-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI ASIA MARKETS ANALYSIS - Sedate Markets Amid President's Day Holiday

Highlights:

- US Treasury futures drift moderately lower through the latter half of the session, remaining within tight ranges

- USD index unchanged, NZD marginally outperforms

- Crude futures edge up into positive territory, recouping earlier losses, all amid thin trading due to the US holiday

US TSYS: Drift Lower In Shortened Session As Fed Minutes Come Into View

Monday trade proved characteristically quiet for a holiday (Presidents' Day) marked by a cash close in Treasuries, with futures weakening slightly throughout the session.

- As of an hour before the close, front Treasury futures were down 3 ticks at 109-21, drifting lower through the latter half of the session and remaining within tight ranges throughout (Hi 109-27, Lo 109-20) and in any case well within Friday's price parameters.

- The just-under 200k contracts traded represents around 1/6th of Friday's volumes at the same point, by comparison.

- Reminder that Globex trade concluded at 1300ET for the day, before re-opening at 1800ET preceding normal session hours Tuesday.

- Implied Fed cutting expectations remain basically unchanged on the day, with 89bp in reductions seen in FF futures through the remainder of 2024, about 1bp less than Friday's close. A first cut in June remains the centrally priced scenario.

- The data and speaker slate remains relatively thin until Wednesday afternoon when we get the minutes to the January FOMC meeting and potentially some further insight into balance sheet runoff plans. Following up on the minutes will be multiple speakers Thursday including Jefferson, Bowman, Harker, Cook, Kashkari, and Waller.

- The next major data focus this week will be Thursday's jobless claims and PMIs.

EGBs-GILTS CASH CLOSE: Core FI Twist Steepens, BoE Speak / ECB Wages Eyed

Bunds and Gilts closed relatively unchanged Monday, with trading activity, macro developments and headlines all dulled by a US market holiday.

- Yields bottomed by mid-morning without any major catalysts evident, before drifting higher - though all very much within Friday's ranges. In futures terms, 450k March Bund contracts traded - around half of the usual volume.

- The German and UK curves leaned twist steeper with yields across almost all tenors closing within 1.0bp of Friday's close. Periphery spreads were mixed, with BTPs underperforming and PGBs outperforming, but the moves were fairly negligible.

- ECB pricing remained relatively steady: still around 104bp of ECB rate cuts seen through 2024 (first cut fully priced by June), while the 69bp priced for the BoE was about 4bp more than seen at Friday's close (first cut remains fully priced by Aug though now a little more firmly).

- Turning to Tuesday, focus will be on supply (EU syndication, German Schatz auction among others) and ECB negotiated wage data (scheduled for 1000GMT release).

- BoE's Bailey, Broadbent, Greene and Dhingra give testimony on the February Monetary Policy Report - see MNI's Gilt Week Ahead.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at 2.816%, 5-Yr is down 0.3bps at 2.387%, 10-Yr is up 0.9bps at 2.411%, and 30-Yr is up 2.5bps at 2.569%.

- UK: The 2-Yr yield is down 0.6bps at 4.614%, 5-Yr is down 0.2bps at 4.134%, 10-Yr is unchanged at 4.108%, and 30-Yr is down 0.4bps at 4.644%.

- Italian BTP spread up 0.8bps at 149.1bps / Greek down 0.7bps at 107.9bps

FOREX: USD Index Unchanged, NZD Remains atop G10 Leaderboard

- G10 currency ranges remained predictably contained on Monday, with the closure of US markets for President’s Day offsetting any potential impact from China markets returning after the LNY break. The dollar index is unchanged as we approach the APAC crossover.

- NZDUSD has consolidated its modest outperformance overnight. The pair was last 0.6145, marginally above Friday highs and continue to operate above the 20 and 50-day EMAs of 0.6120/6135. Continued strength could see a test of the highs from Jan 31 at 0.6174. As noted earlier, local bank BNZ pushed back the timing of RBNZ cuts to November from August, as well as the services PMI rebounding to 52.1 in Jan, from 48.8 prior. With AUD lagging somewhat, AUDNZD has drifted back towards the notable 1.0600 pivot point.

- For USDJPY, despite drifting lower in early session to 149.88 lows, the pair traded with a more supportive tone and stands closer to 150.20 as Monday’s holiday thinned session comes to a close. Speculation continues around the BoJ NIRP exit. The latest MNI policy insight is at this link, which looks at the chances of a shift at the March meeting.

- Above here, 151.43, the November 16 high remains the focus, inching ever closer to the multi-decade highs at 151.95. Initial support moves up to 148.75, the 20-day EMA.

- RBA minutes will be the highlight of Tuesday’s APAC docket before the focus turns to Canadian CPI for January.

FX Options: Expiries for Feb20 NY cut 1000ET (Source DTCC)

EUR/USD: $1.0675-80(E1.3bln), $1.0700-20(E1.2bln), $1.0740(E744mln), $1.0770(E784mln), $1.0790-00(E1.1bln), $1.0865(E833mln)

USD/JPY: Y149.85-00($1.0bln), Y150.50($1.6bln)

EUR/JPY: Y163.10-30(E620mln)

NZD/USD: $0.6150(N$678mln)

USD/CAD: C$1.3625($1.5bln)

EUR/GBP: Gbp0.8530-50(E1.7bln)

AUD/USD: $0.6400(A$1.1bln), $0.6475-85(A$1.1bln)

USD/CNY: Cny7.1855($1.1bln)

CFTC FX: NZD Net Position Bumped Higher as Markets Revise RBNZ Expectations

- A notable improvement in the GBP net position as per Friday’s CFTC data, with ~16k net contracts added to improve the net position by 8.1% of open interest. This shifted the net long to over 50k, nearing the highest level of the past year.

- Markets may also be weary of the bump higher in the NZD net position which, while smaller than the improvement in GBP, puts the positioning Z-score for NZD at the highest among all currencies surveyed. Markets added just over 2,500 in the week ending Feb 13th, putting the net position at 8.1% of open interest – just below the 52w high of 11.5%.

- Improvement in NZD net position comes alongside the shifting views on RBNZ among the sell-side in recent weeks, with ANZ seeing two further hikes ahead, and BNZ delaying their call for easing in New Zealand.

- The EUR net position continue to fade, albeit at a slower pace. Markets trimmed another 9k contracts from the net long, putting the total position at the lowest in 12 months. This tilted the positioning Z-score to -2.32, the lowest among the panel of currencies.

- MXN net improved by 4.6% of open interest, while JPY was the net loser, as markets added 27k contracts to the net short.

- Full update here:

German DATA: Potential For Negotiated Wage Growth Upside In Early 2024

German negotiated wages rose by +3.29% Y/Y overall in December (vs +3.15% Nov), including an increase of +3.70% in the production sector (vs +3.71% prior), per Bundesbank data.

- Negotiated wages apply to approximately 43% of all German employees, according to the Bundesbank, so are closely watched for developments in overall wage pressures. It rounds out the national estimates of negotiated wages for Q4 2023 ahead of the quarterly Eurozone-wide estimate expected to be released on Tuesday.

- Even with the slight Y/Y uptick, overall German wage growth continues to show evidence of recent deceleration (as recently as October it printed +4.64%).

- Wage growth in the production sector came in at the lowest rate since May 2023. The implication is that December's overall uptick seems to be have been driven by the services sector.

- Wage pressures are considered to be one of the main obstacles to ECB rate cuts, as mentioned by a multitude of ECB policymakers recently, particularly in the light of weak Eurozone productivity data. German employee compensation makes up around 1/3 of the Eurozone total.

- Looking ahead, regardless of the labour market softening, German negotiated wage growth is expected to tick up over the coming months, with particular upside potential in March when many agreements are being negotiated, driven by agreement expirations in the construction industry.

- Additionally, an E1,800 "inflation compensation" one-off payment to state public workers and servants, agreed in December and affecting more than 5% of employed persons in Germany, will only be recognized in Q1 2024, which will also push up wage growth in the quarter, as one-off payments are included in the Bundesbank's tracker.

- MNI has previously noted that the private sector German labour market softened considerably in the second half of 2023 (see 'Higher Services-Driven Employment Levelled By Lower Hours Per Person', Feb 16), particularly in manufacturing. This might put some downside pressure on the negotiation leverage of the worker unions going ahead.

MNI, Bundesbank

MNI, Bundesbank

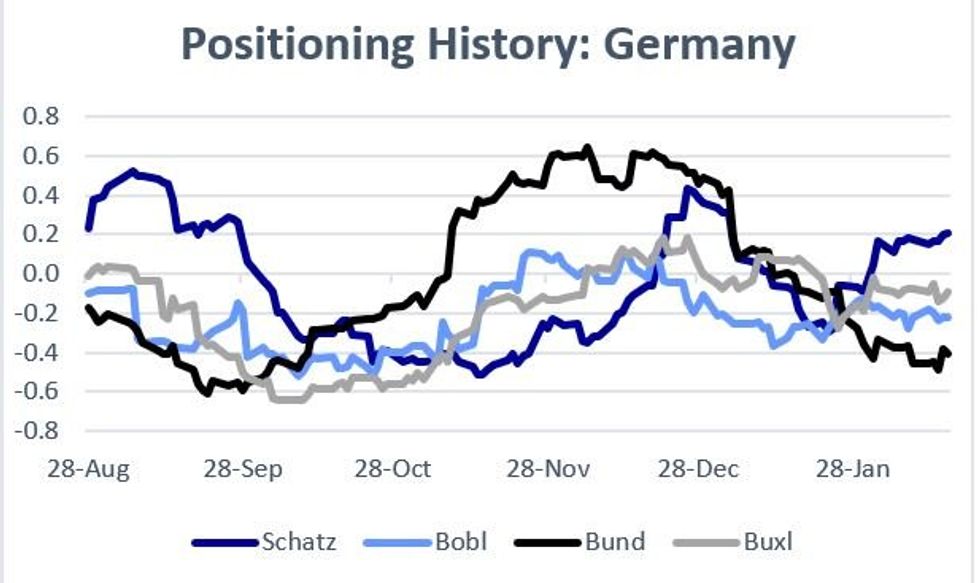

Europe Pi: Schatz Goes Long, Bobl Joins Bund At Short; Buxl Flat (1/2)

From our latest MNI Europe Pi Positioning update (out today, PDF here), among German futures contracts:

- There is more decisive structural positioning in German contracts now vs in early February, when 3 of 4 contracts were flat.

- Schatz has moved into long positioning with Bobl moving to short, whereas both were flat previously. Bund remains short while Buxl remains flat.

- Last week saw shorts set in 3 of 4 contracts, with Buxl the exception (short cover).

Europe Pi: Unchanged In OAT (Flat), Gilt (Short), BTP (Long) (2/2)

Regarding structural positioning in ex-German futures contracts:

- OAT: OAT remains in flat structural positioning, where it has been for most of the past half-year. Trade last week was indicative of short setting.

- GILT: Gilt structural positioning remains short, maintaining the reversal seen this year in contrast to long positioning in late 2023. Longs were reduced last week.

- BTP: BTP structural positioning remains in long territory, where it has been since early February - and last week's trade was indicative of further longs being set.

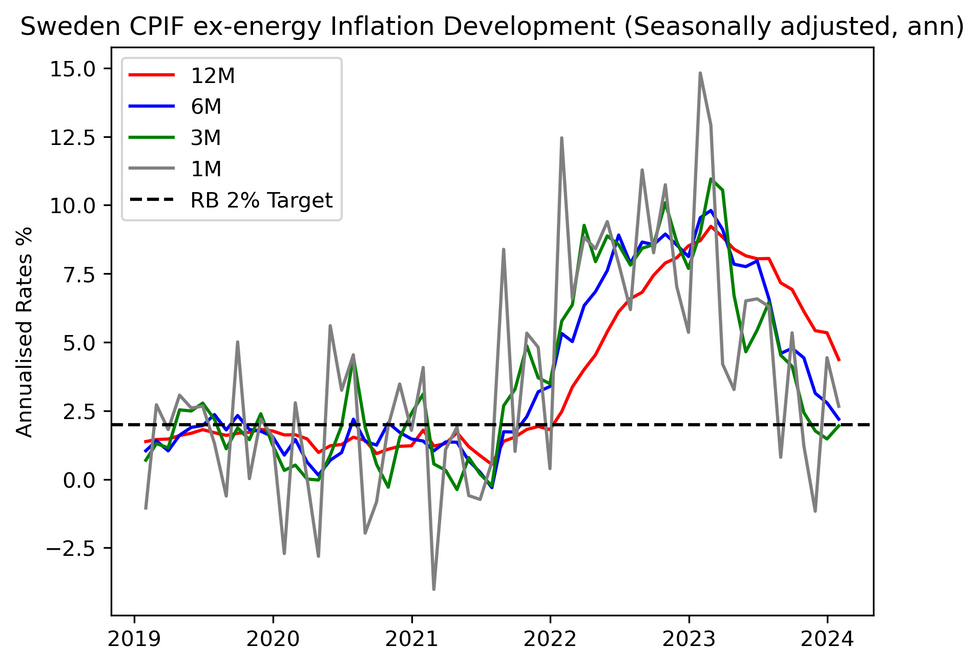

SWEDEN: Seasonal Adjustments Show Clear Deceleration Trend

- The chart below shows that while the development of CPIF ex-energy inflation on a monthly basis (when seasonally adjusted and annualised) is volatile, the trend 3-,6- and 12-month horizons is clearly decelerating.

- Using the X-13 seasonal adjustment method, MNI's calculations indicate SA M/M CPIF ex-energy was +0.22% in January (vs 0.36% in December). On a 3m/3m seasonally adjusted and annualised basis, inflation momentum decelerated to 1.73% (vs 1.89% prior).

- Therefore, the downward trend in Swedish seasonally adjusted inflation momentum continued in January, meaning the basis for the Riksbank's pivot in guidance at the February decision remains firmly intact.

COMMODITIES: WTI Crude Futures Marginally Higher On Session

- WTI is up marginally on the day but has erased some of the additional gains made across European trading hours. Further attacks in the Red Sea continue to weigh against concerns for near-term global demand growth. WTI MAR ‘24 is up 0.1% at 79.27$/bbl

- Houthi rebels struck the Belize-flagged Rubymar in the Bab el-Mandeb Strait on Sunday, which the Houthis claimed, albeit unverified, that the attack resulted in the ship sinking.

- Separately, Iraq will improve its compliance with OPEC+ output cuts after reviewing estimates of its production, Iraqi Oil Minister Hayyan Abdul Ghani said. OPEC+ is likely to extend some if not all oil production cuts into Q2 which would reduce the market surplus according to Energy Aspects last week.

- For precious metals, spot gold edged higher once more, extending the recovery back above the $2,000/oz mark and further eating into the US CPI inspired decline on February 13.

- Silver did not fare as well, declining 1.7%, although price remains closed to last Friday’s opening level around $23.00. Most recent gains appear to be corrective with initial key resistance to watch at $23.534, Jan 12 high. Clearance of this level would instead highlight a stronger reversal.

- Elsewhere, both iron ore and copper are in the red, with Iron ore futures (on SGX) tumbling roughly 1.5%, with market participants weighing prospects for near-term demand in China, the world’s largest metals consumer.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/02/2024 | 0900/1000 | ** |  | EU | Current Account |

| 20/02/2024 | 1000/1100 | ** |  | EU | Construction Production |

| 20/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/02/2024 | 1015/1015 |  | UK | BOE's Bailey et al at TSC to discuss MPR | |

| 20/02/2024 | 1330/0830 | *** |  | CA | CPI |

| 20/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.