-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, March 7

MNI ASIA MARKETS ANALYSIS: Tsys Hold Range Into Month-End

- Treasury futures near highs into month end, curves bull flatten

- Fed speak remains balanced while leaning toward cut(s) in 2H'24

- AI demand spurred late semiconductor stock rally buoys IT sector, wider markets

- US House passes stopgap spending bill, continuing resolution heads to Senate

Tsys Hold Range Into Month-End, ISMs, UofM and More Fed Speak Friday

- Treasury futures hold firmer levels for the most part, short end under pressure heading into month end, curves flatter (2s10s -1.965 at -39.526).

- The new lead quarterly Jun'24 10Y futures currently at 110-14.5 (+3.5) vs. 110-00 low, trading inside technicals: initial technical resistance 110-26+ (20-day EMA) vs. technical support 109-25+ (Low Feb 23).

- Futures bounced off lows following this morning's higher than expected Personal Income (1.0% vs. 0.4% est), Personal Spending came out in line at 0.2% vs est. Supercore PCE, however, at 4.2% over three-months (from 2.2% in Dec), 3.4% over six-months (from 2.8%).

- Initial Jobless Claims higher than expected (215k vs. 210k est) while Continuing Claims climbs to 1.905M vs. 1.874M est.

- Balance of data looked in-line: Real Personal Spending (-0.1% vs. -0.1% est); PCE Deflator MoM (0.3% vs. 0.3% est), YoY (2.4% vs. 2.4% est), PCE Core Deflator MoM (0.4% vs. 0.4% est), YoY (2.8% vs. 2.8% est).

- Fed speak remains balanced while leaning toward cut(s) in 2H'24. Federal Reserve Bank of Atlanta President Raphael Bostic reiterated Thursday the central bank is likely going to be in a position to begin easing interest rates sometime in the summer, but he added that economic data will be the guide and easing can be pulled forward or pushed back.

- Look ahead: Wrapping up the week with another busy data day: ISMs, UofM Sentiment, and more Fed Speakers.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00315 to 5.32244 (-0.00169/wk)

- 3M -0.00773 to 5.33352 (+0.00295/wk)

- 6M -0.01194 to 5.27493 (+0.00142/wk)

- 12M -0.02147 to 5.07185 (-0.00058/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.620T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $670B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $661B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $282B

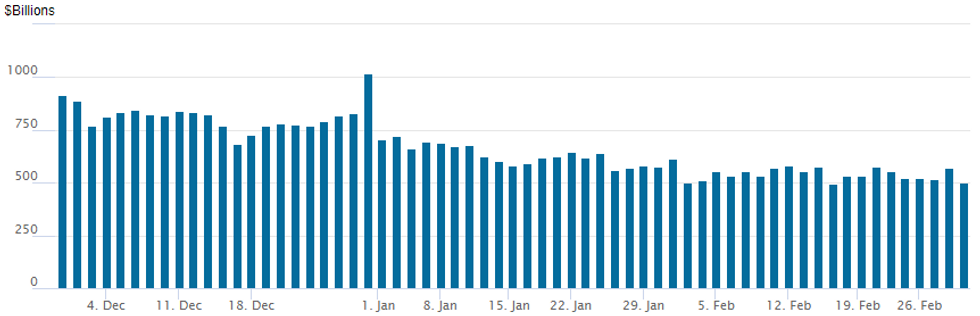

FED Reverse Repo Operation: Usage Falls to Two Week Lows

NY Federal Reserve/MNI

- RRP usage falls to the lowest level in two weeks at $502.074B vs. $569.855B Wednesday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties slips to 83 from 87 Wednesday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY: June Rate Cut Hedging

Focus on June rate cut uncertainty hedging. Paper bought over +35,000 SFRM4 95.50/95.75 call spreads 1.0 ref 94.895 earlier. Heavy open interest in the two strikes: 463,963 and 268,610 respectively as some accounts continue to build mid-year rate cut positions. Jun'24 SOFR options expire two days after the FOMC policy annc on June 12.

- Projected mid-year cut pricing remains uncertain. March 2024 chance of 25bp rate cut currently -2.7% w/ cumulative of -0.07bp at 5.322%; May 2024 steady at -18.4% w/ cumulative -5.3bp at 5.276%; June 2024 -56.4% from -54.5% earlier w/ cumulative cut -19.2bp at 5.137%. First full cut priced in at July w/cumulative -33.6bp at 4.993%. Fed terminal at 5.327% in Mar'24.

- SOFR Options:

- over 35,000 Blocked/screen SFRM4 95.50/95.75 call spreads 1.0 ref 94.895

- Block, 20,000 SFRJ4 94.87/95.00/95.18/95.31 call condors, 3.75-4.0 ref 94.915

- +4,000 SFRJ4 95.00/95.06/95.12 call flys, 0.5 ref 94.91

- -2,500 SFRK4 95.00/95.18/95.25/95.37 call condors, 2.5 ref 94.91

- +5,000 SFRN4 94.56/94.62/94.75 2x3x1 put flys, 1.0 ref 95.21

- -8,000 SFRM4 95.00/95.50/96.00 put flys, 5.0 vs. 94.895/0.22%

- -2,500 SFRH5 95.75 straddles, 98.5 ref 95.81

- Block +12,500 SFRZ4 96.75/97.25 call spds 4.5 vs. 95.50/0.05%

- Block, 5,000 SFRM4 95.75/96.00 call spds, 0.5

- Block, 5,000 SFRM4 95.75/95.87 call spds 0.5

- 3,000 2QH4 96.50/96.75 call spds ref 96.30

- Block, +2,500 SFRJ4 94.75/94.81/94.87 put trees, 0.25

- +8,000 SFRM4 94.87/95.06 put spds, 12.5 ref 94.89

- +4,000 SFRM4 94.81/95.00 put spds, 11.0 vs. 94.89/0.25%

- 4,000 SFRM4 94.87/95.00/95.12 call flys ref 94.89 (some vs. 94.62 put)

- Treasury Options:

- 7,000 TYK4 116 calls, 5 ref 110-19

- 5,000 TYJ4 108.5/109.5 put spds

- 5,000 TYJ4 114/114.5/116/117 call condors vs. 107/107.25 put spds

- 2,400 TUK4 101.75 puts, ref 102-13.38

- 3,000 TYJ4 109.25/111.5 strangles, 51 ref 110-14

- +12,500 TYJ4 108.5 puts, 16 ref 110-03

- 2,400 TYJ4 109.5/111 put spds ref 110-03.5

- Block, 3,030 TYJ4 110.5/111.5 call spds vs. TYJ4 109.25 puts, 1 net/calls over vs. 110-10.5/0.50%

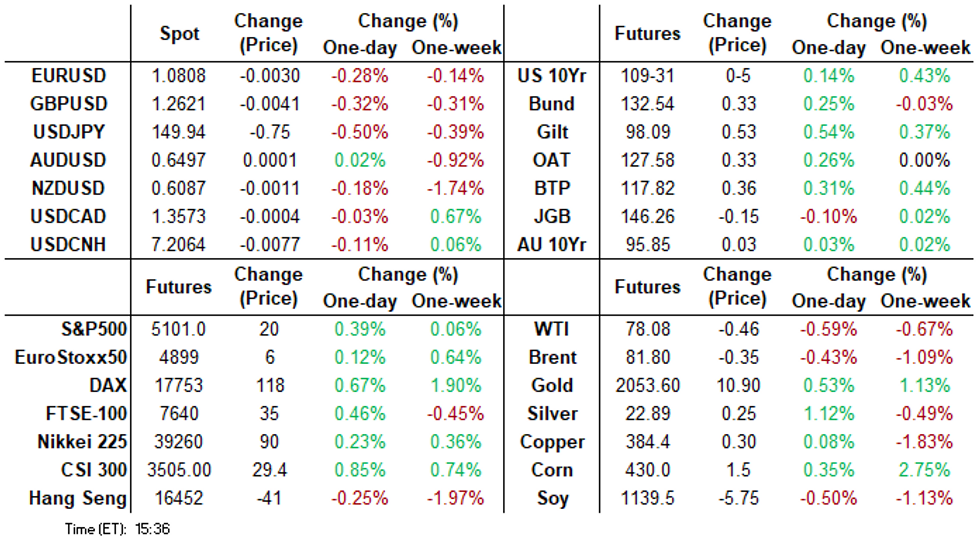

FOREX Initial Greenback Weakness Reverses Course, JPY Remains Outperformer

- US PCE inflation came in close to estimates on Thursday, leaving the greenback victim to weaker-than-expected US jobless claims figures, as well as a below-estimate MNI Chicago PMI. The USD index was quick to erase moderate gains and trade to a fresh session low of 103.66 right ahead of the month-end WMR fix.

- However, with month-end positioning potentially well telegraphed, the greenback had a sharp squeeze into 1600 GMT and continued its reversal higher in the immediate aftermath. The USD index briefly extended its intra-day bounce to 0.5%, before trading a tenth lower into the APAC crossover.

- Despite the late recovery for the greenback and USDJPY, the Japanese yen remains the standout performer on Thursday, largely on the back of the overnight hawkish commentary from BOJ’s Takata, who pointed to the Bank's inflation target being within sight.

- USDJPY traded as low as 149.21 from the overnight 150.70 highs, although the pair trades mid-range in recent trade, supporting the viewpoint that dips remain corrective at this juncture. Initial support lies at 149.63, the 20-day EMA - a level pierced, but not convincingly broken on Thursday.

- Elsewhere, the likes of EUR and GBP have fallen around a quarter of a percent, and the Swiss Franc scans as the weakest in G10, with USDCHF rising to a two-week high above 0.8840.

- Overnight, RBNZ Governor Orr may speak again about the Monetary Policy Statement in Christchurch, however, focus will be on Chinese manufacturing and non-manufacturing PMI’s. Eurozone CPI then takes centre stage before US ISM Manufacturing PMI rounds off the week’s tier-one data.

FX OPTION EXPIRY

- EURUSD: 1.0790 (736mln), 1.0795 (545mln), 1.0800 (656mln), 1.0805 (402mln), 1.0810 (260mln), 1.0830 (404mln), 1.0840 (460mln), 1.0855 (932mln), 1.0860 (1.66bn), 1.0865 (777mln), 1.0885 (489mln), 1.0900 (1.37bn).

- USDJPY: 150.00 (544mln), 150.50 (282mln).

- USDCAD: 1.3545 (519mln), 1.3550 (241mln).

- AUDUSD: 0.6510 (490mln).

- USDCNY: 7.2000 (910mln).

- EURUSD 4.23bn at 1.0840/1.0865.

- EURUSD 1.27bn at 1.0865 (Friday)

- EURUSD 2.22bnat 1.0800 (Monday)

- GBPUSD 1.95bn at 1.2650/1.2655 (Monday)

- AUDUSD 1.24bn at 0.6515 (Monday)

- EURUSD 1.28bn at 1.0845 (Tuesday)

Late Equities Roundup: Late Chip Rally Boosts IT, Energy Reverses

- Stocks have have recovered from midday selling in late trade, potential for whippy month end trade ahead. At the moment, DJIA trades down 4.64 points (-0.01%) at 38940.51, S&P E-Minis up 15 points (0.3%) at 5095.5, Nasdaq up 93.8 points (0.6%) at 16039.99.

- Leading Gainers: Energy sector reversed earlier lead as crude support evaporated (WTI -.50 at 78.04), replaced by Real Estate and Information Technology sectors. Investment trusts lead the Real Estate sector for the second day running, particularly Office and Specialized REITS: Iron Mountain +3.97%, Alexandria Real Estate +3.81%, American Tower +3.43%.

- Strong bid for semiconductor stocks supported the IT sector in late trade: Advanced Micro Devices +8.23%, Enphase +6.17%, Skyworks Solutions +2.76% while Nvidia climbed 2.25%.

- Laggers: Health Care and Financial sectors continued to underperform in late trade, equipment and services shares weighed on the Health Care sector: GE HEalthcare -3.19%, Molina Healthcare -2.45% while Baxter Int traded -2.15%. Insurance names weighed on the Financials sector: Marsh & McClennan -1.92%, Arch Capital -1.77%, Globe Life -1.57%.

- Looking ahead: corporate earnings after the close include: Autodesk Inc, Hewlett Packard Enterprises, Dell Technologies and B Riley Financials.

E-MINI S&P TECHS: (H4) Trend Needle Points North

- RES 4: 5191.21 3.0% Bollinger Band

- RES 3: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5153.29 2.0% 10-dma envelope

- RES 1: 5123.50 High Feb 23 and bull trigger

- PRICE: 5096.25 @ 1515 ET Feb 29

- SUP 1: 5016.21 20-day EMA

- SUP 2: 4936.50 Low Feb 13

- SUP 3: 4904.10/4866.000 50-day EMA / Low Jan 31 and key support

- SUP 4: 4808.50 Low Jan 19

The trend condition in S&P E-Minis remains bullish and the contract continues to trade closer to its recent highs. The latest move higher again highlights the fact that corrections remain shallow - a bullish signal. Support to watch is 5016.21, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4936.50, the Feb 13 low. A resumption of gains would open vol-band based resistance at 5153.29.

COMMODITIES Oil Swings With Mixed US Demand Picture, Gold Resists USD Strength

- Crude futures have been choppy throughout the day, moving into losses as US close approaches amid a mixed picture on demand following US economic data. A recovery in the US dollar erased WTI’s gains after European close.

- Speaking briefly to reporters, US President Biden when asked on the prospect of an Israel-Hamas ceasefire agreement says that 'hope springs eternal,' but that it is unlikely to start by Monday 4 March (previously raised by Biden as a target date).

- Wires carrying comments from the leader of the Houthi forces in Yemen, claiming that the group will introduce military "surprises" in their Red Sea operations, which their "enemies" will not expect.

- Oil output among the OPEC 9 members rose by around 87k b/d in February, according to a Reuters survey. In terms of the additional voluntary cuts for Q1, the OPEC-9 members exceeded their quotas by 191k b/d.

- WTI (J4) is -0.5% at $78.16 as it pulls back from a high of $79.28 amidst heightened volatility. Resistance remains at yesterday’s high of $79.62.

- Brent (K4) is -0.45% at $81.77, off an earlier high of $82.84 that pushed closer to resistance at $83.656 (Jan 29 high).

- Gold is +0.5% at $2045.10, off an earlier high of $2050.72 but nevertheless holding up surprisingly well considering late strength in the USD index. It’s cleared resistance at $2041.1 (Feb 23 high) and opened the key $2065.5 (Feb 1 high).

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2024 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 29/02/2024 | 0110/2010 |  | US | New York Fed's John Williams | |

| 01/03/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 01/03/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 01/03/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/03/2024 | 0730/0830 | ** |  | CH | Retail Sales |

| 01/03/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/03/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/03/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/03/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/03/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/03/2024 | 1400/1400 |  | UK | BOE's Pill Speech at Cardiff University | |

| 01/03/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 01/03/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/03/2024 | 1515/1015 |  | US | Fed Governor Chris Waller | |

| 01/03/2024 | 1515/1015 |  | US | Dallas Fed's Lorie Logan | |

| 01/03/2024 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 01/03/2024 | 1830/1330 |  | US | San Francisco Fed's Mary Daly | |

| 01/03/2024 | 2030/1530 |  | US | Fed Governor Adriana Kugler |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.