-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA MARKETS ANALYSIS: Tsys Bid On Weak Philly Fed Data

- MNI UKRAINE: NATO Chief Talks Up Support, Zelenskyy Calls For Decision On Membership

- MNI SCHUMER SAYS GOP DEBT LIMIT PROPOSAL HAS NO CHANCE IN SENATE bbg

- MNI: BOC DOESN'T SEE BIG PROBLEM IF FED HIKES A BIT HIGHER

- US, ALLIES MOVE CLOSER TO NEAR-TOTAL BAN ON EXPORTS TO RUSSIA, Bbg

- TSY SEC YELLEN: SAYS CHINA'S STATE-DRIVEN MODEL UNDERCUTS OTHER NATIONS, Bbg

- TSY SEC YELLEN: NOT SEEKING TO `DECOUPLE' US ECONOMY FROM CHINA, Bbg

Key links: MNI: Fed's Mester Expects 'Somewhat Further' Tightening / MNI INTERVIEW:BOC Faces Sticky Inflation Fight-Research Winner / MNI BRIEF:US March Existing Home Sales Fall More Than Expected / Recessionary Philly Fed Headline And Prices But Some Improvements Elsewhere / US-CHINA: Biden Executive Order Expected To Limit US Investment In China

US TSYS: Revisiting Early Monday Levels After Weak Philly Fed Mfg Index

- Treasury futures are see-sawing near session highs, holding to a relatively narrow range since this morning's weaker than expected Philly Fed MFG index at -31.3 (-19.3 est). At odds with the surprise bounce in the (far more volatile) Empire State survey on Monday (10.8 reported vs. -18.0 ext).

- Price components stood out on the weak side: current prices received falling from 7.9 to -3.3 saw the first negative since the pandemic and aside from -0.2 in Jun'19 were last seen in 2016.

- Treasury futures gapped higher post data, Jun'23 10Y tapped 114-26 high (+20), back near early Monday levels. Initial firm resistance is at 114-30, the 20-day EMA. A break of this average is required to ease the current bearish threat.

- The 10Y contract remains in a short-term downtrend however after Wednesday’s move lower marked an extension of the pullback from 117-01+, Mar 24 high. The contract has recently traded through the 20- and 50-day EMAs and yesterday pierced 114-00. This signals scope for weakness to 113-23, a Fibonacci retracement.

- Federal Reserve Bank of Cleveland President Loretta Mester on Thursday endorsed a May interest rate increase and said she's prepared to adjust her views on how much higher and for how much longer rates will need to rise based on changing economic and banking conditions.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01834 to 4.96430 (+.07124/wk)

- 3M +0.01510 to 5.07060 (+.08772/wk)

- 6M +0.02125 to 5.09934 (+.15662/wk)

- 12M +0.04508 to 4.92801 (+.24374/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 4.80671%

- 1M +0.02771 to 5.01000%

- 3M +0.01128 to 5.27271% */**

- 6M +0.02272 to 5.47329%

- 12M -0.02114 to 5.46057%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $109B

- Daily Overnight Bank Funding Rate: 4.82% volume: $281B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.307T

- Broad General Collateral Rate (BGCR): 4.76%, $517B

- Tri-Party General Collateral Rate (TGCR): 4.76%, $509B

- (rate, volume levels reflect prior session)

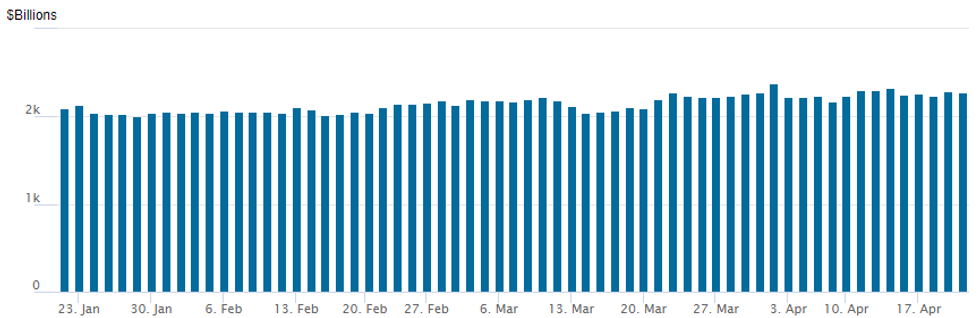

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,277.259B w/ 103 counterparties, compares to prior $2,294.677B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

SOFR/TREASURY OPTIONS SUMMARY

Modest early put trade coming into the session gave way to better upside call structure and vol buying as underlying futures gapped higher after Philly Fed manufacturing index reported much weaker than expected (-31.3 vs. -19.3 est), projected rate cuts for year end firming again.- SOFR Options:

- +10,000 SFRQ3 95.25/95.50/95.75 call flys, 4.0

- Block, 5,000 SFRM3 94.81/94.93/95.06 3x5x2 ratio put flys, 0.5 net/wings over ref 94.90

- Block, +10,000 SFRM3 94.43/94.56/94.68/94.75 broken put condors, 1.5 vs. 94.92/0.03%

- total +16,500 (10K Blocked) SFRM3 94.87 straddles 3.5 over SFRN3 95.25 calls vs. 95.11/0.42%

- +10,000 SFRH4 97.50/98.00 call spds vs. 95.96/0.05% w/

- +10,000 OQU3 97.50/98.00 call spd vs. 96.67, paying 15.25 to buy both

- 5,000 SFRU4 1Y strip 94.25/94.50 put spd

- Block, +12,000 SFRM3 94.68/94.75 put spds, 2.5 vs.

- Block, -6,000 SFRM3 94.43/94.56 put spds 1.0 vs. 94.905/0.10%

- Block, 5,000 SFRM3 94.68/94.81/95.00 2x3x1 put flys, 2.0 net ref 94.885

- 21,000 SFRM3 94.93/95.00/95.06/95.12 put condors ref 94.89

- 2,000 SFRZ3 94.87/95.12/95.37 put flys ref 95.475

- 2,500 SFRU3 94.75/94.87/95.00/95.12 iron condors ref 95.12

- 3,500 SFRM3 94.50/94.68/94.75 put trees ref 94.89

- Treasury Options:

- +5,000 TYK3 113.5/114 put spds, 3

- 3,400 TYK3 114 puts, 4 ref 114-20

- over 3,000 FVK3 109.5 calls, 6 ref 109-07.25

- 7,500 FVK3 109.5/110 call spds ref 109-04.75

- 2,500 FVM3 112.5 calls, 5.5 ref 109-03.25

EGBs-GILTS CASH CLOSE: Soft US Data Spurs First Yield Pullback This Week

European yields pulled back Thursday for the first time this week, with equities setting a risk-off tone and US data disappointing.

- An early move higher in Bunds on soft PPI and French confidence data reversed. And despite a multitude of ECB speakers and the March meeting accounts release, they conveyed little surprise and had limited market impact.

- Instead, core yields took their cue over most of the session from equity struggles (particularly in the auto sector) and a weak US Philly Fed reading.

- After underperforming in a bear flattening move Wednesday, the UK curve reversed, outperforming Germany with bull steepening.

- Terminal BoE and ECB rates pulled back by around 4bp, the largest decline in a week (though 25bp hikes remain fully priced for May).

- Periphery EGB spreads widened modestly.

- Friday's schedule is highlighted by prelim PMIs and UK retail sales.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.5bps at 2.893%, 5-Yr is down 7.6bps at 2.49%, 10-Yr is down 7bps at 2.445%, and 30-Yr is down 4.7bps at 2.505%.

- UK: The 2-Yr yield is down 10.1bps at 3.729%, 5-Yr is down 8.9bps at 3.627%, 10-Yr is down 9bps at 3.766%, and 30-Yr is down 7.9bps at 4.104%.

- Italian BTP spread up 2.1bps at 186.9bps / Spanish up 1bps at 103.8bps

FOREX: Greenback Weakens, AUDNZD Rises 0.75% Following Soft NZ Inflation Print

- Philly Fed Manufacturing index data was surprisingly weak in April (-31.3 vs. -19.3 est.), marking a near-three year low for the metric. Despite a brief bout of USD strength before the data, the greenback weakened in the aftermath and sits moderately lower approaching the APAC crossover.

- An associated recovery for major equity indices boosted the likes of the Aussie, which is the strongest in G10. In particular, AUDNZD gains of 0.75% are notable on Thursday as the New Zealand dollar remains weighed down by a softer inflation print overnight. Q1 CPI slowed to 1.2% against expectations of a 1.5% print, helping prompt a number of sell-side outfits to redraw RBNZ expectations around the May interest rate hike possibly being the last in the cycle.

- The Japanese Yen was among the best performers on the back of lower core yields with particular outperformance seen at the front-end of the US curve following the US data. USDJPY had reached an overnight high of 134.97 before sliding all the way back to the 134.00 handle throughout US hours.

- EUR/NOK continues to grind higher, hitting a new cycle best at 11.6444 today and the highest since Apr'20. Key upside level in EUR/NOK crosses at 11.7486 - the 61.8% retracement for the 2020-2022 downleg and could come into play should the Apr'20 high of 11.6966 give way.

- Focus quickly turns to flash PMI data on Friday for any signals on the trajectory for the health of eurozone and the US economies. Retail Sales data for both the UK and Canada will also cross.

Expiries for Apr21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0973-80(E920mln), $1.1050(E1.7bln)

- GBP/USD: $1.2350(Gbp545mln)

- USD/JPY: Y134.00-20($829mln)AUD/USD: $0.6795-00(A$521mln), $0.6845(A$1.4bln)

- USD/CAD: C$1.3520-40($670mln)

- USD/CNY: Cny7.0100($740mln)

Equities Roundup: Late Risk On Unwinds

Stocks posting modest losses in late trade, turning lower over the last hour: DJIA down 137.7 points (-0.41%) at 33760.14; S&P E-Mini Future down 31.25 points (-0.70%) at 4147.75; Nasdaq down 94 points (-0.8%) at 12064.12.

- The reversal coincides with Treasury futures paring gains. Not particularly headline driven, moves likely position squaring ahead another round of equity earnings after the close: SVB, CSX, Knight-Swift, Bank OZK and PPG industries.

- More earnings early Friday include: Regions Financial Corp, Freeport-McMoRan, Qualtrics International, Schlumberger, HCA Healthcare, First Republic Bancorp and Procter & Gamble.

- Impasse over the US debt ceiling also likely adding to the late risk-off tone.

- Despite the reversal, the technical trend outlook in S&P E-minis remains bullish and the latest move lower (from Tuesday’s high) is considered corrective. Support to watch lies at 4119.30, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4077.86, the 50-day EMA.

- Attention is on the 4200.00 handle where a break would resume the uptrend and open 4205.50,Feb 16 high ahead of 4244.00, the Feb 2 high and key resistance.

E-MINI S&P (M3): Pullback Considered Corrective

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4200.00 Round number resistance

- PRICE: 4147.00 @ 1440ET Apr 20

- SUP 1: 4119.30 20-day EMA

- SUP 2: 4077.86 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

The trend outlook in S&P E-minis remains bullish and the latest move lower (from Tuesday’s high) is considered corrective. Support to watch lies at 4119.30, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4077.86, the 50-day EMA. Attention is on the 4200.00 handle where a break would resume the uptrend and open 4205.50,Feb 16 high ahead of 4244.00, the Feb 2 high and key resistance.

COMMODITIES: WTI Clears 50-Day EMA On Demand Concerns, Product Oversupply

- Crude oil has been on a largely one way move lower today, continuing the week’s slide.

- Similarly, gasoline cracks extended yesterday’s decline, with demand concerns weighing on margins and assisted by the return of US refineries from maintenance and the gradual return of French refineries.

- Oil product market oversupply could be eased if China cuts quota for refined oil products exports in a second batch for 2023. Quotas could be reduced as domestic demand improves while there is less need to boost its economy through oil products exports. China's refinery throughput hit a record-high in March.

- WTI is -2.4% at $77.24 having started the week close to $82.5. A low of $77.00 has seen it push through the 50-day EMA of $77.42, opening $75.72 (Mar 31 high).

- Brent is -2.5% at $81.05 with a low of $80.82 easily through support at $82.08 (50-day EMA) to open $79.95 (Mar 31 high).

- Gold is +0.5% at $2005.00 on a continuation of its inverse relationship with the USD. An earlier high of $2012.3 started to eye resistance at $2015.1 (Apr 17 high) after which lies the sizeable jump to the bull trigger at $2048.7 (Apr 13 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/04/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 21/04/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/04/2023 | 2330/0830 | *** |  | JP | CPI |

| 20/04/2023 | 2345/1945 |  | US | Philadelphia Fed's Pat Harker | |

| 21/04/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 21/04/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/04/2023 | 0700/0900 |  | EU | ECB de Guindos Remarks at Fundacion La Caixa | |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 21/04/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 21/04/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 21/04/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 21/04/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 21/04/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 21/04/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 21/04/2023 | 1430/1630 |  | EU | ECB Elderson at Peterson Institute Climate Event | |

| 21/04/2023 | 1745/1945 |  | EU | ECB de Guindos at Colegio de Economistas de Madrid Event | |

| 21/04/2023 | 2035/1635 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.