-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

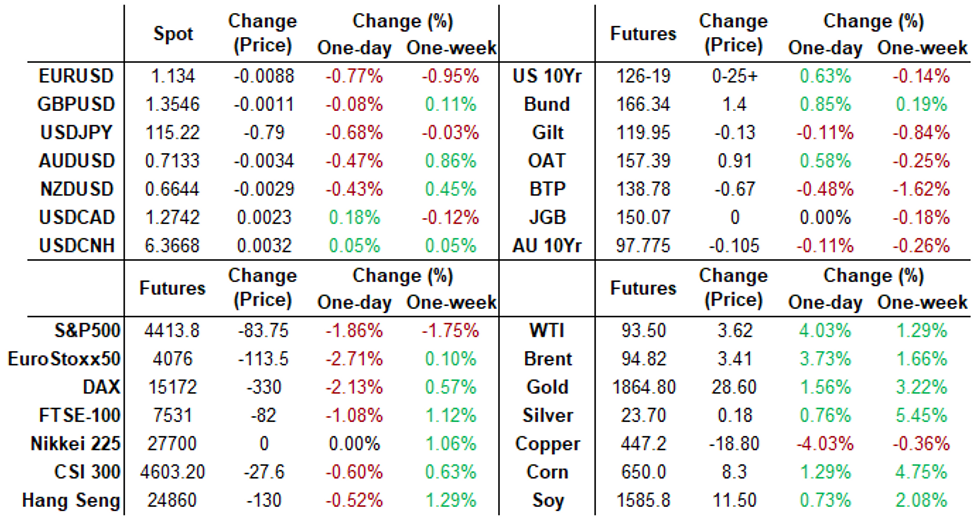

Free AccessMNI ASIA MARKETS ANALYSIS: Risk-Off on Russia Invasion Concern

US TSYS: Nice Range on Day, New Highs Across the Board

Aside from the risk-off buying on Russia/Ukraine invasion fears, Tsys extend session highs after the bell -- for a more prosaic reason: measured pace of QE wind-down after NY Fed annc final buy-operations (see 1513ET bullet).

- Final buy-op on Thu March 9: Tsy 2.25Y-4.5Y, appr $4.025B.

- FI markets unwind shorts on bets the Fed could have annc'd an immediate end to QE, quelling chances of intermeeting move prior to March 16 FOMC.

- 30YY falls to 2.2321%, 2.2349 last (-.0814); 10YY falls to 1.9112%, 1.9147%last (-.1147).

- Trading desks report leveraged $selling 30s and putting on 5s30s steepeners. Incidentally, 5s30s currently +3.81 at 40.21.

- Eurodollar Options: Better volumes than Treasury options so far, but still fairly sporadic from exhausted markets after Thursday's re-pricing of larger/faster rate hikes due to inflation spike.

- Treasury Options: Trade varied but volumes relatively muted given the shifts in policy pricing since Thursday, not to mention support for underlying futures evaporating around the London close.

Short Term Rates

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 at 0.07843% (+0.00143/wk)

- 1 Month +0.06743 to 0.19114% (+0.07585/wk)

- 3 Month +0.11157 to 0.50643% (+0.16743/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.17600 to 0.84043% (+0.28500/wk)

- 1 Year +0.26772 to 1.39229% (+0.39329/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $280B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $914B

- Broad General Collateral Rate (BGCR): 0.05%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $337B

- (rate, volume levels reflect prior session)

NY Fed updated purchase schedule: The Desk plans to purchase approximately $20 billion over the monthly period from 2/14/22 to 3/11/22 -- in effect ending intermeeting move. Note: Eurodollar lead quarterly EDH2 +0.030 at 99.31 as 50bp hike odds fall below 50%.

- Tue 02/15 1010-1030ET: Tsy 4.5Y-7Y, appr $3.225B vs. $6.025B prior

- Thu 02/17 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

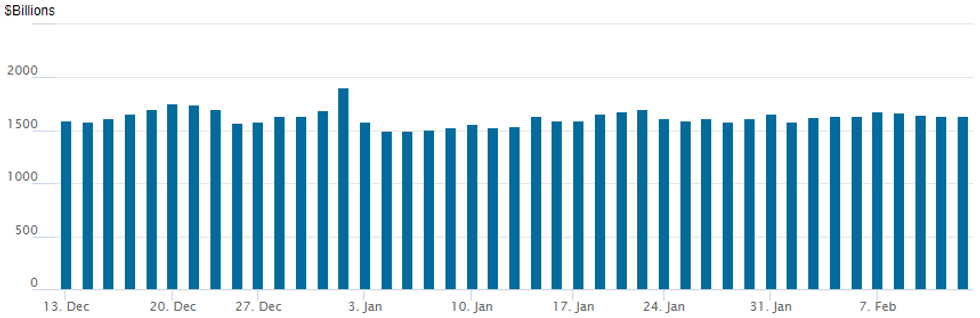

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $1,635.826B w/ 77 counterparties vs. $1,634.146B yesterday -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:

- Blocks, +25,000 SFRM3 98.00 straddles, 96-97

- Block, 10,000 SFRU3 96.87 puts, 227.0 vs. 97.90/0.21%

- Block, 11,500 short Jun 97.50/98.00 put spds, 24.5 at 1158:18ET

- +5,000 Red Sep'23 100.0 calls, 2.0

- +5,000 Dec 97.75/98.75 put over risk reversals, 21.0

- +3,000 Jun 98.81/99.12 1x2 call spds, 0.75-1.0 call spds

- +2,500 Sep 98.31 straddles, 71.0

- -10,000 Sep 99.00/99.12 risk reversals 0.0, hear put sold over

- -25,000 Jun 98.75/98.87 put spds, 6.5

- +2,000 Jun 97.75 straddles, 101.5

- +2,875 Gold Jun 97.00/97.62 put spds on a 5x4 ratio, 50.0 net db vs. 97.805

- Overnight trade

- 5,000 Blue Dec 97.00/97.62 3x2 put spds, 23.0 net at 0629:05ET

- 5,000 Mar 99.50 puts, 26.5 at 0626:41ET

- 5,750 Mar 99.25/99.31/99.37/99.43 call condors

- 1,250 Blue Sep 97.12/97.62 5x4 put spds, 45.0 net at 0619:53ET

- 7,500 Gold Apr 97.00/97.62 put spds, 9.5 at 0603:43ET

- 2,000 Blue Jul 97.12/97.62 5x4 put spds, 43.0 net at 0603:43ET

- Block, +12,000 Mar 99.12/99.18/99.31 2x3x1 put flys, 1.75

- 2,500 FVJ 117.5/118.25 1x2 call spds, 6

- 2,000 TYH 125/125.5 put spds, 10

- 4,500 TYJ 123/125 put spds, 34

- 1,500 TYH 125.5 puts, 15 total volume near 20k

- 2,500 TYH 126.5

- 5,000 FVM 118.75 calls, 23.5

- 2,.000 TYH 128/128.25 straddle spd

- +4,000 TYK 128 calls, 25

- 4,000 TYJ 126 straddles, 159

- Overnight trade

- 5,000 TYH 126 puts, 25

- 3,000 TYH 124.75/125/125.25/125.5 put condors, 1

- 2,500 TYJ 123/125 3x2 put spds

- 5,850 FVJ 118 calls, 20

- 3,000 FVJ 118.5/119.5 1x2 call spds

- +5,000 TYH 126 puts, 26 vs. 125-31.5/0.50%

- +10,000 wk1 TY 125/126 2x1 put spds, 1

EGBs-GILTS CASH CLOSE: Early Reprieve Fades In Late Trade

German and UK yields ended up higher Friday following an early reprieve, as global core FI sold off in the afternoon.

- The Gilt curve bear flattened while the German curve bear steepened (reversing early flattening).

- No obvious drivers of late weakness, looked to be a resumption of Thursday afternoon's post-US CPI bearish price action in sympathy with Tsys.

- Periphery EGB yields widened for yet another session, as central bank tightening remained the focus, though finished off early wides.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1bps at -0.321%, 5-Yr is up 0.3bps at 0.086%, 10-Yr is up 1.6bps at 0.3%, and 30-Yr is up 2.3bps at 0.497%.

- UK: The 2-Yr yield is up 5.8bps at 1.42%, 5-Yr is up 3.3bps at 1.442%, 10-Yr is up 2.7bps at 1.551%, and 30-Yr is up 1.1bps at 1.624%.

- Italian BTP spread up 5.5bps at 166.2bps / Greek bond spread up 4.3bps at 233.6bps

EGB Options: ECB Near-Term Hawkish Plays And Longer-Dated Upside

Friday's Europe rates / bond options flow included:

- OEJ2 172p, bought for 5.5 in 12.5k

- OEH2 130.5/130ps, bought for 14.5 in 5k

- DUH2 11.70p vs 111.90/112.00cs, bought the p for 16 up to 16.5 in 17k (Said to be an unwind)

- 2RH2 98.87/98.62ps, bought for 3.5 in 5k

- ERZ2 99.25/98.75ps bought for 6.25 in 10k

- 2RH2 99.375p, bought for 31.75 in 14k (ref 99.09)

- ERU3 99.75/100.00/100.25c fly, bought 3.25 in 10k

- ERZ3 99.75/100.00/100.25c fly, bought for 3.25 in 20k

FOREX: Greenback Ends Week Trading On Surer Footing

- After a particularly volatile Thursday session, the US dollar looks set to post a marginally positive week overall, with the dollar index currently 0.25% in the green.

- Expectations for a more hawkish Fed have kept the greenback underpinned despite coming under pressure in the hours following the US CPI data yesterday.

- In a generally subdued session, EURUSD traded either side of 1.1400 in a narrower 60 pip range with USDJPY echoing the price action around the 116 mark.

- EURGBP had the most notable move, retreating 0.5% despite the technical outlook remaining bullish, following the rebound from the major area of support around 0.8300.

- EURSEK also retraced 0.65% from yesterday’s highs following the relatively dovish Riksbank on Thursday. It is worth noting that the pair looks set to post its highest weekly close since September 2020.

- Emerging market currencies traded mixed, with the Mexican peso steadily grinding higher following the Feb Banxico meeting. Conversely the Russian Ruble faltered 1.6% following the CBR considering two hiking options and deciding on the more moderate option of a 100bp hike.

- A very quiet data calendar on Monday before RBA minutes and German ZEW sentiment data on Tuesday. The FOMC will also publish the minutes of their January meeting on Wednesday.

Expiries for Feb14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600(E608mln), $1.1480(E1.1bln)

- USD/JPY: Y116.00($532mln)

- AUD/USD: $0.6900(A$1.0bln), $0.7100-10(A$1.6bln)

EQUITIES: Stocks Softer For a Second Session

- Equity markets traded negatively for a second consecutive session on Friday, pressuring futures and putting the e-mini S&P within range of the first key support at the 4446.7 200-dma. Losses were more acutely felt among growth and tech names, putting the NASDAQ-100 lower by as much as 1%.

- Weakness across global equity markets followed Thursday's red-hot CPI, which keeps the prospect of a protracted Fed tightening cycle top of mind for US investors. This put the tech sector comfortably at the bottom of the S&P 500, with value names outperforming.

- A recovery for WTI and Brent crude futures helped underpin a rise for the energy sector, explorers and services firms were the main beneficiaries, putting the likes of Baker Hughes, Phillips 66 and Valero Energy higher by as much as 5%.

- S&P E-minis failed to hold above the 50-day EMA - at 4561.44. This average continues to provide a firm resistance and a clear breach of it is required to suggest scope for a stronger rally that would open 4671.75 initially, Jan 18 high.

COMMODITIES: Oil Finishing The Week Strongly

- Crude oil prices are finishing the week on a strong note, up ~2% on a largely upward trend ever since Europe came in whilst markets remain very tight. This sees oil square up down fractionally on the week after a string of strong weekly gains.

- The US held a call with Transatlantic allies on the Russia-Ukraine situation, with potential ramifications of that still to come.

- WTI is +2.2% at $91.85 having trimmed gains slightly on an increased US rig count. Trend conditions remain bullish though, moving closer to initial resistance of $93.17 (Jan 4 high). First support is seen at the 20-day EMA of $86.83.

- Brent is +2.0% at $93.21, with support seen at $89.93 (Feb 8 low) and resistance at $94 (Feb 7 high) with the outlook remaining bullish.

- Gold also finishes the week on a stronger note, up 0.8% to $1840.7. After a volatile two days on inflation and Fed hiking fears, it’s back just shy of yesterday’s high of $1842.0 after which it’s back to eyeing the bull trigger of $1853.9 (Jan 25 high).

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/02/2022 | 1600/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 14/02/2022 | 1615/1715 |  | EU | ECB Lagarde Speech on anniversary of Euro at EU Parliament | |

| 14/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/02/2022 | 1630/1730 |  | EU | ECB Lagarde Intro at ECB Annual Report 2020 Plenum |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.