-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stronger Rules For Banks Ahead

HIGHLIGHTS

- MNI US-JAPAN: Democrat Lawmakers Issue Statement Opposing US-Japan Deal

- MNI US: McCarthy Challenges Biden To Reach At By End Of Week For Debt Limit Talks

- MNI US: White House Rejects Speaker McCarthy's Call For Debt Ceiling Negotiations

- MNI TURKEY: Kilicdaroglu Seen As Favourite Ahead Of Turkish Presidential Elections

- BARR SAYS SVB WAS RATED AS DEFICIENTLY MANAGED, Bbg

US TSYS: Treasury Yields Inch Higher, Bank Risk Moderates

Tsy futures held modestly weaker in late trade, yield curves bear flattening (2s10s -3.019 at -49.761, well off early high of -40.451) amid ongoing focus on bank risk.

- Early support for stocks soured midday after White House Deputy Press Secretary Dalton indicated to reporters that President Biden will continue to decline to meet with House Speaker McCarthy for debt limit negotiations until House Republicans release a FY24 budget.

- A late session bounce in KBW Bank index (BKX) off midday lows (79.77) to 80.48 (+.10) helped underpin SPX Emini futures in late trade: ESM3 at 3996.0 -11.25.

- The Federal Reserve is monitoring the risks that higher interest rates pose to the balance sheets of banks after losses on a large portfolio of Treasuries helped precipitate the collapse of Silicon Valley Bank, the Fed’s vice chair of supervision Michael Barr told Congress Tuesday.

- “We are monitoring the financial system, monitoring the banking system, we’re looking at interest rate risk and liquidity risk across the banking system,” Barr said. “The banking system is sound and resilient. Depositors are safe. Most banks are highly effective in managing interest rate risk and liquidity risk.”

- Items in focus for Wednesday: Pending Home Sale; Fed speak NY Fed Supervision head Dobbeck will take moderated questions at a Bankers Assn event; US Treasury $22B 2Y FRN and $35B 7Y Note auctions.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00229 to 4.81100% (+0.00214/wk)

- 1M +0.00642 to 4.85871% (+0.02814/wk)

- 3M +0.01972 to 5.16286% (+0.06143/wk)*/**

- 6M +0.08557 to 5.24671% (+0.25942/wk)

- 12M +0.12657 to 5.18771% (+0.35185/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.16286% on 3/28/23

- Daily Effective Fed Funds Rate: 4.83% volume: $92B

- Daily Overnight Bank Funding Rate: 4.82% volume: $268B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.365T

- Broad General Collateral Rate (BGCR): 4.79%, $521B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $514B

- (rate, volume levels reflect prior session)

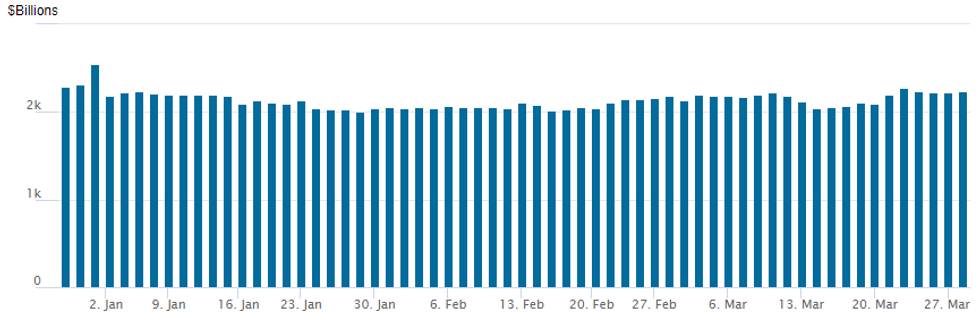

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,231.749B w/ 102 counterparties vs. the prior session's $2,.220.131B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Short term interest rate options on Secured Overnight Financing Rate (SOFR) futures saw consistent put trade Tuesday as implied rate cuts in the second half of 2023 moderated. Option desks reported continued buying in Dec'23 95.50 puts in early trade, ongoing unwind after 30k bought Monday (open interest -15,326 to 248,362 coming into the session). Massive Block: +140,000 OQJ3 (April midcurve) 95.00 puts, 1.0 vs. -80,000 OQJ3 95.37 puts, 1.75 splits (some desks say 95.37 leg a buy, others ratio put spd Blocked for net of even.- SOFR Options:

- Block, 5,000 SFRZ3 94.00/95.00 2x1 put spds, 12.5

- Block, 5,000 SFRU3 95.00/95.75 3x2 put spds, 67.0 net, 2 leg over

- Block, 5,000 SFRZ3 93.00/94.00/95.00 put flys, 6.0 net ref 96.89

- Block, 5,000 SFRU3 95.75/96.00 3x2 put spds, 65.0 ref 95.455

- Block, +140,000 OQJ3 95.00 puts, 1.0 vs. -80,000 OQJ3 95.37 puts, 1.75 splits (some desks say 95.37 leg a buy, others ratio put spd Blocked for net of even)

- Block, 30,000 OQM3 94.50/94.87/95.50 broken put flys, 5.0 vs. 96.53/0.07%

- +5,000 SFRJ3 94.75 puts, 1.25 vs 95.195/0.02%

- -5,000 SFRJ3 95.12/95.25/95.37/95.50 put condors 2.5-2.25 vs. 95.185/0.05%

- Block, 10,000 OQZ3 94.75/95.75/96.75 put flys, 21.0 vs. 96.87/0.10%

- Block, 10,000 SFRZ3 94.50/94.75/95.00 put flys, 2.5 net ref 95.76

- 5,000 SFRM3 94.93 puts ref 95.18

- 2,000 SFRJ3 95.00/95.06/95.12 put flys ref 95.18

- Block, +5,000 SFRZ3 96.50/97.50 call spd w/94.00/95.00 put spd, 40.0

- Block, +5,000 SFRZ3 96.50/97.50 call spd w/93.75/94.75 put spd, 34.0

- 2,500 SFRZ3 94.50/95.00/95.50 put flys ref 95.73 to -.74

- over +23,000 SFRZ3 95.50 puts ref 95.755 to -.77, ongoing unwind: over 30k bought Monday w/ open interest -15,326 to 248,362 coming into the session.

- Treasury Options:

- Block, +7,500 TYK3 118.5 calls, 14 vs. 114-21/0.12%

- 5,500 wk5 5Y 111/111.5 call spds ref 109-13.25

- 2,200 TYK3 113.25/116 call spds, ref 114-23.5

EGBs-GILTS CASH CLOSE: Bank Sentiment Remains Paramount

The German curve bear flattened for a second consecutive session Tuesday, while the UK's bear steepened.

- Yields jumped at the cash open, in part registering BoE Bailey's hawkish-leaning comments on February inflation data made after Monday's cash close.

- The sell-off continued through mid-morning, on risk-on sentiment as reflected in continued gains in European equities.

- The bearish move petered out over the rest of the session after equities peaked.

- There were few discernible headline drivers to the partial reversal, but it remains evident from intraday movements that banking sector risk sentiment remains the driving cross-asset force for now.

- Periphery spreads were mostly wider, but only marginally, with 10Y BTPs yet again unable to break through the 183bp mark vs Bunds.

- Wednesday brings French consumer sentiment data (following confidence readings on the strong side this morning from France and Italy), with UK money supply and mortgage data later in the session. The BoE's financial policy summary release also bears watching.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.1bps at 2.592%, 5-Yr is up 6.9bps at 2.28%, 10-Yr is up 6.3bps at 2.29%, and 30-Yr is up 6.5bps at 2.373%.

- UK: The 2-Yr yield is up 5.3bps at 3.364%, 5-Yr is up 6.6bps at 3.285%, 10-Yr is up 9bps at 3.456%, and 30-Yr is up 5.4bps at 3.861%.

- Italian BTP spread up 1.1bps at 184.8bps / Spanish up 0.1bps at 103.7bps

EGB Options: Mix Of Upside And Downside In Euro Rates

Tuesday's Europe rates / bond options flow included:

- OEK3 114/112ps, sold at 4 in 10k

- ERZ3 98.00c, bought for 14 in 5k and 6.25k

- ERU3 96.50/96.25/96.00 put fly bought for 3.25 in 22k

- ERZ3 97.25/98.00 call spread bought for 13.75 in 4k (v 96.64, 15d)

- SFIM3 95.70/95.80/95.90 call fly bought for 1.5 in 3.25k

FOREX: Greenback Weakness Prevailing, CHF Underperforms

- With few discernible headlines surrounding banking sector risk sentiment, the greenback remained under pressure on Tuesday, falling against all G10 currencies apart from the Swiss Franc.

- The extension of weakness for the USD index (-0.42%) has now seen the entirety of Friday’s bounce reversed and narrows the gap with the March lows at 101.92.

- In line with the greenback move, EURUSD continues to trade with a bid tone and has moved steadily above the 1.08 handle today. For bulls, clearance of 1.0930 would reinstate the recent bull theme and signal scope for a climb towards 1.1033, the Feb 2 high.

- With equities on the back foot, the Japanese Yen has outperformed and USDJPY sits 0.70% lower on Tuesday. The pair briefly matched the Monday lows at 130.41 before a substantial bounce, however, the pair is gravitating back towards those lows approaching the APAC crossover. Little option interest at the Tuesday 10am cut, however interest builds later in the week to month-end: just over $4.5bln rolls off between Y130.00 - 131.00 across the Thursday/Friday cuts, which could help define the range into the end of the week.

- Further weakness, however, through 129.64 would mark a resumption of the March downleg and put prices at the lowest levels since early February. 129.12 undercuts as more notable support - the Feb 2 High.

- Swiss Franc weakness was notable throughout today’s session, making it the worst performer in G10 to partially reverse the outperformance noted at the tail-end of last week. Worth flagging yesterday's sight deposits data surged higher - the first meaningful rise in sight deposits since 2020. Though this doesn't necessarily reflect FX intervention, it likely suggests Swiss banks were users of emergency liquidity facilities made available last week - and may be working against CHF haven flows this week.

- CAD annual budget release and Australian CPI headline the overnight docket before US pending home sales on Wednesday. Focus remains on the latter part of the week where Eurozone CPI prints and US Core PCE price index data are scheduled.

FX Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0680-85(E1.0bln), $1.0780-00($2.5bln), $1.0850(E549mln), $1.1000-20(E1.3bln)

- USD/JPY: Y128.00-10($585mln), Y130.75($630mln), Y131.60-80($1.0bln)

- AUD/USD: $0.6650(A$681mln), $0.6800(A$566mln)

- USD/CNY: Cny6.8000($1.2bln), Cny6.9100($1.7bln)

Late Equities Roundup: Near Lows on Waning Debt Limit Hopes

- US stocks drifting near recent session lows after early risk appetite evaporating since midday. S&P Eminis currently trading at 3985.0 (-22.25) well above initial support of 3937.00/3897.25 (Low Mar 24 / 20).

- Tone changed soon after White House Deputy Press Secretary Olivia Dalton indicated to reporters that President Biden will continue to decline to meet with House Speaker Kevin McCarthy (R-CA) for debt limit negotiations until House Republicans release a FY24 budget.Dalton:

- "We've seen the letter, but where's the budget? The President released his budget three weeks ago... So far all we've seen from Speaker McCarthy and 'MAGA' Republicans in Congress are proposals which will... do nothing to address the deficit."

- S&P E-Minis remain below last Wednesday's high of 4073.75. The pullback from last week’s high means that price has - so far - failed to remain above pivot resistance at the 50-day EMA - the average intersects at 4020.18. A clear upside break of it is required to strengthen bullish conditions.

E-MINI S&P (M3): Testing The 50-Day EMA

- RES 4: 4148.48 76.4% retracement of the Feb 2 - Mar 13 downleg

- RES 3: 4119.50 High Mar 6

- RES 2: 4089.39 61.8% retracement of the Feb 2 - Mar 13 downleg

- RES 1: 4021.50/4073.75 50-day EMA / High Mar 22

- PRICE: 3397.00 @ 14:34 BST Mar 28

- SUP 1: 3937.00/3897.25 Low Mar 24 / 20

- SUP 2: 3839.25 Low Mar 13

- SUP 3: 3822.00 Low Dec 22 and a key support

- SUP 4: 3778.00 Low Nov 3

S&P E-Minis remain below last Wednesday's high of 4073.75. The pullback from last week’s high means that price has - so far - failed to remain above pivot resistance at the 50-day EMA - the average intersects at 4020.18. A clear upside break of it is required to strengthen bullish conditions. Support lies at 3937.00, the Mar 24 low. A breach would instead open 3897.25 next, the Mar 20 low. 4073.75, the Mar 22 high, is the bull trigger.

COMMODITIES: Oil Nudges To Two-Week Highs, Gold Supported By Weaker USD

- Crude oil prices have edged higher after a mixed session, poking to two-week highs. Moves were partly supported by at least a temporary halt of Kurdish exports through Turkey and the Ceyhan pipeline after a recent international ruling.

- WTI is +0.8% at $73.36, pushing through resistance at $73.10 (Mar 27 high) to open $75.12 (50-day EMA).

- Today’s most active strikes in the CLK3 have overwhelmingly been $80 and $79.5 calls.

- Brent is +0.8% at $78.78, through tightly packed resistance around $78.4 to open the 50-day EMA of $80.89.

- Gold is +0.9% at $1974.34 as it gained with increasing downward pressure on the US dollar, taking a step back closer to the bull trigger at $2009.7 (Mar 20 high).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2023 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 29/03/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 29/03/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2023 | 0930/1030 |  | UK | Bank of England FPC Report/minutes | |

| 29/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/03/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 29/03/2023 | 1400/1000 |  | US | US House Financial Services Hearing | |

| 29/03/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 29/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 29/03/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 29/03/2023 | 1630/1230 |  | CA | BOC Deputy Gravelle speech "The market liquidity measures we took during COVID" | |

| 29/03/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 29/03/2023 | 1850/1950 |  | UK | BOE Mann Panellist at NABE | |

| 29/03/2023 | 2045/2245 |  | EU | ECB Schnabel Panels NABE Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.