-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI ASIA MARKETS ANALYSIS: Tsy Hug Low After BoJ YCC Modify

HIGHLIGHTS

- MNI: US: Pentagon Not Seeing Signs Of Belarus Greater Role In Ukraine

- MNI: UKRAINE: Def Min Reznikov: No Evidence Russia Preparing Combat Force In Belarus

- WHITE HOUSE'S KIRBY: THERE IS NO PROGRESS WITH IRAN NUCLEAR DEAL NOW, AND NO PROGRESS EXPECTED IN NEAR FUTURE, Rtrs

US TSYS: BoJ YCC Modification Weighed on Global FI Markets Overnight

Global FI markets gapped lower overnight after the BoJ deployed a surprise widening of its permitted 10-Year trading band (to -/+0.50% vs. the previous -/+0.25%) at the end of its latest monetary policy decision: modifying the YCC parameters apparently implemented to improve market functioning (the BoJ now holds over 50% of outstanding JGBs for the first time).- Most of the (average) session volume occurred in the first few hours or Asia trade, while Tsys moved sideways from early lows through the entire session. Of note, 2s10s bear steepened back to mid-Nov levels tapping -56.923 inverted high overnight, -58.199 on the close (+9.328).

- Muted reaction to US Data, a modest beat in November housing starts, but that is a huge miss in building permits - by 140,000 (1.48mn expected, 1.34mn actual). The 180k M/M drop vs October is one of the largest monthly falls ever for permits - exceeded only a handful of times, in 2020, 2015, and in 2008.

- Fed funds implied hike for Feb'23 at 34.0bp, Mar'23 cumulative 49.0bp (+2.5) to 4.828%, May'23 55.6bp (+4.5) to 4.894%, terminal at 4.88% in Jun'23.

- On Friday: Deadline for Congress to reach an agreement on a year-long omnibus spending bill to avoid a shutdown of the federal government hits Friday at 23:59:59.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00486 to 4.31543% (-0.00157/wk)

- 1M +0.00743 to 4.36129% (+0.00843/wk)

- 3M +0.01428 to 4.75257% (+0.00671/wk)*/**

- 6M +0.02685 to 5.17671% (-0.01015/wk)

- 12M +0.03100 to 5.45871% (-0.02015/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $91B

- Daily Overnight Bank Funding Rate: 4.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.087T

- Broad General Collateral Rate (BGCR): 4.27%, $414B

- Tri-Party General Collateral Rate (TGCR): 4.33%, $399B

- (rate, volume levels reflect prior session)

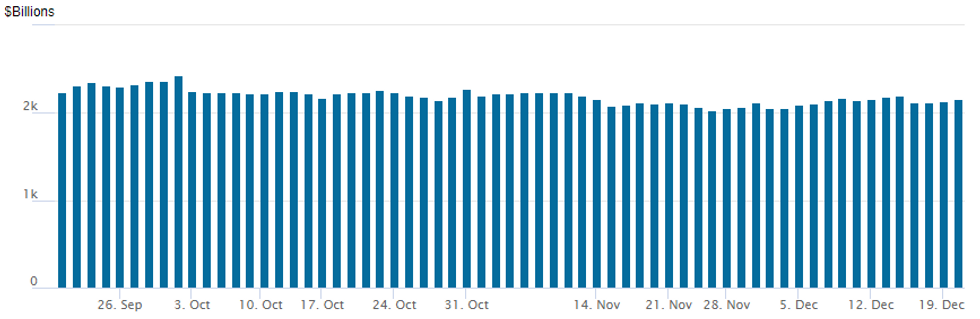

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,159.408B w/ 98 counterparties vs. $2,134.765B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Limited trade Tuesday, but one of note: Mar'23 Eurodollar Puts Brings Up Question Re: End of LIBOR

- +12,000 EDH3 94.12 puts, 1.25 red 94.92 - new position w/ open interest 0 coming into the session.

- This brings up the question, what about Eurodollar futures and options when LIBOR ceases to exist on June 30, 2023? (1, 3, 6 and 12 months USD LIBOR settings will cease immediately following the LIBOR publication on Friday, June 30, 2023).

- If positions are not rolled to corresponding SOFR contracts/options, the CME will convert to corresponding SOFR contracts on April 14, 2023.

- CME Three-Month SOFR futures (SR3) contracts with a price adjustment of 26.161bp (the fixed ISDA Fallback Spread Adjustment: https://assets.bbhub.io/professional/sites/10/IBOR... for 3M USD LIBOR) to the latest Eurodollar (ED) futures daily settlement price.

- Caveat: April 2023, May 2023 and June 2023 Eurodollar futures, and associated options will be excluded from the conversion and will continue to be available for trading until expiration.

- This brings up the question, what about Eurodollar futures and options when LIBOR ceases to exist on June 30, 2023? (1, 3, 6 and 12 months USD LIBOR settings will cease immediately following the LIBOR publication on Friday, June 30, 2023).

EGBs-GILTS CASH CLOSE: Semi-Core Suffers On BoJ Surprise

European curves steepened Tuesday after the Bank of Japan's surprise decision to raise the upper yield boundary of the 10Y JGB by 25bp.

- German and UK yields closed firmly higher (around double-digits basis points), with the exception of 2Y UK yields which were lower on the day.

- OATs underperformed, with 10Y wider by 2bp of Bunds to the widest close since Nov 1(56.5bp). Weaker Japanese demand post-BoJ decision was seen as a factor.

- Periphery spreads widened at the open but narrowed over the session as equities recovered alongside the US dollar softening.

- In data, German PPI and Eurozone consumer confidence were softer than expected, but there was little attention paid, with all eyes on the BoJ move.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.7bps at 2.517%, 5-Yr is up 9.4bps at 2.333%, 10-Yr is up 10.1bps at 2.304%, and 30-Yr is up 12.4bps at 2.187%.

- UK: The 2-Yr yield is down 0.4bps at 3.683%, 5-Yr is up 8.8bps at 3.579%, 10-Yr is up 9.4bps at 3.596%, and 30-Yr is up 6.8bps at 3.892%.

- Italian BTP spread down 0.7bps at 217.2bps / Spanish up 1.3bps at 110.1bps

EGB Options: Put Structures En Vogue After Hawkish BoJ Move

Tuesday's Europe rates / bond options flow included:

- RXG3 133.50/132.00/130.50 put fly bought for 12.5 in 3k. 132.00 strike equivalent to 2.63% yield

- RXG3 137/134 put spread sold from 126 down to 123 in 8k (potential profit taking)

- RXG3 132/131 put spread bought for 14.5 in 2k

- RXG3 132.50/131.50/130.50/129.50 put condor bought for 8.5 in 2k

- ERJ3 96.625/96.875 call spread sold at 9 in 8k

- ERU3 96.375/96.25/96.125/96.00 put condor bought for 1.5 in 3.5k

- ERZ3 96.375/96.25/96.00/95.75 put condor bought for 1.75 in 4k

FOREX: JPY Extends Strength Through London Close

- USDJPY broke lower still into the London close following the BoJ's YCC tweak overnight. The pair hit extended daily lows of 131.01 and making for a 6 point drop on the day. Key support at 131.74 has now given way, opening losses toward late August lows of 130.41 for direction.

- Moving average studies are in a bear-mode position and price remains well below the 20-day EMA. The daily RSI is nearing oversold territory, which could slow downside progress from here on, but the overarching theme remains negative for now.

- The risk backdrop was generally negative, with equity markets across Europe and the US failing to stage a sufficient recovery off the post-BOJ lows. As a result, AUD and NZD were among the poorest performers in G10, with AUD/USD now looking more comfortable below the 100-dma of 0.6664.

- EUR traded more favourably, although EURUSD remains below last week’s highs. The latest pullback is considered corrective - for now. Last week’s break higher confirmed a resumption of the uptrend and maintains the price sequence of higher highs and higher lows. The focus is on 1.0736 next, a Fibonacci projection.

- Focus Wednesday turns to UK public sector net borrowing data, Canadian inflation and US existing home sales for November. There are no central bank speakers of note.

Expiries for Dec21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400-10(E890mln), $1.0450(E726mln), $1.0660-75(E744mln), $1.0700(E655mln)

- USD/JPY: Y132.00-25($696mln), Y134.00-05($560mln), Y134.84-00($555mln)), Y136.00-15($1.1bln), Y140.00($1.1bln)

- AUD/USD: $0.6800(A$613mln), $0.6900(A$1.2bln)

- USD/CNY: Cny6.9500($675mln), Cny7.0100($789mln), Cny7.1500($930mln)

Late Equity Roundup: Energy and Materials Outperform

Major indexes making modest gains in late trade, near midmorning highs with Energy and Materials sectors outperforming. SPX eminis currently trade +7 (0.18%) at 3852.25; DJIA +114.98 (0.35%) at 32871.18; Nasdaq +3.5 (0%) at 10549.28.

- SPX leading/lagging sectors: Energy sector lead for the second day (+1.57%) partially tied to firmer crude prices (WTI +0.83 at 76.02) w/ equipment and servicer stocks (SLB +3.43%, HAL +3.11%, BKR +3.06%) outpacing O&G refiners. Materials up next (+0.78%) with metals/mining shares outperforming: Newmont Corp (NEM) +5.18%.

- Laggers: Consumer Discretionary (-0.83%), Real Estate (-0.09%) and Health Care (+0.09%) sectors underperformed in late trade. Consumer Discretionary weighed by autos, particularly Tesla (-5.83%).

- Dow Industrials Leaders/Laggers: Boeing (BA) +3.31 at 188.99, Caterpillar (CAT) +2.67 at 234.96, Honeywell (HON) +2.55 at 211.96.

- Laggers: Home Depot (HD) -1.77 at 315.56, United Health (UNH) -1.00 at 522.60, MMM -0.60 at 121.53.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/12/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 21/12/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/12/2022 | 0700/1500 | ** |  | CN | MNI China Liquidity Suvey |

| 21/12/2022 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 21/12/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 21/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/12/2022 | 1330/0830 | *** |  | CA | CPI |

| 21/12/2022 | 1330/0830 | * |  | US | Current Account Balance |

| 21/12/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 21/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.