-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Prelim Benchmark Jobs Down-Revised

- US PAYROLLS TO BE REVISED DOWN BY 306K IN PRELIMINARY ESTIMATE, Bbg

- MNI SECURITY: Ukrainian Forces Claim To Have Captured Key Village Robotyne

- MNI RUSSIA: Wagner Boss Prigozhin Suspected Killed In Plane Crash In Russia

- MNI EMERGING MARKETS: Xi @ BRICS-Countries Need To Oppose Decoupling, Econ Coercion

- FITCH DOWNGRADES COUNTRY GARDEN SERVICES TO 'BB+'; RATING, Bbg

- EUROPEAN BENCHMARK GAS FALLS AS MUCH AS 18%, Bbg

US TSYS Services PMI Slowdown Spurs Treasury Rally

- Tail-wind for European rates triggered overnight after weaker than expected European Services PMI carried over to US markets. Cautious short covers reported with many leaning short in anticipation of hawkish messaging from CBs at Jackson Hole eco-summit that starts Thu' evening.

- Treasury futures extend the early rally after S&P PMIs comes out lower than estimated: S&P Global US Manufacturing PMI (47.0 vs 49.0 est), Services (51.0, 52.2 est), Composite (50.4, 51.5 est).

- Rates continued to grind higher after Preliminary Payrolls Benchmark Revision came out lower than some expected. The preliminary estimate of the payrolls benchmark revision based on the latest QCEW suggests the level of payrolls could be revised lower by -306k in the twelve month period up to March 2023.

- Heavy Treasury futures volumes reported, partially tied to post-data squaring and to a surge in quarterly futures from Sep'23 to Dec'23 (Dec'23 takes lead quarterly position Thursday, August 31).

- Today's long end led rally weighed on curves: 3M10Y -14.644 at -127.504, 2Y10Y -4.213 at -76.825. Contributing to the move: several large flatteners Blocked/crossed on the day: 2Y/10Y, 5Y/10Y and 5Y/30Y Ultra.

- Short end support did, however, temper rate hike projections through yr end: Sep 20 FOMC is 11% w/ implied rate change of +2.7bp to 5.356%. November cumulative of +10.1bp at 5.43, December cumulative of 7.9bp at 5.408%. Fed terminal holding has climbed to 5.42% in Nov'23.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00035 to 5.31495 (+.00068/wk)

- 3M +0.00798 to 5.39105 (+0.00788/wk)

- 6M +0.01079 to 5.45769 (+0.01315/wk)

- 12M +0.02318 to 5.41133 (+0.02795/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $101B

- Daily Overnight Bank Funding Rate: 5.31% volume: $273B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.307T

- Broad General Collateral Rate (BGCR): 5.27%, $550B

- Tri-Party General Collateral Rate (TGCR): 5.27%, $543B

- (rate, volume levels reflect prior session)

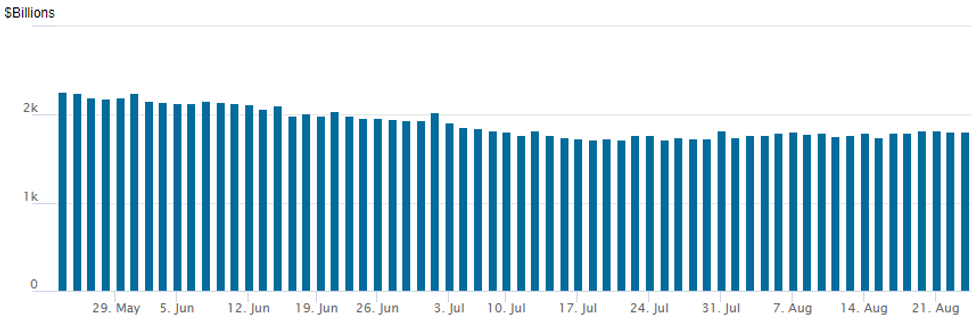

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation inches up to $1,816.533B w/96 counterparties, compared to $1,812.294B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

With a few exceptions, SOFR options saw better upside call structure buying Wednesday with underlying futures bouncing off Tuesday's cycle lows (TYU3 108-28) after lower than expected European service PMIs. Treasury options saw more consistent put trade across the curve in anticipation of hawkish tones from Chairman Powell Friday morning. Intermediate to long end rate led curve flattening (2Y10Y -2.660 to -75.985). Rate hike projections through year end have receded from Tuesday's highs: Sep 20 FOMC is 11% w/ implied rate change of +2.7bp to 5.356%. November cumulative of +10.1bp at 5.43, December cumulative of 7.9bp at 5.408%. Fed terminal holding has climbed to 5.42% in Nov'23.

- SOFR Options:

- +14,000 0QZ3 96.12/96.62 call spds 10.5 vs. 95.76/0.15%

- Block, +20,000 SFRH4 94.50/94.75/95.00 call flys, 7.5 ref 94.60

- Block, 5,000 SFRZ3 94.75/95.75 call spds 2.75 over SFRZ3 94.43/94.50 put spds vs.

- +2,500 SFRH4 94.75/95.00/95.25 call flys, 2.5

- Block, 20,000 0QZ3 97.06/97.31 call spds, 1.5-2.0 ref 95.73

- -5,000 0QH4 97.00/97.50/98.00 call flys, 2.5 vs. 95.85/0.05%

- Block, total 10,000 SFRU4 94.50/94.75/95.00/95.50 put condors, 18.0 vs. 95.395/0.10%

- 2,450 SFRX3 94.25/94.37/94.50 put flys, ref 94.585

- over 5,000 SFRV3 94.56/94.75 put spds ref 94.58

- 4,000 SFRZ3 94.37 puts, total volume over 10k

- Block/screen, 6,000 SFRV3 94.50/94.62/94.75 call flys, 3.75 ref 94.58

- 1,000 SFRV3 94.50 puts ref 94.58

- 8,000 SFRV3 94.62/94.87/95.12 call trees ref 94.58

- Block call condor calendar spread repeated 2k on screen

- Block, 3,750 SFRZ3 94.56/94.62/94.68/94.75 call condors, 2.0 vs. 94.585 vs.

- Block, 3,750 SFRH4 94.56/94.68/94.75/94.87 call condors, 2.5

- 2,000 2QU3 95.87 puts, 9.0 ref 96.05

- Treasury Options:

- -5,000 TYV3 108/1112 strangles, 36

- +4,000 TYZ3 106/106.5 put strip, 53-54

- 1,500 TYU3 110.5/111 1x2 call spds, 2 net ref 109-29

- 1,500 USU3 120/122 put spds, 140 ref 120-05

- over 18,300 TYU3 111 puts, 116 ref 109-25.5

- 8,000 TUU3 101.75 puts, 24-24.5 ref 101-12.38

- 2,000 FVZ3 104.25/105.5 put spds ref 106-14.5 to -14.75

- 4,800 USV3 110/112/114/116 put condors, 14 net ref 119-26

- 5,100 TYU3 107 puts ref 109-20.5

- 3,400 TYU3 108.5 puts, 3 ref 109-14

- 7,500 TYV3 110.5 calls 3 over TYV3 108/109.5 put spds ref 109-17.5

- 1,000 TYV3 111.5/112.5 call spds ref 109-18.5

EGBs-GILTS CASH CLOSE: Bellies Outperform As PMIs Sink Rate Hike Pricing

The bellies of the German and UK curves outperformed in a significant overall rally Wednesday as soft August PMIs signalled recessionary conditions and called into question how much further the ECB and BoE would raise rates.

- Gilts outperformed overall but it was Eurozone PMI data that provided the initial shock. A sharp contraction in German services activity highlighted a poor Eurozone reading (30-month low 48.3 v 50.5 expected), then the UK report piled on with the lowest Services PMI since January 2021 (48.7).

- Whether the ECB hikes next is now at best a 50/50 proposition per market pricing, while a full 25bp hike has been removed from the BoE's hike path in the past few sessions. More cuts past the peak are now expected as well (by 9bp for each of the central banks).

- Hedging around the pricing of the Finnish and EFSF syndications may have provided a little bit of downside impetus in early afternoon trade, but supply was no match for macro as today's driving force.

- Periphery EGB spreads closed mixed, with Italy and Spain outperforming (0.7bp tighter to 10Y Bunds) and Greece underperforming.

- Thursday's data includes French sentiment and UK CBI distributive trades, but attention will turn quickly to US data (incl jobless claims) and the start of the Jackson Hole symposium.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 11.3bps at 2.974%, 5-Yr is down 13.5bps at 2.519%, 10-Yr is down 12.8bps at 2.517%, and 30-Yr is down 9.5bps at 2.63%.

- UK: The 2-Yr yield is down 17.3bps at 4.973%, 5-Yr is down 19.3bps at 4.49%, 10-Yr is down 17.7bps at 4.468%, and 30-Yr is down 13.9bps at 4.696%.

- Italian BTP spread down 0.7bps at 165.2bps / Greek bond up 2.9bps at 132.6bps

EGB Options Post-PMI Downside Liquidation In Bunds

Wednesday's Europe rates / bond options flow included:

- RXU3 131p, bought for 10 in 10k

- RXX3 123/120.5ps sold at 7.5 in 10k

- RXV3 124/122ps, sold at 2.5 in 8k

- SFIH4 94.35/94.45/94.65/94.75c condor, bought for 2 in 6.5k

FOREX Greenback Swiftly Reverses Lower Following Weak US Data

- Early demand for the greenback dissipated during US hours, with the reversal lower for the USD index extending following the weaker than expected US Flash PMI data for August. The substantial move lower for US yields prompted the Yen to outperform and the associated rally for equities left the likes of AUD, NZD and emerging market currencies leading the charge.

- The consistent grind higher for treasury futures underpinned the relentless bid for the Japanese Yen on Wednesday. USDJPY printed as high as 145.90 overnight before eventually sliding back below the 145 mark on the disappointing US PMI data and pushing to session lows of 144.54 in late US trade. Initial firm support lies at 144.17, the 20-day EMA.

- Interestingly, the JPY had also been strengthening during Europe, led by a solid move lower for EURJPY and GBPJPY following similar weakness in the PMI data across Europe.

- The broad USD weakness throughout US hours led the likes of EURUSD and GBPUSD back to unchanged levels, but the noticeable outperformers were both AUD and NZD, as lower yields enhanced the optimism for global risk sentiment. AUDUSD price action today has narrowed the gap with firm resistance seen at 0.6522, the 20-day EMA.

- US durable goods and jobless claims are Thursday’s data highlights, however, obvious focus will be on the Jackson Hole Symposium. Chair Powell’s task in his Jackson Hole keynote speech is to reaffirm the recent turn to a meeting-by-meeting, data-dependent approach to policy while emphasizing that the Fed intends to keep rates in restrictive territory for a lengthy period of time.

FX Expiries for Aug24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E962mln), $1.0814-20(E1.4bln), $1.0840-50(E521mln), $1.0890-00(E1.6bln), $1.0930-50(E1.5bln), $1.1000(E1.1bln)

- USD/JPY: Y144.00($819mln), Y144.50($674mln), Y145.00-05($2.1bln), Y146.00($1.9bln)

- GBP/USD: $1.2675-00(Gbp690mln), $1.2725-35(Gbp602mln)

- EUR/GBP: Gbp0.8595-05(E570mln)

- AUD/USD: $0.6330-50(A$560mln)

- USD/CAD: C$1.3465($745mln)

- USD/CNY: Cny7.2300($1.5bln), Cny7.2400($1bln), Cny7.2500($1.3bln), Cny7.2700($1.1bln), Cny7.3000($3.7bln), Cny7.3300($1.9bln), Cny7.3500($3.2bln)

Late Equity Roundup: Communication Services, IT Outperforming

- Stocks holding decent gains in late trade, SPX Eminis near highs as Communication Services and Information Technology sectors continue to outperform. At the moment, S&P E-Mini futures are up 50.25 points (1.14%) at 4449.75, DJIA up 170.93 points (0.5%) at 34461.26, Nasdaq up 234.9 points (1.7%) at 13741.83.

- Leading gainers: Media and entertainment shares supporting Communication Services with Netflix +4.05% after reporting a surge in subscribers following a pass-word crackdown by the streaming service. Meanwhile, Google +3.1%, Take Two Software +2.9%, Meta +2.55.

- Information Technology sector buoyed by semiconductor makers with hardware and software names a close second. Leaders: Monolithic Power +4.3%, Intel and AMD +2.75%. Meanwhile, Nvidia holds gain of 2.25% ahead of their Q3 earnings after today's close.

- Laggers: Energy and Health Care sectors underperformed. Oil and gas shares weighed on the former after crude traded weak (WTI -.83 at 78.81): EQT -3.6%, Occidental Petroleum -1.75%, Marathon -1.45%, Devon Energy -1.35%. Health Care weighed by equipment and service providers: Insulet Corp -3.67%, Dexcom -1.67%, Hologic -1.45%.

- Technicals: A bearish theme in the E-mini S&P contract remains intact and this week’s recovery appears to be a correction. Last week’s price action reinforces this theme. The move lower resulted in a break of the 50-day EMA and a breach of channel support drawn from the Mar 13 low. The Jun 26 low of 4368.50, was breached last Friday and attention is on 4344.28, a Fibonacci retracement. Initial firm resistance is at 4452.08, the 50-day EMA.

E-MINI S&P TECHS: (U3) Gains Considered Corrective

- RES 4: 4634.50 High Jul 27 and the bull trigger

- RES 3: 4593.50/4634.50 High Aug 2 / Jul 27

- RES 2: 4560.75 High Aug 4

- RES 1: 4452.08/4469.84 50- and 20-day EMA values

- PRICE: 4450.00 @ 1510 ET Aug 23

- SUP 1: 4344.28 38.2% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 2: 4305.75 Low Jun 8

- SUP 3: 4254.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 4: 4216.00 Low May 31

A bearish theme in the E-mini S&P contract remains intact and this week’s recovery appears to be a correction. Last week’s price action reinforces this theme. The move lower resulted in a break of the 50-day EMA and a breach of channel support drawn from the Mar 13 low. The Jun 26 low of 4368.50, was breached last Friday and attention is on 4344.28, a Fibonacci retracement. Initial firm resistance is at 4452.08, the 50-day EMA.

COMMODITIES Crude Recoups Some Losses Whilst Gold Clears Resistance On USD Slide

- Crude markets have regained some of their earlier losses after first a rebound in risk sentiment with the US cash equity open and then the latest EIA data showing a larger than expected draw in crude inventories (-6,1343 vs -2,873 exp). However, it doesn’t stop US oil futures settling at their lowest in a month.

- Saudi Arabia will likely roll over a voluntary oil cut of 1mbpd into October, amid uncertainty about supplies and as the kingdom targets drawing down global inventories further, five analysts said.

- Global oil inventories fell sharply in the last month due to OPEC+ production cuts and resurgent demand according to Bloomberg.

- WTI (V3) is -0.8% at $78.99, off a low of $77.62 which saw it breach support at $78.33 (Aug 3 low) and move closer to $77.36 (50-day EMA).

- Brent (V3) is -0.9% at $83.34, off a low of $81.94 which breached $82.36 (Aug 3 low) but stopped before $81.62 (50-day EMA).

- Gold is +1.0% at $1916.77, benefitng from the sharp reversal of USD strength from earlier in the day and a large rally in Treasuries. A high of $1920.40 cleared resistance at $1916.3 (20-day EMA) to open $1932.7 (50-day EMA).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/08/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/08/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/08/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 24/08/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/08/2023 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/08/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 24/08/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 24/08/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 24/08/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/08/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/08/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.