-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk-On Surge With Weaker Wages, ISM Services

- Weaker than expected US average hourly earnings before ISM Services saw its largest downside miss since 2008 have driven a significant relief rally today with subsequent, largely pre-prepared, Fed commentary making little impact.

- A weaker US dollar and Treasury yields tumbling more than 20bps at the front end to belly have helped drive risk assets. The S&P 500 is finishing the week strongly and gold surges although crude oil can't shake off a solidly negative week on demand fears.

- Powell on Tue (Jan 10) and US CPI (Jan 12) headline next week.

US TSYS: Yields Tumble With Average Earnings, ISM Services Misses

- Cash Tsys have swung from modest cheapening through 2-10Y tenors at the start of the US session to a substantial rally. The latter sees front end to belly yields currently down 21-22.5bps after notably weaker than expected average hourly earnings growth (offset somewhat by a new recent low for the u/e rate) before a significant miss for ISM Services as new orders cratered - see data reviews further below.

- US CPI on Jan 12 will most likely still be pivotal but for now, the market leans more heavily towards a 25bp hike from the FOMC on Feb 1 with 32bp priced vs 36-37bp prior to the data and the implied terminal cut 10bps to 4.95% for June (cumulative 62bps of hikes).

- Further along the curve, still significant rallies of 15bp for the 10Y (led by lower real yields, in turn pushing risk assets materially higher) have limited the steepening in 2s10s to just +5.5bps at -68bps, within yesterday's range. .

- TYH3 climbs to session highs of 114-09+ (+1-09) on very high volumes currently at 1.85M. It's easily through resistance at 113-15+ (Dec 23 high) to next eye 114-17 (76.4% retrace of Dec 13 – 30 bear leg).

- Looking to next week, Powell talking twice on Tue (Jan 10) at the Riksbank event will be firmly in focus, all with an eye on CPI on Thu (Jan 12).

FOREX: Greenback Weakness Prevails Following Key US Data

- Despite early USD strength on Friday, weaker US wage growth combined with a large miss for ISM Service activity have been the main drivers for a substantial greenback turnaround, resulting the in the USD index looking set to post a 1.1% decline on the day.

- Greenback weakness across the board was evident throughout the US session with the greenback pressing on intra-day lows approaching the week’s close. With a substantial recovery for major equity indices, AUD (+1.85%), NZD (+1.88%) and GBP (+1.53%) are the most notable performers in G10 amid the more optimistic sentiment. This is also filtering through to significant gains for some EM currencies, notably the Brazilian Real and Colombian Peso, both rallying over 2%.

- Additionally, the Onshore Yuan has traded to fresh trend lows and breached its 200day moving average against the USD in the process. It is worth highlighting that this is the first test of this average since April 2022. This follows an earlier break of the same average for USDCNH, which has gathered downside momentum across the session.

- Another significant round trip for USDJPY, which after briefly piercing above key resistance at 134.50 before the data now finds itself gravitating towards the 132 handle, substantially trimming the week’s advance following an impressive 525 pip weekly range.

- With expectations for the next Fed hike size in question, focus turns to Chair Powell who speaks next Tuesday, ahead of the important December CPI print which is due Thursday.

STOCKS: Day's Relief Rally Still In Full Flow, ESA Clears Key Resistance

- ESA sees a third wind heading later in the session, hitting new highs of 3928.75 (+2.5%), extending an intraday rally from a low of 3819 10mins before payrolls. It breaks a key resistance level of 3914.41 (50-day EMA), a sustained break of which could open 4043 (Dec 15 high).

- A substantial rally in Treasuries on expectations of less Fed hikes from weaker wage growth before a large miss for ISM Service activity is the main driver for the day’s turnaround, with larger gains in Nasdaq (+3.0%) in a reversal of yesterday’s oversized decline for the latter.

- SPX gains led by materials (+3.4%) but with sizeable gains across a broad swathe of sectors.

EQUITIES: Earnings Season Kicks Off With Banks, Financials

- Quarterly earnings season begins next week, with 4.5% of the S&P 500 by market cap set to report. Banks and financials start the cycle, with JPMorgan, Bank of America, Citigroup and Wells Fargo due among others

- Earnings reach critical mass later in the quarter, with 50% of the index set to have reported by Feb 1st, making earnings releases less relevant for the index from then onwards.

- Full calendar including timings and expectations here: https://roar-assets-auto.rbl.ms/files/50444/MNIUSE...

- S&P 500 EPS growth has plateaued since the recovery off the pandemic lows, helping curtail expectations for the Q4 reporting season. The outperformance of value over growth in 2023 is broadly expected to persist into 2023 as global central banks retain their tightening bias and a global recession is widely predicted

US: Market Inflation Expectations Holding Near Lows With CPI Eyed Next Week

- Today’s significant two-step rally following payrolls and ISM services has been reflected in real yields, with breakevens seeing much smaller moves (5Y -2bp, 10Y -1.5bp).

- That is however after recent sizeable declines for breakevens, with the 5Y of 2.23% nearing early Oct’22 lows that in turn were the lowest since early 2021 and significantly below ~3% before the start of the Ukraine war.

- This has seen significant compression towards the 5Y5Y breakeven of 2.17%, a more typical long-run level and indeed Bullard’s presentation yesterday noted that inflation expectations are consistent with the 2% inflation goal.

5Y breakeven (white) and 5Y5Y breakeven (yellow)Source: Bloomberg

5Y breakeven (white) and 5Y5Y breakeven (yellow)Source: Bloomberg

EGBs-GILTS CASH CLOSE: Weak US Data Steals EZ Core CPI's Thunder

US data sparked a strong afternoon rally across EGBs and Gilts Friday.

- Bund futures hit session lows on the 1100CET Eurozone Dec inflation release which showed core inflation ticking higher, cementing pricing for a 50bp ECB hike in February.

- But shortly after, EGBs and Gilts bottomed and began a sustained intraday rally that accelerated in the afternoon on weaker-than-expected wage data in the US employment report, and on a contractionary US ISM Services reading that spurred recession talk.

- Curve bellies outperformed and periphery EGB spreads came off their wides as ECB tightening pricing faded.

- Looking ahead, BoE's Mann and Pill speak over the weekend, while Monday opens with German IP data (following today's weak factory orders print).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7bps at 2.581%, 5-Yr is down 10bps at 2.251%, 10-Yr is down 10.6bps at 2.21%, and 30-Yr is down 10.7bps at 2.155%.

- UK: The 2-Yr yield is down 9.4bps at 3.438%, 5-Yr is down 10.8bps at 3.45%, 10-Yr is down 8.1bps at 3.472%, and 30-Yr is down 3.7bps at 3.871%.

- Italian BTP spread down 0.3bps at 201.5bps / Spanish unch at 105.8bps

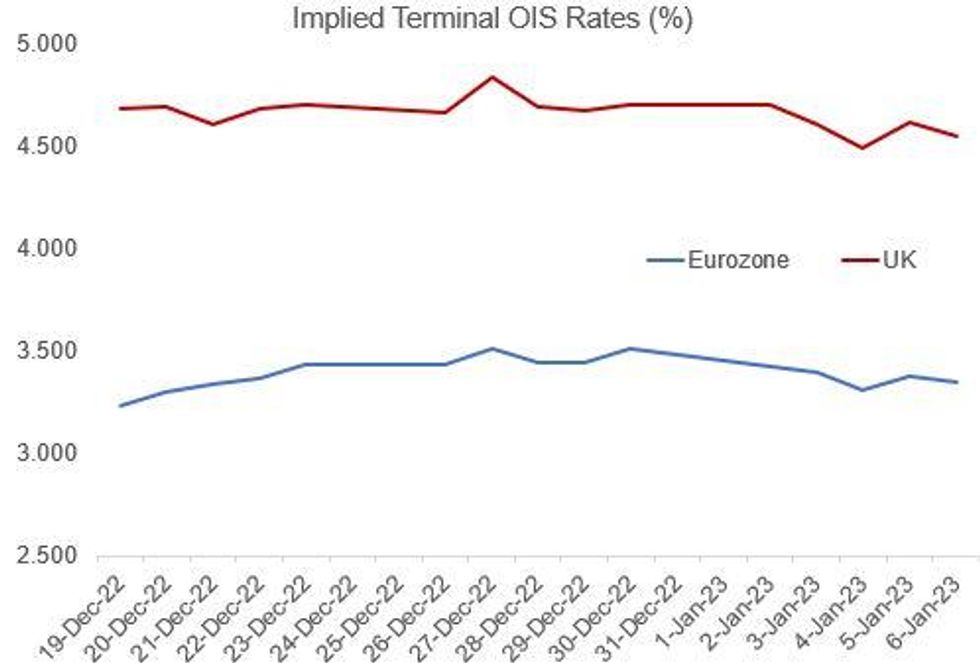

STIR: ECB/BoE Hike Pricing Set To Close Sharply Lower On The Week/Year

ECB and BoE terminal rates are set to close sharply lower on the week, with Eurozone pricing paring 17bp and UK 15bp since the Dec 30 close.

- There's currently 112bp of BoE hikes priced in this cycle through Sep 2023, to a Bank Rate of 4.62% (vs 126bo at end-2022); there are 144bp of ECB hikes priced through a Sep 2023 peak Depo rate of 3.44% (vs 161bp at end-2022).

- The lower tightening expectations are on the back of both softer-than-forecast Eurozone CPI data and poor US data to end the week (including a recessionary ISM Services report).

COMMODITIES: Gold Surges Whilst Oil Ultimately Little Changed On US Data

- Crude oil has seen a mixed day and is ending it broadly flat having reversed initial gains following weaker wage growth in the US payrolls report. It leaves 5+% declines for the week, the largest weekly loss in a month with weaker demand concerns winning out over the week as a whole.

- WTI is +0.3% at $73.89, still sitting close to support at $72.46 (Jan 5 low) but not troubling it having previously cleared the key short-term support at $76.79 (Dec 29 low). The day's most active strikes in the CLG3 are once again for $70/bbl puts.

- Brent is -0.1% at $78.61, also hovering above support at $77.61 (Jan 5 low).

- Gold is +2% at $1868.96, an outright winner with the USD sliding and yields tumbling. It pushes through resistance at $1865.1 (Jan 4 high) to open $1876.0 (3.0% 10-dma envelope).

- Gas: TTF ended the week down almost 10% wk/wk with warm weather extending through the two-week forecast. The front month contract has now fallen 57% since high in early December.

- Weekly moves: WTI -5.9%, Brent -4.5%, Gold +2.5%, US Nat Gas -18.6%, EU TTF Nat Gas -9%

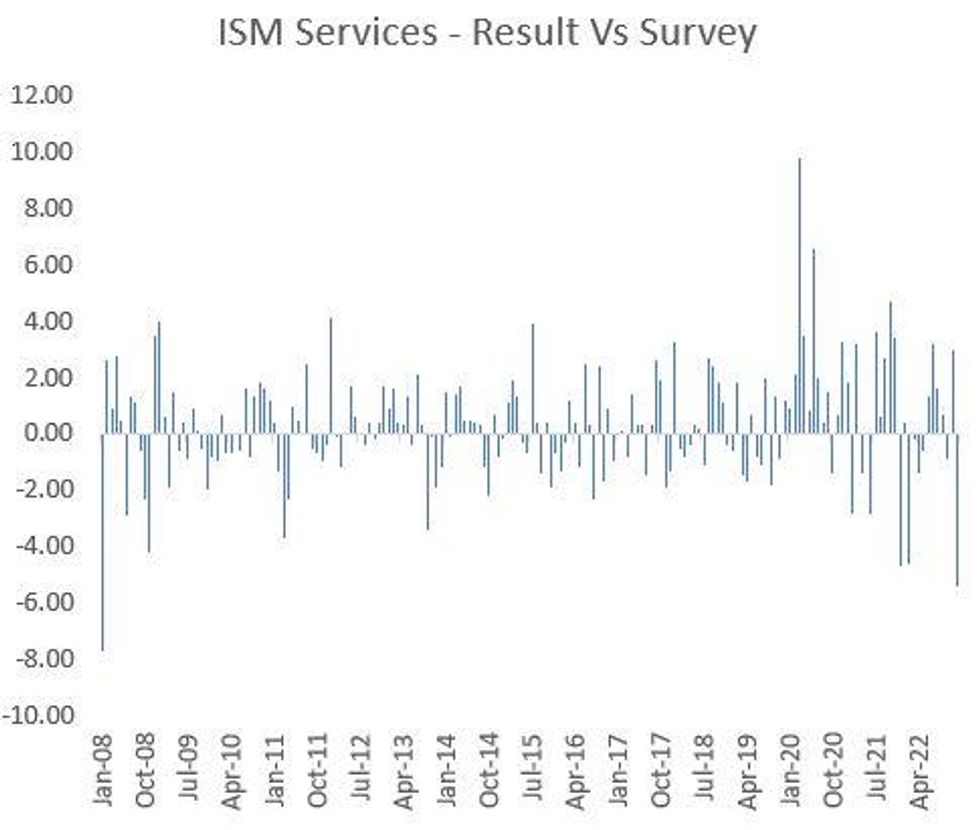

US DATA: ISM Services Posts Lows Since 2009 Outside Of Pandemic

- ISM services was far weaker than expected in December, sliding from 56.5 to 49.6 (cons 55.0) led by new orders, finally following weakness in manufacturing surveys of recent months but far more abruptly than expected.

- ISM services of 49.6 (-6.9pts) is weakest since Nov'09 (41.5 low Apr'20)

- New orders of 45.2 (-10.8pts) is weakest since Mar'09 (32.6 low Apr'20), for a sharper monthly drop in new orders than anything seen in 2008-09.

US DATA: ISM Services Hasn't Missed Expectations This Much Since 2008

Little wonder that markets have reacted so sharply to the shockingly weak ISM Services reading (Tsy yields down 10bp, USD down 0.7%): December's 49.6 vs 55.0 survey median is the biggest downside miss vs expectations for ISM Services (5.4 points) since BBG's survey started in Jan 2008 (that first month, it missed to the downside by 7.7 points).

Source: BBG, ISM, MNI

Source: BBG, ISM, MNI

US DATA: AHE Revises Away Last Month’s Standout Strength

- Last month’s strong upward revision to AHE has proved to be largely a headfake, with total AHE revised down from 0.55% to 0.40% in Nov and slowing to 0.275% in Dec, the sofest rate since Feb and before that Mar’21.

- After a stronger recent run, non-supervisory pay of 0.214% M/M (following a 0.43% revised down from 0.68%) is the softest since Jan’21.

US DATA: Household Survey Roars Back In A Reminder Of Its Volatility

- Household employment came surging back with a 717k increase in Dec.

- It follows two still large but smaller than first thought declines in Oct and Nov, with a cumulative -323k vs -466k initially, but with almost 100k fewer cumulative jobs added in Aug-Sep. (i.e. the prior slowdown in household employment has been less stark that previously thought).

- A strong increase in labour force (439K) and upward revision to Nov (-119k from -186k prior) wasn’t enough to stop the u/e rate falling to just fractionally off record lows at 3.47%.

US DATA: Participation Rates Improve But Still Rangebound

- Fresh recent history lows in both unemployment (3.47%) and U-6 underemployment (6.5%) were noteworthy against the slightly larger than expected rise in participation (from 62.1 to 62.3, cons 62.2%).

- The latter rise was seen across the board in both prime and various non-prime age groups. However, both total and prime participation rates remain off post-pandemic highs seen in the summer, notably so in the case of prime age (see chart), likely require further improvements to more seriously allay concerns of labor not returning to the workforce including early retirees.

- Further into the details, the underemployment rate touching new recent lows came despite a more material bounce in those working part-time for economic reasons from twenty-year lows, likely offset by a less optimistic drop in those marginally attached.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.