466B

- (rate, volume levels reflect prior session)

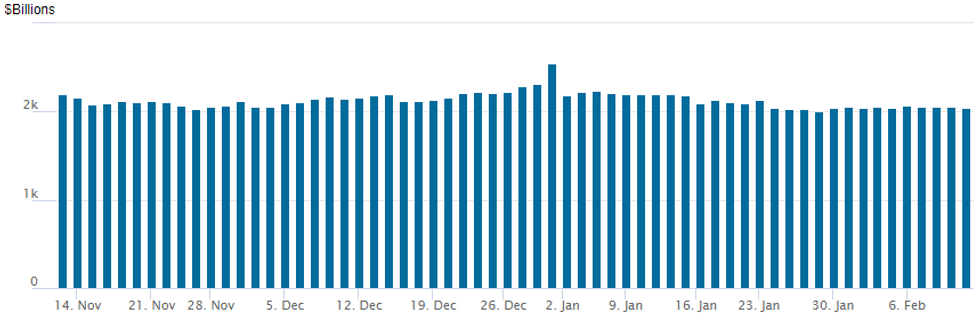

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,042.893B w/ 97 counterparties vs. prior session's $2,058.942B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Aside from a steady increase in volumes of SOFR futures and options ahead of the coming conversion of Eurodollar futures and options on April 14, 2023 - the sophistication of SOFR option flows has risen to the point where Eurodollar options used to excel. Recent examples of put positioning to hedge continued rate hikes into late 2023:- SOFR Options:

- Block, 20,000 SFRU3 94.12/95.12 put spds, 36.5 ref 94.88

- 7,100 SFRN3 94.81/94.93/95.06 put flys, ref 94.875

- Block, 10,000 SFRU 93.75/94.00 put spds, 1.5 vs. 94.89/0.05%

- +10,000 OQM3 95.75/96.12 put spds vs. 2QM3 96.50/96.87 put spds, 1.0 net db flattener

- -10,000 OQM3 95.50 puts, 13.5

- Block, 10,000 SFRZ3 94.87 puts, 26.0 ref 95.16

- Block, 5,000 SFRZ3 95.50/97.50 call spds, 22.5 ref 95.165

- Block, 5,000 SFRZ3 95.00 puts, 28.5 vs. 95.19/0.40%

- Block, 10,000 SFRN3 94.37/95.37

- over 5,800 OQH3 96.37 puts ref 96.74

- 4,000 3QH3 97.00/97.25 1x2 call spds ref 96.915

- 2,000 OQH3 96.18/96.31/96.43 call trees

- Block, 2,500 SFRU3 94.37/94.62/94.75/94.87 broken put condors, 0.0 ref 94.89

- Block, total 16,000 OQM3 96.75/97.25 put spds, 8.0 vs.96.11/0.13%

- Block, 2,500 SFRM3 94.62/94.75/94.87 put trees, 12.5 vs. 94.86/0.05%

- Treasury Options:

- 4,000 TYK3 116.5/117.5 call spds ref 113-10.5

- 3,000 TYK3 112/113 put spds, 17 ref 113-10

- 12,600 TYH3 112.5/114.5 call spds, 47 ref 112-26.5

- 10,000 TYH 110.5/112.5 3x2 put spds vs. x2 TYH 114 calls, 26 net, put spd over ref

- 13,500 TYH3 110.5/111.5/113.5 2x3x1 put flys, 34 net ref 113-00.5

- over 9,300 USH 126 puts. 32 ref 127-30

- over 9,000 wk3 TY 111.25 puts, 5 ref 112-31.5

- Block, 9,000 wk3 TY 111 puts, 4 ref 112-29.5/0.08%

- +4,000 USH3 131/133/135 call flys, 7 ref 127-17

- 5,000 FVH3 107.5/108 put spds, 13 ref 107-31.25

- Block, +15,000 wk3 TY 111 puts, 4 ref 112-28 (expire next Fri)

- over 4,500 TYH3 113 puts, 42 ref 112-31.5

- 3,000 TYH3 113.5 calls, 26 ref 113-02

- -7,000 FVJ3 111.5/113.5 call spds 2 ref 107-27

- 4,000 FVJ3 109.5/110.5 call spds, ref 108-19.25

EGBs-GILTS CASH CLOSE: Upward Hike Repricing Keeps Pressure On Short End

European curves continued to flatten Friday, with short-end UK yields continuing to rise sharply.

- 2Y UK yields hit a fresh 2023 high (3.635% intraday), though German Schatz stole the headlines by briefly hitting the highest since 2008 (2.773%).

- The main catalyst was continued upward repricing of central bank hike prospects and pricing out of cuts, with more speakers today (including ECB's Kazaks in an MNI interview) pointing to the hiking cycle extending beyond March.

- 110bp of further ECB hikes are now seen (up 6bp), just off the late Dec highs; the BoE is seen closer to its peak (52bp away), though that's up 11+bp.

- Just as they narrowed Thursday on rallying equities/risk, so did EGB periphery spreads widen Friday as European stocks retreated.

- A quieter schedule ahead Monday, with focus firmly on UK employment, Eurozone GDP and US CPI Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.9bps at 2.761%, 5-Yr is up 7bps at 2.4%, 10-Yr is up 6.1bps at 2.364%, and 30-Yr is up 5.1bps at 2.323%.

- UK: The 2-Yr yield is up 12.8bps at 3.628%, 5-Yr is up 12.1bps at 3.336%, 10-Yr is up 10.5bps at 3.396%, and 30-Yr is up 7.7bps at 3.813%.

- Italian BTP spread up 2.9bps at 184.5bps / Spanish up 1.6bps at 94.9bps

EGB Options: More Bund Outright Upside Call Buying To End The Week

Friday's Europe rates / bond options flow included:

- RXH3 137.5 calls, bought for 48.5 in 10k

- ERZ3 96.62 straddles, sold at 62.0 in 4k

- SFIK3 95.95/96.05cs, bought for 1.75 in 3.88k

FOREX: Greenback Firms, CAD Bolstered By Large Jobs Beat

- The USD index has firmed roughly 0.4% on Friday and is edging back towards the February highs around the 1.0400 mark. This caps off a stronger week for the greenback as markets have adjusted Fed terminal rate pricing and provides an interesting backdrop ahead of key inflation data in the US next week.

- The Canadian dollar received a substantial boost from January employment figures and is the best performing currency across G10. At the bottom of the board sits the Swedish Krona, retracing some of the Riksbank inspired strength on Thursday, closely followed by weakness in EUR, GBP and the Chinese Yuan.

- EURUSD (-0.66%) has drifted lower into the Friday close amid the more pessimistic tone across equity markets this week, and is testing/has breached support at 1.0674, the 50-day EMA. This represents a key short-term level with the recent move down being considered corrective up to this point.

- Given USDJPY’s sensitivity to movement in core yields and the key US inflation data due next Tuesday, the pair will naturally be in focus for currency traders next week.

- Price action today and throughout the week has been centred around BOJ headlines which, while providing volatility, has not garnered any meaningful adjustment with the pair residing just 0.2% higher on the week.

- Resistance at the 50-day exponential moving average remains intact, currently intersecting at 132.77. This average represents a key short-term level and a clear break is required to suggest scope for an extension higher that would expose 134.77, the Jan 6 high.

- Not expecting much to come from Eurogroup meetings on Monday. First data will be Eurozone flash readings for unemployment and GDP on Tuesday followed by the key risk event of the week, US January CPI.

FX: Expiries for Feb13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0809-10(E592mln), $1.0930(E842mln), $1.1000(E1.5bln)

- USD/JPY: Y130.00-15($1.4bln), Y130.50-60($595mln), Y132.10-12($743mln)

- GBP/USD: $1.2275-90(Gbp786mln)

Late Equity Roundup: Crude Rally Buoys Energy Shares

Major indexes remain mixed after the FI close, DJIA continues to outperform weaker Nasdaq levels. SPX eminis currently trades +5.5 (0.13%) at 4096.25; DJIA +151.45 (0.45%) at 33847.63; Nasdaq -81.4 (-0.7%) at 11704.88.

- SPX leading/lagging sectors: Energy sector (+3.76%) lead by O&G shares (VLO +5.51%, MRO +5.28%, APA +5.16%) after crude rallied in early trade (WTI currently +1.75 at 79.81). Utilitis (+1.75%) and Health Care (+0.98%) sectors follow, the latter lead by services and providers (DXCM +10.63%).

- Laggers: Consumer Discretionary (-1.40%) weighed by automakers (F -6.75%, Tesla -5.45%), Information Technology (-0.88%) and Communication Services (-0.83%) follow, chip makers weighing on IT.

- Dow Industrials Leaders/Laggers: United Health (UNH) +8.05 at 493.78, Chevron (CVX) +3.78 at 172.22, Amgen (AMGN) +3.39 at 243.39. Laggers: Paring or reversing gains from the prior session, Salesforce (CRM) -7.01 at 166.65, Disney (DIS) -2.38 at 107.98, Visa (V) -2.15 at 227.20, Microsoft (MSFT) -2.10 at 261.52.

COMMODITIES: Crude Hangs Onto Russia Output Cut Boost For Strong Week of Gains

- Crude oil’s main move of the day came in European hours with Russia’s Novak saying it plans to cut March output by 500kbpd in order to improve the market situation and reiterating that it won’t comply with any Western price caps.

- Russian barrels being placed into Asia have initially defied predictions of a decline after sanctions came into place Dec 5 as China and particularly India stepped in – albeit at significant discounts to global benchmarks, but a production cut signals Russia’s difficulty in doing this longer term.

- WTI is +1.95% at $79.59 with a high of $80.33 forming initial resistance after which sits a key $83.14 (Dec 1 high).

- Brent is +2.1% at $86.25 off a high of $86.90 that now forms initial resistance after which sits the bull trigger of $89.00 (Jan 23 high).

- Gold is +0.1% at $1864.4 although fair strongly against USD appreciation. It sees a volatile week with a high of $1890 on Thursday that came close to testing resistance at the 20-day EMA of $1892.1, before today’s low of $1852.8 briefly probed support at the 50-day EMA of $1855.5.

- Weekly moves: WTI +8.4%, Brent +7.9%, Gold -0.0%, US nat gas +3.2%, EU TTF nat gas -6.8%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/02/2023 | 0730/0830 | *** |  | CH | CPI |

| 13/02/2023 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 13/02/2023 | 1300/0800 |  | US | Fed Governor Michelle Bowman | |

| 13/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.