-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Reverse After Strong US PMIs

- MNI TURKEY: Erdogan Draws Level In Latest Presidential Polling

- EU COURT CUTS DAILY POLISH FINES IN HALF TO €500,000, Bbg

- RUSSIA: Western Export Ban Would Cause Global Econ Crisis-Kremlin Spox, Bbg

- UKRAINE: NATO Sec Gen Says Members Support Membership, But No Timeline, Bbg

- US PROPOSES TIGHTER OVERSIGHT OF NONBANKS POSING SYSTEMIC RISK, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Strong Flash April US PMIs Take Air Out of Year-End Rate Cut

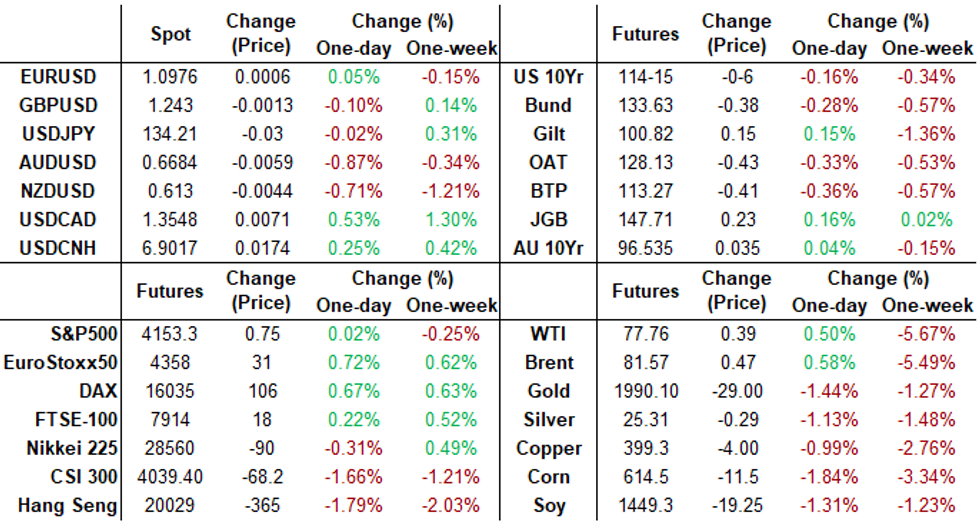

- Treasury futures reverse early session gains to moderately lower after the S&P Global PMIs for April came out much stronger than expected (MFG 40.4 vs. 49.0; Srvcs 53.7 vs. 51.5; Comp 53.5 vs. 51.2 est).

- Front month 10Y futures hit a pre-data high of 115-00 (3.4977% low yld) before falling to a post-data low of 114-13 (-8; yield rebounding to 3.5776% high) amid renewed selling ahead the weekend.

- Reminder, Fed Gov Cook will discuss economic research at 1600ET before the Federal Reserve enters policy blackout at midnight tonight through May 4.

- From a technical perspective, 10Y futures remain in a short-term downtrend and the recovery since Thursday is considered corrective - for now. The contract has recently traded through the 20- and 50-day EMAs and pierced 114-00. This signals scope for weakness to 113-23, a Fibonacci retracement.

- Fed funds implied hike for May'23 remains largely static at 22bp, Jun'23 +29bp cumulative at 5.118%, while projected rate cuts later in the year receded following this morning's data: Nov'23 cumulative -5.2bp vs. 11bp earlier to 4.776%, Dec'23 cumulative -24.1bp vs. -31bp at 4.776%. Fed Terminal currently at 5.11% in Jul'23.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00622 to 4.97052 (+.07746/wk)

- 3M -0.00285 to 5.06775 (+.08487/wk)

- 6M -0.01130 to 5.08834 (+.14532/wk)

- 12M -0.04554 to 4.88247 (+.19820/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 4.80671%

- 1M +0.01043 to 5.02043%

- 3M -0.01757 to 5.25514% */**

- 6M -0.03872 to 5.43457%

- 12M -0.05157 to 5.40900%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $115B

- Daily Overnight Bank Funding Rate: 4.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.281T

- Broad General Collateral Rate (BGCR): 4.76%, $527B

- Tri-Party General Collateral Rate (TGCR): 4.76%, $521B

- (rate, volume levels reflect prior session)

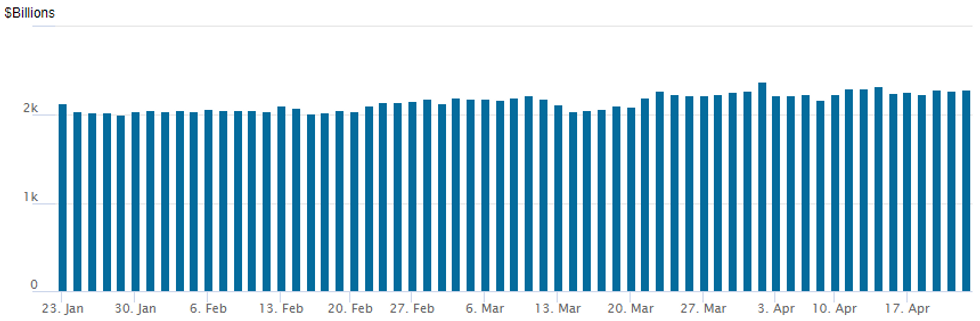

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,290.0239B w/ 105 counterparties, compares to prior $2,277.259B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

SOFR/TREASURY OPTIONS SUMMARY

Early option trade was more paired compared to the better upside call trade in the prior session. Slightly better put trade as accts fade the carry-over support in the underlying since Thursday's sharply weaker than expected Philly Fed Mfg Index. Limited upside SOFR call condor the salient second half trade:- SOFR Options:

- Block, 21,400 SFRZ3 96.00/96.50/97.00/97.50 call condors, 5.25 ref 95.505

- Block, 12,500 SFRZ3 96.00/96.50/97.00/97.50 call condors, 5.0 ref 95.48, more on screen

- +10,000 SFRV3 95.00/95.12/95.37/95.50 put condors at 2.5 ref 95.51

- 5,000 SFRN3 94.93/95.12/95.18/95.43 broken call condors ref 95.105

- +1,500 OQM3 96.00/96.37 2x1 put spds, 1.0

- -1,500 SFRM3 95.00/95.50 call spds, 4.0

- -10,000 OQK3 96.00/96.50 call spds, 30.0 ref 96.44

- 10,000 SFRK3 94.62/94.75/94.81/94.87 put condors ref 94.915

- 4,000 SFRK3 96.12/96.18/96.56/96.68 call condors ref 94.915

- 3,000 OQZ3 96.25/96.50 put spds vs. 2QZ3 96.50/96.75 put spds

- 2,250 SFRM3 94.37/94.56/94.75 put flys, ref 94.91

- 4,000 SFRK3 95.00/95.12 call spds, ref 94.925

- Treasury Options:

- 5,000 FVM3 111.25/112.25 call spds, ref 109-08.5

- 4,000 FVK3 109.5 puts, 9 ref 109-14.75

- 4,400 FVM3 108 puts, 17 ref 109-12.75

- 5,000 FVM3 108.25 puts, 21 ref 109-13.5

- 11,000 FVM3 111 calls, 19 ref 109-13.75 to -12.75

- 5,000 TYM3 110 puts vs. 4,000 TYM3 111 puts ref 114-22

- 5,000 TYM3 117 calls, 24 ref 114-24.5 to -26.5

- 1,000 TYM3 115.5/117/118.5 call flys

EGBs-GILTS CASH CLOSE: Bunds Underperform As Services PMIs Surprise

Gilts outperformed Bunds Friday in a session highlighted by much stronger-than-expected flash Services PMIs offset somewhat by weak Manufacturing readings.

- Overall the hawkish impact from the European PMI readings was short-lived, with a strong reading in the US equivalent required to send Bund yields decisively higher with the German curve bear steepening,

- The UK curve saw some twist flattening, with yield rises possibly restrained by a mixed-to-weak UK retail sales reading.

- In a continuation of this week's ECB speaker theme, de Guindos and Vujcic had no discernible market impact.

- Periphery EGB spreads were little changed on the day, as were ECB / BoE hike prospects.

- We highlighted several sell-side BoE view changes this week following strong CPI/wage data.

- Ratings reviews after hours Friday include Greece, Italy, France, Ireland, and the UK. Focus next week will be on prelim April euro area national PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.6bps at 2.921%, 5-Yr is up 2.9bps at 2.521%, 10-Yr is up 3.6bps at 2.481%, and 30-Yr is up 4.5bps at 2.55%.

- UK: The 2-Yr yield is up 1.5bps at 3.746%, 5-Yr is down 0.8bps at 3.621%, 10-Yr is down 0.9bps at 3.758%, and 30-Yr is down 0.8bps at 4.097%.

- Italian BTP spread up 0.1bps at 187.1bps / Spanish down 0.2bps at 103.9bps

EGB Options: Limited End-Week Flow Includes Euribor Upside

Friday's Europe rates/ bond options flow included:

- ERU3 97.00/98.00 call spread bought for 6 in 9k (v 96.18)

FOREX: Greenback Spikes On US Data, Pares Gains Into The Close

- The USD had been trading on the back foot on Friday before stellar US data prompted a spike to the best levels of the session. Above expectation manufacturing and services PMIs saw the USD index rally the best part of half a percent with a notable uptick for USDJPY. However, the greenback pared these gains into the close and looks set to post a very minor adjustment for the week with expectations for the May FOMC meeting looking set in stone.

- The poorest performers are AUD & NZD across the final session of the week, undoing the late rally across AUD/USD and NZD/USD into the Thursday close. NZD/USD printed down at 0.6127 ahead of the NY crossover following on from the weak NZ CPI data seen early Thursday. This represents the lowest level since early March, narrowing the gap with key support of 0.6085.

- USDCAD has drifted 0.5% higher on Friday, nearing 1.3550 again. The pair has seen a 1.3% advance on the week in a solid reversal of prior oversold conditions. There was limited reaction in the pair to CAD retail sales with a weak March advance release (caveated by a low response rate), but it helps CAD underperform. 1.3582 remains in focus, the 50% retrace of Mar 10-Apr 14 bear leg.

- EURUSD has showed a degree of resilience, hovering just below the 1.10 mark. However, it is worth noting that price action has been limited within Monday’s 90 pip range all week as markets await further tier-one US data and monetary policy decisions from both the Fed and the ECB over the next two weeks.

- The highlight on Monday will be the German IFO Survey: The IFO sentiment index is seen stalling at 93.3 in April, after five consecutive months of improvement. Highlights for the week ahead include advanced US Q1 GDP and German Flash CPI readings. Australian CPI and a BOJ meeting are also on the docket.

FX Expiries for Apr24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0930-35(E737mln), $1.1000(E574mln)

LATE EQUITY ROUNDUP: Quietly Extending Highs

Stocks currently extending late session highs, breaking through top end of narrow 12.0pt range, optimistic despite the sell-off in stocks and Treasuries following this morning's April S&P Global PMIs came out much stronger than expected (MFG 40.4 vs. 49.0; Srvcs 53.7 vs. 51.5; Comp 53.5 vs. 51.2 est).- Currently, DJIA shares are up 24.29 points (0.07%) at 33812.75, S&P E-Mini futures are up 6.5 points (0.16%) at 4159, Nasdaq up 34.2 points (0.3%) at 12094.49.

- Consumer Discretionary sector continues to outperform, lead by retailers (Amazon gaining 3.8%) and auto makers (Tesla +1.5%).

- The trend outlook in S&P E-minis remains bullish while the midweek move lower (from Tuesday’s high) is considered corrective. Support to watch lies at 4119.30, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4077.86, the 50-day EMA.

- Attention is on the 4200.00 handle where a breach would resume the uptrend and open 4205.50, Feb 16 high ahead of 4244.00, the Feb 2 high and key resistance.

E-MINI S&P (M3): Pullback Considered Corrective

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4200.00 Round number resistance

- PRICE: 4150.00 @ 1230 ET Apr 21

- SUP 1: 4122.47 20-day EMA

- SUP 2: 4080.70 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

The trend outlook in S&P E-minis remains bullish and the latest move lower (from Tuesday’s high) is considered corrective. Support to watch lies at 4119.30, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4077.86, the 50-day EMA. Attention is on the 4200.00 handle where a breach would resume the uptrend and open 4205.50, Feb 16 high ahead of 4244.00, the Feb 2 high and key resistance.

COMMODITIES: Crude Oil Slips Nearly $6 On Week, Gold Ending Notably Softer

- Crude oil prices have edged higher today to only slightly sustained losses seen through the week, with a weekly decline of nearly $6/bbl for Brent to today’s low of $80.5.

- The market is assessing the weak economic demand picture against supply cuts and potential for stronger crude fundamentals.

- WTI is +0.6% at $77.84, maintaining levels off support at $75.83 (Mar 31 high) but still off $81.24 (Apr 19 high).

- Brent is +0.6% at $81.61 having held above support at $79.95 (Mar 31 high) but also off resistance at $85.15 (Apr 19 high).

- Gold is -1.2% at $1979.84 for a surprisingly heavy decline considering the net weakness in the USD. The day’s first decline came early in the day with a second leg as Treasury yields climbed on stronger than expected US PMIs. The earlier low of $1971.81 came close to support at $1969.3 (Apr 19 low).

- Weekly moves: WTI -5.7%, Brent -5.5%, Gold -1.2%, US nat gas +4.9%, EU TTF nat gas -2.4%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/04/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 24/04/2023 | 0900/1100 |  | EU | ECB Panetta Panels Event by Bruegel Think Tank | |

| 24/04/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 24/04/2023 | 1330/1530 |  | EU | ECB Panetta Into at ECON Hearing on Digital Euro | |

| 24/04/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.