-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stronger US Data Drives Risk-Off

- Stronger than expected US data drives a sizeable sell-off in Treasuries amidst lower volumes ahead of the Christmas break, with equities selling off accordingly before a late bounce.

- The BBDXY index has seen a 0.7% intraday swing higher but is currently only 0.15% higher on the day after paring some of the gains along with the same late improvement in risk sentiment.

- Market focus turns to Japanese CPI for November before a final flurry of important US data, including core PCE & incomes/spending, preliminary durable goods and the preliminary U.Mich survey.

US TSYS: Bear Flattening On Stronger Data and Thin Markets

- Cash Tsys have seen sizeable swings through the session but ultimately see a solid bear flattening on a combination of stronger than expected US data and thin volumes ahead of the Christmas break. Initial reaction to the US Senate passing the $1.7T funding bill was muted but Goldman sees the package as larger than expected.

- Data included upward revisions for GDP and marginally for core PCE plus further resilience in weekly jobless claims, but the market reaction appears outsized, especially with the leading index also weaker than expected.

- The 2YY is currently 4.257%, +4.4bps having traded in a wide range of 4.185-4.265% (4.21% pre-data), with increased more muted along the curve: 5YY +1.4bp at 3.784%, 10YY +0.7bps at 3.669% and 30YY +1.3bps at 3.726%.

- TYH3 currently trades little changed on the day at 113-17 with thin volumes (660k vs ¬950k typical for the time of day), off earlier lows of 113-13+ which saw the bear threat remains present with support at 113-09+ (Dec 21 low).

- A final flurry of important data tomorrow, including US core PCE & incomes/spending, preliminary durable goods and the preliminary U.Mich survey.

US 5Y TIPS Auction Review: Another Tail But Stronger Internals

- Another tail for 5Y TIPS, approx. 1.4bps after ~1bp at the Oct 20 auction.

- Internals generally stronger, bid-to-cover picks up to 2.51% from a low 2.38, back close to the five auction average of 2.52.

- Directs 17.8% vs 17.0% Oct and 5-auction av 12.1% although primary dealer 8.1% vs 7.7% Oct and 5-auction av 8.2%.

STOCKS: Buy Programs Help Limit Losses In Pre-Holiday Trade

- A string of sizeable buy programs (recently >1000 names) help equity indices off session lows, with earlier declines trimmed to -2.1% for e-mini S&P and -3.1% for Nasdaq 100 in seemingly thin trade ahead of the Christmas break.

- Main movers are as earlier in the session: In a reversal of yesterday’s gains, today’s drivers of SPX are IT (-3.2%) and consumer discretionary (-3.1%) whilst health care and consumer staples (-0.6%) outperform.

- A gloomy outlook from chipmaker Micron Technology Inc. weighed on both indexes, whilst from a macro perspective, higher Fed terminal pricing is a culprit at 4.89% in May’23 for +4bp since stronger data (with 2YY close to session highs +5bp on the day).

FOREX: GBP Extends Pullback, While USD Rallies on Solid GDP

- Tertiary GDP data provided the last look at the US economy headed into year-end, and came in with a surprising upside revision. This put annualized GDP at 3.2%, an unusual 0.3ppts beat on expectations. Personal consumption and core PCE data similarly topped forecast, buoying the USD through the London close.

- The USD Index added 0.3% in response, most notably against high beta and growth-sensitive currencies, before pulling back to 0.15% later in the session. As a result, NZD, AUD and SEK made up the bottom-end of the G10 table.

- JPY was the sole currency to outstrip the USD on Thursday, as post-BoJ YCC tweak strength persisted and an equity sell-off drove flow to safe haven currencies.

- GBPUSD trades lower again and has dipped below the 1.20 handle before quickly reversing to circa 1.204. This follows the move lower on Dec 15 and the extension of weakness through the Thursday close. Attention is on the first key support at 1.1901, the Nov 30 low for now.

- Pre-holiday trade was evident, with light liquidity and only modest volumes clearly exerting their influence on prices.

- In the last pre-holiday session, market focus turns to Japanese CPI for November, Italian consumer confidence and Personal income spending, durable goods and Michigan confidence numbers from the US.

FED: Reverse Repo Uptake Pushes Higher Despite Fewer Counterparties

- There were 9 fewer counterparties with a more typical 96 but that didn’t stop RRP uptake from increasing further ahead of the Christmas break, rising another $16B to $2.223T for an $88B increase in three days.

- It remains the highest since Nov 9 after yesterday’s $48B jump, likely boosted by cash from GSEs.

COMMODITIES: Higher Rate Fears and Dollar Strength Dominate

- Crude oil sees a mixed session with sizeable spillover from broader risk sentiment, which has for the most part been bearish today with stronger than expected US economic data seen driving higher interest rates.

- In more idiosyncratic developments, Putin is to sign a decree on the oil price response on Monday or Tuesday.

- Pulling off lows prior to the Asia-Pac crossover, WTI is -0.3% at $78.02. Resistance is formed at the intraday high of $79.90 whilst support isn’t seen until $73.40 after the recent uptrend.

- Brent is -0.9% at $81.50, off the earlier high of $83.85 and with support at $78.28 (Dec 20 low).

- Gold is -1.4% at $1789.8, sliding with USD strength and pulling more notably away from the bull trigger at $1824.5 (Dec 14 high) to instead next eye support at $1782.9 (20-day EMA).

US DATA: Real GDP Revised Higher On Domestic Demand, So Too GDI

- Real GDP was revised up again from 2.9% to 3.24% annualized in the third Q3 release.

- It was led by personal consumption (from 1.7 to 2.26%) and less so private non-residential investment in positive signs for final domestic demand, offset partly by an even larger than first thought drag from inventories (-1.4pps vs -1.2pps prior).

- That said final domestic demand is still relatively tepid at 1.5% annualized after 0.8% averaged in 1H22, weighed heavily by sliding residential investment.

- The latest Atlanta Fed GDPNow sees only a modest slowing to 2.7% in Q4.

- After a string of downward revisions, GDI also finally sees an upward revision, currently seen +0.8% annualized in Q3 (initially 0.3), which leaves a GDP-GDI average growth rate of 2% annualized in Q3 after -0.5% through 1H22.

US DATA: Initial Claims Maintain Surprising Resilience

- Initial claims were stronger than expected at 216k in the week to Dec 17 (cons 222k) after 214k, in a week which should capture the payrolls reference period.

- The 4-week average of 222k is down from 230k at the turn of the month, surprisingly moving closer to the 218k averaged through 2019 in what was a historically tight labour market as opposed to expectations of claims beginning to climb with the jobs market slowing to more of an equilibrium pace.

- Continuing claims meanwhile hold their recent climb at 1672k (cons 1678k) but still compare favourably to 2019 levels.

US DATA: Core PCE Inflation Revised Fractionally Higher In Q3

- Core PCE price inflation was revised up from 4.60% to 4.66% annualized in the third Q3 release, implying very small upward revisions to prior monthly readings in tomorrow’s release for November.

- Consensus currently sees core PCE maintaining 0.2% M/M pace after the 0.22% M/M in Oct, down from the 0.36% averaged through Q3, the latter biased lower by almost zero inflation in July before rebounding to 0.5% pace in Aug and Sep.

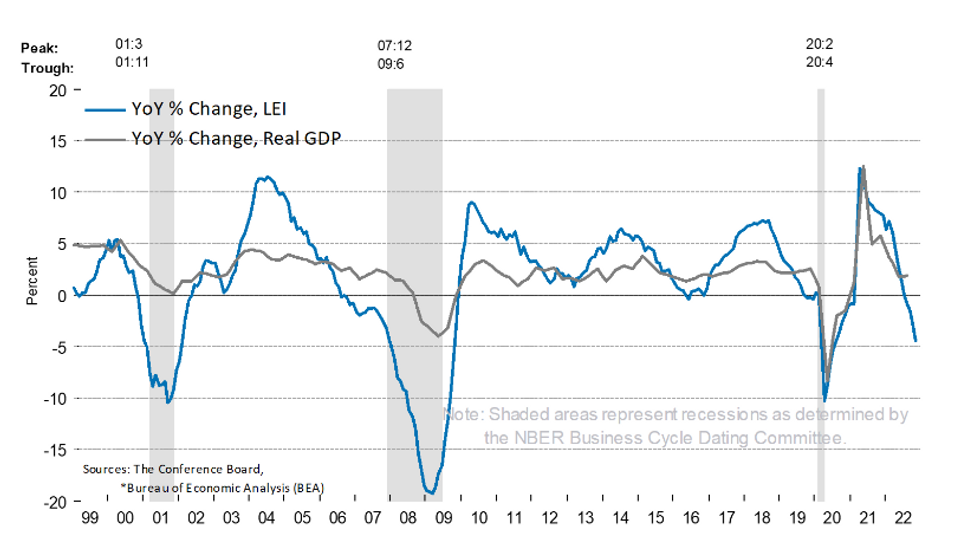

US DATA: Leading Index Misses, No Let Up In Deterioration

- The Conference Board leading index fell by more than expected in November, down -1.0% M/M (cons -0.5) in no let up after -0.9% M/M in Oct (initially -0.8).

- Senior Director Ozyildirim: "Only stock prices contributed positively to the US LEI in November. Labor market, manufacturing, and housing indicators all weakened—reflecting serious headwinds to economic growth. Interest rate spread and manufacturing new orders components were essentially unchanged in November, confirming a lack of economic growth momentum in the near term.”

- “We project a US recession is likely to start around the beginning of 2023 and last through mid-year”

Source: Conference Board

Source: Conference Board

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.