-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI ASIA MARKETS ANALYSIS - Significant Further Treasury Steepening On Powell

Highlights:

- Treasuries have ultimately seen a significant twist steepening with Fed Chair Powell's remarks. 2s10s are some 12.5bp higher on the day, with 10Y yields setting new cycle highs but not quite able to clear the psychological 5%.

- The USD index saw volatility with Powell's remarks but moved to consolidate prior weakness, with the EUR and CHF leading gains on the day.

- Equities have slid again from a combination of higher long-term yields, some large single names falling heavily after earnings and escalating geopolitical tensions in the Middle East.

- Those geopolitical risks have seen gold and oil surge, the former clearing a latest resistance level.

- Ahead, President Biden gives a major foreign policy address at 2000ET with potentially $100B pledged. In Asia Pac, China’s reference lending rate will likely remain unchanged, after Q3’s strong-than-expected economic performance and as the yuan passes through a period of weakness, economists told MNI. Elsewhere, the RBNZ Statement of Intent will be published before retail sales data for both the UK and Canada. There's a particularly skinny US docket after a heavy few days.

US TSYS: Extending Twist Steepening Late Into Session, Biden Address Still Ahead

- Treasuries extend their twist steepening late in the session, with the 2Y pushing new session highs (equating to 6.5bp richer), whilst the long-end is firmly cheaper with 10Y +6bps (never quite clearing 5%) and 30Y +10bps.

- 2s10s sits 12.5bps higher on the day, +10bps since Powell’s remarks and especially the Q&A, at -18bps for highs since Sep’22, whilst 2s30s has increased +16.5bps.

- TYZ3 trades at 105-17+ (-11), having seen sizeable volatility post-Powell touching 105-30+ with the text before a low of 105-10+, the latter new recent lows. Support is seen at 105-01+ (2.0% 10-dma envelope). Very strong cumulative volumes of 2.15M.

- The front end has been strongly bid based on sanguine opening to remarks, noting that "Incoming data over recent months show ongoing progress toward both of our dual mandate goals—maximum employment and stable prices" and the significant tightening in financial conditions (which at the margin could mean less need to hike).

- The long-end did however see significant cheapening impetus on there being evidence that policy is “not too tight right now”.

- Fed Funds implied rates show just 1bp of tightening priced for Nov, building to a cumulative +10bp to a terminal 5.43% effective rate in January (-2.5bp since Powell). It’s followed by 70bp of cuts to end-2024 from 68bp pre-Powell, still near lows for recent months.

- Still to come, Biden’s address on foreign policy with potentially $100B pledged after the close at 2000ET, plus Fedspeak from Bostic, Harker and Logan. Tomorrow meanwhile sees a near-empty US docket after a few stacked days.

FOREX: USD Index Sheds 0.4% As Powell Acknowledges Inflation Progress

- Despite some volatile two-way flow following remarks from Fed Chair Powell on Thursday, the USD index has consolidated losses on the day, declining 0.50% as we approach the APAC crossover. The downward bias has been emphasised by Powell’s remarks on the progress of inflation that has prompted another steepening move for the US yield curve.

- Leading the gains in G10 are the Euro and the Swiss Franc as the Japanese Yen continues to be stuck between the attractive carry profile and the fear of verbal/actual intervention from the Ministry of Finance.

- EURUSD saw some decent upward momentum following the Powell release, coinciding with a break of multiple weekly highs at 1.0595 which prompted a quick rally to highs of 1.0616. Price has since drifted back below the 1.06 handle, however looks set to register a 0.5% advance on the session. On the upside, a break of 1.0640, the Oct 12 high, would signal scope for a stronger technical correction.

- Despite a moderate bounce alongside the greenback weakness, NZDUSD is underperforming once again, following on from the fresh 2023 lows made on Wednesday.

- In sympathy with its Antipodean counterpart, and weakness for equities, AUDUSD is also slightly softer on the day. Furthermore, softer labour market data and disappointing Chinese home sales data worked against the currency. The technical backdrop remains bearish on the currency, with short-term gains still considered corrective. Attention is on $0.6286, the Oct 3/13 low. A clear break of this support would confirm a resumption of the trend and open 0.6215, a Fibonacci projection.

- China’s reference lending rate will likely remain unchanged on Friday, after Q3’s strong-than-expected economic performance and as the yuan passes through a period of weakness, economists told MNI. Elsewhere, the RBNZ Statement of Intent will be published before retail sales data for both the UK and Canada.

Expiries for Oct20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0475-85(E1.2bln), $1.0550(E1.3bln), $1.0575-85(E744mln), $1.0600(E1.4bln), $1.0625(E2.0bln), $1.0640-55(E1.8bln)

- USD/JPY: Y148.85-05($1.0bln), Y149.00-05($976mln), Y150.00($857mln), Y150.50($720mln)

- USD/CAD: C$1.3555($798mln), C$1.3600($1.6bln), C$1.3715-25($576mln)

- USD/CNY: Cny7.2500($1.3bln), Cny7.3000-15($910mln)

EGBs-GILTS CASH CLOSE: Steeper Curves Thursday As Early Losses Fade

The German and UK curves steepened Thursday, with Gilts outperforming and the short end and underperforming at the long end.

- Yield moves were relatively restrained by recent standards by the close, with initial losses reversing over the course of the day. The UK curve twist steepened, with Germany's bear steepening.

- Cash trade closed just as Federal Reserve Chair Powell delivered a speech seen as leaning dovish on the prospect of further tightening, which saw Bund and Gilt futures rally sharply to session's best levels.

- Periphery spreads closed tighter, led by BTPs, which reversed earlier widening.

- There were few evident macro / headline drivers for intraday moves, with data limited (French confidence data was slightly weak vs expectations).

- Friday's early highlight is UK retail sales data. Attention is turning to next week's ECB decision - note the pre-monetary policy meeting quiet period is underway.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at 3.205%, 5-Yr is up 0.7bps at 2.848%, 10-Yr is up 0.7bps at 2.931%, and 30-Yr is up 0.7bps at 3.104%.

- UK: The 2-Yr yield is down 2.1bps at 4.986%, 5-Yr is up 0.9bps at 4.709%, 10-Yr is up 1.6bps at 4.673%, and 30-Yr is up 3.4bps at 5.073%.

- Italian BTP spread down 4.3bps at 201.5bps / Spanish down 2.6bps at 110.7bps

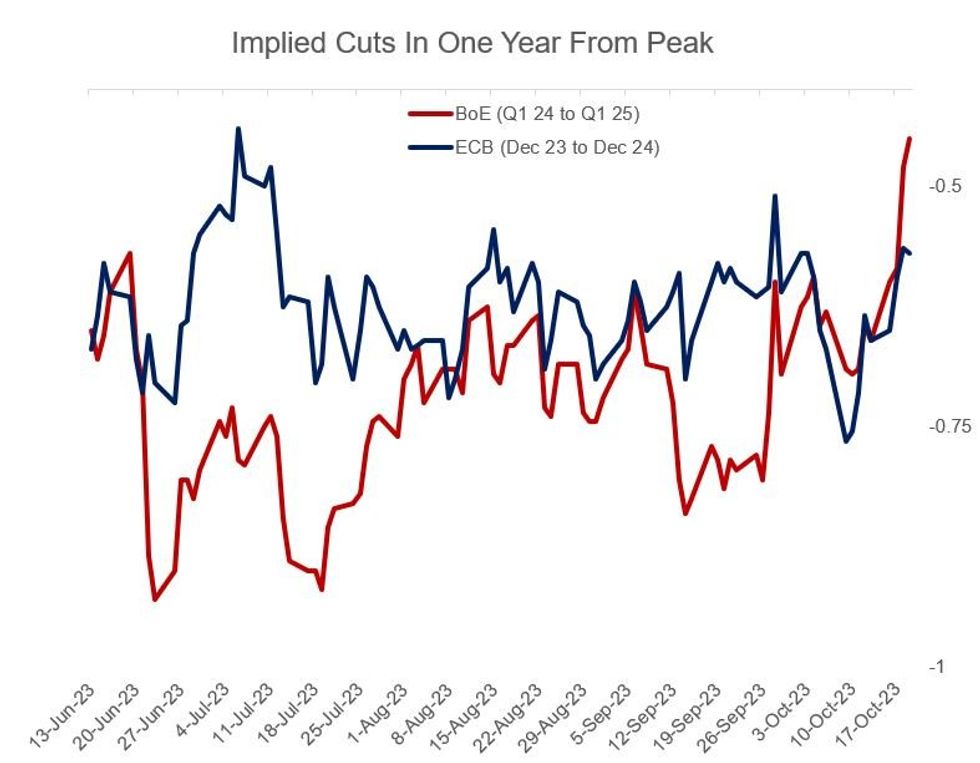

EU STIR: BoE Peak Rate Prospects Fade Intraday; ECB Steady 1 Week Out To Meeting

BoE hike pricing reversed sharply lower intraday Thursday. With terminal pricing having peaked in early trade - implying 22bp of hikes from current levels by the Feb 2024 peak - pricing faded to show only 16bp by day's end, down 2+bp on the day. The drop accelerated at 5pm UK on dovish commentary by Federal Chair Powell.

- There's just over 5bp priced for the November MPC decision, around 21% implied probability of a 25bp hike - unchanged on the day.

- That said there was a small reduction in foreseen cuts, with 45bp in reductions seen in the year following the peak, 3bp less than had been seen Weds.

ECB implied terminal rates rates were relatively steady as the quiet period ahead of next Thursday's decision begins.

- No change is 100% priced for next week, with 3bp of hikes cumulatively priced to the peak in Dec or Jan. There was little change in implied cuts, with 57bp of reductions seen in 2024.

EQUITIES: Slide Continues, Tesla A Particularly Large Drag

- Equities have taken another sharp step lower, with the S&P e-mini pushing new lows of 4305.00 (-0.9%) as Treasuries see a renewed sell-off with the 10Y yield back at fresh cycle highs at 4.99% seen during Powell’s Q&A and 30Y yields pushing higher still.

- The trend structure remains bearish from a technical perspective, with ESZ3 nearing support at 4299.50 (Oct 9 low) after which lies a bear trigger at 4235.5 (Oct 4 low).

- Geopolitical risk remains at the fore, with gold just one dollar off recent highs of $1975 after another day of strong gains for +1.35%.

- Within single names, Tesla continues to lead with heavy declines, currently down more than 10% after yesterday’s post-close results.

- Earnings after today’s close: Taiwan Semiconductor, Intuitive Surgical & CSX

- The Nasdaq 100 e-mini is in line with S&P, also -0.9%, whilst the Dow outperforms (-0.6%) and Russell 2000 underperforms (-1.5%).

- Within the S&P, banks outperform(-0.4%) despite Fed VC for Supervision Barr suggesting greater stress testing, whilst the KBW index suggests regional bank outperformance at -0.2% despite.

COMMODITIES: Gold Clears Latest Resistance On Escalating Middle East Tensions

- A weaker USD before escalating tensions in the Middle East have seen oil and especially gold surging late in the session.

- Reuters has reported rockets and drones hitting an Iraq base housing US forces, whilst the Pentagon has said a US base in Syria was targeted yesterday by two drones and Brigadier General Ryder says a US destroyer has shot down cruise missiles and drones from Yemen which are believed to have been aimed at Israel.

- WTI trades +2.2% at $90.32 having just pulled back off a high of $90.55. It moves closer to resistance at $91.84 (76.4% retrace of Sep 28 – Oct 6 bear leg).

- Brent trades +1.85% at $93.19, just off a high of $93.33. It’s through yesterday’s high of $93.00, with next resistance at the bull trigger at $95.35 (Sep 28 high).

- Gold trades +1.4% at $1976.20 off a high of $1977.91, clearing $1965.5 (61.8% retrace of May 4 – Oct 6 bear leg) to open $1987.5 (Jul 20 high).

US FI OPTIONS: Multiple Nov Call, Dec Put Structures In Rates

Thursday's US Bond/Rate options flow included:

- SFRX3 94.50/94.43ps, sold at 2 in 15k (ref 94.52).

- SFRX3 94.50/94.43/94.37p ladder traded 0.75 in 8.5k

- SFRX3 94.56c traded 3.5 in 20k

- SFRX3 94.62c traded 2.25 in 20k

- SFRZ3 94.62/94.68/94.75/94.81c condor traded 0.75 in 10k

- SFRZ3 94.43/94.37/94.31p ladder, sold at 1.25 in 5k

- SFRZ3 94.37/94.31/94.25p fly, bought for half in 7k

- SFRH4 94.37/94.12/93.87p fly, bought for 4 in 10k (ref 94.59).

EU FI OPTIONS: Limited Rates Trade Focused On Upside

Thursday's Europe rates / bond options flow included:

- ERX3 96.00 call bought for 2.5 in 3k

- SFIX3 94.55/94.65/94.75c fly, bought for 1.75 in 3k

US DATA: First Sub-200k Week For Initial Claims Since Jan, But Higher Continuing Claims

- Initial jobless claims were lower than expected at a seasonally adjusted 198k (cons 210k) in the week to Oct 14, covering a payrolls reference week, after a marginally upward revised 211k (initial 209k).

- It’s the first sub-200k week since January and whilst we don’t put too much weight on a given week, the four-week average isn’t far off at 206k.

- Recall that in 2019 for a comparison with prior periods of tightness, initial claims averaged 218k and saw a low of 197k for the year.

- Based off a 19k drop in the non-seasonally adjusted data to 181k considering mixed results for the same week in previous years, it looks like a reasonably fair SA process at first glance.

- Continuing claims provided an offsetting miss though, surprisingly increasing to 1734k (cons 1706k) from 1705k, marking its highest since early July.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/10/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 20/10/2023 | 2330/0830 | *** |  | JP | CPI |

| 20/10/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/10/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 20/10/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 20/10/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 20/10/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 20/10/2023 | 1300/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 20/10/2023 | 1615/1215 |  | US | Cleveland Fed's Loretta Mester | |

| 20/10/2023 | 1930/1530 | ** |  | US | Treasury Budget |

| 20/10/2023 | 2000/1600 |  | US | Fed Financial Stability Report |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.