-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Swiss FINMA Will Aid Credit Suisse

HIGHLIGHTS

- SNB WILL PROVIDE LIQUIDITY TO CREDIT SUISSE IF NECESSARY, Bbg

- MNI SWITZERLAND: Authorities Said To Hold Talks On Options To Stablise Credit Suisse

- TREASURY DEPT REVIEWING US BANKS' EXPOSURE TO CREDIT SUISSE, Bbg

- CREDIT SUISSE CDS REACH CRISIS LEVELS AS BANKS SEEK PROTECTION, Bbg

- FIRST REPUBLIC BANK CUT TO JUNK BY S&P; ON WATCH NEG, Bbg

US TSYS: Swiss Officials Will Provide Liquidity to Credit Suisse

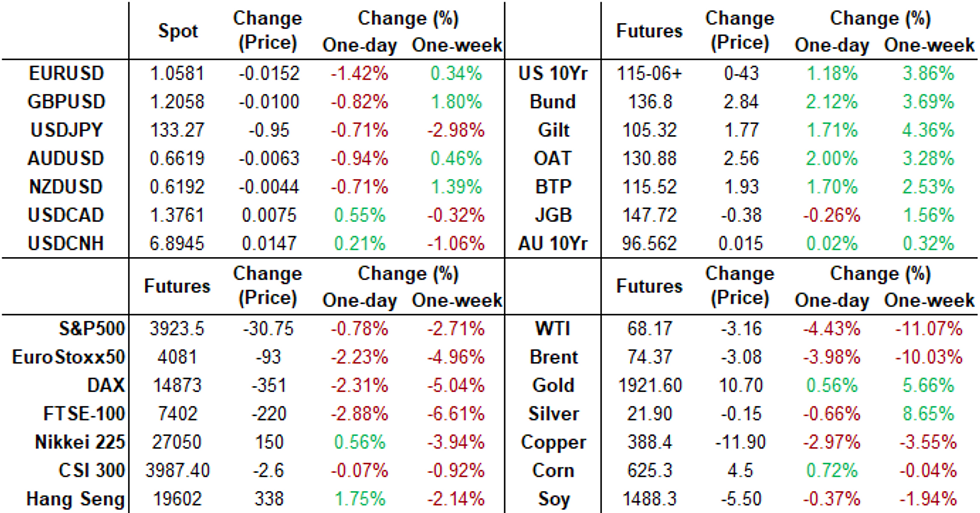

- US rates surged higher Wednesday, breaching Monday's highs by midday on the back of softer than expected data and a sharp sell-off in European banks overnight, particularly Credit Suisse with Knock-on pressure experienced by BNP Paribas and Societe Generale.

- Rates scaled back support later in the session on reports that Swiss officials FINMA will provide liquidity to Credit Suisse after shares fell approximately 30% earlier.

- Exceptionally wide ranges (front Jun'23 SOFR futures halted for 2 minutes after hitting 50Bp range circuit breaker) and heavy volume on the day as front month Tsy futures extending highs after lower than expected PPI (MoM -0.1% vs. 0.3%; YoY 4.6% vs. 5.5% est), Empire State -24.6 vs. -7.9 expected, Retail Sales in line (-0.4%).

- Yield curves see-sawed higher as short end support outpaced bonds in the first half, 2s10s climbed to -29.397 - highest since mid-October, front month 2Y futures tapped 104-01.62 high w/ 2Y yields back below 4% at 3.7115% low (vs. 4.4070% overnight high).

- Short end rates, meanwhile, have gone back to Monday's implied hike levels anticipating rate cuts by mid-year, December cumulative at -84.0 to 3.741 while Fed terminal rate running at 4.835% in May.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00614 to 4.55971% (+0.00257/wk)

- 1M -0.01914 to 4.70857% (-0.09000/wk)

- 3M -0.03386 to 4.90714% (-0.23100/wk)*/**

- 6M -0.13443 to 4.83400% (-0.59429/wk)

- 12M -0.26386 to 4.72843% (-1.00971/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $79B

- Daily Overnight Bank Funding Rate: 4.57% volume: $252B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.203T

- Broad General Collateral Rate (BGCR): 4.53%, $491B

- Tri-Party General Collateral Rate (TGCR): 4.53%, $476B

- (rate, volume levels reflect prior session)

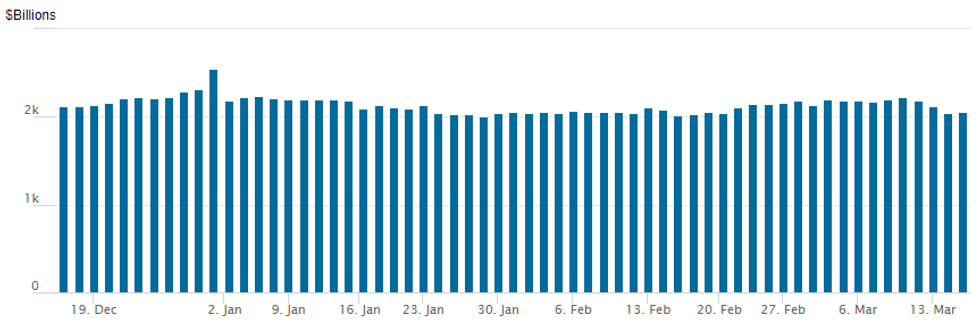

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,055.823B w/ 101 counterparties vs. prior session's $2,.042.579B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Continued two-way option trade on heavy volumes Wednesday: put buying looking for underlying to continue to reverse Wednesday's EU bank sell-off driven rally in rates, vs. call buyers looking for continued pricing of looser monetary policy. Implied vols higher but off highs after Swiss authorities discussing options to stabilize Credit Suisse.- SOFR Options:

- Block, 7,500 SFRU3 95.50/96.00 call spds, 24.5 ref 96.04

- Block, 5,000 SFRZ3 98.50/99.50 call spds, 12.0 ref 96.185

- Block, 30,000 SFRJ3 94.50 puts, 12.0 vs. 95.94/0.11%

- Block 8,000 SFRK3 93.87/94.12 put spds, 2.0 ref 95.88

- Block, 12,500 SFRN3 94.87 straddles, 177

- Block, 22,000 SFRU3 94.12/94.62 put spds, 8.0

- Block, 30,000 SFRU3 94.00/94.50 put spds, 7.5 ref 96.345 to -.36

- +25,000 SFRM3 94.50/95.00 2x1 put spds, 0.0-1.0

- Block, 12,000 SFRU3 97.00/97.50 call spds, 14 ref 96.265

- Block, 15,000 2QJ3 96.25 puts, 9.5 ref 96.645 -.65

- Block, 12,000 SFRM3 97.00/98.00 call spds, 21.0 ref 96.03

- Block, 15,000 2QJ3 96.25 puts, 9.5-10.0 ref 96.65

- 5,500 3QZ3 96.00/96.25 put spds ref 96.83

- 5,000 SFRZ3 98.00/99.00 1x2 call spds (volume in both legs>30k)

- over 8,000 SFRK3 95.00/95.50 2x1 put spds

- Block, 13,187 SFRK3 94.75 puts, 26.0 vs. 95.64/0.24%

- Block, 10,125 SFRK3 95.00/95.50 2x1 put spds, 1.5 ref 95.63

- Block, 5,000 SFRU3 97.00/97.50

- Block, 5,000 SFRK3 94.50/94.87/95.25 put flys, 6.0 ref 95.68

- Block, 2,626 SFRK3 94.93 puts, 29.0 vs. 95.49/0.30%

- over 32,500 SFRJ3 95.75 calls ref 95.08 to -.10

- over 12,700 SFRJ3 95.31 calls, ref 95.065 to .055

- 9,500 SFRZ3 97.25/974.62/98.00 call flys ref 95.535 to -.545

- 7,000 SFRN3 94.62 puts, ref 95.36 to -.365

- over 72,900 SFFRJ3 94.75 puts

- Block, 2,500 SFRJ3 94.62/94.87/95.12 put flys, 3.5

- Block, 2,500 SFRZ3 97.50/99.00 1x2 call spds, 8.0

- Block, 10,000 SFRZ3 97.50/98.50 call spds, 10.0

- Block, 5,000 SFRJ3 94.56/94.81/95.00/95.18 broken put condors, 1.5

- Block, 5,000 SFRM3 94.50/94.75 put spds, 10.5

- Block, 3,000 SFRJ3 95.31 calls, 28.0

- Block, 5,000 SFRM3 94.25/94.75/95.00 broken put flys, 3.5 belly over

- Block, 10,000 SFRJ3 94.87/95.00/95.18 broken put flys, , 4.25-4.00

- Block, 3,870 SFRZ3 96.00/96.50 call spds, 16.0 vs. 95.60

- 2,000 SFRM3 94.81/94.93/95.06 put flys ref 95.22

- Treasury Options:

- 7,500 TYK3 112.5 puts 20 over TYK 117/119 call spds ref 115-24.5

- over 27,000 FVJ3 110 calls, wide range of prices from 8 to 55

- Block, 5,000 FVK3 110/111/112 call flys, 6 ref 109-13.25

- 5,800 TYJ3 117.5 calls, 5 ref 113-20.5

EGBs-GILTS CASH CLOSE: Bank Panic Spurs Record German Rally

German yields across most of the curve dropped the most on record Wednesday as concerns over Credit Suisse spurred further bank-related risk aversion.

- The session began with rates selling off on a Reuters piece pointing to a 50bp ECB hike Thursday (following MNI's / later BBG's reporting), but was quickly consumed by Europe financial sector panic as bank stocks sold off 7% and risk spreads (including BTP periphery bonds) widened.

- The focus was Credit Suisse whose shares collapsed 31% at the lows, as its largest investor said they wouldn't inject more cash into the troubled bank.

- By the end of the session, 2Y, 5Y, and 30Y Bund yields had dropped by a single-day record, with the curve bull steepening sharply as ECB hikes were priced out. That includes just 12% implied prob of a 50bp raise Thursday.

- The CS headlines overshadowed the UK Budget announcement, which held few surprises. Gilts easily underperformed Bunds, with modest bull steepening.

- Attention overnight will remain on any news related to Credit Suisse, ahead of the ECB decision Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 48.3bps at 2.409%, 5-Yr is down 37.5bps at 2.137%, 10-Yr is down 29bps at 2.13%, and 30-Yr is down 26.5bps at 2.145%.

- UK: The 2-Yr yield is down 18.9bps at 3.292%, 5-Yr is down 17.8bps at 3.214%, 10-Yr is down 16.7bps at 3.321%, and 30-Yr is down 13.9bps at 3.755%.

- Italian BTP spread up 13.6bps at 198.1bps / Greek up 18.9bps at 210.2bps

EGB Options: Dovish (Re)positioning Pre-ECB

Wednesday's Europe rates / bond options flow included:

- DUJ3 104.70/104.30ps 1x1.25, sold at 2.25 and 2 in 50k

- OEJ3 115/113ps 1x2 vs OEK3 115/113ps 1x2, bough the May for 8.5 in 2.5k(rolling ps)

- ERJ3 97.25/97.375 cs Bot for 3 vs 96.83 in 8k

- ERZ3 98.00/99.00 cs Bot for 13.5 in 5k

FOREX: EURJPY Partially Recovers After Early Onslaught

- EURJPY came under severe pressure on Wednesday as German yields across most of the curve dropped the most on record as concerns over Credit Suisse spurred further bank-related risk aversion.

- Despite rising overnight to highs of 144.96, financial stability concerns centering around Credit Suisse prompted aggressive JPY strength throughout the European session and crossing over to early US trade. EURJPY briefly traded down over 3% on the session to reach lows of 139.48.

- There was a late reprieve for the struggling pair as Swiss authorities announced they would provide Credit Suisse with liquidity if it was deemed necessary. While not quite the reassurance the market was looking for, equity markets were well supported on the news prompting EURJPY to quickly spike and claw back around 175 pips from the lows.

- The USD index remains up 1.08% approaching the APAC crossover as the overall flight to quality prevailed on Wednesday. Led by EURUSD, the pair sits 180 pips off the overnight highs to trade at 1.0580 ahead of tomorrow’s ECB decision.

- The likes of AUD, NZD and GBP have all declined between 0.7-0.9% amid the market turmoil, but remain relatively less impacted given the focus on Europe today.

- New Zealand GDP and Australian employment data kick off the overnight docket on Thursday. Focus then quickly turns to the ECB to see what impact the most recent developments have had on the governing board’s reaction function.

FX: Expiries for Mar16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0610-20(E1.5bln), $1.0628-40(E1.2bln), $1.0700-15(E1.7bln)

- GBP/USD: $1.2150-55(Gbp588mln)

- EUR/GBP: Gbp0.8800(E829mln)

- AUD/USD: $0.6600-25(A$1.0bln)

- USD/CAD: C$1.3815($716mln)

E-MINI S&P (M3): Trend Outlook Remains Bearish

- RES 4: 4244.00 High Feb 2 and key resistance

- RES 3: 4200.00 Round number resistance

- RES 2: 4119.50 High Mar 6

- RES 1: 3972.50/4035.81 High Mar 14 / 50-day EMA

- PRICE: 3896.25 @ 13:53 GMT Mar 15

- SUP 1: 3839.25 Low Mar 13

- SUP 2: 3822.00 Low Dec 22 and a key support

- SUP 3: 3778.00 Low Nov 3

- SUP 4: 3724.86 76.4% retracement of the Oct 13 - Feb 2 bull cycle

The short-term condition in S&P E-Minis remains bearish and Tuesday’s move higher is considered corrective. Price last week cleared key short-term support at 3960.75, Mar 2 low to confirm a resumption of the bear cycle that has been in place since Feb 2. The move lower signals scope for an extension towards 3822.00 next, the Dec 22 low. Initial firm resistance is seen at 4035.81, the 50-day EMA.

COMMODITIES: Oil Sees Intraday Bounce On Credit Suisse Talks But Still Down Heavily

- A late recovery in risk appetite as Switzerland pushed front crude oil prices up nearly $2/bbl but they’re still down 4% on the day as they continue heavy declines with financial market turmoil.

- WTI is -4.0% at $68.48, having set sights on support at $66.04 (Dec 20, 2021 cont). Most active options volumes in the CLJ3 have been at $65/bbl puts.

- Brent is -3.6% at $74.63, having set sights on support at $71.30 (1.00 proj of the Nov 7 – Dec 12 - Jan 23 price swing).

- Gold is +0.9% at $1921.48 in spite of dollar strength as yields have slumped. A session high of $1937.05 cleared resistance at $1923.2 (76.4% retrace of Feb 2-28 selloff).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/03/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 16/03/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/03/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/03/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 16/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/03/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 16/03/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 16/03/2023 | 1345/1445 |  | EU | ECB Press Conference Following Rate Decision | |

| 16/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.