-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Bounce Off Housing Data Lows

- MNI US: Senate Democrats Push To Revive Pandemic-Era Child Tax Credits

- MNI SECURITY: EU And Iranian Nuclear Negotiators To Meet In Doha

- MNI WHEAT: Russian Foreign Ministry: Black Sea Grain Deal May End July 18

- ECB VILLEROY SAYS MOST OF ECB RATE-HIKE PATH IS COMPLETE, Bbg

- ECB VILLEROY SAYS INFLATION COULD NEAR 2% AT END-2024, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

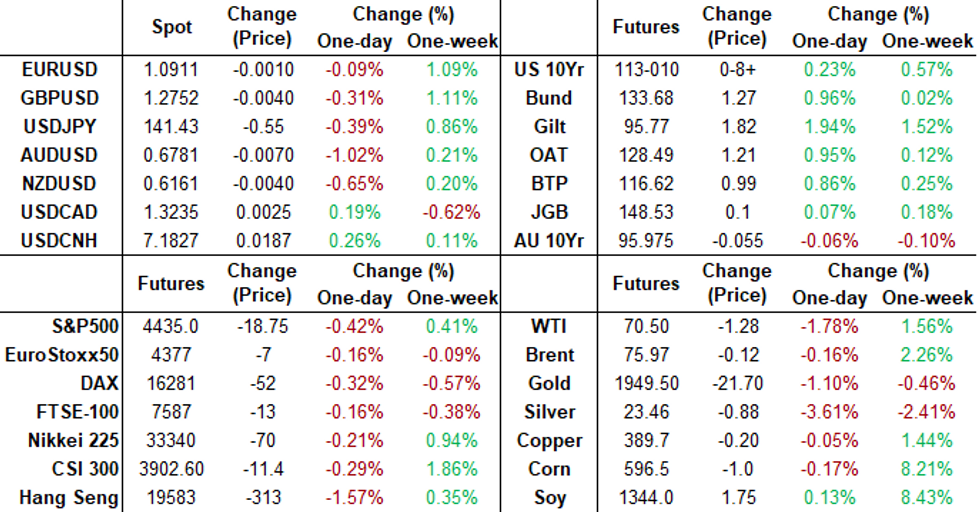

US Tsys Ignore Stronger than Expected Housing Starts Data

- Treasury futures had sold off briefly this morning after stronger than expected Housing starts 1.631M vs. 1.4M est (1.401M prior); permits 1.491M vs. 1.425M est. Rates quickly bounced as they tracked first Gilts then Bunds earlier after German 10Y yield fell 10.9bp, the largest down-move since April 28.

- Front month 10Y Treasury futures near last Thursday's post-weekly claims highs, are currently trading +9.5 at 113-11 vs. session high of 113-17. Initial firm resistance is at 114-00, the Jun 13 high, followed by 114-06+ / 114-17 High Jun 6 / 50-day EMA.

- No significant change in rate hike expectations with short end SOFR futures holding weaker. Market confidence of a hike at the July 26 FOMC is appr 70% with an implied rate of +17.3bp to 5.258%, September and November pricing in appr 86% with cumulative of +22.5bp and 21.0 respectively at 5.3-5.295%. Dec'23 cumulative running near 12bp at 5.205%, Fed terminal at 5.30% in Oct'23 and Nov'23 at the moment.

- Focus turns to Fed Chairman Powell semi-annual testimony House Services Panel tomorrow at 1000ET, though it's unlikely Chair Powell will deviate from last week's policy messaging.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00084 to 5.07713 (+.06141 total last wk)

- 3M +0.01341 to 5.22025 (-.04254 total last wk)

- 6M +0.01923 to 5.30860 (+.00326 total last wk)

- 12M +0.03626 to 5.26658 (+.08215 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.01015 to 5.07529%

- 1M -0.00857 to 5.15414%

- 3M +0.00600 to 5.52029% */**

- 6M +0.01757 to 5.67400%

- 12M +0.00272 to 5.89786%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.08% volume: $129B

- Daily Overnight Bank Funding Rate: 5.06% volume: $285B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.405T

- Broad General Collateral Rate (BGCR): 5.04%, $619B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $600B

- (rate, volume levels reflect prior session)

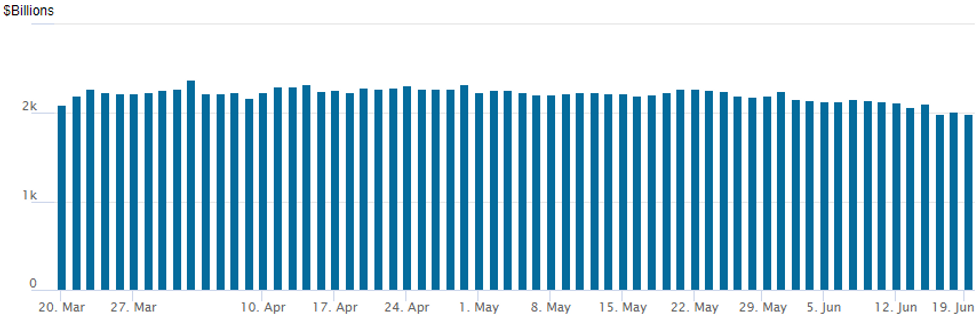

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage is back below $2T again, the current figure is at $1,989.489B w/ 102 counterparties, compared to $2,011.556B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

- Fixed income options saw a quiet return from an extended holiday weekend, focus on Fed Chairman Powell's semi-annual policy testimony to the House Services Panel Wednesday maorning. Short end SOFR options saw more consistent low delta call trade, discounting weaker Jun'23-Sep'23 underlying futures as a projected rate hike in one of the next three FOMC meetings gained traction. Treasury options saw modest interest in Aug'23/Sep'23 10Y calls and Jul'23 5Y puts. Salient trade includes:

- SOFR Options:

- Block, 5,000 SFRQ3 94.62 puts, 10.0 vs. 94.695/0.42%

- Block, 7,000 SFRU393.75/94.25 put spds, 1.75 ref 94.68

- Block +5,000 OQU3 96.50/97.00 call spds, 6.5 vs. 95.915/0.13%

- Block +5,000 OQU3 96.62/97.12 call spds, 8.0 vs. 95.99/0.12%

- +5,000 SFRU3 95.50 calls, 5.5 vs. 94.70/0.13%

- 4,300 OQN3/OQQ3 95.87 straddle spds ref 95.95

- 4,000 FVQ3 109.75 calls, 8 ref 107-23.5

- 2,000 SFRU3 95.37/95.50 call spds vs. 94.75/94.87 put spds

- Treasury Options:

- 1,500 TYQ3 111.5/115 put spds vs. TYU3 111.5/114 put spds

- 2,000 TYN23 114.75 calls, 3

- 4,000 TYU3 117 calls, 18

- 4,100 FVQ3 108.25/110/110.5 broken call trees

- 2,500 TYQ 115/116 call spds, 8

- 2,700 TYU3 109 puts ref 112-31.5

- 4,900 TYQ 115 calls, 15-16

- 5,200 TYQ 116 calls, 8-9

- over 24,000 TYN3 112 puts, 4-5

EGBs-GILTS CASH CLOSE: All Gilt Bets Are Off Ahead Of CPI

Gilts led a global bond rally Tuesday, with caution receding ahead of Wednesday's pre-market UK CPI reading.

- The UK belly outperformed with yields across the curve down double-digits in the biggest rally since March. 2s reversed yesterday's losses; 10s were back to the same yield levels of 6 sessions ago after the key 4.50% level held firm.

- Some desks cited possible short covering (MNI's Europe Pi noted Gilts had been in structural short positioning), with CPI Weds and the BoE decision Thursday eyed - our preview will be published later today.

- The German curve bull flattened, helped by German PPI coming in below consensus, with 10-30Y yields down over 10bp. With the short end / ECB hike pricing anchored, 2s10s hit the most inverted level since 1992.

- ECB's Simkus told an MNI event that “I would in no way be surprised" if the ECB opted to hike in September, with a July hike already "pretty much clear".

- EGB periphery spreads widened amid a broader risk-off asset move, with Portugal underperforming.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.3bps at 3.107%, 5-Yr is down 9.5bps at 2.525%, 10-Yr is down 11.2bps at 2.405%, and 30-Yr is down 11.1bps at 2.488%.

- UK: The 2-Yr yield is down 13bps at 4.953%, 5-Yr is down 17.6bps at 4.509%, 10-Yr is down 15.5bps at 4.337%, and 30-Yr is down 10.3bps at 4.454%.

- Italian BTP spread up 2.2bps at 162.6bps / Portuguese up 2.4bps at 66.7bps

EGB Options: Rate Upside Features

Tuesday's Europe rates / bond options flow included:

- 0RZ3 97.25/98.00 call spread bought for 10 in 4k. Underlying is ERZ4

- RXQ3 137.00/139.50/142.00c fly, bought for 13.5 in 2k

- RXU3 137/135/133 put fly sold at 33 in 4.5k

FOREX: AUD Consolidates Post RBA Minutes Decline, USDJPY Resistance Holds

- A 50 pip round trip for the USD index following yesterday’s US holiday culminates in the DXY trading broadly unchanged on the session. Mixed performance across G10 sees the majority of currencies decline against the greenback, although the Japanese Yen outperforms amid the lower core yields.

- AUD is the clear laggard across G10 currency markets following the overnight RBA minutes. Despite the RBA not showing explicit dovishness, market sentiment appears to have been influenced by subtle changes in wording regarding the necessity of additional tightening, along with the finely balanced decision on whether to raise interest rates or maintain the status quo.

- AUD extended losses as risk off flows weighed and breached support at $0.6810 to trade as low as 0.6753 during the US session. The next support level is $0.6727 the June 12 low.

- Gilts led a global bond rally Tuesday, with caution receding ahead of Wednesday's pre-market UK CPI reading. Lower core yields have benefitted the Japanese Yen specifically allowing JPY to move to the top of the G10 FX pile, with USD/JPY the best part of 60 pips lower on the day at 141.40 at typing. Initial technical resistance in the form of the 21 Nov ‘22 high (142.25) held to the pip before the pullback.

- The aforementioned UK CPI on Wednesday brings attention back on to GBP ahead of the BOE decision on Thursday. Despite the gilt move weighing on GBPUSD all the way down to 1.2714, a late bounce shows that the pair is broadly consolidating its impressive advance last week. Moving average studies remain in a bull-mode condition reflecting current trend conditions and the topside focus is on 1.2877, the Apr 25 2022 high. Initial firm support is at last Thursday’s 1.2630 low.

- Worth pointing out that EURSEK has extended its move to the upside and in the process, has printed fresh all-time highs at 11.8164, increasing the year’s advance to around 5.7%.

- Aside from UK inflation data, Canadian retail sales will also cross before Fed Chair Powell will deliver the Semi-Annual Monetary Policy Report in congress.

Late Equity Roundup: Bull Theme Intact, Stocks Off Lows

- Still weaker in late trade, stocks have recovered from first half lows. Buyers not willing to give up on stock "euphoria" yet as SPX and Nasdaq indexes drift near the best levels since mid-April 2022, DJIA best levels since late November 2022 last Friday.

- Trading desks had cited various reasons for early selling that included less than expected cut to five-year China rate (10bp vs. 15bp) weighed on financial shares overnight. In Europe, usually stable chemical/materials stocks underperformed.

- Near the upper half of the session range, S&P E-Mini future are currently down 28 points (-0.63%) at 4425.75, DJIA down 281.33 points (-0.82%) at 34016.35, Nasdaq down 65.7 points (-0.5%) at 13623.86.

- Laggers: Energy and Materials sectors continue to underperform, the former as crude prices trade weaker (WTI -1.28 to 70.50) with Devon energy -3.6%, APA -3.55% and Marathon -3.5%. Materials weighed by containers and packaging stocks: Celanese -4.5%, Ball Corp -3.95% while Eastman Chemical trades -3.3%.

- Leading gainers: Consumer Discretionary sector shares traded flat to mildly higher, auto stocks outperforming (Tesla +3.9%). Health Care sector followed as equipment and servicers (UNH +2.35%, CVS +1.75%) outperform biotech shares (MNRA -2.94%).

- A bull-theme in S&P E-minis remains intact. Last week’s gains confirmed a resumption of the uptrend, marking an extension of the bull cycle that started in October 2022. The focus is on 4494.20, the top of a bull channel drawn from the Oct 2022 low (cont). Initial support is at 4381.75, the Jun 13 low. A firmer support lies at 4332.90, the 20-day EMA. Pullbacks are considered corrective.

E-MINI S&P TECHS: (U3) Approaching The Top Of A Bull Channel

- RES 4: 4576.72 2.50 projection of the May 4 - 19 - 24 price swing

- RES 3: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 2: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- RES 1: 4494.20 Bull channel top drawn from the Oct 2022 low (cont)

- PRICE: 4438.00 @ 1500ET Jun 20

- SUP 1: 4381.75/4332.90 Low Jun 13 / 20-day EMA

- SUP 2: 4250.15 50-day EMA

- SUP 3: 4154.75 Low May 24

- SUP 4: 4098.25 Low May 4 and a key support

A bull theme in S&P E-minis remains intact. Last week’s gains confirmed a resumption of the uptrend, marking an extension of the bull cycle that started in October 2022. The focus is on 4494.20, the top of a bull channel drawn from the Oct 2022 low (cont). Initial support is at 4381.75, the Jun 13 low. A firmer support lies at 4332.90, the 20-day EMA. Pullbacks are considered corrective.

COMMODITIES

- WTI Crude Oil (front-month) down $1.28 (-1.78%) at $70.50

- Gold is down $13.38 (-0.69%) at $1937.27

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/06/2023 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 21/06/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/06/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 21/06/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 21/06/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 21/06/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 21/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/06/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/06/2023 | 1345/1545 |  | EU | ECB Schnabel Panels Discussion at Landesvertretung Hessen | |

| 21/06/2023 | 1400/1000 |  | US | Senate Hearing on Fed Nominees | |

| 21/06/2023 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 21/06/2023 | 1625/1225 |  | US | Chicago Fed's Austan Goolsbee | |

| 21/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 21/06/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.