-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA MARKETS ANALYSIS: Soft US Data Outweighs Policy Hawks

HIGHLIGHTS

- ECB FACED SIZABLE PUSH FAVORING 75 BASIS-POINT RATE HIKE, Bbg

- ECB SAYS RATES STILL NEED TO RISE SIGNIFICANTLY, AT STEADY PACE, Bbg

- LAGARDE: SHOULD EXPECT TO HIKE AT 50BPS PACE FOR PERIOD OF TIME, Bbg

Off Midday Highs, Policy-Driven Vol Receding

Bonds near top end of range after extending session highs (30YY 3.4622% low ahead midday vs. 3.5605% post-ECB high) past midday. Curves bull flattening on average volumes (TYH>1.1M) following a volatile early session.

- Little react to expected 50bp hike from the BOE - not the case following ECB annc: Tsys pared gains after ECB hiked 50bp to 2.0%, focus on persistent inflation at 6.3% in 2023 (5.5% forecast).

- Data driven rebound: Tsys bounced off hawkish ECB guidance lows to new session highs (30YY back down to 3.5042% couple minutes after tapping 3.5605% high) following Empire Manufacturing sharply lower than expected at -11.2 vs. -1.0 est, weekly claims lower than expected at 211k vs. 232k est, retail sales weaker at -0.6% vs. -0.2% est.

- Real vol continues to deliver: Tsys scaled off post-data highs amid hawkish comments from ECBs Lagarde regarding 50bp hikes "for some time".

- While weaker than forecasted data (claims, retail sales and NY mfg index) helped futures jump off post-ECB lows to new session highs, yield curves remain stubbornly flatter: 2s10s -6.648 at -80.667.

- In-line trade: large 5s/10Y ultra-bond flattener block: -18,125 FVH3 109-10, sell through 109-13.5 post-time bid vs. +8,079 UXTH3 121-30, through 121-29.5 post-time offer.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.50243 to 4.31829% (+0.50029/wk)

- 1M +0.01285 to 4.33771% (+0.06885/wk)

- 3M +0.00142 to 4.73771% (+0.00557/wk)*/**

- 6M +0.02700 to 5.15229% (+0.01258/wk)

- 12M +0.06043 to 5.46729% (-0.03214/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $101B

- Daily Overnight Bank Funding Rate: 3.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.045T

- Broad General Collateral Rate (BGCR): 3.76%, $411B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $397B

- (rate, volume levels reflect prior session)

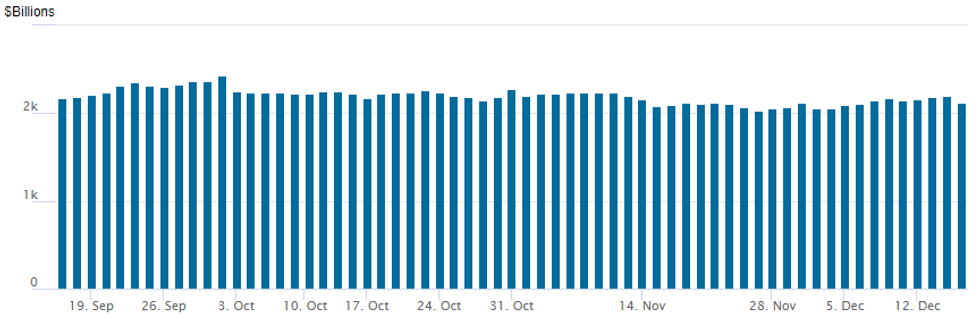

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,123.995B w/ 98 counterparties vs. $2,192.864B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Aside from some smaller call trades, theme for the day is better downside put plays, particularly condors in 10s, and vol selling in SOFR options w/ data and policy event risk in the rear-view mirror. Limited Eurodollar option trade, Dec futures and options expiring Friday.- SOFR Options:

- +10,000 2QM3 97.50/97.75/97.87 broken call flys, 5.0

- Block, -5,000 SFRZ3 95.75 straddles, 96.0 (99.0 set')

- 2,500 SFRZ4 (Green-Dec) 95.00 puts, 21.5 ref 96.98

- Block 3,750 SFRH 95.12/95.37/95.62 call flys, 8.0 ref 95.16

- Block, -5,000 SFRZ3 95.75 straddles, 94.0 (99.0 set')

- +10,000 SFRZ3 94.00/94.50/95.00/95.50 put condors, 12 vs. 95.75/0.10%

- Block/screen, 8,500 SFRH 94.93/95.06/95.18/95.31 put condors, 3.75 ref 95.165-.15

- Eurodollar Options

- Note: December futures and options expire Friday.

- Treasury Options:

- 3,000 TYH 110/111.5 put spds, 11

- 3,000 TYG 111/112 put spds, 8 ref 114-25.5-26

- +3,000 FVF 109.5 calls, 20 vs. 109-16

- +1,500 TYG 112.5/113/113.5/114 put strip, 2-11

- Block, 3,750 TYH 114/115.25 put over risk reversal, 6 vs. 114-25/0.62% (2.5k more on screen)

- 3,000 TYF 111.75 puts

- 3,500 TYG 113.5 puts, 42 ref 114-24

EGBs-GILTS CASH CLOSE: Dovish BoE Contrasts With Very Hawkish ECB

A hugely busy session Thursday centred on central bank decisions saw EGB yields soar and Gilt yields decline, with periphery spreads widening sharply.

- The BoE hiked by 50bp as expected, but the dovish-leaning 3-way vote split and suggestion that UK inflation had peaked pulled UK yields lower.

- In contrast, the ECB meeting was very hawkish: while the expected 50bp hike was duly delivered, the statement revealed concrete details on QT to start next March, and noted rates "will still have to rise significantly at a steady pace".

- The resultant EGB selloff extended after Lagarde said this could mean 50bp hikes at each of the next 2-3 meetings.

- BTPs saw their biggest sell-off since March 2020, with 10Y yields up 30bp and spreads to Bunds 16bp wider.

- The schedule picks up first thing Friday with UK retail sales and Europe PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 25.4bps at 2.387%, 5-Yr is up 22.7bps at 2.16%, 10-Yr is up 14.3bps at 2.083%, and 30-Yr is up 4.6bps at 1.89%.

- UK: The 2-Yr yield is down 5.5bps at 3.396%, 5-Yr is down 6.6bps at 3.231%, 10-Yr is down 7.1bps at 3.244%, and 30-Yr is down 4.7bps at 3.649%.

- Italian BTP spread up 15.7bps at 208.3bps /Spanish up 4.6bps at 107.8bps

EGB Options: Large Euribor Put Spread Buying Follows Hawkish ECB

Thursday's Europe rates / bonds options flow included:- ERZ2 97.75/97.625/97.50p fly, bought for 2.25 in 2k

- Post-ECB:

- ERM3 96.875/96.75ps, now bought for 6.5 in 20k, was bought earlier for 6 in 10k

- OEH3 116.50/116.00ps sold at 14 in 5k

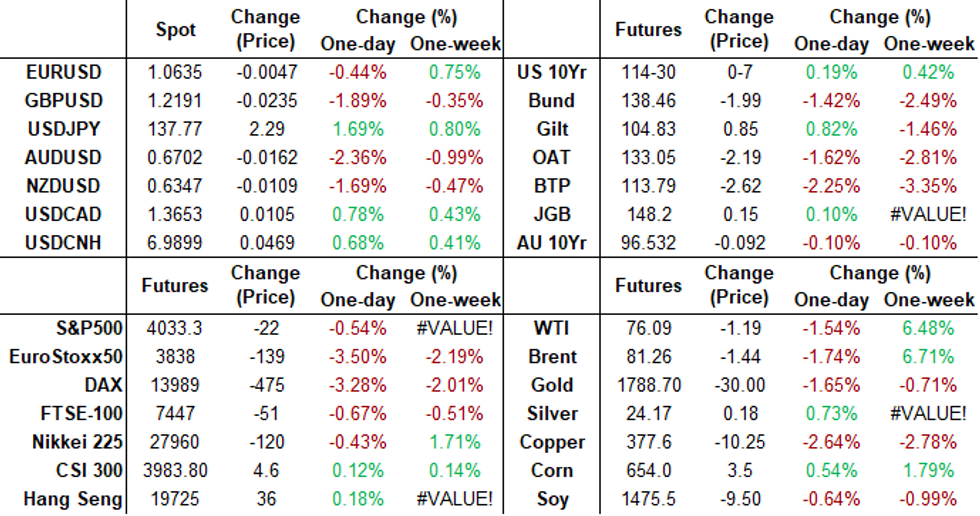

FOREX: Dampened Sentiment Bolsters Greenback, AUDUSD Plummets

- The widespread dampening of risk sentiment across global markets has prompted a strong recovery for the US Dollar on Thursday. The USD index has seen a strong recovery over the course of the US session, advancing 0.75% on the day as hawkish central bank rhetoric continues to hamper the mood across equity indices

- Despite a hawkish ECB president Lagarde, EURUSD had a swift turn lower, making new session lows below 1.0600, soon after reaching fresh six-month highs during the press conference at 1.0735.

- Losses against the greenback are broad based across G10, however, underperformance for commodities and in particular metals is significantly weighing on AUD, which has plummeted ~2.5%.

- Despite overall bullish trend conditions AUDUSD has broken initial support at 0.6731, the 20-day EMA and is now approaching the key support level of 0.6657, the 50-day EMA. A clear break of this average would highlight a possible reversal and signal scope for a deeper retracement.

- Not quite as extreme, yet still substantial, GBP, JPY and NZD have all lost between 1.5-1.9% on the session.

- Amid the hawkish ECB, EURGBP (+1.45%) has broken above the 50-day EMA, at 0.8653, which marked a key short-term resistance point and in turn eases the bearish technical threat. This opens up a move to 0.8778, the Nov 16 high.

- No rest on the economic calendar with UK retail sales and Eurozone PMIs headlining a busy European docket on Friday.

FX OPTION EXPIRY

- EURUSD: 1.0600 (551mln), 1.0650 (295mln), 1.0700 (2.09bn).

- GBPUSD: 1.2350 (1.54bn).

- USDJPY: 136.15 (335mln).

- USDCAD: 1.3500 (709mln), 1.3625 (250mln).

- AUDUSD: 0.6770 (235mln).

- NZDUSD: 0.6400 (250mln).

- USDCNY: 0.6990 (600mln), 7.000 (1.3bn).

Late Equity Roundup: Inching Off Lows

Weaker stocks drifting off second half lows. after Tue's shooting star formation candle pattern, e-mini S&P march futures breached key support of 50-day EMA (3960.81) and Dec-7 low (3945.75) to 3910.00 low. Next key support of 3782.75 Nov 9 low. SPX eminis currently trade -95.25 (-2.36%) at 3936.25; DJIA -699.81 (-2.06%) at 33272.27; Nasdaq -326.4 (-2.9%) at 10846.12.

- SPX leading/lagging sectors: Communication Services (-3.74%) continue to underperform, weighed by Netflix (NFLX) -8.73% following 4Q financial results show ad target miss, Warner Bros/Discovery (WBD) -7.83%, Paramount (PARA) -7.80, META -5.64%. Information Technology next up (-3.39%) w/ hardware, software and semiconductor makers evenly underperforming. Leaders: Energy (-0.54%), Real Estate (-0.60%) and Utilities (-0.97%).

- Dow Industrials Leaders/Laggers: Goldman Sach (GS) -10.46 at 349.92, United Health (UNH) -10.37 at 527.99, Microsoft (MSFT) -7.84 at 249.38. Leaders: Verizon (VZ) +0.43 at 37.88, Intel (INTC) -0.97 at 27.37, Coca-Cola (KO) -1.00 at 62.99.

Shooting Star Candle Highlights A Reversal Threat

Markets

Markets- A rally in the S&P E-Minis Tuesday saw price trade above 4142.50, Dec 1 high.

- However, a strong reversal, resulted in a sharp move lower and price remains below Tuesday high.

- The contract is trading lower today and this highlights a possible bearish threat.

- Note that Tuesday’s candle pattern is a shooting star formation - a reversal signal.

- Through key support of 3945.75, Dec 7 low to 3915.00 low, next key support 3782.75, Nov 9 low

- Key resistance is 4180.00, Dec 13 high.

COMMODITIES: Oil Rally Fizzles Out With Hawkish ECB, Keystone Partial Restart

- A surprisingly hawkish ECB and a section of the Keystone pipeline restarting saw the three-day, 8% rally in crude oil pause for breath.

- There could be further supply chain disruption ahead: Some of the biggest companies in ship reinsurance are planning to cease to cover key war-related risks for vessels going to Russia and Ukraine by the end of the year according to Bloomberg sources.

- WTI is -0.7% at $76.74 having very briefly tested resistance at the 20-day EMA of $77.50. Support is seen at $73.21 (Dec 13 low).

- Today’s most active strikes in the CLF3 have been $75/bbl puts.

- Brent is -1.1% at $81.81, briefly clearing resistance at the 20-day EMA of $83.04. Support is seen at $78.10 (Dec 13 low).

- Gold is -1.6% at $1778.93 as USD strength resumed in a risk-off environment after the ECB decision and in particular the press conference. It brings the yellow metal closer to support at $1771.9 (20-day EMA).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/12/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 16/12/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 16/12/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 16/12/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 16/12/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 16/12/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 16/12/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 16/12/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 16/12/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 16/12/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 16/12/2022 | 1000/1100 | ** |  | IT | Italy Final HICP |

| 16/12/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 16/12/2022 | 1030/1330 |  | RU | Russia Central Bank Key Rate Decision | |

| 16/12/2022 | - |  | US | 'Continuing Resolution On US Government Funding Expires | |

| 16/12/2022 | - |  | UK | BOE Announce Q1 Active Gilt Sales Schedule | |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 16/12/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 16/12/2022 | 1700/1200 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.